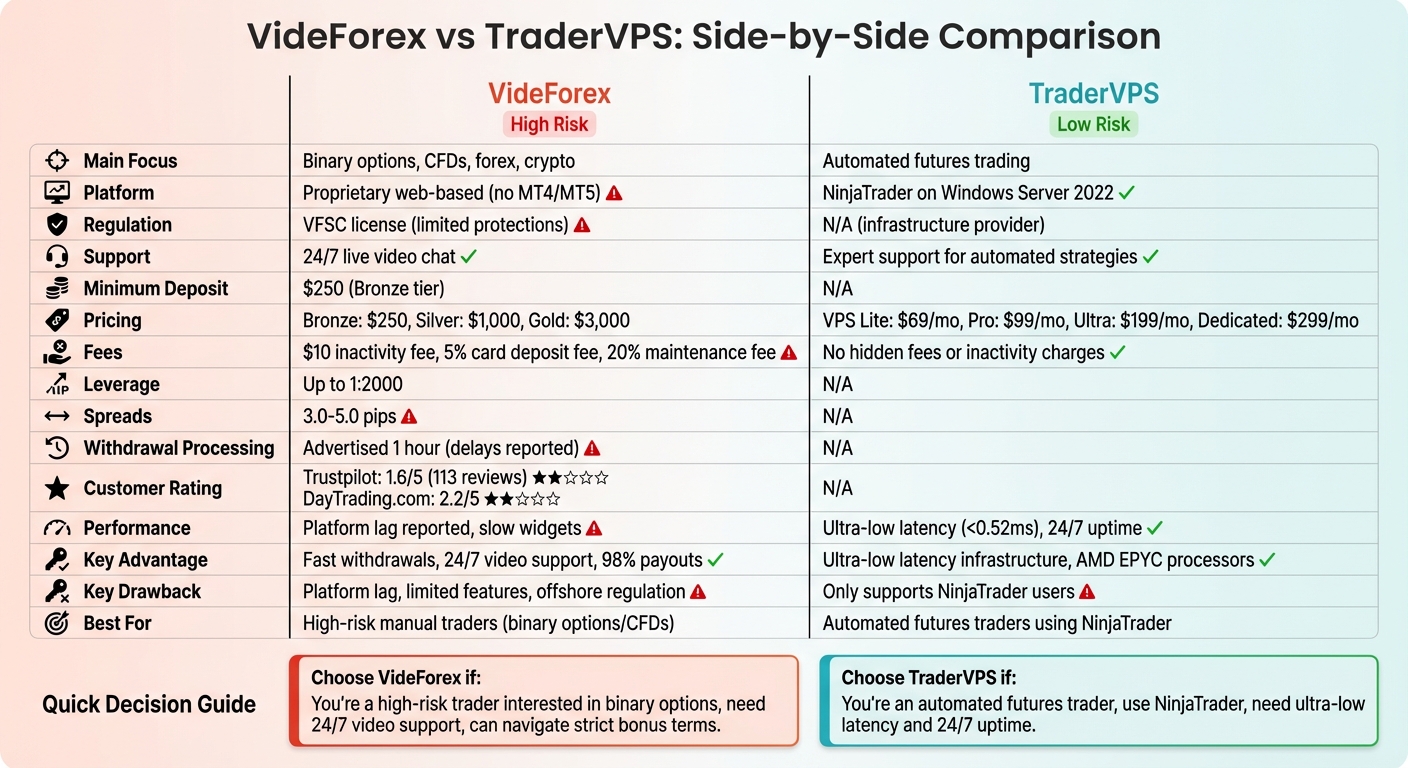

VideForex, an offshore broker since 2017, has gained attention for its high-risk offerings like binary options, CFDs, and cryptocurrencies. However, it operates without major regulatory oversight, raising concerns about safety and transparency. Key points:

- Pros: 24/7 video support, payouts up to 98%, and leverage up to 1:2000.

- Cons: High fees, strict withdrawal terms, and numerous complaints about delays or non-payments.

- Trust Issues: Trustpilot rating is 1.6/5 from 113 reviews, with users citing withdrawal problems and platform lag.

For automated futures traders, TraderVPS offers ultra-low latency and stable infrastructure tailored for NinjaTrader users. It’s ideal for high-frequency trading but lacks support for other platforms like MetaTrader.

Quick Takeaway: VideForex suits high-risk traders willing to navigate fees and risks, while TraderVPS is a reliable choice for automated futures trading. Choose based on your trading style and risk tolerance.

1. VideForex

Features and Tools

VideForex operates on its own proprietary web-based platform rather than the widely-used MetaTrader 4 or 5. This platform incorporates TradingView charts, offering over 80 technical indicators for analysis. It also includes a "Turbo" mode for binary options trades with expirations as short as 5 seconds [2]. A built-in copy trading feature allows users to mimic the strategies of "Top Traders", though it lacks detailed transparency on drawdowns [2]. Other tools include a $1 "Rollover" feature, an economic calendar, a social sentiment tracker called "Live Trades", and an AI Trade Assistant. To engage users, weekly contests with a $20,000 prize pool are held, though these efforts don’t fully offset the platform’s operational drawbacks. Financial writer William Berg from DayTrading.com commented:

"the client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders" [2].

These tools provide a glimpse into VideForex’s offerings, but the platform’s costs and fees require closer examination.

Pricing and Plans

To start trading with VideForex, users need to deposit a minimum of $250 for the Bronze account tier [2]. The platform offers three account levels:

- Bronze: $250 deposit with a 20% bonus.

- Silver: $1,000 deposit with a 50% bonus and three risk-free trades.

- Gold: $3,000 deposit with a 100% bonus and a dedicated personal success manager [2].

However, trading costs are on the higher side. Spreads for major currency pairs range between 3.0 and 5.0 pips, and additional charges include a 0.07% overnight swap fee, a $10 monthly inactivity fee, and a 5% commission on credit card deposits [2]. Bonus conditions are strict – standard accounts require 100% turnover, while bonus accounts demand 300% turnover before withdrawals are permitted. Additionally, a 20% maintenance fee is applied to withdrawals if clients fail to trade at least the equivalent of their deposit amount [2]. Forex Brokers Reviews criticized the broker, stating:

"VideForex is not very transparent with their associated fees and commissions. Nowhere on their website do they state the account fees if any, as well as trading fees and deposit and withdrawal fees."

The combination of high fees and strict conditions raises questions about the platform’s overall value.

Reliability and Performance

VideForex operates as an unregulated broker registered offshore, which raises reliability concerns [2]. While the broker advertises 1-hour withdrawal processing, user experiences suggest otherwise. Reports of delays – sometimes lasting months – or outright non-payment have led to a poor user rating of 1.6/5 from 113 reviews [1]. The absence of MetaTrader 4 or 5 compatibility further limits the platform’s appeal, as traders cannot use expert advisors or most automated trading bots. During periods of high market volatility, the platform’s slow responsiveness has frustrated active traders [2]. These issues are reflected in its low ratings: 2.2/5 on DayTrading.com and 1.58/10 on WikiFX, where it is flagged as "High potential risk" [2].

Suitability for Trading Styles

VideForex is not well-suited for scalpers or automated traders due to its high spreads and occasional platform lag [2]. The lack of MT4/MT5 support eliminates the possibility of using most expert advisors, though the platform does offer basic copy trading and an AI analysis tool introduced in 2025. Instead of traditional futures contracts, VideForex focuses on CFDs and binary options. For binary options traders, the platform provides payouts of up to 98% on OTC currency pairs, with "Turbo" expiries as short as 5 seconds [2]. Leverage is offered up to 1:2000, far exceeding regulated limits of 1:30 to 1:50. While this can magnify profits, it also significantly increases the risk of losses.

The platform’s lack of structured educational materials makes it a poor choice for beginners. Additionally, features like mystery boxes and "Hype Pool" contracts, which advertise high payouts, could encourage risky trading behavior [2].

2. TraderVPS

Features and Tools

TraderVPS is designed specifically for automated NinjaTrader futures trading, offering a VPS setup that prioritizes speed and reliability. Powered by AMD EPYC processors and NVMe storage, it ensures fast execution for algorithmic trading. Each plan includes essential features like DDoS protection, automatic backups, and Windows Server 2022, catering to traders who require stable and secure operations. The platform also supports multi-monitor setups and trade copier compatibility, making it ideal for simultaneous charting and advanced trading strategies. With server locations worldwide, boasting 1Gbps+ network speeds and unmetered bandwidth, TraderVPS ensures consistent performance, even during high-traffic trading periods. These features are tailored to meet the demands of traders who rely heavily on automated systems and expert advisors.

Pricing and Plans

TraderVPS offers a range of pricing options to accommodate different trading needs:

- VPS Lite: Priced at $69/month, this plan includes 4x AMD EPYC cores, 8GB RAM, and 70GB NVMe storage, suitable for running 1–2 charts.

- VPS Pro: At $99/month, this plan provides 16GB RAM, support for 3–5 charts, and dual-monitor setups, making it a popular choice for intermediate traders.

- VPS Ultra: For $199/month, this plan steps up with 24x AMD EPYC cores, 64GB RAM, 500GB NVMe storage, and support for 5–7 charts across 4 monitors.

- Dedicated Server: At $299/month, this option offers 12x+ AMD Ryzen cores, 128GB RAM, and 2TB+ NVMe storage, designed to handle more than 7 charts with up to 6 monitors.

TraderVPS keeps pricing straightforward, with no hidden fees, inactivity charges, or withdrawal restrictions, ensuring transparency for its users.

Reliability and Performance

TraderVPS is built to address the common performance challenges faced by traders. The platform delivers 24/7 uptime and ultra-low latency, with execution speeds under 0.52ms [3]. Unlike some platforms that struggle during periods of market volatility, TraderVPS handles demanding tasks like intensive backtesting and real-time execution without lag. Expert support is also available to help traders fine-tune their automated strategies, reinforcing the platform’s commitment to reliability and fast execution – critical for those relying on automated systems.

Suitability for Trading Styles

TraderVPS is an excellent choice for traders who prioritize high-frequency and automated futures trading. Its infrastructure is optimized for scalpers and high-frequency traders using NinjaTrader, ensuring the rapid execution essential for success in futures contracts. The platform supports continuous operation of expert advisors and advanced backtesting, capabilities that some competitors with proprietary setups cannot match. For traders focused specifically on futures, TraderVPS provides the technical tools and stability needed for professional-grade automated trading and real-time charting.

Videforex Review – Pros and Cons of Videforex (Is It Worth It?)

Pros and Cons

VideForex vs TraderVPS: Complete Trading Platform Comparison 2026

Here’s a breakdown of the main strengths and weaknesses of each service discussed. VideForex stands out with its one-hour withdrawal processing and 24/7 multilingual video support, giving traders access to over 150 assets, including technology stocks and cryptocurrencies [2]. However, it operates under a VFSC license, which lacks the investor protections provided by top-tier regulators [2]. Financial writer William Berg highlights:

"Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders" [2].

On the downside, VideForex’s proprietary web-based platform has been criticized for being slow and unresponsive during recent tests. It also doesn’t support industry-standard platforms like MetaTrader 4 or 5 [2]. Additionally, strict bonus turnover requirements apply, and bonus funds cannot be withdrawn [2].

TraderVPS, on the other hand, is a specialized solution for automated futures trading on NinjaTrader. It offers ultra-low latency performance, robust hardware equipped with AMD EPYC processors and NVMe storage, and 24/7 uptime – all essential for intensive backtesting and real-time trading. Pricing is transparent, with plans starting at $69 per month for VPS Lite and going up to $299 per month for dedicated servers, with no hidden fees or inactivity charges. However, its exclusive focus on NinjaTrader makes it less suitable for traders using other platforms.

The table below helps clarify the unique positions these two services occupy in the trading landscape:

| Aspect | VideForex | TraderVPS |

|---|---|---|

| Main Advantage | Fast withdrawals; 24/7 video support | Ultra-low latency infrastructure |

| Support | 24/7 live video chat [2] | Expert support for automated strategies |

| Regulation | VFSC license (limited protections) | N/A (infrastructure provider) |

| Platform | Proprietary; no MT4/MT5 support [2] | Optimized for NinjaTrader on Windows Server 2022 |

| Fees | $10 inactivity fee; 5% card deposit fee [2] | No hidden fees or inactivity charges |

| Trading Focus | Binary options, CFDs, forex, crypto [2] | Automated futures trading exclusively |

| Key Drawback | Platform lag; limited features | Only supports NinjaTrader users |

VideForex has an average customer rating of 2.2/5 and a Trustpilot score of 3.5/5, based on around 100 reviews [2]. Common complaints include withdrawal issues tied to bonus terms and the absence of strong regulatory oversight. Tobias Robinson, CEO of DayTrading.com, notes:

"The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders" [2].

TraderVPS, meanwhile, continues to focus on delivering reliable performance tailored to automated futures traders.

Conclusion

VideForex and TraderVPS cater to different types of traders, each with its own strengths and weaknesses. VideForex focuses on binary options and CFDs, boasting features like 24/7 video support and one-hour withdrawals. However, its offshore registration raises regulatory concerns. As of late 2025, the platform holds a 1.6/5 rating on Trustpilot based on 113 reviews [1].

The platform’s proprietary system lacks support for MT4 or MT5, charges a $10 monthly inactivity fee, and imposes strict bonus terms requiring a 300% turnover before withdrawals are allowed [2]. While offering high leverage (up to 1:2000) and binary options with potential payouts of up to 98%, VideForex also comes with a steep $250 minimum deposit, high spreads, and increased risks due to its offshore status. These factors may appeal to manual traders who prioritize high-risk, high-reward opportunities, but they also underline the importance of caution.

On the other hand, TraderVPS is designed for automated futures traders, particularly those using NinjaTrader. With pricing plans ranging from $69 to $299 per month, it provides the ultra-low latency infrastructure necessary for algorithmic trading and backtesting. TraderVPS ensures 24/7 uptime, offers transparent pricing, and avoids hidden fees or inactivity charges, making it a reliable choice for professional traders.

If you’re drawn to manual binary options trading with features like instant video support, VideForex might be worth exploring – just keep its regulatory and performance challenges in mind. Meanwhile, for traders focused on automated futures strategies, TraderVPS delivers the specialized tools and infrastructure needed for precision and efficiency. The right choice ultimately depends on your trading preferences and risk tolerance.

FAQs

What are the risks of trading with VideForex?

Trading on VideForex carries some serious risks that you should be aware of. First off, the platform operates as an unregulated offshore broker, which raises red flags about its transparency and accountability. On top of that, it offers very high leverage – up to 1:500. While this might sound appealing, it can magnify both your profits and your losses, making it especially hazardous for those new to trading.

There have also been troubling reports about withdrawal difficulties, pushy sales tactics aimed at getting traders to deposit more funds, and bonus programs that often come with restrictive and unclear terms. When you combine these issues with the lack of regulatory oversight, it becomes clear why caution is crucial when considering VideForex as a trading platform.

Is VideForex’s lack of regulation a risk for traders?

VideForex is an offshore broker operating without regulatory oversight, which means it doesn’t hold a license from any recognized financial authority. Without this regulation, traders miss out on essential protections, such as oversight to ensure fair practices or safeguards to shield their investments.

This absence of regulation significantly increases the risk of financial loss or even fraud. If disputes arise, there’s no formal recourse to rely on. It’s crucial to weigh these risks carefully before deciding to trade on an unregulated platform like VideForex.

What should traders know about VideForex’s high leverage options before using them?

VideForex provides leverage of up to 1:100, allowing traders to magnify their potential profits. However, this also means that losses can escalate just as quickly, particularly in unpredictable markets. While such leverage might attract seasoned traders, it comes with a heightened level of risk.

On the downside, VideForex operates as an unregulated platform, carries a low Trustpilot rating, and has faced complaints about withdrawal delays. These concerns raise questions about the platform’s reliability and the security of your funds. It’s crucial to carefully weigh these risks before deciding to trade with them.