Forex prop firms can be a great way to trade with larger capital, but choosing a reliable one is critical. In 2024, nearly 100 firms shut down, leaving traders without payouts. This guide highlights 15 trusted firms in 2026, selected for their payout consistency, profit splits, and trading conditions.

Key takeaways:

- Top firms like FTMO and Apex Trader Funding have paid $450M and $378M, respectively.

- Profit splits range from 80%-100%, with some firms offering instant or 24-hour payouts.

- Evaluation fees vary widely, starting at $25 and going up to $3,000+.

- Scaling potential can reach up to $5M with firms like Funded Trading Plus.

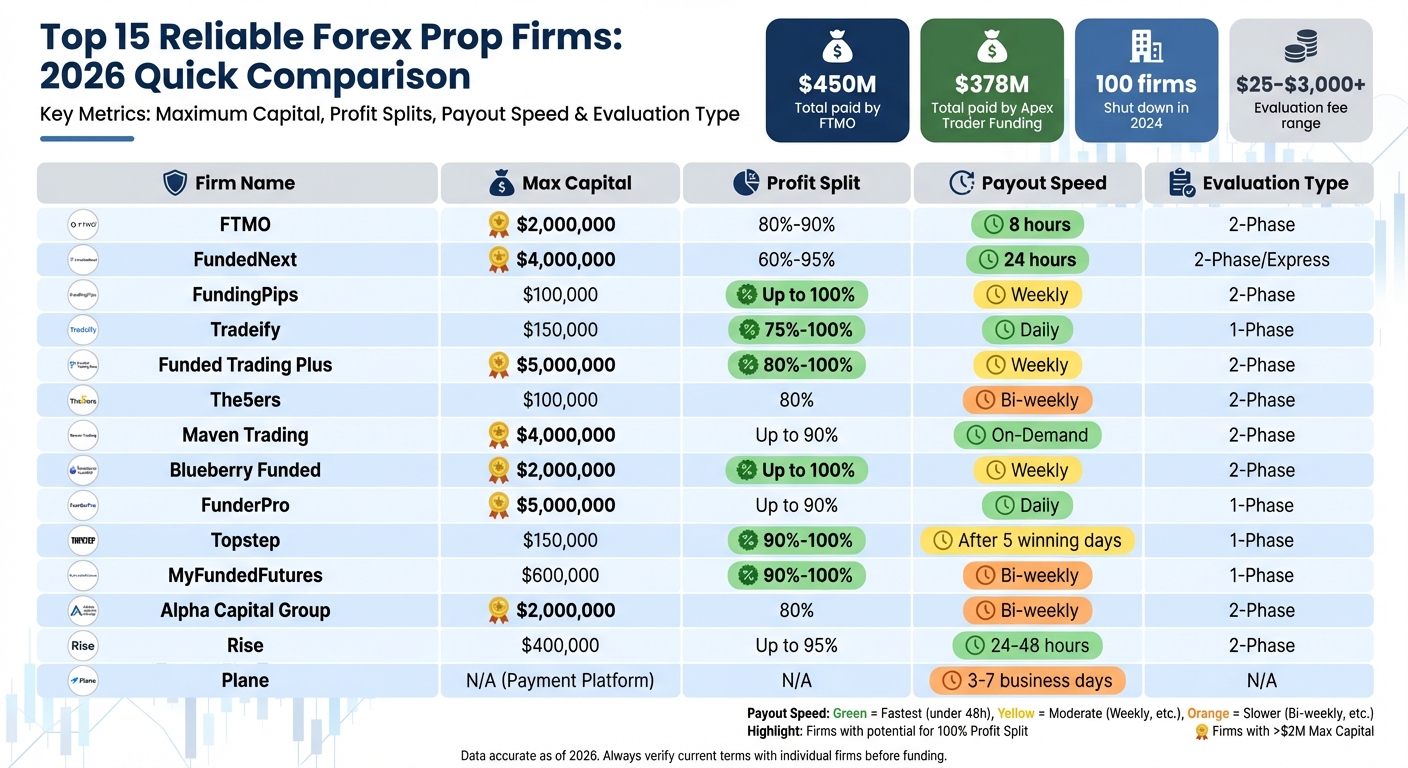

Quick comparison of payout features:

| Firm | Max Capital | Profit Split | Payout Speed | Evaluation Type |

|---|---|---|---|---|

| FTMO | $2,000,000 | 80%-90% | 8 hours | 2-Phase |

| FundedNext | $4,000,000 | 60%-95% | 24 hours | 2-Phase/Express |

| FundingPips | $100,000 | Up to 100% | Weekly | 2-Phase |

| Tradeify | N/A | 75%-100% | Daily | 1-Phase |

| Funded Trading Plus | $5,000,000 | 80%-100% | Weekly | 2-Phase |

For traders, factors like payout speed, drawdown policies, and evaluation rules should align with your trading style. Read on for detailed insights into each firm.

Top 15 Forex Prop Firms Comparison: Profit Splits, Payout Speed & Maximum Capital 2026

Ultimate Prop Firm Tier List Video (2026 Updated)

Quick Comparison Table

Here’s a breakdown of 15 prop firms based on key metrics like maximum funding, profit splits, payout speed, and evaluation structure. This table offers a quick way to see which firms might suit your trading goals and style.

One of the standout differences is scaling potential. While many firms start with $100,000 to $200,000 in funding, companies like FXIFY and The5ers allow traders to scale up to $4,000,000 [7][8]. Funded Trading Plus even goes further, offering up to $5,000,000 in scaled capital [7]. On the other hand, futures-focused firms such as Topstep and Tradeify have lower caps, maxing out at $150,000 [3][6].

Payout frequency is another area where firms differ significantly. FXIFY provides on-demand withdrawals [6], and Tradeify processes payouts daily for select accounts [6]. Most forex-focused firms follow a bi-weekly payout schedule, but FundingPips and Funded Trading Plus offer weekly cycles [6][7]. Topstep, however, requires traders to achieve five winning days before their first withdrawal [3].

When it comes to profit splits, the range typically falls between 80% and 90%. However, some firms go beyond this range. Topstep offers 100% of the first $10,000 in profits [3], and both The5ers and Funded Trading Plus allow traders to scale to a 100% profit split [4][7]. FundedNext also offers up to 95% for CFD accounts [4].

| Prop Firm | Max Initial Size | Max Scaled Capital | Profit Split | Payout Frequency | Evaluation Type |

|---|---|---|---|---|---|

| FundingPips | $100,000 | N/A | Up to 80% | Weekly | 2-Phase |

| FundedNext | $300,000 | $4,000,000 | 60% – 95% | 24-Hour | 2-Phase/Express |

| FTMO | $200,000 | $2,000,000 | 80% – 90% | Bi-weekly | 2-Phase |

| The5ers | $100,000 | $4,000,000 | 50% – 100% | Monthly/Bi-weekly | 2-Phase |

| Maven Trading | $100,000 | N/A | 80% | Bi-weekly | 2-Phase |

| FXIFY | $400,000 | $4,000,000 | Up to 90% | On-Demand | 2-Phase |

| Blueberry Funded | $200,000 | $400,000 | Up to 100% | Weekly | 2-Phase |

| Funded Trading Plus | $200,000 | $5,000,000 | 80% – 100% | Weekly | 2-Phase |

| FunderPro | N/A | N/A | N/A | Daily | 1-Phase |

| Topstep | $150,000 | $150,000 | 90% – 100% | After 5 winning days | 1-Phase |

| MyFundedFutures | $150,000 | $600,000 | 90% – 100% | Bi-weekly | 1-Phase |

| Tradeify | $150,000 | N/A | 75% – 100% | Daily | 1-Phase |

| Rise | N/A | N/A | N/A | N/A | Payment Infrastructure |

| Plane | N/A | N/A | N/A | N/A | Payroll Platform |

| Alpha Capital Group | $200,000 | N/A | 80% | Bi-weekly | 2-Phase |

1. FundingPips

FundingPips has built a strong reputation for its reliable weekly payouts and straightforward profit-sharing system. Their "Tuesday Payday" feature ensures withdrawals are processed every Tuesday, with an average processing time of just 4 hours. By early 2026, the company had distributed over $200 million to traders in more than 195 countries [9][11]. Let’s dive into the funding models and profit-sharing options that make FundingPips stand out.

The profit split starts at an impressive 80% and can reach up to 100%, depending on account performance and payout frequency. Traders can choose accounts ranging from $5,000 to $100,000, with evaluation fees spanning from $29 to $555. For those looking to skip the evaluation process, FundingPips offers the "Zero" Instant Funding model, which requires traders to achieve seven profitable days per month.

Each funding model comes with distinct evaluation criteria:

- 2-Step Standard: Requires an 8% profit target in Phase 1 and 5% in Phase 2, with a 5% daily loss limit and a 10% maximum drawdown.

- 2-Step Pro: Features stricter rules, including 6% profit targets, a 3% daily loss limit, a 6% maximum drawdown, and a 45% consistency requirement.

- 1-Step Model: Demands a 10% profit target with a 6% maximum drawdown.

- Zero Model: Uses a 5% trailing drawdown and requires a 15% consistency rate [9].

The company operates under the guiding principle:

"Your Skill Is Our Capital." – Khaled Ayesh, Founder of FundingPips [10]

In October 2024, the firm processed a notable $45,000 payout in the United Kingdom as part of their "Tuesday Payday" initiative [11]. FundingPips prides itself on its zero reward denials policy and ensures trader payouts are safeguarded through segregated accounts. Supported trading platforms include MetaTrader 5, cTrader, and Match-Trader, with leverage offered up to 1:100 for forex pairs [9].

2. FundedNext

FundedNext stands out with its 24-hour payout guarantee and rewards for traders even during the evaluation phase. To date, the firm has paid over $150 million to more than 43,000 traders across 170+ countries, with an average processing time of just 5 hours [12]. What’s more, they back their promise with action – if a payout exceeds 24 hours, FundedNext adds $1,000 to your withdrawal. In 2024, they demonstrated this commitment by compensating 176 clients with a total of $176,000 following an operational outage [13]. This fast payout system pairs seamlessly with their competitive profit-sharing model, creating additional benefits for traders.

Their profit-split structure is equally appealing. Traders start with profit splits at 80% and can go up to 95% for CFDs and 100% for Futures [14]. Plus, during the challenge phase, traders earn a 15% profit share, credited once they secure funding [15].

"At FundedNext, we do things a little differently… we offer a 15% profit share in the Challenge phase for traders who meet the profit requirements." – FundedNext [15]

FundedNext offers account sizes ranging from $6,000 to $200,000, with refundable evaluation fees between $49.99 and $1,049.99 [12]. Traders can choose from six models: four CFD options (Stellar 1-Step, Stellar 2-Step, Lite, Instant) and two Futures options (Rapid, Legacy) [14]. For example, the Stellar 2-Step model requires traders to achieve an 8% profit target in Phase 1 and 5% in Phase 2, while adhering to a 5% daily loss limit and a 10% maximum drawdown. The best part? There are no time limits for any challenge phase [12].

Supported trading platforms include MetaTrader 4, MetaTrader 5, cTrader, and Match-Trader for CFDs, as well as Tradovate, TradingView, and NinjaTrader for Futures [14]. FundedNext has earned a stellar 4.5/5 rating on Trustpilot, based on over 55,265 reviews, with traders frequently praising their fast payouts and 24/7 multilingual customer support [12]. For those looking to scale, successful traders can access a plan that boosts their account balance by 40% every four months, up to a maximum of $4,000,000 [16].

3. FTMO

FTMO has been a key player in the prop trading world since 2015, with a solid 10-year history of dependable payouts. The firm has paid out over $500 million to traders globally and serves a massive customer base of more than 3.5 million people [18]. In January 2024 alone, FTMO handled $9,643,269 in payouts, including some of the highest individual withdrawals recorded [1]. This consistency highlights their strong profit-sharing framework.

FTMO’s profit split starts at 80% but can climb to 90% for traders who meet specific scaling requirements. To qualify, traders need to achieve a 10% net profit over four months and complete two successful payouts. Meeting these criteria also earns a 25% account balance increase [17]. Payouts operate on a 14-day cycle, with an average processing time of just 8 hours. Plus, FTMO sweetens the deal by refunding 100% of the evaluation fee with the first profit withdrawal [17].

The evaluation process is divided into two phases. Phase 1, known as the FTMO Challenge, requires traders to hit a 10% profit target. Phase 2, the Verification stage, lowers the target to 5%. Both phases include a 5% daily loss limit and a 10% maximum drawdown, with traders needing to trade for at least 4 days in each phase [17]. Account sizes range from $10,000 to $200,000, with evaluation fees spanning $169 to $1,249 [17].

FTMO provides leverage of up to 1:100 on standard accounts. For traders who prefer holding positions over weekends or during major news events, the "Swing" account is available, though leverage is reduced to 1:30 for this option [17]. With a 4.8/5 TrustScore on Trustpilot based on over 35,000 reviews, FTMO has earned a strong reputation. Traders can also scale their accounts up to $2,000,000, offering plenty of room for growth [17].

4. The5ers

Founded in 2016, The5ers is among the most established proprietary trading firms in the industry. With over 6,471 payouts processed each month and an average payout turnaround of just 16 hours, the firm has built a reputation for efficiency and reliability [21]. Payouts are made bi-weekly after traders complete their first 14 days on a funded account [20]. Unlike many firms that rely on demo accounts, The5ers uses real capital accounts, adding credibility to its funding model [19].

The5ers offers three distinct evaluation programs tailored to different trading styles:

- High Stakes: A two-step process with account sizes ranging from $5,000 to $100,000. Profit targets are 8% in the first step and 5% in the second, with fees between $39 and $545. Traders can access leverage up to 1:100.

- Hyper Growth: A one-step evaluation for $10,000 to $40,000 accounts, requiring a 10% profit target. Fees range from $260 to $850, with leverage capped at 1:30.

- Bootcamp: A three-step program offering accounts from $25,000 to $250,000. Each step requires a 6% profit target, with an entry fee of $95 and a $205 setup fee. Leverage is limited to 1:10 [20].

The firm also stands out with its competitive profit-sharing model, starting at 50% and scaling up to 100%. Traders can grow their accounts to a maximum of $4,000,000, highlighting the firm’s potential for long-term partnerships [20]. The5ers accommodates various trading strategies, including news trading and holding positions overnight or over weekends, though specific restrictions may apply depending on the program. A major advantage is the unlimited time allowed to meet profit targets, removing the pressure to rush trades [20].

The5ers has earned a stellar 4.8/5 rating on Trustpilot from over 15,000 reviews [21]. Many traders commend the firm for its quick payouts and clear rules. Verified trader Manoj Kumar shared:

"My favorite prop firm is the one that pays on time, supports traders, and keeps rules fair. Trust and consistency matter most" [21].

Additional perks include 24/7 customer support and access to The5ers Academy, which features webinars and educational resources [21].

However, there are a few considerations to keep in mind. Bootcamp accounts come with lower leverage, which may limit aggressive trading strategies [20]. Accounts that remain inactive for 30 days are terminated, so consistent activity is required [20]. Additionally, traders must complete KYC requirements during the evaluation phase to ensure smooth processing of their first payout.

5. Maven Trading

Maven Trading stands out among top proprietary trading firms by offering reliable funding options paired with trader-friendly features. With over 25,000 traders funded and more than $130 million distributed, the firm has cemented its place in the industry [26]. Maven provides five funding paths – 1-Step, 2-Step, 3-Step, Instant Funding, and Mini – with entry fees ranging from $13 to $440 and account sizes from $2,000 to $100,000 [24].

Withdrawals are available every 10 business days, but traders must wait 14 days after their initial payout request [22]. The firm offers a standard 80% profit split across all account types, which, while competitive, may not surpass some other firms in the market [23]. A notable perk is the refundable challenge fee. For most accounts, traders get their initial fee back after their third successful withdrawal. Mini accounts, however, refund the fee after the very first payout [22] [26].

One of Maven’s key advantages is its flexible timelines. Unlike many competitors, Maven allows unlimited days to reach profit targets, except for the 2-Step challenge, which requires three profitable trading days [27]. Additionally, the firm offers a "Buy Back" feature. If a trader breaches their account, they can pay a fee – ranging from $200 for $2,000 accounts to $6,000 for $100,000 accounts – to restore their funded status without retaking the challenge [24] [25].

All accounts come with 75:1 leverage and access to over 400 trading pairs, covering forex and digital currencies [27]. However, traders in the US and Canada face platform restrictions, as MetaTrader 5 is unavailable in these regions. Instead, they must use cTrader or Match-Trader [24] [25]. Withdrawal fees include a $20 charge for payouts via Rise, though direct bank transfers are available in certain regions without this fee [25]. These features create a well-rounded offering for traders.

Editor-in-Chief Andre Witzel of WR Trading gave Maven a 4.4/5 rating, highlighting its low costs and strong support. However, he noted drawbacks such as a $10,000 payout cap and higher fees on cTrader [24]. Maven’s active Discord community, with more than 95,000 members, further enhances its support network for traders [26].

6. FXIFY

FXIFY has made a name for itself with its fast payouts, having distributed over $35 million to more than 200,000 active traders as of January 2026 [28][30]. One of its standout features is the on-demand first payout, allowing traders to withdraw profits immediately after their first successful trade on a funded account – no minimum trading days required [28][29]. This approach highlights FXIFY’s focus on creating a trader-friendly environment.

The firm’s profit-sharing model adds to its appeal. Traders start with an 80% profit split, but they can boost it to 90% by purchasing an add-on [30][31]. Payouts are scheduled every 30 days by default, but traders can switch to a bi-weekly schedule with an additional upgrade. Withdrawals require a $50 minimum, and the company has processed payouts as high as $117,000 [28][29]. Evaluation fees range from $39 for a $5,000 three-phase account to $2,950 for a $400,000 one- or two-phase account, with the full fee refunded on the first payout [31].

FXIFY offers a variety of evaluation options, including One-Phase, Two-Phase, Three-Phase, Lightning, and Instant Funding. Profit targets range between 5% and 10%, daily loss limits fall between 3% and 5%, and drawdowns range from 4% to 10% (the Three-Phase option uses a fixed 10% drawdown) [30][31].

Traders often praise FXIFY for its efficiency. For example, Ahmet Jessel shared his experience on Trustpilot in January 2026:

"Passed the challenge, got funded, placed one small winning trade, and requested the withdrawal immediately. Honestly, I expected delays or excuses. But the money arrived really fast."

He has since maintained a consistent bi-weekly payout schedule [31].

With over 4,000 reviews on Trustpilot, FXIFY holds a 4.4/5 rating. Users frequently commend the on-demand payout feature and the absence of consistency rules [31]. The platform supports more than 300 symbols – including 42 forex pairs and 30 stocks – on MetaTrader 4, MetaTrader 5, and DXTrade. Traders can use Expert Advisors, trade during high-impact news, and hold positions over weekends, except when participating in the Lightning Challenge [28][31].

FXIFY operates in partnership with FXPIG, a broker regulated by the Vanuatu Financial Services Commission. It also offers a scaling plan that increases account capital by 25% every three months for consistent traders, with accounts scaling up to $4 million [28][31]. These features position FXIFY as a strong player in the competitive world of prop trading firms.

7. Blueberry Funded

Blueberry Funded stands out among payout systems thanks to its collaboration with Blueberry Markets, an ASIC-regulated broker. This partnership ensures top-tier execution and reliability for traders. By early 2026, the company had already paid out over $5 million to more than 15,000 active traders, demonstrating its strong track record [34].

Payouts are processed on a 14-day cycle. After funding, traders can make their first withdrawal after 14 days, provided they meet the $100 minimum withdrawal requirement and have completed three active trading days (five for Instant Elite/Prime accounts) [32][33][34]. For those who need faster access, a 7-day payout option is available for an additional 20% fee on the challenge price [35]. Payments are primarily handled via RiseWorks and are settled in cryptocurrencies like USDC or USDT (TRC20). Most requests are completed within 2 business days, with some traders reporting payouts as quickly as 6–8 hours [35][36].

The profit split begins at 80% and can increase to 90% for traders who achieve a 10% net profit over three consecutive months, complete at least four payouts, and grow their account balance by 25% [33][34][36]. Accounts have the potential to scale up to a maximum size of $2 million [34][35].

Traders can choose from several evaluation options, including 1-Step, 2-Step, Prime, Rapid, Stock, Synthetic, and Instant Funding [34]. Challenge fees vary, starting at $25 for a $5,000 Synthetic account and going up to $1,100 for a $200,000 1-Step account [33][36]. The platform also provides access to more than 1,100 trading instruments across MetaTrader 4, MetaTrader 5, DXTrade, and TradeLocker [36].

With a Trustpilot rating of 3.8/5 from over 1,200 reviews, Blueberry Funded is often praised for its fast payout processing and responsive 24/5 customer support. However, some users have expressed concerns about the strict enforcement of news trading restrictions [33][36].

8. Funded Trading Plus

Funded Trading Plus stands out by offering flexible weekly withdrawals across most of its programs. For the Master (Instant Funding) and Experienced (1-Step) programs, traders can access their first payouts immediately on Day 0. In comparison, those in the Premium and Advanced (2-Step) programs face a 7-day waiting period. The minimum withdrawal amount is $50, with no additional fees except standard bank charges or currency conversion costs. Most withdrawals are processed within 24–48 hours, though some traders report receiving their payouts in just minutes.

The profit-sharing model further boosts trader incentives. Profit splits begin at 80/20, increase to 90/10 once traders achieve a 20% simulated profit milestone, and reach 100/0 at 30%. The Prestige Pro program offers an alternative payout structure, allowing traders to choose between receiving 65% of profits every 7 days or 80% every 14 days.

Beyond payouts and profit splits, the account and fee structures provide additional options for traders. Account sizes start at $5,000 and go up to $200,000, with scaling opportunities reaching $2.5 million – or even $5 million with an enhanced scaling add-on. Challenge fees range from $119 for a $12,500 Experienced account to $1,099 for a $200,000 Advanced account. Funded Trading Plus offers five evaluation paths: Master (Instant), Experienced (1-Step), Advanced, Premium, and Prestige Lite (2-Step). Each program comes with its own profit targets, drawdown limits, and trading rules.

The firm has earned a 4.4/5 rating on Trustpilot from 2,594 reviews and was recognized as "The Most Trusted Trading Firm UK 2025" by International Business Magazine [37]. CEO Simon Massey highlights their dedication to traders:

"Our 5-Star Promise isn’t just meaningless words on a page, it’s a reflection of our dedication to providing an exceptional experience" [37].

Traders consistently praise the fast payouts and 24/7 live support, though some note that the pricing is on the higher side and leverage is capped at 30:1.

To maintain account activity, traders must execute at least one trade every 30 days. Additionally, they should ensure enough profit remains to cover potential losses. If the account balance falls below the initial capital after reaching the required profit milestone (6% or 8%), the account will be closed.

9. FunderPro

FunderPro stands out by offering three distinct payout models tailored to different trading styles. The Pro (2-Phase) program features a Daily Rewards system, allowing traders to request withdrawals as soon as their account achieves at least 1% profit above the initial balance. Meanwhile, the Classic and One Phase programs operate on a bi-weekly payout schedule. Across all programs, traders can enjoy profit splits of up to 90%, with a minimum withdrawal threshold of $100 [79,80].

Payouts are processed impressively fast – averaging 8 hours, with a guarantee of completion within 24–48 hours. Traders also benefit from a refund of their evaluation fees after their first successful withdrawal. For those who consistently hit a 10% profit target over three consecutive months, account scaling is available, increasing account size by 50% each time, up to a maximum of $5 million [79,81,83].

Account Options and Pricing

FunderPro offers account sizes ranging from $5,000 to $200,000. Challenge fees start at $69 for a $5,000 One Phase account and go up to $989 for a $200,000 account. For those looking to bypass the evaluation process, an Instant Funding option is available, starting at $79 [38].

Risk Management Rules

FunderPro uses balance-based drawdown limits, calculated daily at 5 PM EST. This approach is more flexible compared to equity-based models [81,82]. However, traders must follow two key rules during the evaluation period:

- Consistency Rule: Limits the contribution of any single day’s profits to the overall profit target (45% for Pro accounts, 40% for One Phase accounts).

- 20% Margin Rule: Restricts using more than 20% of account margin on a single asset class. Violations require corrective action or result in account closure [79,82].

Platforms and Additional Features

Traders can choose between MT5, cTrader, and TradeLocker platforms. While news trading is permitted during challenges, it’s restricted on funded accounts – traders must avoid trading two minutes before and after major news releases unless they purchase the Swing Add-on. This add-on also allows for weekend holding [79,82].

It’s worth noting that accounts will be terminated if no trades are placed within a 30-day period, so maintaining activity by executing at least one trade per month is essential [39].

FunderPro’s combination of flexible payout models, fast processing times, and trader-friendly rules makes it an appealing choice for both new and experienced traders.

10. Topstep

Topstep has been a trusted name in the trading world since 2012, with over $16,000,000 paid out to funded traders since 2020 alone [40]. The company also boasts a 4.6/5 rating on Trustpilot, drawn from more than 5,500 reviews, reflecting its commitment to transparent operations and dependable payouts [40].

The evaluation process revolves around the Trading Combine, which sets clear profit targets and loss limits. For example, a $50,000 account requires a $3,000 profit target, with a maximum loss of $2,000 and a $1,000 daily loss limit. Larger accounts follow similar scaling: a $100,000 account aims for $6,000 in profit with a $3,000 maximum loss and $2,000 daily limit, while a $150,000 account targets $9,000 in profit with a $4,500 maximum loss and a $3,000 daily limit [40].

Topstep provides two pricing options tailored to traders’ needs:

- Standard Path: Costs between $49 and $149 per month, with a one-time $129 activation fee.

- No Activation Fee Path: Priced at $89–$189 monthly, eliminating the upfront activation charge.

The Standard Path offers lower ongoing costs, making it appealing to traders looking to minimize monthly expenses, while the No Activation Fee Path caters to experienced traders seeking simplicity [3].

"Comparing My Funded Futures vs. Topstep is like pitting the new kid on the block against a more experienced and tested foe." – Sarah Edwards, Contributor, Benzinga [40]

One thing to keep in mind: Topstep’s trailing drawdown resets to zero after a payout. While this feature encourages disciplined trading, it can reduce the trading cushion if withdrawals are too frequent [3]. Additionally, the program enforces strict daily loss limits, which may feel restrictive compared to newer firms. However, these parameters emphasize Topstep’s focus on risk management, making it a solid choice for traders who prioritize consistency and discipline [40].

11. MyFundedFutures

MyFundedFutures is all about futures trading, providing access to regulated U.S. futures contracts on major exchanges like CME, CBOT, NYMEX, and COMEX. This focused approach reflects the growing demand for niche, regulated trading platforms. With over 70,000 traders and a 4.8/5 rating on Trustpilot from more than 1,020 reviews, the firm has built a solid reputation in the trading community [43].

Their plans offer flexible profit-sharing and payout options. The Rapid plan comes with a 90% profit split and allows daily withdrawals, while the Core and Pro plans provide an 80% split with weekly and bi-weekly payouts, respectively [42]. These options make MyFundedFutures a strong competitor in the futures trading market.

"Most payout requests are approved instantly!" – My Funded Futures Help Center [42]

The evaluation process is straightforward and quick. Traders can complete it in as little as two days by meeting a $3,000 profit target and staying within a $2,000 max drawdown on a $50K account [41]. Between January 2024 and July 2025, 20.35% of evaluation accounts graduated to funded status, and 28.56% of funded traders earned at least one payout [42].

Pricing for a $50K account varies by plan: $77 for Core, $126 per month for Rapid, and $227 for Pro. Both the Pro and Rapid plans require traders to hit a $2,100 buffer, but up to 60% of profits can be withdrawn before reaching that threshold [42]. Additionally, there are no daily loss limits on the Core, Pro, or Rapid plans, giving traders more flexibility [41].

12. Tradeify

Tradeify has built a reputation for its quick payouts and accommodating trader programs, having distributed over $100 million to more than 60,000 traders as of early 2026 [47]. The platform offers an impressive 90% profit split across most plans, and traders get to keep 100% of their first $15,000 in profits before the split kicks in [46]. What really sets Tradeify apart is its fast payout processing – often completed within 60 minutes to 24 hours, even on weekends. This efficiency has earned the platform a 4.7/5 rating on Trustpilot from over 1,660 reviews [47].

"Payout request approved in less than 2 minutes and money in my bank account in 10 minutes on a Saturday." – Pascal Kemelong [47]

Tradeify provides several evaluation options tailored to different trading styles. The Select Plan requires at least 3 trading days, applies a 40% consistency rule, and has no daily loss limit. On the other hand, the Growth Plan offers a faster path with a 1-day evaluation and no consistency rule during the challenge [45][46]. For those looking to bypass evaluations altogether, the Lightning Funded option provides immediate access to funded accounts for a one-time fee ranging from $349 to $729, depending on the account size [44].

The platform uses an End-of-Day (EOD) trailing drawdown for its plans – Select, Growth, and Lightning – which is considered more lenient than intraday tracking [45]. Pricing for a $50,000 Select account starts at $159 per month, with discounts bringing it down to $111 during promotions [45]. After completing 5 payouts, traders can qualify for the Tradeify Elite program, which allows trading with live capital [45][47].

For added flexibility, Tradeify offers specialized options like Select Daily, which allows daily withdrawals once a buffer is met, and Select Flex, which provides milestone-based payouts of up to $5,000 without daily loss limits. However, at least 50% of trades must be held for more than 10 seconds to avoid issues with micro-scalping [45][46].

13. Rise

Rise (RiseFunded) stands out with a profit-sharing model that offers traders up to 95%. Payments are processed quickly through its Rise Pay system, typically within 24–48 hours.

The evaluation process at RiseFunded is broken into two stages: the Challenge Phase and the Funded Account Phase. What makes this system appealing is its 50/50 fee structure – traders pay half the fee upfront and the rest only after meeting initial success. This helps lower the financial burden at the start. Account sizes range from $25,000 to $200,000, with the potential to scale up to $400,000. To succeed, traders must hit specific profit targets while staying within strict daily and overall drawdown limits. Rise supports a wide variety of trading options, including Forex, stocks, indices, commodities, and cryptocurrencies, all accessible through the TradeLocker platform. This platform offers advanced tools for charting and risk management, making it a robust choice for traders.

While the high profit split and fast payouts are attractive, the stringent evaluation process and limited leverage can be tough for less-experienced traders. That said, Rise provides 24/7 customer support and educational resources, helping traders navigate its demanding risk management system and improve their skills [48].

14. Plane

Continuing with the focus on ensuring reliable payouts, this next piece of infrastructure plays a crucial role in facilitating smooth international transfers.

Plane is a global platform designed for payments and payroll, specifically used by prop firms to distribute trader profits [49]. It serves as the backbone for international payouts, focusing solely on payment facilitation rather than offering trading accounts or evaluations.

Since Plane is strictly a payment processor, it doesn’t determine account sizes, profit splits, or evaluation criteria. Those terms are set by the prop firms it partners with. Firms that use Plane for their payouts often provide profit splits in the range of 80% to 90% [49].

What sets Plane apart is its reliability. The platform supports faster and more flexible international bank transfers, making cross-border payouts smoother and more efficient [49][6].

KYC (Know Your Customer) verification typically takes 24–72 hours, while fiat transfers are completed within 3–7 business days. To avoid delays, it’s a good idea to complete your KYC during the evaluation phase [6].

This payment platform forms the backbone of many prop firms’ payout systems, ensuring trust and efficiency in global transactions.

15. Alpha Capital Group

Alpha Capital Group has built a solid reputation with over $48 million in payouts and more than 21,000 verified withdrawals to date [54]. The company supports a global community of over 250,000 registered traders across 180+ countries [53]. This success is underpinned by straightforward profit-sharing and flexible funding options.

Traders benefit from an 80% profit split across all account types [50][51][52][54]. Account sizes range from $5,000 to $200,000, with evaluation fees starting at $50 and going up to $997 depending on the account [52][51]. One standout feature is the scaling plan: accounts can grow by 10% for every 10% profit achieved, with a maximum cap of $2 million in virtual capital [50][51][52].

The payout system is designed with convenience in mind. Traders can choose between On-Demand payouts, which release funds once gross profits reach 2% of the account balance, or Bi-weekly payouts, available with a $100 minimum profit every 14 days [50][51][54]. Withdrawal methods include cryptocurrency (processed within an hour), e-wallets (up to 24 hours), and bank transfers (1–5 business days) [50][51]. Performance fees are typically processed and paid within two business days [51][53].

"Alpha Capital is one of the most reliable and well-rounded prop firms out there. It delivers fair pricing, flexible payouts, and strong platform options." – Muhammad Soban, FXEmpire [54]

Alpha Capital enforces a 40% Best Day Rule, ensuring no single day accounts for more than 40% of total profits. Additionally, all open trades must be closed before submitting payout requests, temporarily locking the account during processing [50][51][54][55]. The firm has earned a 4.7/5 rating on Trustpilot, based on over 16,000 reviews [53].

What to Look for in a Prop Firm

Picking the right prop firm boils down to three key aspects: consistent payouts, fair evaluation terms, and transparent profit splits. Start by checking whether the firm has maintained at least three years of steady payouts[1]. This is a solid first step in evaluating any firm.

Take a close look at their drawdown policies. Static or End-of-Day (EOD) drawdowns are generally more trader-friendly than intraday trailing drawdowns, which can unfairly penalize you for normal market movements. In fact, traders using EOD drawdowns have an 83% higher success rate compared to those using intraday trailing models[57]. Also, make sure that withdrawing profits doesn’t reset your maximum loss limit – this kind of restriction can severely limit your flexibility as a trader[3].

Profit splits should be simple and fair. Most firms offer splits ranging from 80% to 95%[1][3]. Be cautious of hidden rules, like consistency requirements, which might block payouts if a single day makes up a large portion (around 30–40%) of your total profits[5]. Also, factor in the Total Cost of Funding (TCF). This includes not just the upfront evaluation fee but also activation fees and potential reset costs[56]. Understanding these costs will help you determine if the firm’s structure aligns with your trading goals.

Make sure the firm’s rules fit your trading style. Look for firms that allow weekend holds if that’s part of your strategy. Double-check whether your trading platform, news trading, or EA usage complies with their guidelines[2][5]. Lastly, confirm the withdrawal methods – whether it’s crypto, bank wire, or e-wallet – before hitting your profit targets to avoid unnecessary delays[1].

FAQs

What should I look for when choosing a reliable forex prop firm?

When choosing a forex prop firm, focus on factors that directly influence your trading experience, potential earnings, and overall success. Payout reliability should be at the top of your list. Look for firms with a proven history of timely payments and attractive profit splits, which often range from 80% to 100%. Another important factor is the funding program. Compare evaluation fees – typically between $150 and $600 – and the maximum capital they provide, which usually falls between $50,000 and $400,000. Opting for firms with lower costs and higher funding limits can significantly boost your profitability.

It’s also essential to examine the firm’s trading rules. Consider how flexible they are regarding drawdown limits, time restrictions, and whether they allow strategies like overnight or news trading. Make sure their platforms and market access align with your trading preferences. Whether you favor MetaTrader, TradingView, or another tool, confirm they support the instruments you trade most frequently. Lastly, take into account the firm’s reputation and support. Firms with clear policies, verified payout histories, and responsive customer service are more likely to provide a reliable and supportive trading environment.

What are the typical profit splits and payout schedules offered by top forex prop firms?

When it comes to profit splits, top forex prop firms typically offer traders between 80% and 100% of the profits. Some firms, especially those with tiered programs, might start at lower percentages, such as 50% to 80%, but increase the split as traders reach specific milestones or demonstrate consistent performance. In certain cases, firms even offer 100% profit splits for select accounts or specific product types, serving as a reward for their top-performing traders.

Payout schedules also differ from firm to firm. While many provide weekly payouts, some go the extra mile with faster options like daily payouts or even same-day withdrawals. For traders who value immediate access to their earnings, firms with quicker payout cycles can be a great fit. On the other hand, those willing to wait a bit longer might lean toward firms that prioritize higher profit splits or offer additional benefits.

How do forex prop firms evaluate traders for funding?

Forex prop firms typically rely on a few evaluation models to determine whether a trader qualifies for funding. One of the most common is the single-phase challenge, where traders are required to hit specific profit targets while adhering to strict risk management rules within a set period.

Another popular approach is the two-phase program, which starts with an initial challenge and then moves to a verification stage. This second phase ensures the trader can maintain consistent performance before receiving funding.

Some firms take it a step further with a multi-phase evaluation, introducing additional performance milestones even after the verification stage. Others offer instant-funding accounts, where traders gain access to capital right away after meeting basic criteria, such as paying a small upfront fee or passing a simple eligibility check. These evaluations often include consistency rules, like setting daily profit caps or requiring a minimum number of trades, to promote disciplined and responsible trading.