FXGlory offers some of the highest leverage in the trading industry, with up to 1:3000 for accounts under $1,000. This enables traders with smaller capital to control large market positions, but it also comes with significant risks. The broker uses a tiered leverage system, automatically reducing leverage as account balances grow. For example:

- 1:3000 for balances under $1,000

- 1:100 for accounts over $30,000

High leverage can amplify both profits and losses, making risk management crucial. FXGlory provides various account types tailored to different trading styles, from beginner-friendly Standard accounts to CIP accounts for high-net-worth individuals. Features like swap-free accounts, VPS services, and tiered spreads further cater to diverse trader needs.

Key Takeaways:

- Leverage: Up to 1:3000 for small accounts; reduced for larger balances.

- Account Types: Standard, Premium, VIP, and CIP, with varying spreads and leverage caps.

- Risk: High leverage increases potential gains and losses; strong risk management is essential.

- Flexibility: Options for scalpers, day traders, and long-term traders.

FXGlory’s unique leverage offerings can be powerful for traders who understand the risks and use proper strategies.

FX Glory Honest Review

FXGlory Leverage Tiers and Features

FXGlory Leverage Tiers and Account Types Comparison Chart

Available Leverage Levels

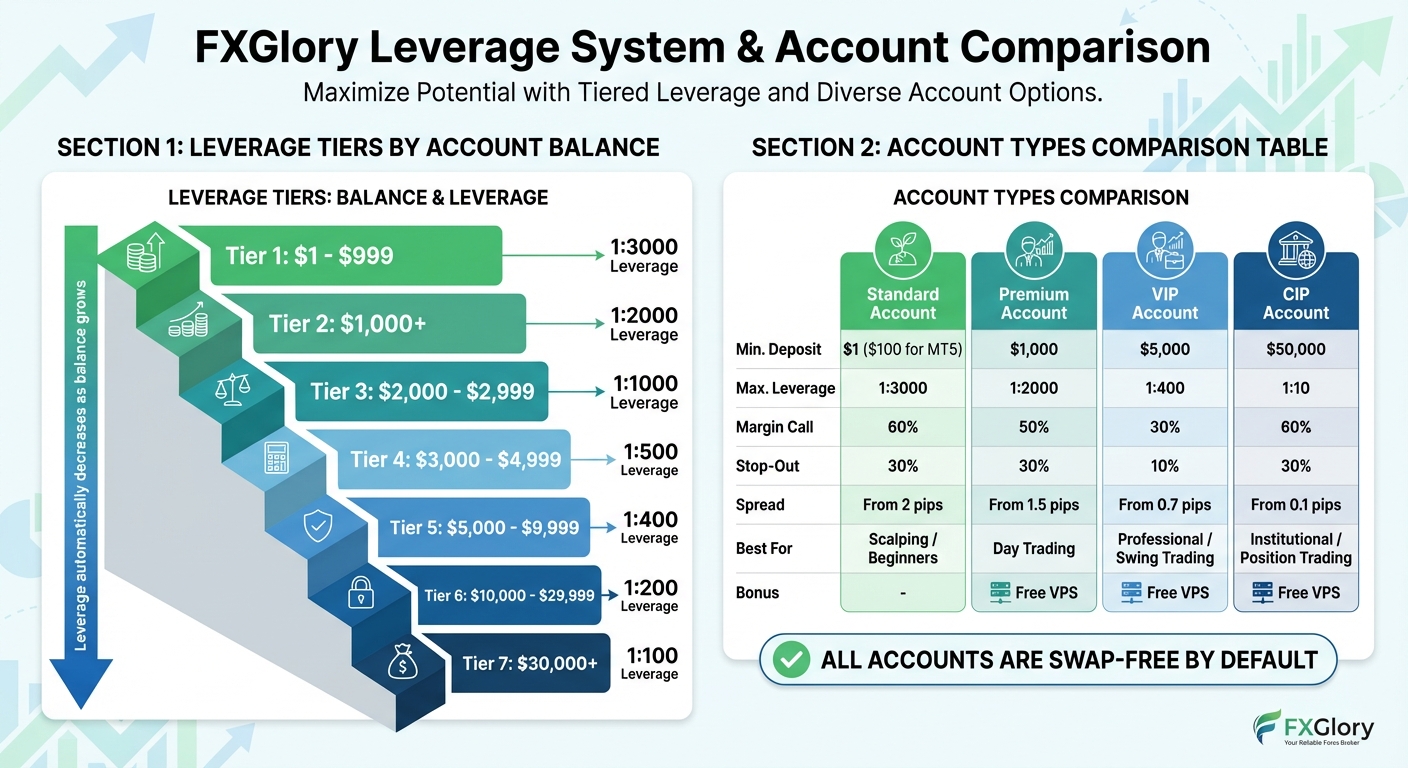

FXGlory employs a tiered system for leverage based on account balance. The broker offers seven distinct tiers:

- 1:3000 for balances between $1 and $999

- 1:2000 for $1,000 and above

- 1:1000 for $2,000–$2,999

- 1:500 for $3,000–$4,999

- 1:400 for $5,000–$9,999

- 1:200 for $10,000–$29,999

- 1:100 for accounts exceeding $30,000 [2].

As your account balance grows, the leverage automatically adjusts downward. However, if your balance decreases, leverage does not automatically increase – you’ll need to request a change manually through the Client Cabinet. This structured approach allows for a direct comparison with broader industry standards.

How FXGlory’s Leverage Compares to Industry Standards

FXGlory’s maximum leverage of 1:3000 stands out significantly compared to the restrictions in the US and Europe, where leverage is typically capped between 1:30 and 1:50. This high leverage is especially appealing to traders with smaller capital, offering them the ability to take on larger market positions [4].

Account Types and Their Leverage Options

FXGlory provides four account types, each designed to suit different trading needs. These accounts vary in leverage limits, minimum deposit requirements, and trading conditions:

| Account Type | Min. Deposit | Max. Leverage | Margin Call | Stop-Out | Spread |

|---|---|---|---|---|---|

| Standard | $1 ($100 for MT5) | 1:3000 | 60% | 30% | From 2 pips |

| Premium | $1,000 | 1:2000 | 50% | 30% | From 1.5 pips |

| VIP | $5,000 | 1:400 | 30% | 10% | From 0.7 pips |

| CIP | $50,000 | 1:10 | 60% | 30% | From 0.1 pips |

- Standard Accounts are perfect for beginners or retail traders, requiring minimal capital and offering the highest leverage.

- Premium Accounts cater to traders with at least $1,000, providing tighter spreads and a leverage cap of 1:2000.

- VIP Accounts are tailored for experienced traders with a $5,000 minimum deposit, featuring tighter spreads, reduced stop-out levels, and a leverage limit of 1:400.

- CIP Accounts target high-net-worth individuals with a $50,000 deposit requirement, offering institutional-level spreads and a conservative leverage cap of 1:10 [4].

For added perks, Premium, VIP, and CIP account holders gain access to free VPS services, ensuring uninterrupted automated trading. Additionally, all account types are swap-free by default, removing overnight interest charges [4][6].

How High Leverage Affects Trading Strategies

Benefits of High Leverage for Retail Traders

High leverage can open doors for traders with smaller accounts to control larger positions. For example, FXGlory offers leverage of 1:3000, meaning that with just $100, a trader could manage a $300,000 position. A mere 0.1% market movement in this scenario could result in a $300 gain or loss – potentially tripling the initial account balance[3][1]. FXGlory’s tiered leverage structure allows traders with a $500 deposit to access this high leverage, enabling significant positions in major currency pairs without requiring large amounts of upfront capital. However, while the opportunities are enticing, the accompanying risks cannot be ignored.

Risks of High Leverage

The same leverage that amplifies profits can just as easily magnify losses. Using the earlier example, a $100 account controlling a $300,000 position could be completely wiped out by a modest 0.1% adverse market move – a fluctuation that’s quite common in trading[3][1]. FXGlory sums it up well:

Leverage is like a two-edged sword. As it can increase the profits, it can increase the losses too

[3].

For accounts exceeding $1,000, FXGlory reduces maximum leverage from 1:3000 to 1:2000. If the balance falls back below $1,000, traders must manually request the higher leverage through the Client Cabinet[2]. During periods of high market volatility – such as during major economic announcements – FXGlory may lower leverage further or limit trades to a maximum of 1:100 to protect against sudden price gaps[2]. These measures emphasize the importance of strong risk management strategies when trading with high leverage.

Leverage Examples with Real Numbers

Concrete examples show how leverage can both amplify gains and expose traders to significant risks. Take a Standard account holder with a $1,000 deposit and $200,000 in exposure. A favorable 50-pip market move could generate a $1,000 profit, effectively doubling the account. On the flip side, adverse moves could trigger a margin call at 60% equity and potentially lead to a stop-out at 30%, closing positions to prevent further losses[4].

Now consider a VIP account holder with a $5,000 deposit. This trader might open a position of around $80,000, using lower effective leverage. A 50-pip move in their favor could result in a $400 gain – an 8% return. However, tighter risk controls in VIP accounts, such as a 30% margin call and a 10% stop-out level, help limit drawdowns[4].

These scenarios underline the balancing act of leverage. While it can produce impressive gains, it demands precise timing and disciplined risk management to avoid rapid losses.

FXGlory Leverage for Different Trading Styles

Let’s explore how FXGlory’s leverage options align with various trading approaches, offering flexibility tailored to different strategies.

Scalping and Day Trading

FXGlory’s high leverage, especially the 1:3000 option available on Standard accounts (with just a $1 minimum deposit), is a strong match for scalpers and day traders. These traders focus on taking advantage of small price movements, and the ability to open sizable positions with minimal capital is a key advantage. Fixed spreads starting at 2 pips make it easier to calculate precise targets, while both Instant and Market execution options ensure the speed and accuracy crucial for quick trades. This setup is ideal for those aiming to profit from rapid market fluctuations.

Swing Trading and Position Trading

For swing and position traders, who hold trades over longer periods, stability and reduced costs are critical. FXGlory supports these strategies with swap-free accounts that avoid rollover fees, allowing traders to maintain positions without worrying about overnight costs. Additionally, as account balances increase, FXGlory automatically lowers leverage, promoting a more cautious approach to risk. Traders with larger accounts can opt for VIP or CIP accounts, which offer reduced leverage levels of 1:400 and 1:10, respectively, to support more measured, long-term trading strategies.

Leverage Adjustments by Instrument

The appropriate leverage often depends on the instrument being traded and the current market conditions. While FXGlory allows leverage up to 1:3000 for forex trading across its 34 currency pairs, adjustments are sometimes necessary. For instance, during periods of high volatility, FXGlory may lower leverage or limit trades exceeding 1:100 to help mitigate the risks associated with market gaps. This flexible approach ensures traders can adapt to changing conditions while managing risk effectively.

| Account Type | Best For | Max Leverage | Spread | Margin Call | Stop Out |

|---|---|---|---|---|---|

| Standard | Scalping/Beginners | 1:3000 | From 2 pips | 60% | 30% |

| Premium | Day Trading | 1:2000 | From 1.5 pips | 50% | 30% |

| VIP | Professional/Swing | 1:400 | From 0.7 pips | 30% | 10% |

| CIP | Institutional/Position | 1:10 | From 0.1 pips | 60% | 30% |

Source: [4]

How to Use FXGlory’s Leverage Effectively

Using FXGlory’s leverage to your advantage requires careful planning and disciplined risk management. While high leverage can magnify profits, it can also increase losses, so a strategic approach is essential for long-term success.

Risk Management Best Practices

Always set stop-loss and take-profit orders for every trade. With leverage reaching up to 1:3000, even small market fluctuations can significantly impact your account balance. Fixed spreads can help you better track pip movements and manage your risk effectively [4].

Monitor your margin levels closely to avoid the risk of forced liquidations, especially during periods of high market volatility.

Understand leverage adjustments. FXGlory automatically reduces your maximum leverage as your account balance grows. For instance, accounts with balances under $1,000 can access 1:3000 leverage, but this decreases to 1:100 for balances exceeding $30,000 [2]. If your balance decreases, leverage won’t automatically increase – you’ll need to adjust it manually in the Client Cabinet [2].

Pay attention to the economic calendar. FXGlory may lower leverage or restrict trades requiring leverage above 1:100 during major economic events or around market openings and closings to mitigate risks from price gaps [2]. Adjust your trading positions accordingly to avoid surprises.

Practice on demo accounts before trading live. FXGlory’s demo system allows you to get comfortable with their one-click trading and immediate execution features without risking real money [5][7].

Once you’ve established strong risk management habits, you can tailor your leverage settings to align with your trading goals.

Choosing the Right Leverage for Your Goals

Selecting the right leverage is key to aligning with your trading strategy. Your choice should depend on factors like your account size, trading style, and risk tolerance. FXGlory’s leverage system adjusts based on your account balance: accounts under $1,000 can access up to 1:3000 leverage, while those over $30,000 are limited to 1:100 [2].

Match your leverage to your trading style. Scalpers might benefit from higher leverage, while swing traders may prefer lower leverage for more stable, long-term trades. FXGlory offers various account types to suit different needs:

- Standard accounts: Up to 1:3000 leverage, with spreads starting at 2 pips.

- Premium accounts: Up to 1:2000 leverage, with tighter spreads from 1.5 pips.

- VIP accounts: Leverage capped at 1:400, but with a more favorable 10% stop-out level [4].

Start with lower leverage ratios. Even if you’re eligible for higher leverage, beginning with 1:100 or 1:200 can help you understand how leverage affects your trades while protecting your capital [7].

Using FXGlory’s Tools for Better Results

FXGlory provides several tools to help you manage your strategy effectively. The Client Cabinet is your central hub for adjusting leverage settings and monitoring your account balance to ensure it aligns with your trading plan [2].

Premium VPS services are available for Premium, VIP, and CIP account holders. These services improve connectivity and reduce technical risks, which is especially important during high-leverage trading [4][5].

The MetaTrader 4 and 5 platforms offer essential risk management tools, such as stop-loss and limit orders, along with real-time margin monitoring. Additionally, the internal MetaTrader 4 email system sends notifications about temporary leverage adjustments during significant market events [2].

Diversify your trades to spread risk. FXGlory offers a wide range of trading instruments, allowing you to balance your portfolio and use high leverage strategically [7].

Conclusion

This review explored FXGlory’s tiered leverage system and how it influences different trading strategies. The broker’s structure offers traders considerable flexibility, but success hinges on understanding how the tiers operate and managing risk wisely. For example, accounts with balances between $1 and $999 can access leverage as high as 1:3000. However, this leverage decreases as balances grow, dropping to 1:100 for accounts exceeding $30,000 [2].

It’s essential to align your leverage ratio with your trading style and account size. Scalpers and day traders might benefit from higher leverage on smaller accounts, while swing traders with larger balances may find lower ratios more suitable. FXGlory’s account types – Standard, Premium, VIP, and CIP – each come with specific leverage caps and features, so choose an option that matches your risk tolerance and capital needs [4].

Be mindful of market conditions. During significant economic announcements or market openings, FXGlory may reduce leverage or limit high-volume trades above 1:100 to mitigate risks associated with price gaps [2]. Planning your trades around such events can help you avoid unexpected changes.

FAQs

What are the potential risks of trading with extremely high leverage, such as 1:3000?

Trading with extremely high leverage, such as 1:3000, can dramatically magnify both your potential gains and your potential losses. Even minor price fluctuations can translate into significant profits – or wipe out your account in an instant. This level of volatility increases the likelihood of margin calls, sharp drawdowns, or even losing your entire account balance.

On top of that, going beyond your broker’s leverage limits or neglecting proper risk management could result in account restrictions or even suspension. High leverage is generally more suitable for seasoned traders who have a well-thought-out risk management plan. For most traders, it’s essential to weigh whether this kind of leverage fits their trading objectives and risk appetite.

How does FXGlory’s leverage system change as your account balance grows?

FXGlory uses a tiered leverage system that adjusts based on your account balance. Here’s how it works: if your account balance falls between $1 and $999, you can access leverage up to 1:3000. For balances starting at $1,000, the maximum leverage shifts to 1:2000, and once your balance exceeds $30,000, leverage is capped at 1:100.

It’s important to note that leverage doesn’t automatically increase if your balance drops into a lower tier. To adjust your leverage, you’ll need to do so manually through your client dashboard. This approach is designed to help you better manage risk as your account grows.

Which trading strategies are best suited for FXGlory’s high-leverage options?

FXGlory offers high-leverage options that can be a game-changer for strategies relying on small price shifts or those needing larger position sizes without locking up too much capital. Take scalping or day trading, for instance – these approaches often thrive with high leverage, allowing traders to profit from short-term market moves while starting with a relatively modest investment.

That said, high leverage is a double-edged sword. While it can boost potential profits, it also magnifies risks. Before diving in, traders should evaluate their risk tolerance and have a solid risk management strategy in place. This includes practices like setting stop-loss orders and sticking to disciplined position sizing to navigate the heightened risks effectively.