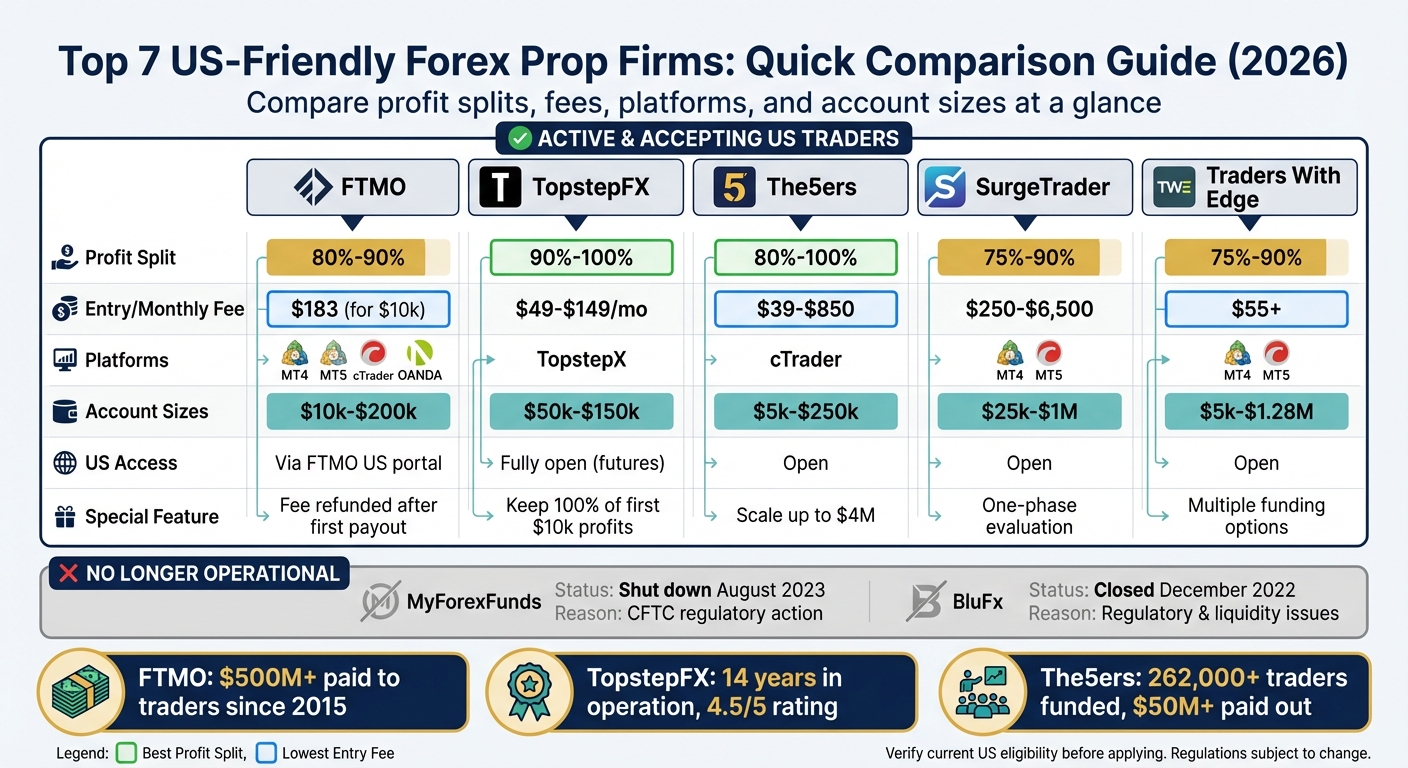

Updated Top 7 US-Friendly Forex Prop Firms

Forex prop trading firms provide traders with access to significant capital in exchange for a share of profits. For US traders, these firms offer opportunities to bypass strict domestic leverage limits by operating through futures or simulated accounts. Here's a quick breakdown of the top prop firms for US traders in 2026:

- FTMO: Offers leverage up to 1:33 and supports MetaTrader 5 (via OANDA) with profit splits starting at 80%, increasing to 90%. Fees are refunded after the first profitable payout.

- TopstepFX: Focuses on CME futures and provides a 90% profit split, letting traders keep 100% of their first $10,000 in profits. Monthly fees range from $49 to $149.

- The5ers: Flexible programs with profit splits up to 100%. Challenges start at $39, and traders can scale their accounts up to $4 million.

- SurgeTrader: Simple one-phase evaluation with a 75%-90% profit split. Fees range from $250 to $6,500, depending on account size.

- Traders With Edge: Offers multiple funding options with profit splits up to 90%. Entry fees start at $55.

- MyForexFunds: No longer operational due to regulatory shutdowns in 2023.

- BluFx: Closed in 2022 due to regulatory and liquidity issues.

Each firm has unique features, fee structures, and compliance measures tailored to US regulations. Below is a quick comparison table summarizing the key details for active firms.

| Firm | Profit Split | Fee Example | Platforms | Account Sizes | US Eligibility |

|---|---|---|---|---|---|

| FTMO | 80%-90% | $183 ($10k) | MT5 (OANDA) | $10k-$200k | Open via FTMO US portal |

| TopstepFX | 90%-100% | $49/month ($50k) | TopstepX | $50k-$150k | Fully open (futures) |

| The5ers | 80%-100% | $39-$850 | cTrader | $5k-$250k | Open |

| SurgeTrader | 75%-90% | $250 ($25k) | MT4, MT5 | $25k-$1M | Open |

| Traders With Edge | 75%-90% | $55 ($5k) | MT4, MT5 | $5k-$1.28M | Open |

Consider your trading style, budget, and platform preferences when choosing a firm. Ensure the firm's rules align with your goals, especially regarding risk management and payout structures.

Top US-Friendly Forex Prop Firms Comparison 2026

5 Best Prop Firms for US Traders in 2024

1. FTMO

FTMO stands out as a prominent prop trading firm in the U.S., striking a balance between regulatory adherence and trader-focused features. The company re-entered the U.S. market on August 26, 2025, through a partnership with OANDA Prop US Corporation [9]. Operating as an educational simulation platform rather than a traditional brokerage, FTMO ensures compliance while offering traders access to significant capital [8].

U.S. Trader Eligibility and Regulatory Compliance

FTMO welcomes U.S. residents and incorporated entities aged 18 or older who have a valid Tax Identification Number (TIN) [9]. To participate, traders must complete an IRS W-9 form and provide proof of a U.S. bank account for receiving payouts. The evaluation phase is managed by an FTMO entity, while an OANDA entity oversees the simulated Rewards Account [9]. U.S. traders must access the program via the dedicated FTMO US portal at ftmo.oanda.com. The program includes leverage up to 1:33 and offers trading opportunities across 42 FX pairs, gold, oil, three U.S. indices, and BTCUSD [8]. This structure ensures compliance while maintaining the platform's robust features.

Trading Platform Compatibility

FTMO US exclusively supports MetaTrader 5 (MT5) for all accounts in the U.S. [8]. Unlike many firms focused on futures, FTMO US allows traders to keep positions open overnight and over weekends, with no restrictions on trading during news events. This flexibility is particularly appealing to swing traders [6][8]. Combined with its platform offerings, FTMO US also sets itself apart with an appealing profit-sharing model.

Profit-Sharing Models

FTMO offers a profit split starting at 80%, which can increase to 90% through its Scaling or Premium Program [7][8]. The initial challenge fee is refunded after the first profitable withdrawal, and traders can request their first payout as early as 14 days after opening a Rewards Account, provided the account is profitable and all positions are closed [9]. Account sizes range from $10,000 to $200,000, with a one-time entry fee - approximately $164 for a $10,000 account [7]. Since its launch in 2015, FTMO has paid traders over $500 million globally and boasts a 4.8/5 rating on Trustpilot based on more than 38,000 reviews [6].

2. MyForexFunds

MyForexFunds is no longer operational and is not an option for U.S. traders. On August 31, 2023, the U.S. Commodity Futures Trading Commission (CFTC) and Canadian regulators froze the company's bank accounts and shut it down after accusing it of defrauding clients. As of February 2026, the company remains prohibited from conducting business, and no new accounts can be opened. These regulatory violations highlight serious compliance issues that plagued the firm [10].

U.S. Trader Eligibility and Regulatory Compliance

The CFTC accused MyForexFunds of manipulating prices and using misleading practices that negatively impacted traders' equity. Regulators also claimed the company operated as an unregistered broker-dealer and misrepresented its simulated trading environment as mirroring real market conditions. Mike Diamond from Financial Skills remarked, "MFF was definitely using the demo trading environment to their advantage, often at traders' expense" [10].

Historical Fee Structures and Profit-Sharing Models

Before its closure, MyForexFunds offered competitive pricing for its evaluation accounts, with fees up to 25% lower than some competitors. For instance, a $10,000 account cost $84. The firm provided three distinct account options:

- Evaluation Accounts: These accounts featured profit splits ranging from 75% to 90%.

- Rapid Accounts: Starting with a 50% profit split, which increased by 15% each profitable month, capped at 80%.

- Accelerated Accounts: Offered instant funding with a fixed 50/50 profit split, paid weekly.

While the company once boasted a 4.8 out of 5 rating on Trustpilot from over 10,000 reviews, many traders criticized its equity-based drawdown rules. These rules calculated losses based on floating equity instead of the actual account balance, a system that often sparked frustration among users [10].

3. TopstepFX

TopstepFX, based in Chicago, has been operating since 2012, offering U.S. traders access to regulated CME futures products. Unlike many proprietary trading firms that focus on CFDs - prohibited for retail traders in the U.S. - TopstepFX exclusively deals in CME futures, including currency futures like Euro FX, British Pound, and Yen. This focus on regulated exchange products ensures compliance with legal standards across all 50 states[11]. Below, we’ll explore the firm’s compliance, profit-sharing structure, fees, and trading platform.

U.S. Trader Eligibility and Legal Compliance

Topstep operates within U.S. legal boundaries by employing a simulated account evaluation process. Since the firm doesn’t handle client funds or offer brokerage services, it avoids the need for oversight by agencies like the CFTC or SEC. Edris Derakhshi, Founder of TradingRage, clarifies:

"While Topstep is a legitimate and transparent company, it is not regulated by financial authorities. Yet, since it doesn't manage real money or offer brokerage services, TopStep is legal in the US."[11]

With a 14-year track record and a solid 4.5 out of 5 rating from 98 reviews, Topstep has established itself as a reliable option for traders[3].

Profit-Sharing Structure

Topstep provides traders with a 90% profit split, and as a standout perk, traders get to keep 100% of their first $10,000 in profits[12]. Payouts are processed weekly once traders achieve five profitable days with a minimum net gain of $200[12]. However, traders must adhere to the 50% consistency rule, which ensures that no single trading day accounts for more than half of the total profits during the evaluation phase[1].

Fees and Funding Options

The firm’s profit-sharing benefits are complemented by a straightforward fee structure. Monthly fees are tiered based on account size:

- $49 for a $50,000 account

- $99 for a $100,000 account

- $149 for a $150,000 account

Additionally, there’s a one-time $149 activation fee for accessing an Express Funded Account[12]. Traders can access up to $750,000 in capital and earn performance bonuses at certain milestones. For instance, reaching $15,000 in profits earns a $1,000 bonus, while hitting $100,000 unlocks a $20,000 bonus[3].

Trading Platform Features

TopstepX, the firm’s proprietary platform, is required for all Trading Combine accounts. This web-based platform works seamlessly on PCs, Macs, and mobile devices, with no need for additional software installation. Key features include TradingView charting tools and "The Tilt™", which provides real-time insights into trader positioning[12]. According to Topstep, traders using TopstepX have an 86% higher pass rate compared to those on third-party platforms[12].

Notably, all positions must be closed by 3:10 PM CT daily. Overnight and weekend positions are not allowed, ensuring disciplined trading practices[12].

4. The5ers

The5ers has carved out a notable space for U.S. traders by addressing compliance needs and offering flexible profit-sharing options. Founded in 2016, the firm resumed operations for U.S. clients in late August 2025 after halting them in February 2024 due to compliance issues. By shifting U.S. traders to the cTrader platform, The5ers resolved these concerns and has since funded over 262,000 traders, paying out more than $50 million. The firm also holds a stellar 4.8 out of 5 rating on Trustpilot based on over 20,000 reviews[13].

U.S. Trader Eligibility and Compliance

U.S. traders can participate in all of The5ers' challenges - High Stakes, Bootcamp, and Hyper Growth - exclusively through the cTrader platform[14]. Eligibility requirements include being at least 18 years old and completing KYC verification (identity and proof of address) within 24 hours. Because The5ers funds traders with company capital, it operates outside many traditional brokerage regulations[17]. U.S. traders also benefit from leverage of up to 1:100 on certain instruments, a significant improvement over the limits imposed by domestic retail brokers[14].

Profit-Sharing Opportunities

The5ers provides an attractive profit-sharing model, starting with an 80% split in programs like High Stakes. Top-performing traders can even earn a full 100% profit split[13]. Verified trader Hassan Nawaz shares his experience:

"If you need reliable firm with transparency in rules and timely payouts, then the5ers is Highly recommended firm."[13]

Payouts are processed swiftly - typically within 1 to 3 business days - via Crypto, Rise, or Bank Transfer. Additionally, traders can scale their managed capital up to $4 million by hitting performance milestones[13].

Fees and Funding Options

The5ers caters to traders with various budgets. The High Stakes Challenge fees range from $39 for a $5,000 account to $495 for a $100,000 account[16]. The Bootcamp Program offers a low-cost entry point, starting at $95 for a $100,000 challenge, with the remaining fee payable only after passing the evaluation stage. For those seeking immediate funding, the Hyper Growth program costs between $260 and $850, depending on the starting capital[13]. Payout commissions are minimal: 2% for Crypto and Rise, 3% for Bank Transfers, and 0% for Hub Credits[15].

Trading Platforms and Features

U.S. traders are required to use the cTrader platform[14], while non-U.S. clients have access to The5ers’ licensed MetaTrader 5, available on PC, web, and mobile devices[17]. The firm’s proprietary dashboard enhances the trading experience with advanced performance analytics and real-time tracking capabilities. Verified trader Black highlights the advantages:

"The new dashboard is visually appealing, provides rapid account credentials after payment, and offers extremely tight spreads during sessions such as the NY overlap."[13]

The platform supports features like news trading, overnight holding, and weekend holding in most programs. Additionally, there are no margin calls or stop-out levels, offering traders more flexibility[18].

5. BluFx

BluFx stopped accepting U.S. traders in December 2022 due to regulatory hurdles and liquidity problems, ultimately leading to its closure. Despite its shutdown, BluFx's unique approach to funding and fee structures sheds light on the difficulties prop firms face under tight regulatory conditions.

U.S. Trader Eligibility and Regulatory Challenges

In December 2022, BluFx barred U.S.-based traders, citing regulatory complications. Around the same time, the firm encountered liquidity provider issues that disrupted trade execution for three weeks. This combination of challenges led to its eventual closure. Over its operational span, BluFx funded more than 20,000 traders across 140 countries, showcasing its global reach before regulatory issues brought it to a halt [19].

Profit-Sharing Model

BluFx adopted a straightforward profit-sharing model that set it apart. Traders enjoyed a 50/50 profit split regardless of their account tier, with instant funding available up to $100,000 - no evaluation process required. Pro account holders could scale their capital to $1 million after achieving a 10% profit target. Weekly payouts were available for eligible accounts, and the firm enforced a 10% maximum drawdown rule without daily loss limits. Before its closure, BluFx held a Trustpilot rating of 4.4 out of 5, based on over 950 reviews [19].

Fee Structures and Subscription Model

Instead of charging a one-time fee, BluFx used a monthly subscription model. The pricing tiers were:

- Mini Lite account ($10,000 capital): $99 per month

- Lite account ($25,000 capital): $159 per month

- Pro account ($50,000 capital): $369 per month

- Super Pro account ($100,000 capital): $1,099 per month

For traders seeking swap-free options, higher-priced plans were available, ranging from $129 to $1,239 depending on the account size. Additionally, BluFx offered Anniversary One-Time Accounts, such as the Basic account with $20,000 capital for a one-time fee of $429 [19].

Trading Platform and Features

BluFx operated on the cTrader platform, supporting trades in major and minor forex pairs as well as gold. Lite accounts had restricted trading hours, while Pro accounts provided greater flexibility. However, with the firm's closure, these features are no longer accessible to traders [19].

6. Traders With Edge

Traders With Edge is a prop trading firm that welcomes US-based traders and offers a flexible scaling system. It provides three distinct funding options: the 1-phase "Turtle" challenge, the 2-phase "Hare" challenge, and an Instant Funding model.

US Trader Eligibility and Regulatory Compliance

US traders can access all three funding options. For the challenge-based models, traders demonstrate their skills on demo accounts, adhering to US regulations for leveraged CFD trading. The Turtle plan requires hitting a 10% profit target while staying within a 6% total loss limit and a 3% daily loss cap. The Hare plan, on the other hand, is split into two phases: Phase 1 requires a 10% profit target, while Phase 2 lowers the target to 5%. Both phases impose a 10% total loss limit and a 5% daily loss cap. These stringent criteria ensure only disciplined and skilled traders succeed [20].

Profit-Sharing Models

Traders who complete the challenge-based evaluations enjoy an 80% profit split, with payouts made every two weeks. The Instant Funding model, which skips the evaluation process, starts with a 50% profit split and allows traders to begin trading immediately. Through the challenge routes, traders can scale their accounts up to $3 million, and after two years of consistent performance, they may qualify for institutional backing of up to $30 million. However, the profit split for retail-funded accounts remains capped at 80%, unlike some competitors that occasionally offer higher percentages [20].

Fee Structures and Funding Requirements

The entry fee for the Turtle challenge starts at $55, while the Hare challenge begins at $69. Importantly, these fees are refundable upon successful completion of the evaluation. For those opting for Instant Funding, the desk fee starts at $250 for a $5,000 account and goes up to $2,000 for larger accounts. Instant Funding accounts can scale across seven levels, reaching up to $1.28 million, though the growth pace is slower compared to the challenge-based paths [20][21].

Trading Platform Compatibility

Trading is conducted through Swift Trader, the firm’s broker partner, which offers ECN-style accounts with tight spreads and low commissions. The platform supports Expert Advisors (EAs), news trading, and holding positions over the weekend, giving traders plenty of flexibility. A built-in Metrics Monitoring System tracks live performance, including losses and rule violations, and sends immediate email alerts when limits are breached. Traders can also connect with others via a Discord community for strategy discussions and workshops. However, the firm’s strict risk management rules make it most suitable for seasoned traders [20].

7. SurgeTrader

SurgeTrader simplifies the evaluation process for traders with a single-step approach. Headquartered in Naples, Florida, the firm's "Audition" requires traders to achieve a 10% profit target while staying within a 5% daily loss limit and an 8% maximum trailing drawdown. There are no minimum trading days or time restrictions, allowing traders to work at their own pace [22].

US Trader Eligibility and Regulatory Compliance

SurgeTrader's funding programs are available to US traders across a range of account sizes, from $25,000 to $1,000,000. As an evaluation and training firm - not a regulated broker - SurgeTrader operates within a legal framework that addresses many regulatory concerns for US-based traders. The company ensures transparency by providing clear registration and legal disclosures [27, 46].

Profit-Sharing Models

Traders start with a profit-sharing rate of 75%, which can increase to 90% with an optional add-on. Profits are paid through Deel, offering flexibility with payout options such as bank transfers, cryptocurrency, and digital wallets. Withdrawals can be made once every 30 days [46, 47].

Fee Structures and Funding Requirements

The audition fee is refundable with the first profit payout. For example, a $25,000 account comes with a $250 fee, a $100,000 account costs $700, and a $1,000,000 account requires a $6,500 fee. While these fees may be higher than those for multi-phase challenges, they provide immediate access to funding, eliminating the need for prolonged evaluations [27, 46]. This structure offers traders a more direct and flexible path to funded trading.

Trading Platform Compatibility

SurgeTrader works with MetaTrader 4 and MetaTrader 5 through its broker partner, ThinkMarkets. Traders can use Expert Advisors, trade on news events, and hold positions over weekends without restrictions. The platforms support a wide variety of instruments, including forex pairs, cryptocurrencies, indices, metals, oil, and individual stocks, with leverage of up to 1:20. All trades must include a stop-loss [46, 47].

Side-by-Side Comparison

Picking the right prop firm means balancing several factors to match your trading goals and capital requirements. The table below outlines key features across seven firms to help you compare them at a glance.

| Firm | Profit Split | Challenge Fee (Example) | Primary Platforms | US Eligibility (2026) | Account Sizes |

|---|---|---|---|---|---|

| FTMO | 80% - 90% | $183 (for a $10,000 account) | DXtrade, MT5 (via OANDA), cTrader | US traders access FTMO via DXtrade [2][4] | $10,000 - $200,000 |

| MyForexFunds | 80% - 85% | $99 (for a $10,000 account) | MT4, MT5 | Not operational as of 2026 | $5,000 - $300,000 |

| TopstepFX | 90% - 100% (keep first $10,000) | $49/month (for a $50,000 account) | TopstepX, TradingView, NinjaTrader | Fully open (US-based, futures) [3] | $50,000 - $150,000 |

| The5ers | 80% - 100% | $39 - $850 | MT5, cTrader | Mixed; some programs restricted [2][4] | $5,000 - $250,000 |

| BluFx | 80% - 90% | $99 (for a $10,000 account) | MT4, MT5 | Open | $10,000 - $200,000 |

| Traders With Edge | 75% - 90% | $150 (for a $25,000 account) | MT4, MT5 | Open | $25,000 - $100,000 |

| SurgeTrader | 75% - 90% | $250 (for a $25,000 account) | MT4, MT5 (via ThinkMarkets) | Open | $25,000 - $1,000,000 |

TopstepFX stands out as a fully US-based futures trading firm, making it accessible to traders across all 50 states [1][3].

The choice of platforms has shifted significantly in recent years. Many firms have moved away from MetaTrader due to licensing issues with MetaQuotes and regulatory hurdles in the US related to leveraged CFD trading [4]. For example, FTMO now directs US traders to DXtrade or MT5 via OANDA. Futures-based prop trading has also gained traction, with firms leveraging regulated exchanges like the CME Group to ensure compliance nationwide [1].

Among the firms, The5ers offers some of the lowest challenge fees, starting at just $39 for a $5,000 account. It’s also worth noting that most firms refund challenge fees after the first profitable payout. However, TopstepFX operates differently, using a monthly subscription model instead [3].

Conclusion

When selecting a prop firm, it's essential to find one that aligns with your trading style, experience level, and regulatory requirements. For example, TopstepFX offers a straightforward approach to futures trading tailored for US traders, while FTMO stands out with its educational resources, bolstered by its partnership with OANDA.

Risk management rules are another critical factor to consider. Some firms use End-of-Day drawdown models, which provide more flexibility during volatile sessions. In contrast, intraday trailing drawdown rules can be stricter, potentially causing account failures even during routine market fluctuations. Choosing a firm that matches your risk tolerance and trading approach is crucial.

For those seeking accessible entry points, The5ers offers challenge fees starting at just $39, making it an affordable option. On the other hand, SurgeTrader simplifies the process with a single-phase evaluation model and fewer restrictions. For even faster access, some traders prefer no-evaluation prop firms that provide immediate funding. A bonus: many firms refund challenge fees after your first profitable payout.

Due to MetaTrader licensing restrictions in the US, platform availability has changed. Be sure to confirm that the firm you choose supports your preferred platform, whether that's cTrader, TradingView, NinjaTrader, or another US-compliant option.

Matching your trading strategy with a firm's rules, platforms, and scaling programs can make a significant difference. Scaling programs, in particular, allow you to increase your capital with consistent performance, enhancing your earning potential without taking on extra risk. For instance, FTMO has paid out over $500 million since 2015 [2], and TopstepFX has distributed more than $81,177,000 to over 10,000 traders globally [5].

Finally, keep in mind that the regulatory environment for US traders is always evolving. Always verify a firm's current US eligibility and refund policies before committing. This due diligence will help ensure you make an informed decision that supports your trading goals.

FAQs

Are these prop firms legal for US traders?

Yes, prop firms are legal for U.S. traders as long as they operate with transparent, evaluation-based funding models and do not function as unregulated brokers. Many of these firms openly accept U.S. clients while complying with applicable regulations, providing a safe and regulated trading experience.

Which firm is best for swing trading in the US?

While no particular company is directly identified as the top choice for swing trading in the US, Ronan Edwards from Secrets To Trading 101 points to a standout option called 'Best Prop Firm For Swing Traders.' This firm is praised for providing features that cater specifically to the needs of swing traders, making it a strong contender in this space.

What drawdown rule is safest for beginners?

The safest approach for beginners is to stick to a strict maximum drawdown limit, typically between 5% and 10%. This strategy helps protect your capital and keeps risks manageable while you build your trading skills. By maintaining losses within this range, you create a more stable environment to focus on learning and refining your techniques without facing overwhelming financial pressure.