Switch Markets offers raw spreads starting at 0.0 pips on its Pro account, paired with execution speeds under 76ms, making it a strong option for traders focused on cost efficiency. For scalpers and algorithmic traders, tight spreads combined with fast execution are critical, and Switch Markets delivers on both. Additionally, TraderVPS provides 1ms latency and 99.99% uptime, ensuring reliable and near-instant trade execution, which is especially useful for automated strategies.

Key takeaways:

- Pro Account: Raw spreads from 0.0 pips, $3.50 commission per lot per side, and fast execution.

- Standard Account: No commissions but wider spreads starting at 1.4 pips.

- TraderVPS: Free for live account holders, with ultra-low latency and high uptime.

- Regulation: Operates under SVGFSA, offering less stringent oversight compared to Tier-1 regulators.

- Costs: No deposit/withdrawal fees, but inactivity fees and crypto deposit fees apply.

While Switch Markets excels in trading conditions and technology, its offshore regulation under SVGFSA may be a concern for some. This setup is best suited for experienced traders who prioritize tight spreads and fast execution over stricter regulatory protections.

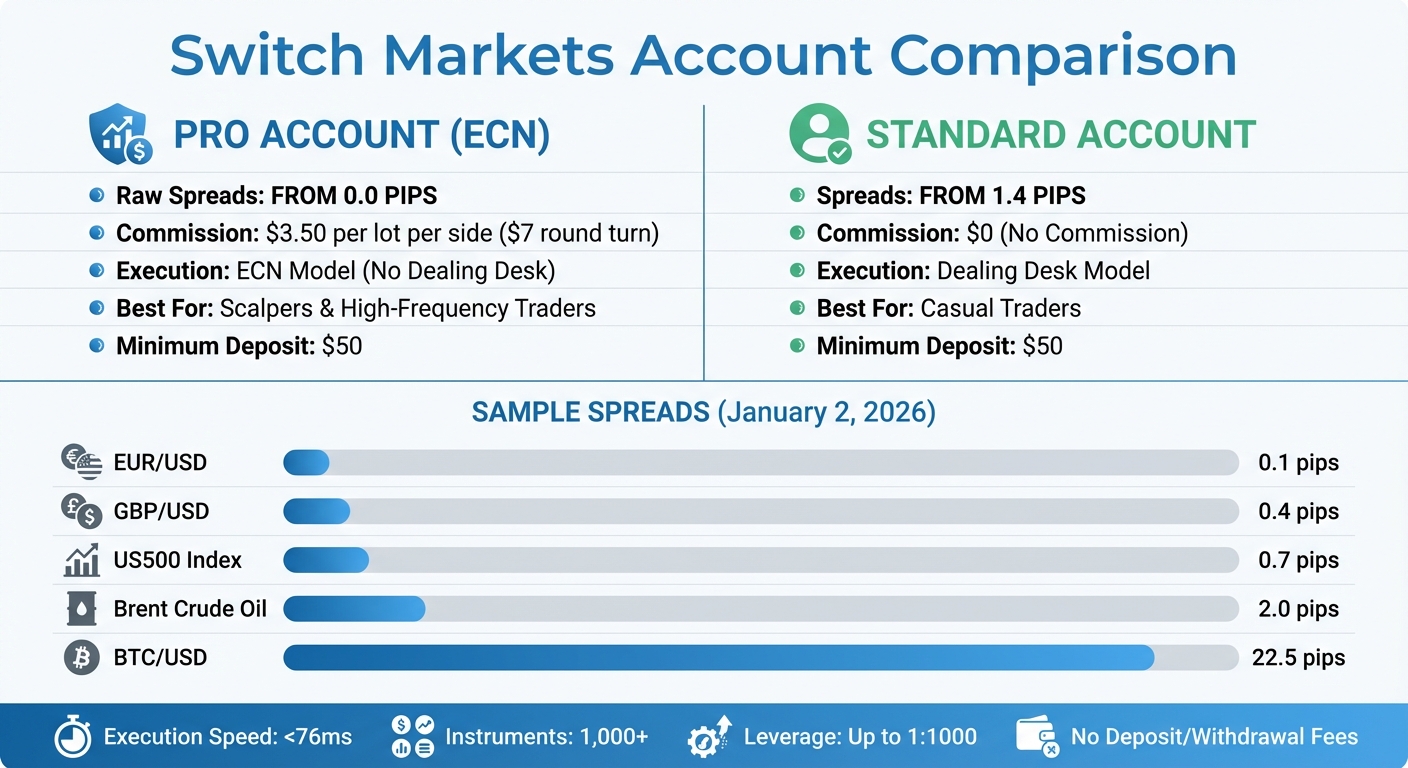

Switch Markets Account Types Comparison: Pro vs Standard Spreads and Costs

1. Switch Markets

Spread Tightness

Switch Markets delivers tight spreads by providing direct ECN access to deep liquidity pools. This approach eliminates dealing desk interference and ensures raw market pricing from multiple sources, including Tier-1 banks and hedge funds [2][5]. Thanks to this setup, spreads can start as low as 0.0 pips on major currency pairs like EUR/USD [1].

For instance, data from January 2, 2026, shows spreads of 0.1 pips for EUR/USD, 0.4 pips for GBP/USD, and 0.7 pips for the US SPX 500 Index (US500) [1]. In commodities, Spot Brent Crude Oil is quoted at 2.0 pips, while Bitcoin (BTC/USD) has a wider spread of 22.5 pips, which is typical for cryptocurrency trading. These figures directly influence the break-even point for each trade, making tight spreads a critical factor in assessing trading cost efficiency.

Trading Cost Efficiency

For traders seeking cost-effective options, the ECN/Pro account stands out with raw spreads starting at 0.0 pips and a fixed commission of $3.50 per lot per side (or $7 round turn) [7]. On the other hand, the Standard account charges no commission, embedding costs into slightly wider spreads. For scalpers and high-frequency traders, the Pro account often proves to be the more economical choice.

Switch Markets also keeps things accessible with a low minimum deposit of $50 and no fees for deposits, withdrawals, or inactivity [7][8].

"With an ECN account, you pay a fixed commission on trades, and the spreads are as low as the market can offer." – Isaac Lavandero, Writer, Switch Markets [7]

Next, let’s look at how the platform’s features enhance trading efficiency.

Platform Features

Switch Markets doesn’t just focus on costs – it also equips traders with powerful tools to maximize their strategies. The platform supports MetaTrader 4 and 5 across desktop, mobile, and web [2]. For those interested in automation, the AlgoBuilder AI allows traders to design and backtest automated strategies using plain English, no coding knowledge required [2][5]. If you’re a TradingView user, the PineConnector bridge makes it easy to execute trades directly in your MT5 account based on TradingView alerts [2].

With access to over 1,000 tradable instruments, including Spot and Futures CFDs for indices and commodities, the platform offers plenty of variety [2][4]. Plus, with an average execution speed of under 76 milliseconds [3], traders can act on rapid price changes with efficiency.

Regulation and Security

Switch Markets is regulated by the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) through Royal ETP LLC [6]. To ensure client safety, funds are held in segregated accounts at Tier-1 banks, keeping them separate from the broker’s operational funds [2][6]. Additionally, negative balance protection ensures traders cannot lose more than their account balance [6].

Previously, Switch Markets operated under an ASIC license with Switch Markets PTY LTD, though that license has since been revoked [6]. Now primarily under SVGFSA regulation, the broker operates with less stringent oversight compared to regulators like ASIC or CySEC. Despite this, the platform maintains a strong reputation, earning a 4.7/5 rating on Trustpilot from 838 reviews. Users frequently commend its 24/7 customer support and quick verification process [2].

2. TraderVPS

Trading Cost Efficiency

TraderVPS helps reduce slippage, ensuring you can maintain tight spreads. By hosting servers in the same data centers as Switch Markets’ trading servers, it achieves trade execution latency as low as 1 millisecond [2][3]. This means your orders hit the market almost instantly, allowing you to lock in those 0.0 pip spreads before prices shift.

Here’s the best part: this premium VPS service, valued at $497 annually [1], is offered free to all live trading account holders. There’s no minimum trading volume requirement, making it accessible to everyone. For scalpers and high-frequency traders using Expert Advisors, this setup eliminates the need for costly local hardware while delivering precision in trade execution. This combination of savings and performance is perfect for deploying advanced trading tools effectively.

Platform Features

The VPS is preloaded with MetaTrader 4 and MetaTrader 5 [3], so you can dive straight into trading. With a 99.99% uptime guarantee [2], your automated trading strategies keep running smoothly – even when your personal computer is turned off. For algorithmic traders, this reliability is a game-changer, ensuring uninterrupted access to the market.

"Keep your algo trading strategies online 24/7 with 99.99% uptime guarantee and at 1ms trade execution latency times." – Switch Markets [2]

You can manage your trading platform remotely from any device with internet access [2]. To activate the VPS, live account holders just need to fund their accounts and contact Switch Markets support. The broker also provides step-by-step training videos and 24/7 technical support to make the setup process seamless [2].

Regulation and Security

TraderVPS operates on infrastructure hosted in Equinix Data Centers, known for their robust physical and network security [3][9]. The 99.99% uptime guarantee ensures your automated strategies stay active without interruptions [2]. Since the servers are co-located with Switch Markets’ trading infrastructure, you not only benefit from ultra-low latency but also from the high-security standards of Equinix facilities. This setup ensures your trading remains both fast and secure.

Pros and Cons

To recap the key points discussed earlier, here’s a breakdown of how various features affect trading efficiency and execution. The table below outlines the main advantages and drawbacks.

Switch Markets

| Feature | Strengths | Weaknesses |

|---|---|---|

| Spreads & Execution | The Pro account delivers raw spreads starting at 0.0 pips with execution speeds under 76ms[3]. Its ECN model aggregates liquidity from multiple providers[1]. | Standard account spreads begin at 1.4 pips, which are less competitive for cost-sensitive traders[6]. |

| Cost Structure | Transparent commissions and fee-free transactions for most flows[6]. | Cryptocurrency deposits come with a 0.8% fee, and inactivity fees apply to dormant accounts[6]. |

| Regulation | Rated 4.7/5 on Trustpilot based on over 838 reviews[2]. | Operates under the SVG FSA after losing its ASIC license, with no investor compensation scheme[6]. |

| Market Access | Access to over 1,000 tradable instruments, including 60+ Forex pairs, and supports scalping, hedging, and EA trading[6]. | Services are unavailable to residents of the US, North Korea, and Cyprus; crypto trading is limited to set hours[6]. |

| Account Types | Requires a minimum deposit of $50 and offers leverage up to 1:1000[6]. | Standard accounts rely on dealing desk execution, which can be slower compared to the ECN model[7]. |

TraderVPS

| Feature | Strengths | Weaknesses |

|---|---|---|

| Performance | Boasts 1ms trade execution latency and guarantees 99.99% uptime[2]. | Requires an active Switch Markets account. |

| Cost | Free for live account holders (a $497 annual value)[1]. | |

| Infrastructure | Hosted in Equinix Data Centers with advanced security measures[2]. | |

| Support | Provides 24/7 technical support[2]. |

The Pro account is ideal for active traders who prioritize fast execution and tight spreads, while the Standard account may not suit high-frequency trading due to its higher costs. On the regulatory side, the reliance on SVG FSA oversight might be a concern for traders seeking stricter Tier-1 regulation. As for TraderVPS, it offers excellent benefits, especially when paired with a Switch Markets account, making it a valuable addition for serious traders.

This comparison highlights the key trade-offs for those aiming to balance costs and execution efficiency.

Conclusion

Switch Markets lives up to its promise of tight spreads, offering raw spreads starting as low as 0.0 pips on major currency pairs. Popular pairs like EUR/USD and USD/JPY typically maintain spreads below 0.5 pips. Coupled with execution speeds under 76ms and access to deep liquidity pools, the platform provides institutional-grade trading conditions, all for a modest $50 minimum deposit.

"Tight spreads combined with lightning-fast execution times and deep liquidity can make Switch Markets one of the best choices in the brokerage market for some traders." – The Forex Geek

The Pro account, with its $7 round-turn commission, balances out the raw spreads, making it a practical choice for active traders. On the other hand, the Standard account – offering spreads starting at 1.4 pips – might not appeal to those who are particularly mindful of trading costs.

That said, it’s important to consider the regulatory landscape. Since Switch Markets operates under the SVG FSA following the revocation of its ASIC license, traders are not covered by the investor protection schemes offered by top-tier regulators. This makes the platform a better fit for experienced traders who are well-versed in managing the risks tied to offshore regulation.

For those focused on performance, the integration with TraderVPS adds another layer of efficiency. TraderVPS’s high-performance solutions provide ultra-low latency and near-perfect uptime, making it an excellent tool for automated trading strategies. Together, Switch Markets’ competitive spreads and TraderVPS’s optimized infrastructure create a trading environment designed to help you capitalize on tight spreads and fast execution.

FAQs

What are the pros and cons of trading under offshore regulation by the SVGFSA?

Switch Markets operates under the regulation of two entities: the SVGFSA (St. Vincent and the Grenadines Financial Services Authority) and ASIC (Australian Securities and Investments Commission). While the SVGFSA oversees offshore brokers, its regulatory standards are generally viewed as less rigorous compared to those of well-established bodies like ASIC.

Advantages: Offshore regulation can sometimes offer brokers the flexibility to provide trading conditions that are more accommodating. This might include features like higher leverage or lower entry requirements, which can appeal to certain traders.

Drawbacks: However, trading under offshore regulation often comes with reduced oversight. This means traders may face limited protections in cases of disputes or financial complications involving the broker.

It’s essential for traders to weigh their risk tolerance carefully and fully understand the potential trade-offs of engaging with brokers operating under offshore regulatory frameworks.

What are the key differences in trading costs between the Pro and Standard accounts?

The Pro account stands out for its zero trading fees, no charges on deposits or withdrawals, and a minimum deposit requirement of just $50. These perks make it a budget-friendly alternative when compared to the Standard account, which lacks these fee exemptions.

For those aiming to keep their trading expenses as low as possible, the Pro account offers a straightforward way to cut costs without sacrificing convenience or ease of access.

What benefits does TraderVPS provide for algorithmic traders on Switch Markets?

TraderVPS provides algorithmic traders on Switch Markets with a powerful hosting solution tailored to improve their trading experience. With the free premium VPS offered by Switch Markets (valued at $497), traders can leverage robust hardware that includes 2 CPU cores, 4 GB RAM, and 100 GB SSD storage, all operating on Windows 2016, 2019, or 2022. This setup allows users to run multiple Expert Advisors or custom bots without the need for extra hardware expenses.

The VPS is hosted in key U.S. data centers located in New York, Chicago, and Los Angeles, offering ultra-low latency – as low as 1 millisecond. This means trades are executed faster, spreads are tighter, and slippage is minimized. With guaranteed 24/7 uptime, your algorithmic strategies remain active without interruptions, ensuring you never miss a trading opportunity.

By combining premium hardware, low-latency connectivity, and reliable uptime, TraderVPS is an excellent option for traders looking to boost performance, cut trading costs, and simplify their algorithmic trading operations on Switch Markets.