Auto futures trading APIs are the backbone of automated trading systems, enabling real-time data access, order execution, and portfolio management. With advancements in speed and infrastructure, individual traders can now achieve near-institutional performance levels. Here’s a quick look at the top APIs for 2026:

- Barchart Futures API: Extensive market coverage, REST and WebSocket support, and reliable performance with TraderVPS.

- TickAPI: Focused on historical intraday data with REST API for seamless integration.

- Interactive Brokers API: Access to 160 markets globally, with multiple connectivity options like REST, WebSocket, and FIX.

- TradeStation API: Direct market access and advanced order types for complex strategies.

- YCharts API: Premium historical data for securities, ideal for backtesting.

- Databento API: Ultra-low latency, nanosecond-level precision, and comprehensive market data.

- Polygon Futures API: Tick-level futures data for historical analysis and intraday strategies.

- dxFeed Futures APIs: Real-time and historical data with low-latency performance.

- Bourse Data API: Promising new tool for futures market data (details pending).

- Oanda API: CFD proxies for futures trading with REST and FIX API options.

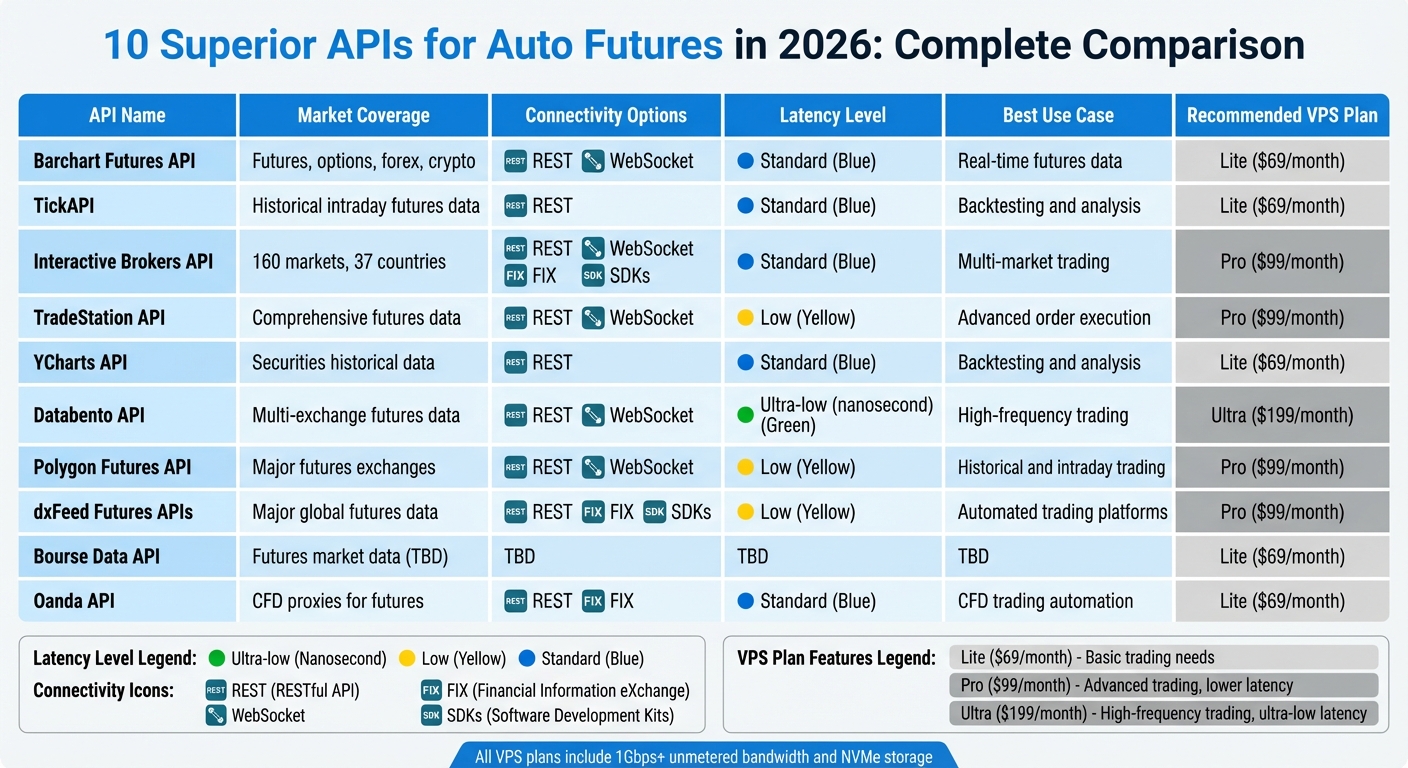

Quick Comparison

| API | Market Coverage | Connectivity Options | Latency | Best For | Hosting Plan |

|---|---|---|---|---|---|

| Barchart Futures API | Futures, options, forex, crypto | REST, WebSocket | Standard | Real-time futures data | VPS Lite ($69/month) |

| TickAPI | Historical intraday futures data | REST | Standard | Backtesting and analysis | VPS Lite ($69/month) |

| Interactive Brokers API | 160 markets across 37 countries | REST, WebSocket, FIX, SDKs | Standard | Multi-market trading | VPS Pro ($99/month) |

| TradeStation API | Comprehensive futures data | REST, WebSocket | Low | Advanced order execution | VPS Pro ($99/month) |

| YCharts API | Securities historical data | REST | Standard | Backtesting and analysis | VPS Lite ($69/month) |

| Databento API | Multi-exchange futures data | REST, WebSocket | Ultra-low (nanosecond) | High-frequency trading | VPS Ultra ($199/month) |

| Polygon Futures API | Major futures exchanges | REST, WebSocket | Low | Historical and intraday trading | VPS Pro ($99/month) |

| dxFeed Futures APIs | Major global futures data | REST, FIX, SDKs | Low | Automated trading platforms | VPS Pro ($99/month) |

| Bourse Data API | Futures market data (details pending) | TBD | TBD | TBD | VPS Lite ($69/month) |

| Oanda API | CFD proxies for futures | REST, FIX | Standard | CFD trading automation | VPS Lite ($69/month) |

Each API has unique strengths. For ultra-low latency, Databento excels. If global market access is a priority, Interactive Brokers is a top choice. Pairing these APIs with TraderVPS hosting ensures reliable performance tailored to your trading needs.

Top 10 Auto Futures Trading APIs Comparison 2026

1. Barchart Futures API

Market Coverage and Futures Contract Support

The Barchart Futures API offers a wide range of market coverage, including commodities like grains, energies, metals, softs, and livestock, as well as financial instruments such as interest rates, indices, and currencies. It sources data from major global exchanges across North America, Europe, and the Asia-Pacific region, making it a versatile tool for diversified futures trading. Whether you’re tracking crude oil, E-mini S&P 500, or corn futures, the API delivers both real-time and historical data for futures and options on futures. This broad scope makes it easier to integrate with various trading platforms and connectivity setups.

Connectivity Options (REST, WebSocket, FIX, SDKs)

Barchart provides multiple data delivery options to suit different needs. Its OnDemand APIs handle real-time and historical market data, while Barchart Stream offers low-latency streaming with consolidated and compressed feeds for efficiency[5]. Although specific protocols aren’t fully detailed, the emphasis on "Easy Integration" suggests support for common standards like REST endpoints and streaming. For instance, platforms such as Tradovate, which rely on REST APIs with OpenAPI definitions and WebSocket connections for streaming data[4], may find compatibility with Barchart’s feeds. This flexibility ensures smooth integration and performance, making it a practical choice for hosting on TraderVPS.

Hosting Performance on TraderVPS (CPU, Bandwidth, Uptime)

When using Barchart’s API with TraderVPS, the infrastructure ensures reliable and efficient performance. The 1Gbps+ unmetered bandwidth is ideal for handling real-time data streams without interruptions. For traders managing multiple futures contracts simultaneously, the VPS Pro plan – equipped with 6 AMD EPYC cores and 16GB of RAM – offers enough computing power for tasks like data parsing and order execution. Additionally, the 24/7 uptime and NVMe storage keep your systems running smoothly, even during overnight trading sessions when futures markets remain active.

2. TickAPI

Market Coverage and Futures Contract Support

TickAPI provides top-notch historical intraday data for futures contracts traded on global financial exchanges[7]. This service ensures access to clean, reliable data, offering traders a detailed look at quote and trade histories across numerous futures instruments. By utilizing OneTick Cloud’s infrastructure, TickAPI also includes Futures Continuous Contracts in its data offerings[7][8]. This feature is especially useful for traders who want to backtest their strategies thoroughly before putting them into action. With such a solid data foundation, integrating with the API becomes a seamless process.

Connectivity Model (REST API)

TickAPI operates through OneTick Cloud’s REST API, making it simple to access both real-time and historical market data[8]. Developers will find the API easy to work with, thanks to its clear documentation. Key data types like L1 tick data, trade/quote bars, and book depth are all readily available. To further ease integration, the API documentation includes a REST URL builder and sample Python code, allowing for smoother incorporation into automated trading systems. While this REST-based setup is ideal for retrieving and analyzing data, it differs from the streaming WebSocket connections commonly used for ultra-low-latency order execution.

Hosting Suitability on TraderVPS

TraderVPS provides an optimized environment for deploying TickAPI-connected applications. With unmetered 1Gbps+ bandwidth available on all plans, downloading large historical datasets for backtesting is hassle-free. For instance, the TraderVPS Pro plan, equipped with a 6-core AMD EPYC processor and 16GB of RAM, offers plenty of power to manage multiple data queries and perform complex analyses. Additionally, NVMe storage ensures faster read/write speeds, and 24/7 uptime guarantees that your data pipelines stay operational without interruptions. This combination of performance and reliability makes TraderVPS a strong choice for hosting TickAPI applications.

3. Interactive Brokers API

Market Coverage and Futures Contract Support

Interactive Brokers API provides access to futures markets across the globe, with connections to 160 markets in 37 countries and over 30 exchanges[9][11]. It supports a wide range of futures contracts, including standard, micro, and mini futures. These cover various asset classes like equity indices, interest rates, currencies, commodities, cryptocurrencies, fixed income, agriculture, metals, softs, and volatility indices[9][10]. This broad market reach ensures traders have the tools they need for diverse strategies and opportunities.

Connectivity Model (REST, WebSocket, FIX, SDKs)

The API offers several connectivity options tailored to different needs. These include the TWS API, which uses a TCP socket and supports SDKs for Python, Java, C++, C#, and Visual Basic. There’s also a RESTful Web API with WebSocket streaming, along with an institutional-grade FIX API for high-speed order routing[1][11][12][13]. Each option provides access to Interactive Brokers’ full range of order types, account and P&L data, as well as market data, including snapshots, streaming feeds, and historical information[11][13].

Latency and Reliability for Platforms like NinjaTrader and Multicharts

Platforms like NinjaTrader and Multicharts rely on the TWS API to handle market data, execute trades, and manage accounts through Trader Workstation or IB Gateway[1]. For improved stability, IB Gateway is recommended over the full TWS interface. To optimize performance, enable "ActiveX and Socket Clients", disable the "Read-Only API" option, and allocate 4,000MB of memory to the API[1]. These configurations ensure smoother operation, especially when paired with a dependable hosting solution.

Hosting Suitability on TraderVPS

TraderVPS provides an ideal setup for running IB API applications efficiently. For basic API tasks, the VPS Lite plan (featuring 4 AMD EPYC cores and 8GB DDR4 RAM) is sufficient. For more demanding use cases, such as running multiple strategies or meeting IB Gateway’s 4,000MB memory allocation, the VPS Pro plan (6 cores, 16GB RAM) is better suited. With unmetered 1Gbps+ bandwidth and NVMe storage, TraderVPS ensures real-time data streaming and quick access to logs without interruptions.

4. TradeStation API

Market Coverage and Futures Contract Support

The TradeStation API v3 offers a streamlined and efficient approach to futures trading. With a single API key, users gain direct market access to both real-time and historical data, as well as specialized endpoints for brokerage and execution services. This setup supports advanced trading strategies by enabling the use of complex order types like bracket orders, One-Cancels-Other (OCO), One-Sends-Other (OSO), and multi-leg orders. Additionally, direct routing capabilities enhance the execution of sophisticated futures trading strategies [14][15]. The API’s versatility is further amplified by its wide range of connectivity options.

Connectivity Model (REST, WebSocket, FIX, SDKs)

TradeStation API supports multiple programming languages, including C#, C++, Python, PHP, and Ruby. It integrates seamlessly with its network-based Order Execution (OX) system, ensuring fast and dependable connections. A practical example of this integration is TradingView, which uses the API to let users trade futures directly within its platform [14]. This flexibility ensures smooth execution and rapid data flow, both essential for maintaining low-latency trading operations.

Latency and Reliability for Platforms like NinjaTrader and Tradovate

When deployed on optimized infrastructure, such as Chicago-based datacenters, the TradeStation API achieves impressively low latency – measuring under 0.52 milliseconds to the CME Group exchange [3]. This reliability is critical for platforms like NinjaTrader and Tradovate, where speed and precision are non-negotiable.

Hosting Suitability on TraderVPS

For traders using automated systems, TraderVPS provides hosting plans tailored to various needs. Options range from 4-core/8GB setups for basic strategies to 6-core/16GB configurations for more complex, multi-strategy operations. With unmetered bandwidth exceeding 1Gbps and NVMe storage, TraderVPS ensures continuous data streaming and quick access to historical data, keeping systems running smoothly around the clock. This makes it an ideal choice for traders relying on the TradeStation API.

5. YCharts API

Market Coverage and Futures Contract Support

The YCharts API provides access to a wealth of premium historical data, covering stocks, ETFs, bonds, and more, with over 4,000 financial metrics available [16][6]. While it occasionally comes up in discussions about futures, its primary focus is on historical securities analysis rather than real-time futures contracts [6].

Keep in mind that using YCharts requires a commercial licensing agreement. For businesses, it offers an Enterprise plan that includes features like custom Excel Add-ins [6][16].

Connectivity Model

The YCharts API is only accessible through its Enterprise tier and does not follow standard documented protocols. Instead, it requires a custom integration process, which works best when paired with a reliable hosting setup.

Hosting Suitability on TraderVPS

Since the YCharts API is centered around historical data rather than real-time performance, ultra-low latency isn’t a critical factor. TraderVPS, with its high-performance CPUs, NVMe storage, and unmetered 1Gbps+ bandwidth, provides an excellent setup for tasks like backtesting and retrieving extensive historical data.

6. Databento API

Market Coverage and Futures Contract Support

The Databento API delivers futures contracts and market data from leading exchanges, including CME Group (Globex MDP 3.0), ICE Futures US, ICE Futures Europe, Eurex, Cboe Futures Exchange (CFE), EEX, and ICE Endex [17][18][20]. It spans key asset classes such as Agriculture, Energy, Equities, Foreign Exchange, Interest Rates, and Metals [20].

With nanosecond-resolution timestamps and full order book depth, this platform is tailored for high-frequency trading and in-depth market microstructure analysis [17][19]. It supports multiple data schemas, including Market By Order (MBO), Market By Price (MBP-1, MBP-10), Top of Book (TBBO), tick-by-tick trades, and OHLCV aggregates at intervals of 1 second, 1 minute, 1 hour, and 1 day [17][19]. Historical CME data is available dating back to June 6, 2010, enabling extensive backtesting [17][20]. This comprehensive market data integrates seamlessly with Databento’s connectivity model, explained below.

Connectivity Model

Databento’s API is designed to be lightweight, efficient, and ultra-low latency [6]. It offers live PCAP support, providing raw transaction data with nanosecond precision [6]. This level of granularity is a game-changer for traders using automated systems on platforms like NinjaTrader and Tradovate.

The real-time data gateways, developed in Rust and C, achieve a median latency of just 6.1 microseconds from the exchange to the client application [21]. For cloud and internet-based users, proprietary DPDK acceleration ensures a 100-gigabit line rate with a median latency of 64 microseconds [21]. To maintain reliability, Databento guarantees 99.9%+ uptime with virtually no data gaps, even when processing billions of messages daily, thanks to its redundant networks and servers [21].

Hosting Suitability on TraderVPS

Performance metrics highlight the importance of hosting infrastructure. Databento’s high-volume data streams, described as a "full-venue firehose", require substantial bandwidth [17][21]. TraderVPS meets these demands with its unmetered 1Gbps+ bandwidth and high-performance AMD EPYC cores, ensuring seamless handling of Databento’s nanosecond-level data. For internet-based users, the 90th percentile latency reaches just 590 microseconds to the client application [17][21]. With NVMe storage and low-latency networking, TraderVPS supports both intensive backtesting and live trading environments effectively.

7. Polygon Futures API

Futures Data Access

Polygon, under its Massive brand, now provides beta futures data with detailed tick-level granularity. This data is ideal for tasks like historical analysis, intraday adjustments, algorithmic trading, and backtesting. Users can access it through specific time-range queries, making it a versatile tool for traders and analysts.

Connectivity Model

Polygon’s connectivity framework is designed to seamlessly integrate with trading systems, building on its established data solutions. With an API-first approach, it offers both REST and WebSocket APIs. The WebSocket API delivers real-time and delayed bid/offer quotes, while the REST API allows users to pull tick-level trade data for specific contracts.

For added convenience, Polygon provides client libraries, such as a Python RESTClient, access to raw datasets via S3, and support for SQL queries. The pricing model is straightforward, featuring flat fees, free initial testing access, and a generous 50% discount for startups during their first year.

What’s the BEST cheap data for futures trading? Algorithmic Trading | Python

8. dxFeed Futures APIs

dxFeed provides a powerful solution for traders who need extensive market data coverage combined with low-latency performance.

Market Coverage and Futures Contract Support

dxFeed offers futures market data from major exchanges in the US, EU, and Turkey [24]. It supports a wide range of instruments, including traditional futures contracts, FX, cryptocurrencies, equities, and indices [22]. For traders using platforms like NinjaTrader or Tradovate, dxFeed provides both Level 1 data (best bid/ask, last traded price) and Level 2 data (full order book depth) [23]. The service also delivers real-time, historical, and tick-level data, along with aggregated datasets and calculated metrics to aid technical analysis [23]. This broad market coverage makes it a great choice for executing various futures strategies across different contract types and regions.

Connectivity Model

dxFeed’s connectivity options include support for Java, C/C#, Python SDKs, FIX, and REST APIs [25]. Its standardized API design simplifies integration into automated trading systems. Built on the high-performance QDS infrastructure, dxFeed ensures scalability and reliability, with redundant direct exchange connections [25][26]. The low-latency APIs are fine-tuned for applications where speed is critical, making them suitable for automated trading platforms like NinjaTrader and Tradovate [24].

Latency and Reliability for Platforms Like NinjaTrader and Tradovate

Low-latency data delivery is a cornerstone of dxFeed’s service, which is essential for executing time-sensitive futures trades [24]. By leveraging direct exchange connections and a geographically distributed infrastructure, dxFeed ensures consistent uptime and reliable feeds, even in volatile market conditions [25][26]. For NinjaTrader users running automated strategies, this means fewer interruptions and a stable data flow.

Hosting Suitability on TraderVPS

For automated futures trading, reliable and low-latency data requires a solid hosting platform. dxFeed doesn’t have specific hardware requirements, making it an excellent fit for hosting solutions like TraderVPS. For instance, TraderVPS’s Pro plan ($99/month) with 6 AMD EPYC cores and 16GB of RAM is more than capable of handling dxFeed’s data streams. Traders who need to process Level 2 order book data or perform intensive backtesting might prefer the Ultra plan ($199/month) with 24 cores and 64GB of RAM. Additionally, the unmetered 1Gbps+ bandwidth included in all TraderVPS plans ensures smooth and uninterrupted data flow.

9. Bourse Data API

The Bourse Data API provides access to futures market data, designed with automated trading in mind. While specifics about market coverage, contract types, and connectivity are still under wraps, updates are expected soon. For now, this API is shaping up to be a promising tool, especially when paired with reliable hosting solutions.

Hosting Considerations on TraderVPS

Even as we await more details about the API, traders can ensure their operations run smoothly with dependable hosting. TraderVPS delivers high-performance VPS plans tailored for futures trading. With ultra-low latency, reliable uptime, and unmetered 1Gbps+ bandwidth, it’s well-suited for handling everything from basic charting to executing intricate trading strategies seamlessly.

10. Oanda API with CME Futures CFDs Proxy

The Oanda API provides access to CFDs that emulate underlying futures contracts, even though it doesn’t directly offer native futures trading. With support for over 90 currency pairs and metals [27], it also delivers rates for more than 200 currencies, commodities, and precious metals traded as CFDs [28]. Examples include US30_USD (US Wall Street 30 Index CFD) and DE30_EUR (Germany 30 Index CFD), allowing traders to tap into major futures markets through a CFD proxy framework.

Connectivity Options (REST, FIX, SDKs)

Oanda offers a range of connectivity options tailored to different trading needs. Its REST and REST-V20 APIs are ideal for developing mobile and web applications or backtesting trading systems [29]. For institutional traders managing high transaction volumes, the FIX API provides a robust and efficient protocol. Both REST and FIX APIs support real-time streaming of bid, ask, and mid-point rates [28]. Additionally, developers can leverage pre-built SDKs and wrappers for popular programming languages. For example, the oandapy Python wrapper simplifies tasks like fetching prices, placing orders, and streaming live rates [30].

Performance and Reliability for Automated Trading

Oanda’s infrastructure is designed with automated trading in mind. Its redundant server architecture ensures reliability, while HTTPS security safeguards data transmission [28]. The platform is optimized for real-time data feeds, making it a strong option for high-frequency trading algorithms. However, since the API is focused on CFD trading rather than direct futures connectivity, it’s essential to determine if a CFD proxy aligns with your trading strategy. These features also integrate seamlessly with TraderVPS hosting solutions, ensuring smooth operation for automated systems.

Hosting with TraderVPS

Using the Oanda API on TraderVPS guarantees uninterrupted execution of automated CFD strategies. For basic automation needs, the VPS Lite plan at $69 per month includes 4× AMD EPYC cores and 8 GB of RAM. For more complex strategies involving multiple instruments, the VPS Pro plan at $99 per month provides 6 cores and 16 GB of RAM. TraderVPS delivers high-performance hosting designed to support real-time CFD automation effectively.

API Comparison Table

Here’s a detailed comparison of various APIs based on market coverage, connectivity, latency, platform compatibility, and the recommended TraderVPS plan:

| API | Market Coverage | Connectivity Options | Latency | Platform Compatibility | TraderVPS Plan |

|---|---|---|---|---|---|

| Barchart Futures API | Futures, options, forex, and cryptocurrencies across diverse markets [6] | REST, WebSocket | Standard | NinjaTrader, custom platforms | VPS Lite ($69/month) |

| TickAPI | Futures with extensive historical data [6] | REST, WebSocket | Standard | NinjaTrader, custom platforms | VPS Lite ($69/month) |

| Interactive Brokers API | Access to over 50 markets across 18 countries with direct CME connectivity [2][3] | TCP Socket, Python, Java, C++, C#, VisualBasic [1] | Standard | NinjaTrader, MultiCharts [1] | VPS Pro ($99/month) |

| TradeStation API | Comprehensive futures data [6] | Web-enabled REST | Standard | TradeStation platform, custom apps | VPS Pro ($99/month) |

| YCharts API | Futures market data | REST | Standard | Custom platforms | VPS Lite ($69/month) |

| Databento API | Multi-exchange futures data | REST, WebSocket | Ultra-low latency (nanosecond resolution) [6] | Custom platforms, HFT systems | VPS Ultra ($199/month) |

| Polygon Futures API | Major futures exchanges | REST, WebSocket | Low | Custom platforms | VPS Pro ($99/month) |

| dxFeed Futures APIs | Major futures data feed compatible with other feeds [3] | REST, WebSocket, FIX | Low | NinjaTrader, custom platforms | VPS Pro ($99/month) |

| Bourse Data API | Not specified | Not specified | Not specified | Not specified | VPS Lite ($69/month) |

| Oanda API with CME Futures CFDs Proxy | Not specified | Not specified | Not specified | Not specified | VPS Lite ($69/month) |

Among the standout options, Interactive Brokers API provides coverage across more than 50 markets in 18 countries, offering direct CME connectivity [2][3]. For traders requiring ultra-low latency, the Databento API is a strong choice, delivering nanosecond-resolution data [6], ideal for high-frequency trading strategies. Additionally, dxFeed Futures APIs supports institutional-grade execution with its FIX protocol [3].

When it comes to hosting, TraderVPS offers plans tailored to different trading needs:

- VPS Lite ($69/month): Best for single-strategy setups, featuring 4× AMD EPYC cores and 8 GB RAM.

- VPS Pro ($99/month): Suited for multi-instrument portfolios, with 6-core processors and 16 GB RAM.

- VPS Ultra ($199/month): Designed for ultra-low latency strategies, offering 24-core processors and 64 GB RAM.

Conclusion

Choose an API that aligns with your trading goals and technical skills. For high-frequency traders, ultra-low latency solutions like the Databento API are ideal. Developers familiar with object-oriented programming might find the Interactive Brokers API more suitable, while others may gravitate toward simpler, more intuitive interfaces.

Cost considerations are just as important as technical features. Decide whether you need Level 1 basic data or the more detailed Level 2 market depth, which often comes with additional fees. For instance, some brokers charge $16 per month per exchange for Level 2 data, or $41 per month for bundles covering all U.S. exchanges [31]. Understanding your data requirements and the associated subscription costs can help you avoid unexpected expenses.

"Trading bots are excellent at automating tasks. However, they perform best when combined with real-time market analysis tools, such as our tool Bookmap" [34].

Looking ahead, middleware like SignalStack offers powerful tools for automation. By 2025, it will be capable of converting alerts into live trade orders across more than 33 brokers, with execution speeds under 0.45 seconds and 99.99% uptime [32]. Using a combination of APIs can enhance both data analysis and trade execution.

"Successful futures trading often involves combining multiple analysis methods and tools. Traders can leverage the strengths of AI technologies, chart pattern recognition, time cycles, price calculation models, and even astrological timing to create a well-rounded trading strategy" [33].

Ensure your chosen API integrates seamlessly with your trading platform and infrastructure. Pairing the right API with a reliable hosting solution is crucial for efficient performance. For optimal results, consider matching your API with a TraderVPS plan. Whether it’s the VPS Lite for single-strategy setups or the VPS Ultra for high-frequency trading, these plans can help reduce latency and improve execution efficiency.

FAQs

What should I look for in an API for automated futures trading?

When choosing an API for automating futures trading, it’s crucial to focus on factors that match your specific trading requirements. Start by ensuring the API works seamlessly with your preferred platforms, such as NinjaTrader or Tradovate, and offers easy integration through a well-documented interface.

Another key consideration is data quality and latency. APIs that deliver low-latency, accurate market data can make a big difference in the effectiveness of your trading strategies. Features like advanced analytics, risk management tools, and optional AI or machine learning capabilities can also add extra value by enabling real-time decision-making.

Finally, don’t overlook security and reliability. Opt for APIs that provide strong encryption, reliable infrastructure, and comprehensive developer support to ensure smooth and secure operations in the fast-moving world of futures trading.

How do latency and connectivity affect automated futures trading performance?

Latency is the time it takes for market data to travel to your trading system and for your orders to be executed on the exchange. In futures trading, even a few milliseconds of delay can make a difference, potentially causing slippage and cutting into your profits. For strategies like high-frequency trading or scalping, low-latency APIs are essential because they allow you to respond to market changes almost instantly.

Connectivity is a major factor in achieving low latency. Placing your trading system on a VPS near the exchange – like in Chicago for CME – shortens the network distance, cutting down delays. Using reliable connectivity options, such as dedicated fiber connections or redundant ISP links, ensures stable performance with minimal packet loss or jitter. When combined, a low-latency API and dependable connectivity can dramatically boost order execution speed, reduce slippage, and improve the overall efficiency of your automated trading system.

What are the advantages of using TraderVPS to host automated futures trading APIs?

TraderVPS stands out as a solid option for hosting automated futures trading APIs, offering a host of features designed to enhance trading performance. With high-performance servers and ultra-low latency, it supports faster trade execution – an essential factor in futures trading, where every millisecond can influence profitability.

Another major advantage is its reliable uptime and stability, which helps avoid disruptions during critical trading sessions. This consistency ensures that automated strategies operate smoothly without interruptions. Plus, TraderVPS works seamlessly with widely-used platforms like NinjaTrader and Tradovate, simplifying the integration process and saving valuable time.

What’s more, TraderVPS provides dedicated resources specifically configured to meet the demands of high-frequency trading. This means your APIs can handle heavy workloads efficiently without compromising performance. These capabilities make TraderVPS a dependable choice for traders looking to run their automated futures trading systems effectively.