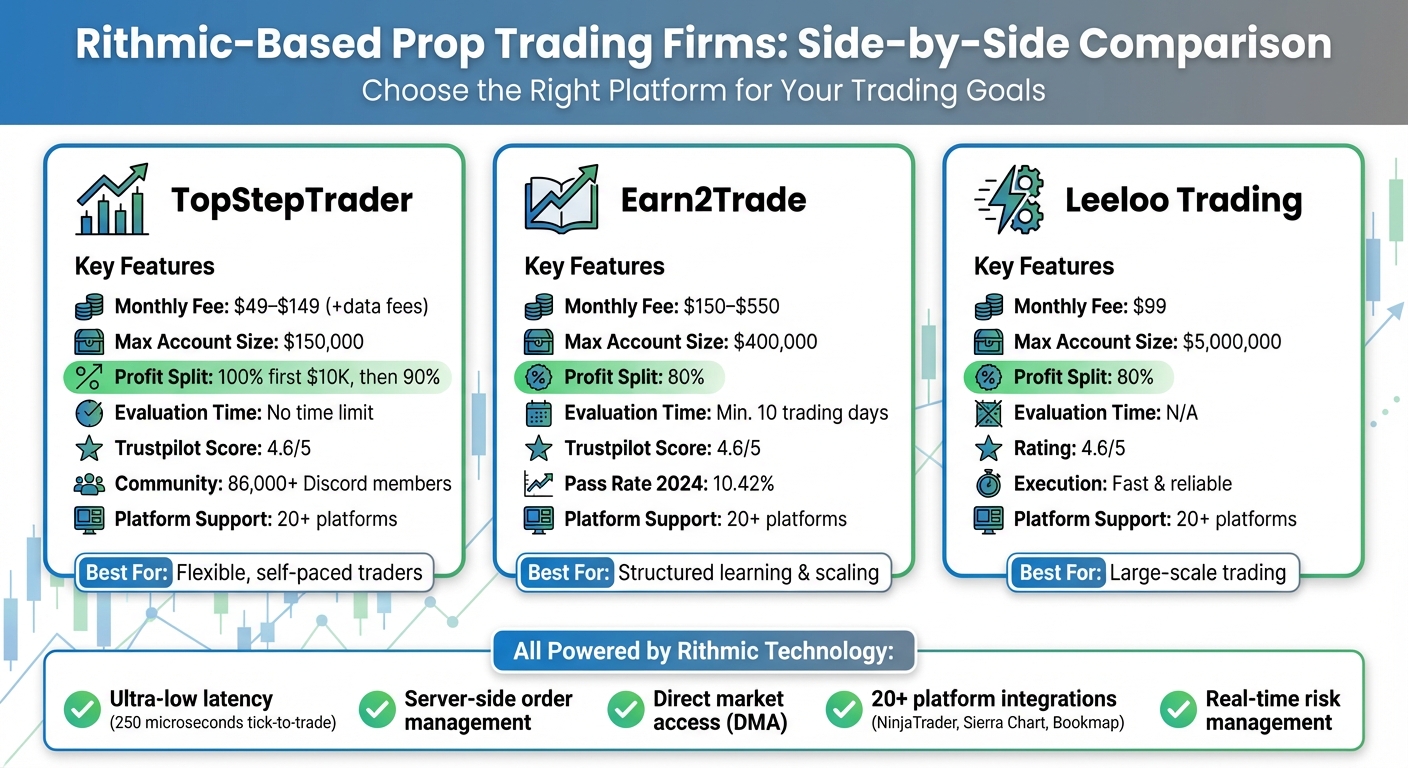

Rithmic-based proprietary trading firms offer traders access to fast, reliable futures trading platforms with direct market access (DMA). These firms use Rithmic‘s low-latency infrastructure, real-time risk management tools, and server-side order execution to help traders meet evaluation criteria and scale their trading strategies. Here’s a quick look at three firms leveraging Rithmic technology:

- TopStepTrader: Offers flexible evaluation programs starting at $49/month, with no time limits and profit splits of 100% for the first $10,000, then 90%.

- Earn2Trade: Focuses on structured evaluations like the Gauntlet Mini™, with fees from $150–$550/month and an 80% profit split. Requires a minimum of 10 trading days.

- Leeloo Trading: Provides accounts up to $5,000,000 with an 80% profit split for $99/month. Rithmic ensures fast execution and strong risk controls.

Rithmic’s technology supports over 20 trading platforms, including NinjaTrader and Sierra Chart, enabling traders to execute strategies with precision. Each firm has unique features to suit different trading styles and goals.

Quick Comparison

| Feature | TopStepTrader | Earn2Trade | Leeloo Trading |

|---|---|---|---|

| Monthly Fee | $49–$149 (+data fees) | $150–$550 | $99 |

| Max Account Size | $150,000 | $400,000 | $5,000,000 |

| Profit Split | 100% first $10K, then 90% | 80% | 80% |

| Evaluation Time | None | Min. 10 trading days | N/A |

| Platform Support | 20+ platforms | 20+ platforms | 20+ platforms |

Rithmic’s low-latency execution, robust risk management, and extensive platform compatibility make it a valuable tool for futures traders. Choose a firm based on your trading needs, whether flexibility, structured evaluations, or larger account sizes are your priority.

Rithmic Prop Trading Firms Comparison: TopStepTrader vs Earn2Trade vs Leeloo Trading

1. TopStepTrader

Evaluation Models

TopStepTrader sets the bar high with its evaluation programs. Traders must meet strict criteria, including consistent profitability, adherence to profit targets, and staying within daily loss limits and drawdown thresholds. To assess performance, the firm relies on advanced tools typical of Rithmic-powered platforms, which combine precise order routing with detailed market data. This approach ensures that traders are evaluated under realistic and challenging conditions, supported by Rithmic’s strong risk management capabilities.

Rule Enforcement via Rithmic

One standout feature is Rithmic’s server-side order management. This system ensures that critical risk controls, like bracket orders and trailing stops, remain active even if connectivity issues arise. It’s a safety net that helps maintain discipline and protects traders from unexpected disruptions.

Platform and Infrastructure Support

TopStepTrader connects seamlessly with over 20 professional trading platforms. This integration offers traders flexibility and speed, with execution times as fast as 250 microseconds from tick to trade [7][3]. Additionally, traders gain access to unfiltered, tick-by-tick market data, including Market By Order details, which provide a detailed view of the order book for sharper trading insights.

Scalability and Trader Benefits

These advanced features not only support the rigorous evaluation process but also boost real-time trading performance. The platform’s low latency and robust infrastructure enable traders to capitalize on even the quickest market opportunities. During high-activity sessions, the system handles large message volumes without compromising stability, allowing traders to focus on showcasing their skills under demanding conditions.

Never Fail a Prop Firm Account In One Day Again: Mastering Rithmic’s Risk Parameters

2. Earn2Trade

While TopStepTrader focuses on offering broad platform access and strong risk management tools, Earn2Trade takes a different approach, prioritizing a streamlined evaluation process and ongoing trader support.

Evaluation Models

Earn2Trade’s Gauntlet Mini™ evaluation uses R|Trader and R|Trader Pro to implement real-time risk controls and ensure compliance with strict trading parameters[6]. Similar to TopStepTrader, it leverages Rithmic’s low-latency market data to give traders the tools they need for precise execution. The system is tailored to support "Funding Evaluators", allowing firms to monitor capital allocation closely while ensuring traders stick to their strategies with accuracy[1][5].

Rule Enforcement via Rithmic

The platform automatically enforces trading rules and monitors compliance, ensuring traders adhere to guidelines without manual oversight[8][5]. To further support disciplined trading, Earn2Trade offers live webinars and educational resources designed to reinforce good habits and strategic thinking[6].

Platform and Infrastructure Support

Rithmic’s direct market access (DMA) enables lightning-fast execution, with tick-to-trade speeds under 250 microseconds[7]. The platform connects with over 20 third-party tools, including NinjaTrader, Bookmap, and Quantower, giving traders access to advanced charting and order flow analysis[9]. Additionally, R|Trader Pro provides real-time Excel integration, allowing traders to automate systems and create custom indicators for a more tailored experience[9].

Scalability and Trader Benefits

Once traders complete the evaluation phase, they move to live funded accounts, continuing to use the same Rithmic platform. This seamless transition eliminates the need to learn a new system. Earn2Trade’s collaboration with Helios Trading Partners ensures access to real capital and payouts. Meanwhile, Rithmic’s advanced order types and API capabilities allow traders to scale complex strategies effectively[6][8].

Next, we’ll explore how Leeloo Trading builds on these features.

3. Leeloo Trading

Leeloo Trading is part of a growing network of proprietary trading firms that rely on Rithmic’s trusted infrastructure. They offer trading accounts with balances of up to $5,000,000 and an 80% profit split, all for a $99 monthly fee. Their Rithmic-powered setup ensures fast and dependable trade execution[8].

Evaluation Models

Leeloo Trading utilizes Rithmic’s R|Trader and R|Trader Pro platforms to provide real-time risk management during the evaluation process, helping traders stay within defined limits as they work towards funding[8].

Automated Risk Management with Rithmic

The platform enforces strict pre- and post-trade risk controls automatically. Rithmic’s built-in tools and specialized risk screens ensure traders operate within the set guidelines, maintaining accountability and minimizing unnecessary risks[1][2].

Platform and Infrastructure

Leeloo Trading capitalizes on Rithmic’s robust infrastructure to provide traders with direct market access (DMA), ensuring seamless connections to exchanges[1]. The platform supports over 20 professional trading tools, such as NinjaTrader, Sierra Chart, Bookmap, and Quantower. For those seeking custom solutions, API options like R|API, R|API+, and R|FIX API are available[1][9]. Pedro Taveira from LivingFromTrading highlights the platform’s strengths:

"fast, reliable, and precise"[8]

Scalability and Trader Advantages

These features enhance scalability and build trader confidence. Once funded, traders continue using the same Rithmic platform, ensuring a consistent trading experience. With a strong 4.6 rating, Leeloo Trading demonstrates its commitment to supporting growth. Additionally, server-side order management keeps trailing stops, OCOs, and bracket orders active, even during connectivity disruptions, offering peace of mind to traders[8][9].

Pros and Cons

Rithmic-based prop firms offer a variety of benefits and challenges, making them a unique option for traders.

TopStepTrader stands out with its flexible Trading Combine phase, which doesn’t impose time restrictions. This makes it a great choice for traders who prefer to move at their own pace. The monthly fees for the Trading Combine start at $49 for a $50,000 account, with additional data fees of $135 per month per exchange for live accounts. The firm boasts a Trustpilot score of 4.6 and a community of over 86,000 members on Discord. Profit sharing is especially appealing, offering 100% on the first $10,000 earned and 90% thereafter for accounts up to $150,000 [10].

Earn2Trade uses structured evaluations like the Trader Career Path® and Gauntlet Mini™, requiring a minimum of 10 trading days. Monthly fees range from $150 to $550, depending on the account size, and the program allows account scaling up to $400,000 with an 80% profit split. However, the evaluation process is rigorous, as demonstrated by a drop in pass rates from 23.38% in 2023 to 10.42% in 2024. Earn2Trade also holds a Trustpilot score of 4.6, backed by over 2,000 reviews [11].

Leeloo Trading offers a Rithmic-powered platform with low-latency server-side order management. However, details about its evaluation model, fees, and account scalability are not widely available.

Below is a comparison of key features across these firms:

| Feature | TopStepTrader | Earn2Trade | Leeloo Trading |

|---|---|---|---|

| Monthly Fee | $49–$149 (+data fees) | $150–$550 | N/A |

| Max Account Size | $150,000 | $400,000 | N/A |

| Profit Split | 100% first $10K, then 90% | 80% | N/A |

| Evaluation Time Limit | None | Min. 10 trading days | N/A |

| Trustpilot Score | 4.6/5 | 4.6/5 | N/A |

| Platform Compatibility | TopstepX, Tradovate, NinjaTrader, etc. | Rithmic-based platforms | Rithmic-based integration |

Choosing the right firm depends on your trading priorities. Whether you’re looking for low entry costs, structured learning paths, or efficient execution, aligning your goals with the right firm can help you make the most of Rithmic’s capabilities.

Conclusion

Choosing the best Rithmic-based prop firm comes down to your specific trading style, technical know-how, and long-term goals. TopStepTrader and Earn2Trade each cater to different needs – one focuses on a more adaptable evaluation process, while the other emphasizes a structured program for trader development. Think about which approach aligns better with your strategy and career path.

Rithmic’s speed is a key advantage for both scalpers and algorithmic traders. Scalpers and short-term traders can capitalize on the low-latency execution – perfect for navigating fast-moving markets. At the same time, algorithmic traders gain a significant edge with Rithmic’s R | Diamond API™, offering a direct link to exchange-facing gateways for ultra-low latency performance[4].

"Rithmic’s market data and trade execution software delivers to you the low latency and high throughput performance formerly seen only by the very large trading houses and boutique hedge funds." – Rithmic [1]

Another standout feature is Rithmic’s extensive platform integration. With support for over 20 platforms – including NinjaTrader, Sierra Chart, and Bookmap – you can select the interface that suits your trading approach[9]. Features like server-side order management ensure bracket orders and trailing stops remain active even during connectivity hiccups. Additionally, Market By Order data provides detailed order book insights, helping traders make better-informed decisions.

Ultimately, the right prop firm combines the right evaluation structure, robust technical tools, and solid support to help you elevate your trading game.

FAQs

What are the key advantages of using Rithmic-powered platforms for futures trading?

Rithmic-powered platforms deliver blazing-fast execution speeds and low-latency order routing, both essential for thriving in futures trading. These tools give traders access to precise, unfiltered market data, ensuring they see the market exactly as it is.

On top of that, the platforms come equipped with sophisticated analytics tools and dependable server-side order management, empowering traders to make smarter decisions and execute trades with confidence. This blend of speed, accuracy, and reliable infrastructure positions Rithmic as a go-to option for dedicated futures traders.

What are the differences in the evaluation processes of TopStepTrader, Earn2Trade, and Leeloo Trading?

TopStepTrader uses a two-step evaluation process that begins with a trading challenge and is followed by a verification phase. They offer traders the opportunity to earn profit splits of up to 80-90%, providing a structured pathway for those looking to prove their skills.

Earn2Trade takes a different approach with a one-step evaluation that emphasizes risk management and achieving profit targets. This simplified process also allows traders to access profit splits of up to 80-90%.

Leeloo Trading stands out by offering flexible evaluation options, letting traders choose between one- or two-step processes. Their approach focuses on speed and maintaining strong risk controls, while also providing profit splits of up to 80-90%.

The main distinction between these platforms lies in their structure: TopStepTrader sticks to a traditional two-step process, while Earn2Trade and Leeloo Trading offer more streamlined or adaptable alternatives.

What should I look for in a proprietary trading firm that uses Rithmic?

When selecting a prop trading firm that utilizes Rithmic, it’s essential to prioritize factors that directly impact your trading efficiency. Platform speed, reliability, and low-latency execution are especially important for futures trading, where split-second decisions can make a significant difference.

You should also take a close look at the firm’s profit-sharing structure, the fairness of their evaluation process, and their risk management rules to ensure they align with your trading style and objectives. These elements can heavily influence your overall experience and success with the firm.

Beyond that, consider the firm’s reputation and transparency. A trustworthy firm will provide clear terms and conditions, making it easier to understand what you’re signing up for. The quality of market data they offer is another crucial factor – accurate, real-time data is a must for informed decision-making.

Finally, features like account scaling options, platform compatibility, and advanced analytics tools can take your trading to the next level. These extras not only improve your performance but also make the entire trading process smoother and more enjoyable.