Proprietary trading firms (prop firms) make money in ways that directly affect your trading experience. Here’s what you need to know:

- Main Revenue Sources:

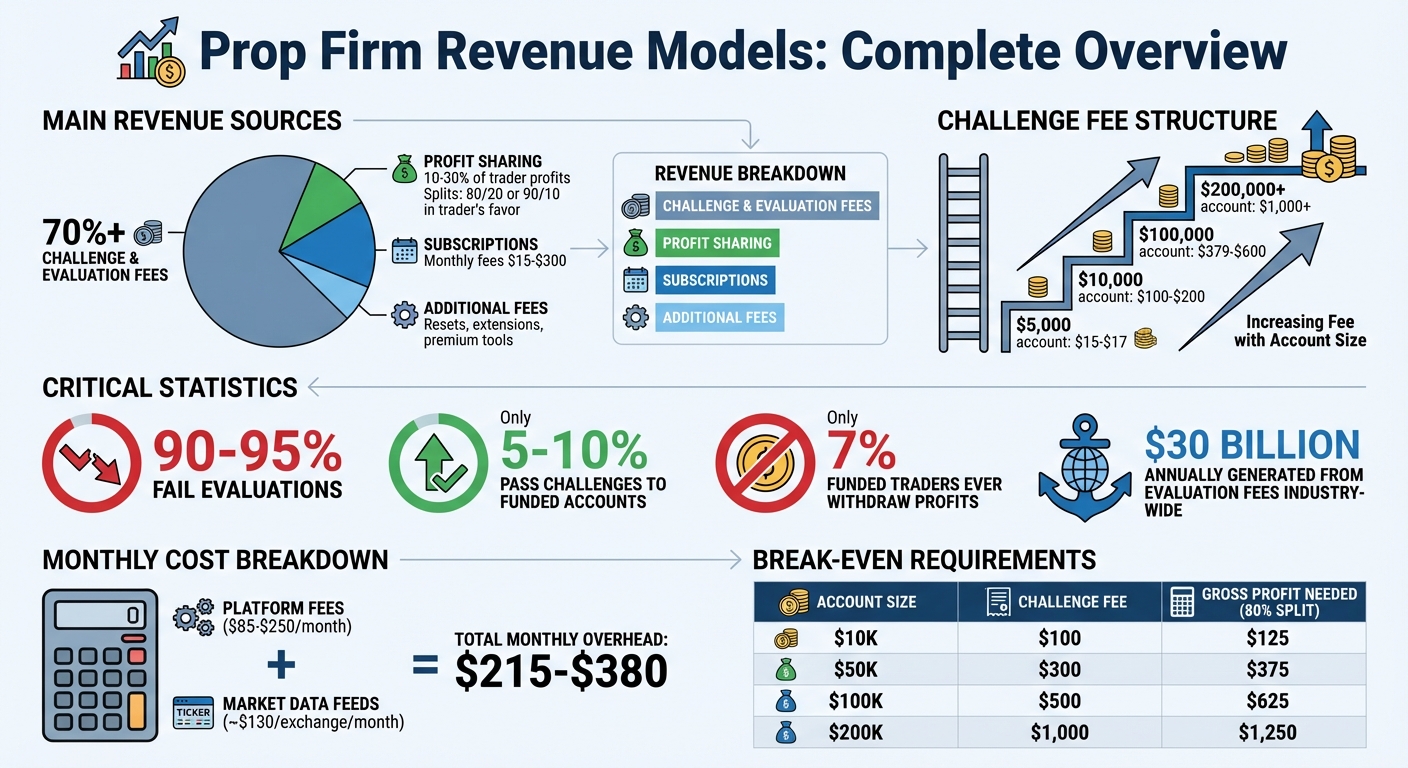

- Challenge & Evaluation Fees: These account for 70%+ of their income. Traders pay fees ($100–$1,000+) to prove their skills. Most don’t pass, but firms profit from retries.

- Profit Sharing: Once funded, firms take 10%–30% of trader profits. Popular splits are 80/20 or 90/10 in favor of traders.

- Subscriptions: Monthly fees ($15–$300) cover platform access, data feeds, or instant funding options.

- Additional Fees: Account resets, time extensions, and premium tools add extra costs.

- Key Stats:

- 90%–95% of traders fail evaluations.

- Only 7% of funded traders ever withdraw profits.

- Evaluation fees generate $30 billion annually for the industry.

- What It Means for You:

- Success requires careful planning. Factor in costs like evaluation fees, monthly subscriptions, and potential resets.

- Profit-sharing aligns firms with trader success, but strict rules (drawdown limits, profit thresholds) can be challenging.

- Watch for hidden costs, such as platform fees or data subscriptions.

Understanding these revenue models helps you make smarter choices, manage costs, and improve your chances of succeeding with a prop firm.

Prop Firm Revenue Model Breakdown: Sources, Statistics, and Trader Success Rates

Prop Firms: The Truth No One Talks About | Gary Norden

Challenge and Evaluation Fees

Challenge and evaluation fees make up the biggest source of revenue for most proprietary trading firms, contributing to over 70% of their income [4]. These fees are one-time payments that traders must pay to participate in evaluations, which come with specific profit targets and strict drawdown limits. This system allows firms to identify skilled traders before offering them funded accounts.

Fee Structures and Refund Policies

The cost of entering a challenge depends on the size of the account you aim to trade. For instance:

- $10,000 accounts typically cost $100–$200.

- $100,000 accounts range between $379–$600.

- Smaller challenges, such as $5,000 accounts, are priced around $15–$17.

- Larger accounts exceeding $200,000 often cost $1,000 or more [8][9].

Many firms offer a refund on the evaluation fee after a trader’s first profitable withdrawal, essentially waiving the fee for those who succeed [8][2]. For traders who fail, there’s often an option to pay a "reset fee" – usually between $50 and $200 – to restart the challenge at a reduced cost instead of paying the full fee again [3].

Impact on Traders and Firms

These fees provide a steady revenue stream that covers operational expenses, such as technology infrastructure, market data feeds (which can cost around $130 per exchange each month [4]), and staffing. Since the evaluations are conducted on demo accounts [3][5], firms can assess traders’ skills without exposing themselves to financial risk during this phase.

This model is highly effective because only about 5% to 10% of participants successfully pass the challenges and move on to funded accounts [3]. Traders who don’t succeed often try again, paying additional fees with each attempt. As a result, firms generate significant income from most participants while managing only a small number of funded accounts. This approach also creates opportunities for additional revenue streams, such as profit-sharing and subscription-based services.

Profit-Sharing Models

After traders successfully navigate the evaluation phase, proprietary trading firms transition their focus to profit-sharing, a model that ties their earnings directly to traders’ success.

Once a trader passes the evaluation process, profit-sharing becomes the main ongoing revenue source for the firm. Alongside evaluation fees, this approach forms the core of the firm’s revenue strategy. The firm supplies the capital and trading infrastructure, while the trader contributes their expertise. When profits are made, they are split between the trader and the firm based on a pre-agreed percentage [6].

"The foundation of the prop firm’s business model is mainly based on the profits from successful trades that are shared between you and the firm." – Noam Korbl, Co-founder [10]

This arrangement aligns the goals of both parties. Typically, firms retain 10%–30% of the net profits generated by funded traders [6]. Since only a small percentage of traders advance to the funded stage [3], firms can afford to offer competitive profit splits while maintaining financial stability through evaluation fees.

Profit Splits and Conditions

The 80/20 split – where traders keep 80% of the profits and the firm takes 20% – is widely regarded as the industry standard [11]. However, increasing competition has driven firms to offer more appealing terms. Today, profit splits often range from 70% to 90% in the trader’s favor, and some firms even provide higher percentages [6].

Certain firms add unique incentives, such as allowing traders to keep 100% of their initial profits – up to a set limit – before moving to a split structure, often 90/10 [11]. Others start with an 80% split and give traders the option to upgrade to a 90% split during the funding process [11].

These profit-sharing arrangements come with strict rules. Traders must adhere to daily loss limits and drawdowns, typically capped at 5%–10% [3]. Additionally, most firms require traders to meet a minimum profit threshold – usually between $50 and $1,000 – before they can request a withdrawal [6]. Consistency rules, like the "30% rule" (which limits any single day’s profit to 30% of total earnings), are designed to reward steady, disciplined performance [11].

Balancing Trader Incentives and Firm Sustainability

Profit-sharing models are carefully structured to motivate traders while ensuring the firm’s financial health. Many firms offer scaling plans that allow traders to grow their accounts to $1 million or more, often with increased profit percentages for consistent performance [11]. These incentives encourage long-term participation and reward traders who demonstrate dependable results.

Payout schedules are evolving to be more trader-friendly, shifting from monthly payouts to bi-weekly, weekly, or even on-demand withdrawals [6]. This quicker access to earnings appeals to experienced traders looking for flexibility.

From the firm’s perspective, sustainability is achieved through risk management. Strict drawdown limits help control potential losses, and many firms use "A-book" models to hedge trades by passing successful positions to liquidity providers [3]. Some firms even keep funded traders on demo accounts, paying out real money from evaluation fees while mirroring profitable strategies in live markets. This approach minimizes direct market exposure while still rewarding traders’ skills [12].

"The better you do, the more they earn, making it in their best interests to see you succeed." – BestPropFirms [6]

Subscription and Recurring Fees

Subscription fees offer a steady stream of recurring revenue that helps firms cover essential costs like platform upkeep, real-time market data, and risk management tools [13][14]. For companies like TraderVPS, which prioritize cost efficiency, these fees ensure ongoing platform improvements while maintaining financial stability.

Across the industry, monthly subscription fees generally fall between $100 and $300 [4]. For instance, Apex Trader Funding charges funded traders $85 per month after completing the evaluation process, while Goat Funded Trader keeps its monthly platform fee at a modest $15 [4][13]. This recurring revenue model has also given rise to hybrid approaches that combine challenge fees with ongoing subscription payments.

The "Instant Funding" model takes a different approach by offering traders immediate access to capital in exchange for monthly fees [15]. However, firms adopting this model need significantly higher startup capital – ranging from $100,000 to $250,000, compared to just $25,000 for traditional challenge-based setups [15]. The benefit for traders is immediate access to funded accounts, while firms secure reliable monthly income.

"Subscription models also align well with profit-sharing arrangements, allowing firms to diversify their revenue while maintaining incentives for trader success." – Goat Funded Trader [13]

Hybrid Models Combining Subscriptions and Challenges

Many firms now mix upfront challenge fees with monthly subscriptions once traders achieve funded status. This strategy provides firms with immediate revenue through evaluations while ensuring a continuous income stream through subscriptions [4]. Additionally, some companies offer premium upgrades as optional monthly add-ons, enabling traders to customize their experience while creating extra revenue opportunities for the firm [15].

Pros and Cons of Subscription Models

Subscription-based models come with both benefits and challenges for traders and firms. For firms, recurring fees provide a dependable cash flow, reducing reliance on new challenge sign-ups and covering fixed costs like data and platform maintenance [13][4]. For traders, these models often lower the initial entry cost and may include enhanced tools and support [13][15].

However, there are financial trade-offs. Christopher Downie, Content & Product Strategist at LuxAlgo, highlights:

"For traders, these ongoing fees can add up over time, increasing the overall cost of trading. Even for those with consistent performance, these expenses can gradually chip away at their profitability." [4]

Here’s a closer look at the pros and cons for both parties:

| Stakeholder | Advantages | Disadvantages |

|---|---|---|

| Prop Firm | Reliable cash flow; covers platform and data costs; reduces reliance on new challenges [13][4] | Requires intensive management and substantial startup capital [15] |

| Trader | Access to capital; lower initial costs; often includes improved tools/support [13][15] | Recurring fees can erode profits; costs continue during unprofitable months [4][14] |

Traders should carefully evaluate whether subscription fees align with their trading goals. Conducting a break-even analysis can help determine if the potential profits justify the recurring costs. For instance, extended evaluation periods – lasting beyond three or four months – can make subscription fees more expensive than one-time challenge fees [4][14]. Additionally, some firms charge separate fees for market data, which can add hidden costs that traders need to account for [14].

Platform Fees and Upsells

In addition to challenge and subscription fees, many proprietary trading firms generate extra income through a variety of add-ons like account resets, time extensions, and scaling plan applications [1][7]. These fees can significantly raise the overall cost of participating in evaluations. Reset and extension fees, for instance, often play on the sunk cost fallacy – traders are tempted to pay more to avoid losing progress on a challenge they’re close to failing [7].

Another revenue stream comes from premium tools. Firms offer subscriptions for advanced charting software, proprietary indicators, and real-time market data feeds, creating a recurring income model similar to SaaS businesses [1][2]. Educational resources and mentorship programs are also common, with prices ranging from $200 to over $1,000 [1].

Low-latency infrastructure is another critical factor in trading. Firms use AI-based risk controls to monitor for latency arbitrage, and traders with slower connections may face challenges like increased slippage or higher spread markups [1][2]. Some firms even add markup fees of 0.2 to 0.5 pips on real bid-ask spreads, which can quickly accumulate for high-volume traders [1]. With these added costs, having a cost-efficient and reliable trading setup becomes essential.

TraderVPS as a Cost-Efficiency Solution

While secondary fees can weigh heavily on traders, investing in optimized infrastructure can help reduce other trading-related expenses and improve overall performance. For those running automated strategies or managing multiple charts, a dependable setup is crucial to stay competitive. TraderVPS offers specialized Virtual Private Server (VPS) solutions designed for high-performance trading, ensuring 24/7 uptime and ultra-low latency connections to broker servers.

For traders managing multiple charts and demanding setups, the VPS Ultra plan costs $199 per month and provides 24 AMD EPYC cores, 64GB DDR4 RAM, and 500GB NVMe storage. It supports up to four monitors, making it ideal for running 5-7 charts simultaneously on platforms like NinjaTrader. This eliminates the need for expensive local hardware by using servers strategically located near exchange networks, reducing execution delays and minimizing slippage.

For those starting out with funded accounts, the VPS Lite plan at $69 per month offers 4 AMD EPYC cores and 8GB RAM, suitable for running 1-2 charts. The VPS Pro plan, priced at $99 per month, upgrades to 6 cores and 16GB RAM, supporting up to three monitors and 3-5 charts. All plans include features like DDoS protection, automatic backups, and unmetered bandwidth on a high-speed 1Gbps+ network, ensuring stability even during periods of heavy trading activity.

Financial Implications for Traders

Before diving into trading with a prop firm, it’s essential to crunch the numbers – starting with your break-even point. For example, if you pay $500 for a challenge with an 80% profit split, you’ll need to generate $625 in total profit just to cover that initial cost[1]. This is your first financial hurdle, and it’s critical to factor in how recurring fees and potential failures can further impact your bottom line.

Challenge fees are just the beginning. High failure rates in evaluations can quickly erode your return on investment. Many traders find themselves repeatedly paying for challenges, which can be a significant drain on resources.

"For many retail-focused prop firms, these fees [challenges and subscriptions], not profit splits, form the bulk of their revenue."

- Christopher Lewis, DailyForex[5]

On top of challenge fees, monthly fixed costs can add up fast. For instance, platform access fees range from $85 to $250 per month, and market data feeds can add another $130 per exchange[4]. Altogether, monthly overhead can land between $215 and $380. With an 80% profit split, you’ll need to generate approximately $269 to $475 in gross profit just to break even on these recurring costs.

Here’s a breakdown of common financial thresholds:

| Account Size | Challenge Fee | Profit Split | Break-Even Gross Profit | Monthly Subscription Cost | Additional Monthly Profit Required (at 80% split) |

|---|---|---|---|---|---|

| $10,000 | $100 | 80/20 | $125 | $215 | $269 |

| $50,000 | $300 | 80/20 | $375 | $215 | $269 |

| $100,000 | $500 | 80/20 | $625 | $215 | $269 |

| $200,000 | $1,000 | 80/20 | $1,250 | $215 | $269 |

This table highlights how quickly costs can pile up. Take a $100,000 account, for example. You’d need to generate $625 in profit to recover the initial challenge fee and another $269 each month for platform and data fees – totaling $894 in gross profit. And if you add reset fees ($80–$200) or extension fees ($50–$150)[1], your financial targets climb even higher.

To make informed decisions, compare your realistic monthly profit expectations to these thresholds. Some prop firms offer refundable challenge fees upon your first payout, which can help mitigate initial risks. By understanding these financial dynamics, you can better align your approach with the revenue models discussed in this article.

Conclusion

Grasping how prop firms generate revenue is crucial for traders aiming to succeed in this space. The bulk of these firms’ income comes from evaluation fees, while only a small percentage of traders manage to reach funded accounts [1][4].

To navigate this landscape effectively, it’s important to calculate your break-even point. This means factoring in both the initial challenge fees and any recurring costs that can chip away at your profits. A thorough understanding of these financial commitments will help you determine how much gross profit you’ll need to simply cover these expenses.

Equally important is ensuring that the firm’s rules – like drawdown limits, consistency requirements, and trading style restrictions – align with your strategy. As Ngan Pham from H2T Funding insightfully points out:

"The challenge itself is a meticulously designed product, sold to the masses, just as much as it is a filter for elite talent" [1].

This level of financial discipline requires an equally reliable trading setup. As mentioned earlier, strict drawdown rules mean that even a single connection issue could jeopardize your evaluation. Services like TraderVPS provide the 24/7 uptime and ultra-low latency execution needed to meet these stringent requirements.

Ultimately, success in prop firm trading depends on a clear understanding of the financial commitments and selecting a firm whose structure aligns with your goals for sustainable profitability. Take the time to analyze every cost and choose wisely.

FAQs

How do challenge and evaluation fees affect my earnings with a prop firm?

When you start trading with a proprietary firm, you’ll encounter challenge and evaluation fees – upfront costs that are essential to consider. These fees are often subtracted from your initial profits, which can shrink your net earnings, especially if you end up retaking the challenge more than once.

For traders, it’s crucial to account for these fees as part of your overall strategy. Ask yourself: do the potential rewards outweigh the initial investment? By understanding these costs, you can make smarter decisions and ensure your trading approach aligns with your financial objectives.

What profit-sharing splits do prop firms typically offer, and how do they impact my earnings?

Most proprietary trading firms operate on a profit-sharing model, where traders typically retain 70% to 90% of the profits they generate. The most common arrangement is an 80/20 split, meaning traders keep 80% of their earnings while the firm takes the remaining 20%. Essentially, the higher your share, the more you take home from each successful trade.

While these splits can significantly impact your earnings, it’s crucial to look beyond just the percentage. Factors like fees and funding structures can also play a big role in determining your actual income. Make sure to weigh these elements carefully to ensure they align with your overall trading strategy and financial goals.

What are the hidden costs of trading with a prop firm?

When working with a prop firm, the evaluation fee is usually the first cost that grabs your attention. But beyond that, there are several hidden expenses that can quietly chip away at your earnings. For instance, if you don’t pass a challenge and need more time, many firms charge reset or extension fees. Once you’re funded, you could also face monthly platform or subscription fees for tools like data feeds, charting software, or account upkeep – these fees typically range between $50 and $200 per month.

Another cost to consider is tied to your trading activity. Prop firms often benefit from broker commissions or spread markups, which can make each trade slightly more expensive without it being immediately obvious. On top of that, some firms promote optional extras like premium education or mentorship programs, which can easily add hundreds of dollars to your overall costs. And don’t overlook withdrawal or inactivity fees, which might kick in if you don’t regularly withdraw profits or maintain a certain level of trading activity.

To avoid unexpected charges, take the time to thoroughly examine a firm’s fee structure and terms before signing up. Factor these costs into your trading plan to ensure they align with your financial objectives.