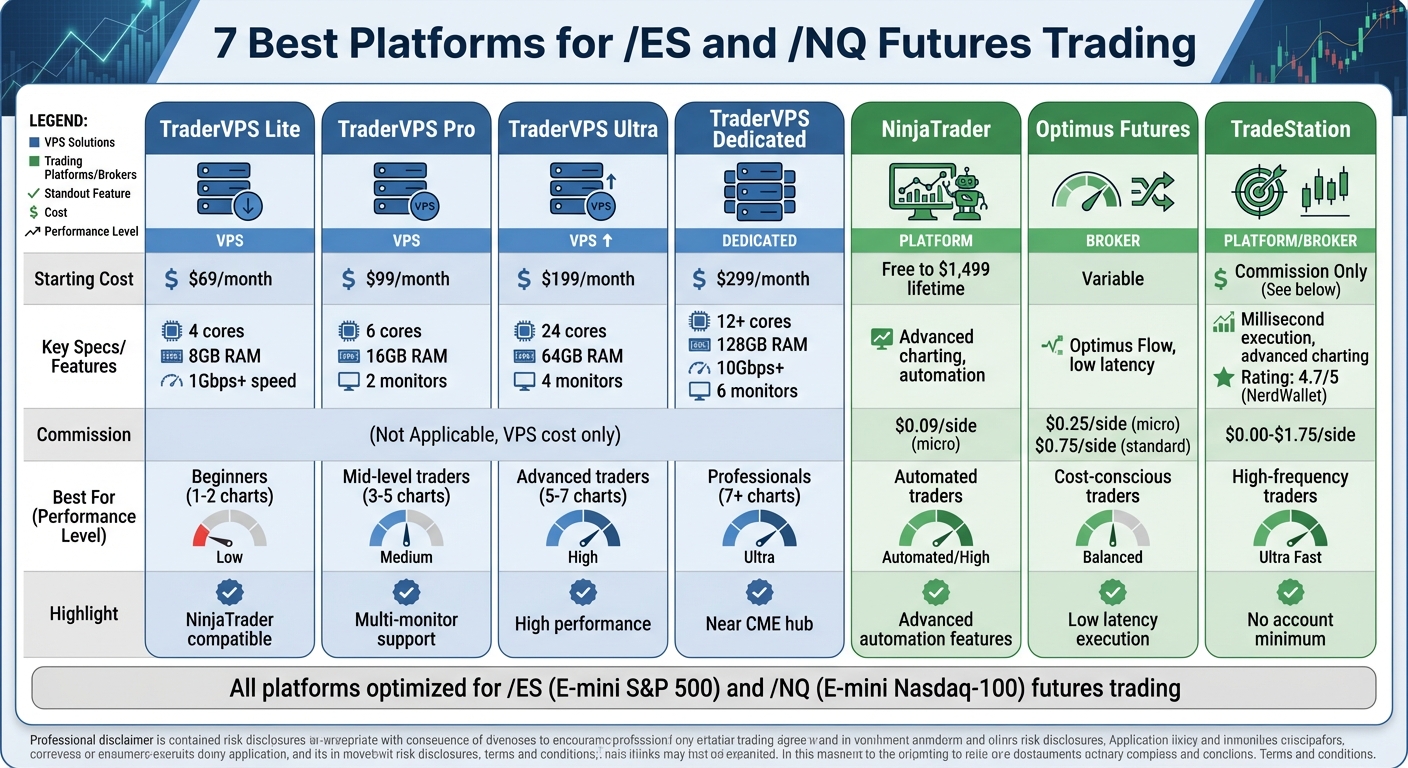

When trading /ES (E-mini S&P 500) and /NQ (E-mini Nasdaq-100) futures, having the right platform is critical. These contracts are highly leveraged and trade nearly 24/5, requiring tools that prioritize speed, reliability, and advanced features. Here’s a quick summary of the top platforms and services tailored for these futures:

- TraderVPS: Offers VPS plans (VPS Lite, Pro, Ultra, and Dedicated Server) designed for low-latency execution and seamless NinjaTrader integration, starting at $69/month.

- NinjaTrader: Known for its advanced charting, automation capabilities, and tiered licensing options, with commissions as low as $0.09 per side for micro futures.

- Optimus Futures: Provides multiple platform options like Optimus Flow, focusing on low-latency execution and competitive commissions starting at $0.25 per side.

- TradeStation: Offers millisecond-level execution precision, advanced charting tools, and no account minimums, with commissions ranging from $0.00 to $1.75 per side.

Each platform is tailored to different trading needs, from basic setups to professional, resource-intensive strategies. Below is a comparison to help you decide which fits your trading style.

Comparison of 7 Best Futures Trading Platforms for ES and NQ

How to Trade Futures: Basics, Strategy, and Best Brokers for 2025

Quick Comparison

| Platform | Key Features | Starting Cost | Best For |

|---|---|---|---|

| TraderVPS Lite | VPS with 4 cores, 8GB RAM, 1Gbps+ speed, NinjaTrader compatibility | $69/month | Beginners running 1-2 charts |

| TraderVPS Pro | VPS with 6 cores, 16GB RAM, multi-monitor support | $99/month | Mid-level traders managing 3–5 charts |

| TraderVPS Ultra | VPS with 24 cores, 64GB RAM, supports 5–7 charts | $199/month | Advanced traders with complex strategies |

| TraderVPS Dedicated | Dedicated server near CME hub, 128GB RAM, 10Gbps+ network | $299/month | Professionals needing maximum resources |

| NinjaTrader | Advanced charting, automation, tiered licensing ($99/month or $1,499 lifetime) | Free to $1,499 license | Automated and technical analysis traders |

| Optimus Futures | Low-latency execution, Optimus Flow platform, $0.25 commissions | Variable | Cost-conscious traders with flexible needs |

| TradeStation | Millisecond execution, advanced charting, no account minimum | $0.00 to $1.75/side | Precision-focused, high-frequency traders |

Picking the right platform depends on your trading style, budget, and the tools you need. Let’s dive into the details of each to help you make an informed choice.

1. TraderVPS VPS Lite

Infrastructure (VPS Specs)

The VPS Lite plan is built with 4x AMD EPYC cores, 8GB DDR4 RAM, and 70GB NVMe storage. This setup is perfect for traders running 1-2 NinjaTrader charts, especially those focusing on futures like /ES or /NQ. The server operates on Windows Server 2022, offers 1Gbps+ network connectivity, and comes with unmetered bandwidth. At $69 per month, it provides a dependable solution for traders who need a VPS tailored for precision and speed in their trading strategies.

Execution Speed

With its ultra-low latency network, the VPS Lite ensures lightning-fast order execution – essential for trading fast-moving contracts like /ES and /NQ. The inclusion of NVMe storage enables swift data access, maintaining stable performance even during heavy trading activity. This combination minimizes slippage and enhances order fills, particularly during volatile market swings when every millisecond matters.

NinjaTrader Compatibility

Designed specifically for NinjaTrader, the VPS Lite supports all of the platform’s features, including advanced charting, automated strategies, and market depth tools. The server runs your NinjaTrader setup 24/7, ensuring that automated trades continue seamlessly even if your local system is offline. This integration, paired with the VPS Lite’s low latency and solid specifications, makes it a go-to choice for futures traders focusing on /ES and /NQ.

Fees

For $69 per month, the plan includes DDoS protection and automatic backups, with no additional fees for bandwidth or data usage. This straightforward pricing allows traders to easily factor the cost into their overall trading expenses, alongside broker commissions and exchange fees.

2. TraderVPS VPS Pro

Infrastructure (VPS Specs)

The VPS Pro plan packs a punch with 6 AMD EPYC cores, 16GB DDR4 RAM, and 150GB NVMe storage. Designed for traders managing 3–5 NinjaTrader charts, it can handle multiple /ES and /NQ positions effortlessly. Running on Windows Server 2022, it offers 1Gbps+ network connectivity with unmetered bandwidth, ensuring smooth performance. Plus, it supports up to two monitors, making it a versatile option for those seeking to upgrade from basic setups. At $99 per month, it strikes a good balance between power and cost, providing a reliable platform for demanding trading activities.

Performance

With a powerful processor and ultra-fast NVMe storage, this plan ensures a responsive trading experience. Whether you’re juggling multiple charting windows or executing automated strategies, the VPS Pro maintains its performance – even during high market volatility.

NinjaTrader Compatibility

Tailored for NinjaTrader users, this plan excels at managing advanced charting, automated strategies, and real-time data analysis. The generous RAM and storage allow for seamless handling of complex strategies and large datasets needed for backtesting. And with 24/7 uptime, your automated trades can continue uninterrupted, even if your local machine is offline.

Fees

For $99 per month, the plan includes DDoS protection, automatic backups, and unlimited bandwidth and data transfers. This straightforward pricing makes it easier to budget for trading expenses, alongside broker commissions and exchange fees for /ES and /NQ futures.

3. TraderVPS VPS Ultra

Infrastructure (VPS Specs)

The VPS Ultra plan is built for traders who demand exceptional performance. It comes with 24 AMD EPYC cores, 64GB DDR4 RAM, and 500GB NVMe storage, making it a solid choice for running 5–7 NinjaTrader charts at the same time. Whether you’re trading /ES or /NQ futures, this setup is equipped to handle the demands of intensive trading with reliability. Powered by Windows Server 2022, it features 1Gbps+ network connectivity and unmetered bandwidth. Plus, it supports up to four monitors, giving you the flexibility to conduct in-depth market analysis. Priced at $199 per month, this plan is tailored for active traders who rely on significant computing power to manage complex automated strategies and multiple open positions.

NinjaTrader Compatibility

This plan is fully optimized for NinjaTrader, offering features like multi-monitor support, 24/7 uptime, and the resources needed to run multiple charts and automated strategies without interruptions.

Fees

The VPS Ultra plan includes DDoS protection, automatic backups, and unlimited bandwidth. There are no hidden charges for data transfers or extra storage, ensuring a transparent pricing structure.

4. TraderVPS Dedicated Server

If you’re looking for robust power and reliability for high-demand futures trading, the TraderVPS Dedicated Server is designed to meet the needs of professional traders.

Infrastructure (VPS Specs)

This is TraderVPS’s premium offering, tailored for traders who need top-tier performance. It features 12+ AMD Ryzen cores, 128GB DDR4/5 RAM, and 2TB+ NVMe storage, enabling seamless operation of 7+ NinjaTrader charts. The server also boasts 10Gbps+ network connectivity with unmetered bandwidth and runs on Windows Server 2022. With support for up to six monitors, it’s perfect for handling complex trading environments. Priced at $299 per month, this server is ideal for traders managing intricate portfolios, particularly across /ES and /NQ futures, where dedicated resources are essential for peak performance.

Execution Speed

Strategically located near Chicago, the hub of the CME Group, the Dedicated Server ensures ultra-low latency by minimizing data travel. For futures trading, where every millisecond counts, this setup provides a significant edge. Since the server resources are exclusively yours, there’s no competition with other users, guaranteeing consistent performance – even during high-volume trading sessions when execution speed is critical.

NinjaTrader Compatibility

Built with NinjaTrader in mind, this server offers reliable 24/7 performance for advanced automation, intensive backtesting, and real-time analysis. It’s engineered to handle the demands of volatile /ES and /NQ movements, ensuring uninterrupted trade execution.

Fees

For $299 per month, you get more than just raw power. The fee includes DDoS protection, automatic backups, and unlimited bandwidth, with no surprise charges for data transfers or extra storage. It’s a straightforward pricing model that delivers everything you need for professional futures trading.

5. NinjaTrader with VPS Integration

Building on our look at TraderVPS solutions, combining NinjaTrader with a VPS brings some real advantages for traders. NinjaTrader is tailored for trading /ES and /NQ futures and becomes even more effective when paired with a VPS. This setup is especially useful for traders running automated strategies or needing round-the-clock market access. By integrating NinjaTrader with a VPS, you minimize downtime – a critical factor when dealing with the fast-moving E-mini contracts. This approach enhances the performance benefits discussed in earlier TraderVPS plans.

Execution Speed

When trading /ES and /NQ futures, speed is everything. Prices can shift in milliseconds, and a VPS located near Chicago ensures your orders travel shorter distances, cutting down on latency. This proximity is a game-changer during high-activity periods like market opens or Federal Reserve announcements, where even microseconds can make a difference.

Charting Tools

NinjaTrader stands out with its advanced charting features and SuperDOM (depth of market) tools, allowing you to analyze price movements and place orders with precision. You can execute trades directly from the charts, which is crucial during rapid /ES or /NQ price swings. Additionally, using a VPS lets you run backtests and automate strategies without overloading your local machine, giving you the flexibility to fine-tune your trading approach.

Fees

NinjaTrader offers a tiered licensing structure:

- Free version: Limited features, with commission rates of $0.39 per side for micro contracts and $1.29 per side for standard contracts.

- $99 monthly subscription: Lower commission rates.

- $1,499 lifetime license: The most cost-effective option for active traders, with commissions at $0.09 per side for micro contracts and $0.59 per side for standard contracts like /ES and /NQ.

Keep in mind, live market data subscriptions are an additional cost, and all plans include standard exchange, clearing, and NFA fees.

NinjaTrader Compatibility

NinjaTrader’s fee structure aligns well with its seamless integration into a VPS setup. To trade live, you’ll need a supported brokerage account, but once connected, the platform works effortlessly within a VPS environment. This configuration is ideal for traders juggling multiple charts, as the VPS handles the heavy computational tasks. You can access your trading setup from anywhere with an internet connection, enabling everything from simple automated trades to complex multi-leg strategies on /ES and /NQ futures.

6. Optimus Futures Platforms

Optimus Futures integrates seamlessly with a range of platforms tailored for precise trading in /ES and /NQ futures. Among these options are Optimus Flow, Rithmic, CQG, and Trading Technologies. Notably, Optimus Flow has received significant acclaim, winning the Benzinga Fintech Award for Best Software for Trading Futures in both 2023 and 2024. Designed with active futures traders in mind, this platform offers dependable execution and advanced tools specifically for /ES and /NQ trading. It’s a valuable addition to the professional solutions already available, giving traders the resources they need for success.

Execution Speed

One standout feature of Optimus Flow is its ultra-low latency execution, achieved through direct exchange connectivity. This ensures that orders are processed with minimal delay, even during high-volatility periods, providing traders with a critical edge.

Charting Tools

Optimus Flow offers a robust set of tools for detailed market analysis. Its customizable tick charts allow for precise price tracking, while the Depth of Market (DOM) feature provides live order book data, enabling traders to assess market sentiment and liquidity. For those interested in automation, the platform supports algorithmic trading through advanced APIs, making it an excellent choice for traders looking to automate their /ES and /NQ strategies. These tools come together to create a fully equipped trading environment, eliminating the need for additional software.

Fees

When it comes to costs, Optimus Futures keeps things competitive. Commissions start at $0.25 per side for micro futures contracts and $0.75 per side for standard contracts, including /ES and /NQ. The broker also offers some of the lowest intraday futures margin rates in the market. However, additional fees for exchange, clearing, and NFA services do apply.

7. TradeStation Futures

TradeStation has built a strong reputation for precision in desktop futures trading, as noted by sources like Investopedia [1] and StockBrokers.com [2]. With millisecond-level order control and an impressive 4.7/5 rating from NerdWallet [4], it’s an excellent choice for trading fast-moving E-mini futures like /ES and /NQ.

"TradeStation isn’t a futures broker for everyone, but if you want precision, control, and the ability to program your trades down to the millisecond, it’s one of the most capable platforms available." – StockBrokers.com [2]

Execution Speed

TradeStation’s platform is specifically designed for traders who need speed and accuracy. Its technical infrastructure supports advanced order execution, allowing trades to be programmed with millisecond precision [2]. This is particularly important when trading volatile instruments like /ES and /NQ, where even slight delays can impact profitability. Additionally, the platform offers automation tools for creating custom execution systems [2]. These features are further enhanced by TradeStation’s cutting-edge charting tools, providing traders with a comprehensive toolkit.

Charting Tools

When it comes to charting, TradeStation is among the best in the industry. Investopedia describes it as a:

"robust platform that boasts sophisticated tools for charting, order entry, and position management" [1]

The platform provides access to extensive historical data for backtesting and supports custom indicators, alerts, and automation through its developer tools [1][2]. For non-professional users, market data is free if they generate at least $40 in monthly commissions or during an initial 90-day grace period [2].

Fees

TradeStation pairs its technical capabilities with a competitive fee structure. For micro futures like /ES and /NQ, commissions range from $0.25 to $0.50 per trade per side, while standard futures trades cost between $0.00 and $1.75 per side [1][3]. Keep in mind that additional fees, such as NFA, exchange, and overnight position fees, also apply [1][3]. For intraday trading, the platform offers margin rates as low as 10% on select contracts, which can be appealing for short-term strategies, although overnight margin requirements are higher [2]. Monthly market data fees are $20 per package, but these can be waived by meeting the $40 monthly commission threshold [2]. Another bonus? There’s no account minimum required to start trading [1][2][4][3].

Pros and Cons

Here’s a breakdown of the strengths and weaknesses of the reviewed platforms, focusing on how they align with different /ES and /NQ futures trading strategies.

TraderVPS stands out for its infrastructure tailored specifically for NinjaTrader futures trading. Its plans vary based on processing power and multi-monitor support, making it suitable for handling different levels of chart complexity. While it offers impressive speed and 24/7 uptime, it’s important to note that TraderVPS functions as a VPS hosting solution rather than a standalone trading platform.

NinjaTrader shines with its automation capabilities and highly customizable charting tools. However, it comes with a steep learning curve and does not support direct options or equity trading. For traders seeking alternatives, Optimus Futures presents an interesting option.

Optimus Futures is appealing for its competitive pricing, starting at $0.25 per side for micro contracts, and its ultra-low latency execution. That said, its broad selection of platforms might feel overwhelming for newcomers.

TradeStation impresses with its millisecond-level execution precision and has earned a 4.7/5 rating from NerdWallet [4]. However, it also has drawbacks, including a steep learning curve and subpar customer support. Commissions range from $0.00 to $1.75 per side, depending on trading volume, which could influence its appeal depending on trading frequency.

Each platform offers distinct advantages and challenges, making it essential to choose based on your specific trading needs and experience level.

Conclusion

Choosing the right platform for trading /ES and /NQ futures comes down to matching your trading style with the appropriate tools and infrastructure. TraderVPS provides a range of solutions tailored to different needs – from beginner-friendly entry-level plans to dedicated servers designed for professional traders managing complex strategies and automated systems.

In futures trading, having a dependable VPS setup is essential. With /ES and /NQ contracts being highly leveraged, even minor price changes can lead to significant gains or losses. This makes rapid trade execution and uninterrupted system availability absolutely crucial. A reliable VPS helps safeguard against connectivity issues and power outages that could disrupt trades at critical moments.

Platforms like NinjaTrader, when paired with VPS hosting, offer powerful automation and advanced charting tools, though they may require some learning. Optimus Futures appeals to budget-conscious traders with competitive pricing, while TradeStation stands out for its advanced execution features and sophisticated order types.

Ultimately, a solid trading infrastructure ensures low latency and smooth execution, reducing the risk of slippage in fast-moving markets. Direct CME routing further enhances speed and execution quality, which is vital in futures trading.

Whether you’re a beginner looking for a straightforward and affordable setup, an active day trader requiring fast execution and detailed charting, or an algorithmic trader needing dedicated resources and API access, the right VPS hosting can make all the difference. It’s a key component in maintaining the speed, reliability, and flexibility needed to excel in futures trading.

FAQs

What features should I prioritize when choosing a platform for trading /ES and /NQ futures?

When choosing a platform to trade /ES (E-mini S&P 500) and /NQ (E-mini Nasdaq-100) futures, make sure it offers fast execution speeds. This is crucial, especially in fast-moving markets where delays can impact your results.

You’ll also want access to advanced charting tools with customizable indicators and real-time data. These features help you perform detailed market analysis and make informed decisions.

Other key factors to consider include low fees, a simple and intuitive interface, and support for various order types to align with your trading approach. If you rely on automated trading systems, check that the platform integrates seamlessly with your tools. Lastly, strong margin and risk management features are essential to safeguard your capital and improve your overall trading efficiency.

How does using a VPS improve NinjaTrader’s performance for trading futures?

Using a VPS can take NinjaTrader’s performance to the next level for futures trading by offering quicker trade execution, reduced latency, and enhanced reliability. These advantages are crucial for traders who depend on precise timing and stable connections to implement their strategies without interruptions.

By running your trading platform on a VPS, you’re leveraging a high-speed, dedicated server environment. This minimizes delays that might come from local internet problems or hardware constraints. It’s an excellent solution for active traders and those using automated trading systems, ensuring seamless performance and dependable order handling.

What should traders look for when selecting a TraderVPS plan?

When selecting a TraderVPS plan, it’s important to focus on features that complement your trading style and goals. Start by looking at execution speed, as fast order processing can make a big difference in trading efficiency. Also, check the usability of the platform – an intuitive interface can save time and reduce frustration. Ensure the VPS is compatible with your trading tools, including automated systems or custom strategies you rely on.

Don’t overlook the pricing structure – it should align with your budget while offering good value. Reliable customer support is another key factor, as quick assistance can minimize downtime during critical trading moments. Lastly, some VPS providers offer educational resources that can enhance your trading knowledge and skills, which might be worth considering. By aligning these factors with your needs, you can choose a plan that supports your trading success.