OctaFX, now rebranded as Octa, has stepped into 2026 with a zero-fee trading model, eliminating charges for commissions, deposits, withdrawals, and swaps. With spreads starting at 0.6 pips and a low $25 minimum deposit, the platform appeals to both new and experienced forex and CFD traders. Its standout features include competitive spreads across asset classes and a well-developed social trading ecosystem powered by AI tools.

Key Highlights:

- Low Spreads: EUR/USD averages 0.90 pips, 18% below the industry average.

- No Fees: No commissions or swap charges across all accounts.

- Social Trading: Over 1,500 Master Traders available via the Octa Copytrading app.

- AI Tools: Provides performance insights for better decision-making.

- Execution Speed: Trades processed in under 0.1 seconds.

- Asset Range: 300+ instruments, including forex, crypto, commodities, and indices.

While Octa offers cost-effective trading and user-friendly tools, its offshore regulation and limited asset options might concern traders seeking broader security or diversification. High Master Trader commissions (up to 50%) can also reduce returns for social trading users.

Pros:

- Zero commissions, swap-free accounts.

- AI-driven analytics for trade insights.

- Accessible for beginners with a low deposit requirement.

Cons:

- Offshore regulation with a Trust Score of 72/99.

- Limited asset selection (300+ symbols).

- No guaranteed stop-loss orders.

OctaFX is ideal for traders prioritizing low costs and social trading but may not satisfy those needing stricter oversight or advanced risk management tools.

OctaFX Review 2025 – Low Spreads, Copy Trading & Real Withdrawal Test | Compare Forex #9

1. Spreads Across Different Asset Classes

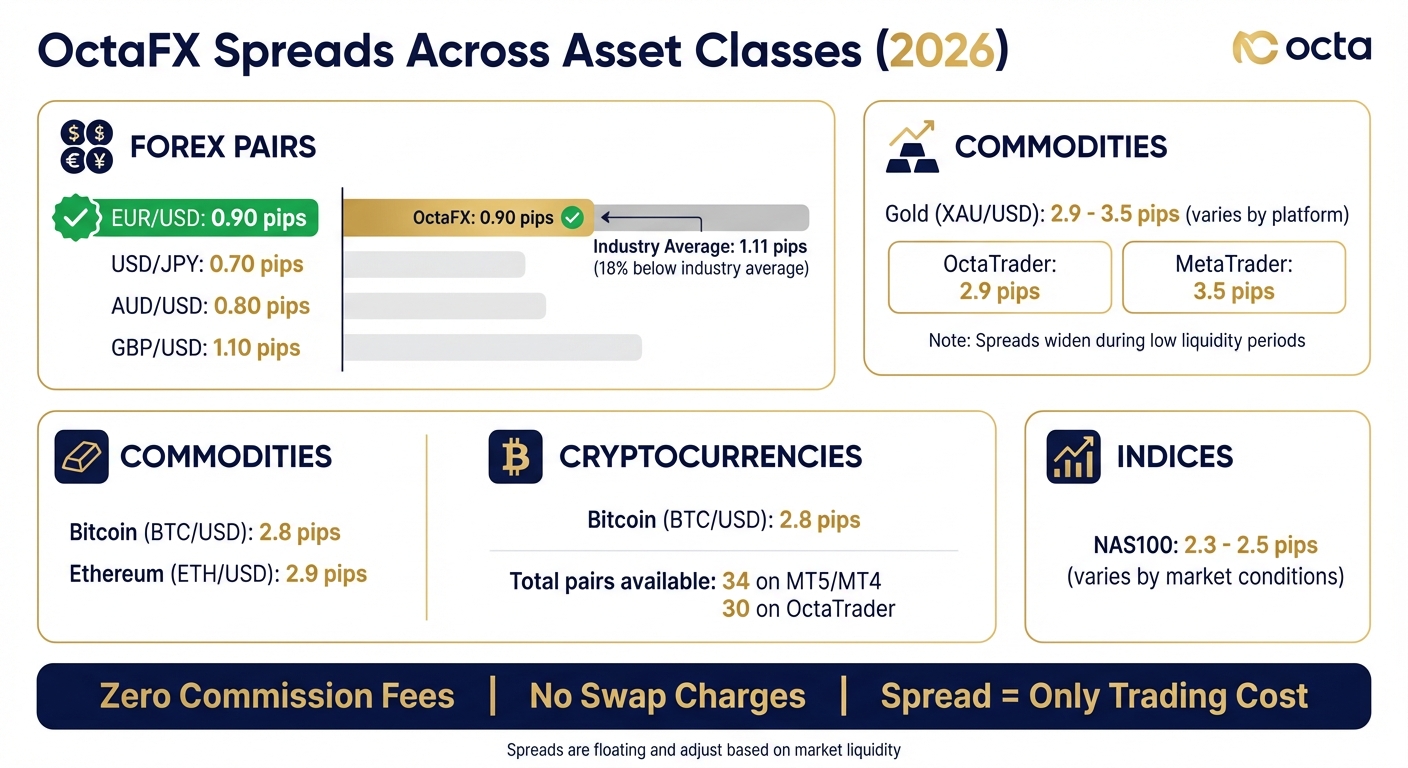

OctaFX Spreads Comparison Across Asset Classes 2026

OctaFX employs a floating spread model in 2026, adjusting spreads based on real-time market liquidity. Using ECN (Electronic Communications Network) technology, the broker connects orders to the best available prices. This approach keeps spreads tight during active trading periods but allows for some widening when liquidity is lower [6]. These spreads are consistently competitive across various asset classes.

Forex pairs offer particularly attractive spreads. For instance, the EUR/USD spread averages 0.90 pips. Justin Grossbard from CompareForexBrokers highlighted this advantage:

"roughly 18% cheaper than my industry average tests of 1.11 pips for EUR/USD, positioning Octa as a low-spread broker" [6].

This makes OctaFX’s EUR/USD spread about 18% lower than the industry average of 1.11 pips. Other popular pairs also feature low spreads, including USD/JPY at 0.70 pips, AUD/USD at 0.80 pips, and GBP/USD at 1.10 pips. However, spreads can fluctuate, narrowing during peak trading hours and widening during quieter periods, such as holidays like December 31, 2025 [8] [9].

In the commodities market, gold (XAU/USD) spreads range from 2.9 pips on OctaTrader to 3.5 pips on MetaTrader platforms. These spreads tend to widen during periods of lower liquidity. For example, live data from December 31, 2025, showed gold spreads near the higher end of this range [1] [7] [9].

Cryptocurrency spreads are also competitive. Bitcoin (BTC/USD) is priced at 2.8 pips, while Ethereum (ETH/USD) spreads stand at 2.9 pips [1]. OctaFX supports 34 crypto pairs on MT5 and MT4, with 30 pairs available on OctaTrader [5].

For indices, spreads are equally appealing. NAS100, for instance, typically ranges between 2.3 and 2.5 pips, depending on market conditions [9]. Importantly, OctaFX does not charge commission fees or swap charges on any asset class. This means the spread is the sole trading cost, making it easier for traders to calculate expenses before opening positions [4] [6].

2. Social Trading Platform Functionality

OctaFX runs its social trading through the Octa Copy platform, available on both mobile and web platforms[10]. With access to over 1,500 Master Traders to copy[6], the platform combines competitive spreads with social trading to create a more efficient trading environment. This setup allows for in-depth analysis of trader performance and the mechanics of copying strategies.

The Octa Copy platform is designed with user accessibility in mind, offering a detailed Master Rating system. Traders are categorized into five tiers based on key performance metrics such as risk scores (ranging from 1 to 6), gain percentages, the number of copiers, and commission rates. Each trader’s profile provides a wealth of data, including historical profit/loss figures, drawdowns, and order histories[10].

One standout feature is the integration of AI-powered performance analytics:

"OctaTrader now includes AI-powered performance analytics… I thought using AI to analyze your closed and historical trades was an interesting use case of the technology." [2]

When it comes to copying trades, users have flexibility in determining volume ratios. Trades can be copied at equal (1x), double (2x), triple (3x), or custom volumes in relation to the Master Trader. For added safety, risk management tools like the Balance Keeper and a manual "kill switch" allow users to pause copying if their account equity dips below a set threshold[11]. Copied trades are executed within minutes, ensuring minimal delays[11].

Master Traders earn commissions ranging from 0% to 50% of the copier’s gains[3]. OctaFX doesn’t charge separate subscription fees for copy trading; instead, a small markup is applied to the spreads[10]. The platform also includes the Spaces module, which provides real-time news updates, technical analysis, and chart pattern signals through a social feed[6].

Additionally, a real-time portfolio dashboard enables users to track their overall performance. This dashboard displays floating profits, total equity, and the outcomes of individual trades. Users retain full control over their investments, with options to manually close trades, adjust capital allocation, or unsubscribe from Master Traders at any time[10]. The platform has earned high praise, including a 4.7/5 rating from Trusted-Broker-Reviews and recognition as the Best Forex Copy Trading Platform by TradeForexSA magazine[11].

Pros and Cons

After diving into the details of spreads and social trading features, here’s a balanced look at OctaFX’s main strengths and weaknesses to help you better understand what the platform offers.

OctaFX stands out with its zero-commission model and swap-free trading across all accounts, which can save traders money, especially for overnight positions. The social trading platform is another highlight, offering AI-powered analytics and an intuitive mobile app. However, one downside is the hefty Master Trader commissions, which can go as high as 50% of profits, potentially cutting into your returns. While the platform’s risk scoring system helps identify conservative versus aggressive strategies, the lack of robust comparison tools makes it harder to evaluate Master Traders effectively[2].

For beginners, the $25 minimum deposit is a low barrier to entry. Execution times are quick, averaging under 0.1 seconds[1], and high-volume traders can enjoy better spreads through the Status Program. On the flip side, the platform lacks 24/7 customer support and operates under an offshore regulatory license (MISA), which might raise concerns for those who prioritize stringent oversight. Additionally, the absence of guaranteed stop-loss orders leaves traders exposed to risks during volatile market conditions. OctaFX holds a Trust Score of 72/99 ("Average Risk") from ForexBrokers.com[2], a rating that underscores its regulatory limitations despite its operational advantages.

| Feature Area | Advantages | Disadvantages |

|---|---|---|

| Cost Efficiency | Zero commissions; No swap or withdrawal fees | Limited asset selection, reducing diversification |

| Spread Pricing | Competitive spreads; 97.5% of orders without slippage | No historical spread data available |

| Social Trading | AI-powered insights; Risk scoring for strategies | High Master commissions (up to 50%); Limited performance tools |

| Accessibility | Low $25 deposit; 1:1000 leverage; Easy-to-use app | Support limited to weekdays; Offshore regulation |

| Risk Controls | Negative balance protection; Capital safeguards | No guaranteed stop-loss orders; Offshore license |

These factors make OctaFX a solid choice for cost-conscious traders and those interested in social trading features. However, traders looking for stricter regulatory oversight or advanced risk management tools may find the platform lacking in these areas.

Conclusion

OctaFX stands out in 2026 as a platform that prioritizes cost-effective trading with its zero-commission model and swap-free accounts. With a low $25 minimum deposit and an intuitive interface, it caters well to beginners. At the same time, its Status Program offers tighter spreads, rewarding high-volume traders for their activity.

The platform further strengthens its appeal with a streamlined social trading experience. Features like its dedicated mobile app and the AI-powered Octa Vision analytics tool make it particularly beginner-friendly. Traders can choose from over 1,500 Master Traders, each with transparent risk scores, making copy trading accessible and straightforward. However, the lack of advanced tools for comparing strategy providers could be a drawback for those seeking more in-depth analysis.

While OctaFX delivers on affordability and ease of use, its limited asset selection of about 300 symbols might not satisfy traders looking for broader diversification. Additionally, its offshore regulatory status, with a Trust Score of 72/99 [2], may raise concerns for those who prioritize stricter regulatory oversight.

For traders who value low spreads, cost-saving features, and robust social trading tools over a vast asset range or Tier-1 regulatory credentials, OctaFX presents a compelling option. The combination of zero fees, competitive spreads, and accessible copy trading tools makes it particularly appealing to forex traders and those holding positions overnight. However, its limitations become evident when compared to brokers offering broader asset options and stricter regulatory frameworks.

FAQs

How does OctaFX’s zero-fee trading model reduce overall trading expenses?

OctaFX’s zero-fee trading model removes commissions, swaps, and hidden charges, leaving traders responsible for paying only the spread. This setup can help lower trading costs, making it an appealing choice for both newcomers and seasoned traders.

With its emphasis on the spread, OctaFX ensures a clear and straightforward pricing structure. This allows traders to manage their expenses more effectively and plan their strategies without the stress of surprise fees.

What are the pros and cons of using OctaFX’s social trading platform?

OctaFX’s social trading platform makes it easier for beginners to dive into the trading world by letting them copy the strategies of seasoned professionals. The process is straightforward: you select a trader to follow based on factors like their performance, risk level, and other filters. Once chosen, you can start mirroring their trades in just a few minutes. The platform also works smoothly with OctaFX’s web tools and MetaTrader 4/5, giving you the flexibility to tweak trade sizes, set stop-loss levels, and adjust other parameters to suit your preferences.

That said, there are a few drawbacks to keep in mind. OctaFX provides fewer asset types compared to some of the larger brokers, which might limit your trading strategies. On top of that, commission fees for copy trading can vary widely – from 0% up to 50% of the copied trader’s profits – potentially cutting into your overall returns. And, as with any type of trading, risks are always present. High leverage and market volatility can still lead to substantial losses, even when you’re following experienced traders.

Is OctaFX’s offshore regulation a risk for traders concerned about security?

OctaFX’s regulatory status, governed by offshore authorities such as CySEC, MISA, FSC, and FSCA, can be a point of concern for some traders. The absence of regulation within the United States may raise questions for those who prioritize more stringent oversight.

While offshore regulation enables OctaFX to provide specific trading conditions, it’s crucial for traders to assess whether this level of oversight meets their expectations for security and aligns with their trading requirements.