Yes, OANDA remains a strong choice for currency traders in 2026. Here’s why:

- Regulation & Trust: Licensed in 9 regions, including NFA and ASIC, with a Trust Score of 93/99.

- Platforms & Tools: Offers MT4, MT5, TradingView, and its proprietary OANDA Trade platform, catering to both discretionary and automated trading.

- Execution & Reliability: Features a pricing engine with real-time data, transparent historical spreads, and no dealer intervention.

- Pricing: Two models – spread-only and Core Pricing (requires $10,000 deposit). Elite Trader program offers rebates for high-volume traders.

- Risk Management: Includes tools like stop-loss and trailing stops, plus guaranteed stop-loss in some areas.

- TraderVPS Partnership: Ensures low-latency, uninterrupted trading for automation and high-frequency strategies.

Key Considerations:

- Costs can be higher than competitors, with features like inactivity fees and wide spreads on certain assets.

- Customer support can be slow during peak times.

OANDA’s regulatory backing, platform variety, and execution quality make it a reliable option, while TraderVPS enhances performance for advanced traders.

1. OANDA

Trading Platforms and Tools

OANDA provides a range of platforms designed to suit different trading preferences. These include the proprietary OANDA Trade platform (accessible via web and mobile), as well as MetaTrader 4, MetaTrader 5, and a TradingView integration that connects users to a community of over 50 million active traders [9]. The OANDA Trade platform features an easy-to-use interface, over 100 technical indicators, Autochartist pattern recognition, and chart intervals as short as five seconds. For traders interested in automation, algorithmic trading is supported through MetaTrader 4/5 and TradingView [10].

One of the standout features is the ability to trade with as little as 1 unit, allowing for precise position sizing. Additionally, OANDA offers a robust set of risk management tools, including stop-loss orders, trailing stops, and, in some jurisdictions, guaranteed stop-loss orders [6]. These tools and platform options cater to a variety of trading strategies and directly tie into the pricing structures discussed below.

Pricing and Costs

OANDA operates with two main pricing models. The first is the spread-only model, where costs are built into the spread. The second is the Core Pricing model, which offers tighter spreads paired with a $5 commission per side for every $100,000 traded [12]. To access Core Pricing, traders must maintain a minimum deposit of $10,000 [7]. Standard accounts have an average spread of 1.69 pips for EUR/USD, which is higher than the industry average of around 1.08 pips [3][4].

For high-volume traders, OANDA offers the Elite Trader program, which provides rebates ranging from $5 to $17 per million traded on volumes exceeding $10 million. This program can reduce trading costs by as much as 34% [12]. However, there are additional fees to consider, such as a $10 monthly inactivity fee and a $10 charge for bank wire withdrawals [4].

"OANDA’s forex trading costs are generally steep, with high effective spreads across both its default and core pricing, compared to the best brokers." – Steven Hatzakis, Global Director of Online Broker Research, ForexBrokers.com [3]

These pricing models, while flexible, reflect the premium nature of OANDA’s services.

Execution Speed and Reliability

OANDA’s execution system is powered by a proprietary pricing engine, which aggregates real-time price data from global liquidity providers. This data is used to calculate a mid-point price, around which symmetrical spreads are applied [14]. The platform operates without dealer intervention, making it well-suited for high-volatility conditions [9][14]. To ensure transparency, OANDA provides access to historical spread data, allowing traders to verify pricing.

Margin requirements start at 2% for EUR/USD and 3% for AUD/USD [1]. This reliable execution setup, combined with its transparency, has earned OANDA a reputation for dependable performance, even during volatile market conditions.

Regulatory Compliance and Security

OANDA is licensed in nine regions, including oversight by the NFA and CFTC in the United States, the FCA in the United Kingdom, and ASIC in Australia. With a Trust Score of 93 out of 99, OANDA ranks among the most rigorously regulated brokers globally [3][13]. Operating under seven Tier-1 jurisdictions, OANDA has over 25 years of experience in the foreign exchange market and has maintained compliance with evolving regulatory requirements [1].

Despite its strong regulatory standing, it’s important to note that about 73.5% of retail investor accounts lose money when trading CFDs – a risk that regulators require brokers to disclose [3]. This transparency and adherence to strict regulations help build trust and confidence among traders who choose OANDA as their broker.

2. TraderVPS

Execution Speed and Reliability

TraderVPS is designed to enhance execution speed for automated and high-frequency trading. With 24/7 uptime and low-latency connectivity, it ensures smooth operation for traders using Expert Advisors (EAs) on MetaTrader 4 and MetaTrader 5. By leveraging servers powered by AMD EPYC processors and NVMe storage, TraderVPS eliminates the risks associated with local hardware failures and unreliable internet connections.

For OANDA users, this setup means automated strategies can run uninterrupted – even during periods of high market volatility. The VPS environment significantly reduces delays often encountered when trading from a home setup. This is particularly beneficial for scalpers and algorithmic traders who depend on precise timing for their trades. The combination of OANDA’s execution model and TraderVPS’s low-latency infrastructure creates a highly reliable trading experience.

"Clients can also benefit from VPS hosting, maximizing trade execution speed and protecting against power and internet outages." – Dan Blystone, FX Empire [4]

Trading Platforms and Tools

TraderVPS supports a wide range of trading platforms compatible with OANDA, including MetaTrader 4, MetaTrader 5, and custom API-based interfaces. The service is tailored to meet the needs of different trading setups. For instance, the VPS Lite plan is perfect for traders managing one or two charts on a single monitor, while higher-tier plans cater to more complex setups with multi-monitor support. Additionally, the VPS environment is ideal for intensive tasks like backtesting and trade copying, as it offloads the heavy processing of historical data from your local system. With 1Gbps+ network connectivity and unmetered bandwidth, data feeds remain consistent and reliable throughout the trading day.

Pricing and Costs

TraderVPS offers four pricing plans to suit various trading needs:

- VPS Lite ($69/month): Includes 4 AMD EPYC cores and 8GB RAM, ideal for managing one to two charts on a single monitor.

- VPS Pro ($99/month): Features 6 AMD EPYC cores and 16GB RAM, designed for traders running three to five charts with dual-monitor support.

- VPS Ultra ($199/month): Offers 24 AMD EPYC cores and 64GB RAM, supporting advanced setups with up to four monitors.

- Dedicated Server ($299/month): Provides 12+ AMD Ryzen cores and 128GB RAM, perfect for traders with extensive requirements, including setups for up to six monitors.

Each plan includes DDoS protection, automatic backups, and Windows Server 2022. There are no extra fees for bandwidth usage, making the pricing simple and transparent for traders of all levels.

OANDA Review | Worth Using In 2025?

Pros and Cons

OANDA vs TraderVPS Features and Pricing Comparison 2026

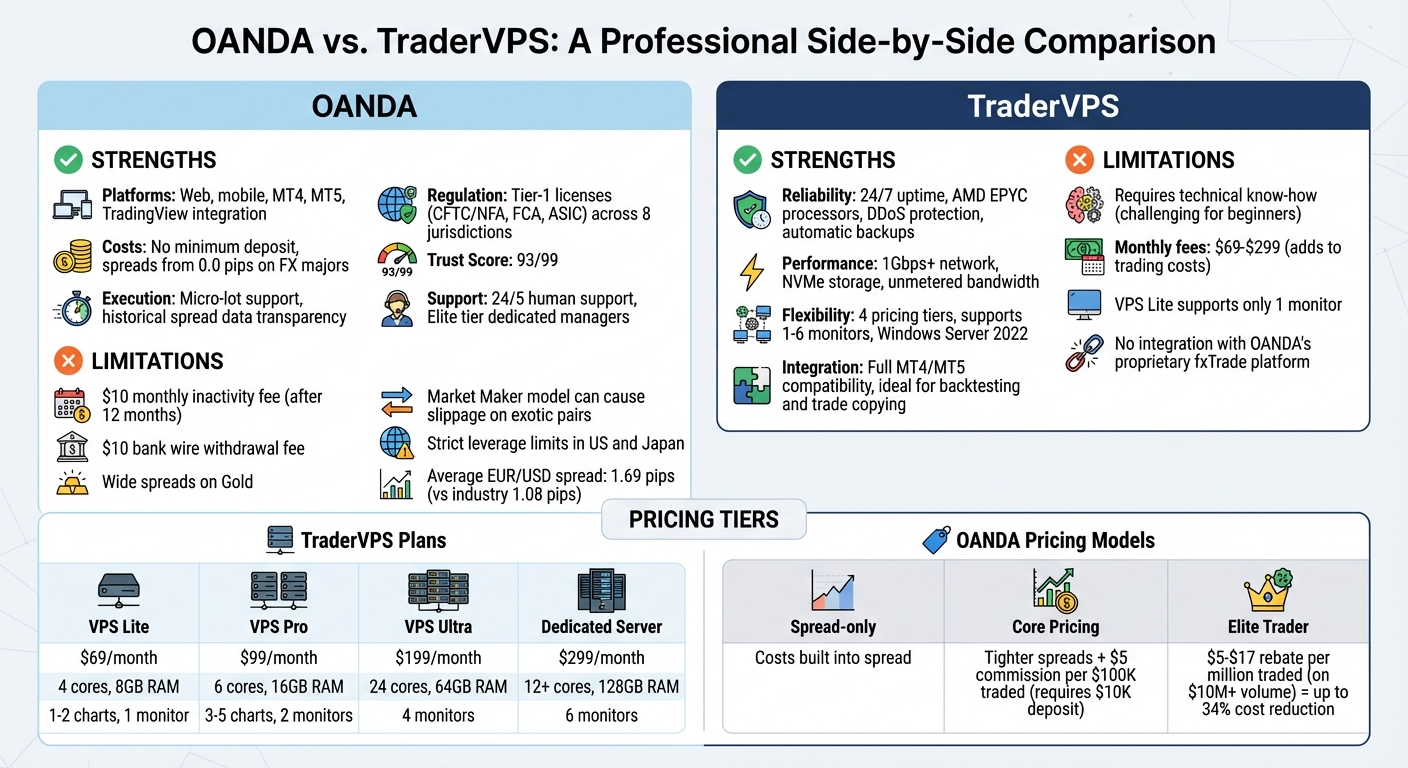

OANDA and TraderVPS each offer distinct benefits and challenges for currency traders, catering to different needs and trading styles.

OANDA

| Feature | Strengths | Limitations |

|---|---|---|

| Platforms | Web and mobile trading; integration with MT4, MT5, and TradingView [1][5] | MT4/MT5 are not cross-compatible; proprietary web platform lacks 1-click trading |

| Costs | No minimum deposit; spreads starting from 0.0 pips on FX majors [4][8] | $10 monthly inactivity fee after 12 months; $10 bank wire withdrawal fee; wide spreads on Gold [4] |

| Execution | Micro-lot support; access to historical spread data for transparency [4][11] | Market Maker model can result in slippage, particularly on exotic currency pairs [4][11] |

| Regulation | Tier-1 licenses (CFTC/NFA, FCA, ASIC) across eight jurisdictions [4][8] | Strict leverage limits in regions like the US and Japan [4][7] |

| Support | 24/5 human support; Elite tier traders get dedicated relationship managers [1] | Some users report slow response times and payout delays exceeding a week [2] |

"OANDA excels in the area of research, with a range of innovative tools and high-quality analysis to support traders." – Dan Blystone, Editor at FX Empire [4]

While OANDA’s research tools and trading options stand out, inconsistent customer service remains a concern. For instance, the broker’s 3.9/5 Trustpilot score for its Prop Trader program [2] points to potential frustrations during volatile market conditions when quick support is essential.

On the other hand, TraderVPS emphasizes infrastructure reliability and performance, particularly for automated trading setups.

TraderVPS

| Feature | Strengths | Limitations |

|---|---|---|

| Reliability | 24/7 uptime powered by AMD EPYC processors; DDoS protection; automatic backups | Requires technical know-how, which can be challenging for beginners |

| Performance | High-speed 1Gbps+ network connectivity; NVMe storage; unmetered bandwidth | Monthly fees range from $69 to $299, adding to trading costs |

| Flexibility | Offers four pricing tiers, supporting 1–6 monitors; includes Windows Server 2022 | VPS Lite tier supports only one monitor |

| Integration | Full MT4/MT5 compatibility, ideal for backtesting and trade copying | Does not integrate with OANDA’s proprietary fxTrade platform |

TraderVPS eliminates the risks associated with local hardware failures, making it a solid choice for algorithmic traders running Expert Advisors. However, for casual traders who rely on OANDA’s mobile app, the added complexity and cost of setting up a VPS might not be worth it.

Together, OANDA and TraderVPS offer complementary solutions: OANDA provides versatile trading platforms and regulatory oversight, while TraderVPS ensures robust technical infrastructure for automated strategies.

Conclusion

OANDA continues to shine as a top choice for currency traders in 2026, boasting a Trust Score of 93 out of 99 and licenses from seven Tier-1 regulators, including the CFTC, FCA, and ASIC [3]. The platform’s flexibility is evident in its support for MetaTrader 4, MetaTrader 5, and seamless integration with TradingView. Coupled with advanced tools like MarketPulse and the Order Book sentiment indicator, OANDA provides a comprehensive trading experience. Additionally, traders with accounts of $10,000 or more can unlock Core Pricing, which offers tighter spreads and lower trading costs.

"A trusted global brand, OANDA stands out for its reputation and quality market research. Its regulatory track record is strong, and its support for third-party features bolsters its overall offering." – Steven Hatzakis, Global Director of Online Broker Research, ForexBrokers.com [3]

To further enhance trading efficiency, TraderVPS provides a reliable solution for those using automated strategies or Expert Advisors. Its low-latency infrastructure ensures uninterrupted trading, even during local power or internet outages. This is especially beneficial for high-frequency traders, where execution speeds under 50 milliseconds can make all the difference [11]. TraderVPS plans cater to various needs, starting at $69/month for the VPS Lite tier and going up to $299/month for dedicated servers designed for more complex setups.

FAQs

Why is OANDA still a top choice for currency traders in 2026?

OANDA remains a standout choice for currency traders in 2026, thanks to its long-standing reputation and trusted regulatory oversight. Regulated by top-tier authorities like the CFTC, NFA, and FCA, it provides a secure and transparent trading environment. With roots going back to 1996, OANDA has consistently proven itself as a reliable broker.

Traders can take advantage of lightning-fast order execution, competitive spreads, and multiple platform options, including MT4, MT5, and TradingView. The broker also boasts powerful research tools, making it a strong option for day traders, scalpers, and algorithmic traders. OANDA’s dedication to staying compliant and forward-thinking ensures it remains a key player in the ever-changing forex landscape.

How does OANDA’s pricing impact your trading costs?

OANDA’s pricing model revolves around variable spreads, which tend to be on the higher side compared to some competitors. For instance, in August 2025, the average spread for EUR/USD was approximately 1.69 pips. While most accounts don’t incur extra commissions, this could lead to higher overall costs for traders who execute a large number of trades. However, the absence of additional fees simplifies cost calculations.

One standout feature of OANDA’s approach is its commitment to clarity in pricing. By being upfront about trading costs, the platform makes it easier for traders to understand their expenses, which is particularly appealing to those who value straightforward and predictable fee structures.

What advantages does TraderVPS offer when used with OANDA’s trading platforms?

Using TraderVPS alongside OANDA’s trading platforms offers a combination of quicker execution speeds, improved stability, and reduced latency – key factors for precise trading and limiting slippage, particularly for active or algorithmic traders.

TraderVPS provides a dedicated server environment that ensures uninterrupted connectivity, even during periods of intense market activity. This dependable setup allows traders to remain connected and carry out their strategies without the worry of unexpected disruptions.