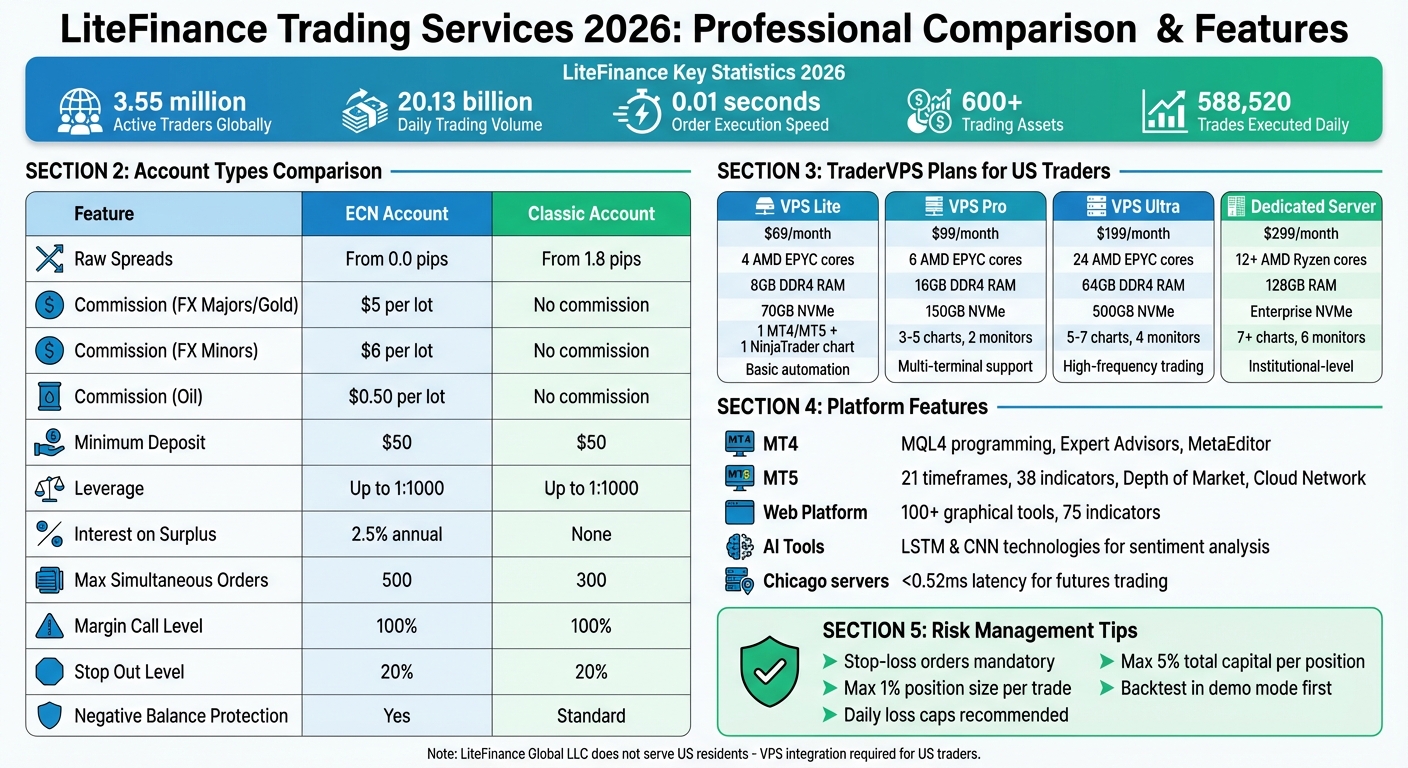

LiteFinance, previously known as LiteForex, has evolved significantly since its rebranding in 2021. By 2026, the platform serves over 3.55 million active traders globally, with a daily trading volume of $20.13 billion. Here’s a quick look at their latest updates and offerings:

- AI Tools: Advanced sentiment analysis and price forecasting using LSTM and CNN technologies.

- Trading Execution: Lightning-fast order execution (0.01 seconds) with raw spreads from 0.0 pips.

- Platforms: MT4, MT5, and a browser-based Web Platform, with support for over 600 trading assets.

- Account Types: ECN (tight spreads, low commissions) and Classic (no commissions, floating spreads).

- VPS Services: Dedicated hosting for automated trading, starting at $15/month.

- US Traders: Limited access to educational resources; integration with third-party VPS services like TraderVPS for automated futures trading.

LiteFinance continues to focus on automation, AI-driven tools, and robust infrastructure to support modern trading needs. For U.S. traders, VPS solutions are essential for leveraging these advancements.

LiteFinance Account Types and TraderVPS Plans Comparison 2026

LiteFinance Trading Platforms and Technology

MT4, MT5, and Web Platform Features

LiteFinance offers three trading platforms, each designed to cater to different trading styles. MetaTrader 4 (MT4) is a favorite among algorithmic traders, thanks to its MQL4 programming language and built-in MetaEditor, which allows users to create Expert Advisors, scripts, and custom indicators [8]. MetaTrader 5 (MT5) steps it up with 21 timeframes, 38 built-in indicators, and a "Depth of Market" feature that provides real-time order book data. This makes it suitable for both Forex trading and exchange derivatives [8][10].

"MT5 features the Depth of Market and instruments for transactions. Thus, the platform is suitable for both Forex market and exchange derivatives trading." – Oleg Tkachenko [8]

LiteFinance’s Web Platform is a browser-based terminal offering over 100 graphical tools and 75 integrated indicators. While it’s excellent for manual trading, it doesn’t currently support custom automated strategies. On the other hand, MT5’s Cloud Network technology enables traders to leverage distributed computing power from the MQL community, making it easier to backtest complex strategies [8].

Starting July 1, 2025, MetaQuotes discontinued support for older versions of MT4 and MT5. To remain compatible with LiteFinance’s servers, traders must use MT4 Build 1440 or MT5 Build 4755 and above [11].

These advanced platform features align with LiteFinance’s focus on delivering efficient and precise trading experiences.

Order Execution and Pricing Models

LiteFinance’s order execution system complements its platform capabilities, ensuring seamless and efficient trading. The broker employs an ECN+STP execution model, which routes trades directly to Tier-1 liquidity providers. This eliminates broker interference, removing any conflict of interest since LiteFinance doesn’t trade against its clients [6][5]. With execution speeds as fast as 0.01 seconds, the system is ideal for high-frequency trading strategies [1][8]. Additionally, five-digit quotes enhance pricing precision, resulting in tighter spreads.

The broker offers two account types:

- ECN Accounts: Provide raw spreads starting at 0.0 pips, with commissions as low as $0.25 per lot.

- Classic Accounts: Feature floating spreads beginning at 1.8 pips, with no additional commission fees.

For futures traders, commissions vary: $3.50 per contract for stock indices and $0.50 per lot for oil trades [6][9]. Both account types utilize Market Execution with no re-quotes, offer leverage up to 1:1000, and include negative balance protection to ensure losses don’t exceed the account balance. ECN accounts also come with a 2.5% annual interest on surplus funds [10][9].

Market Analysis and Data Tools

LiteFinance enhances trading decisions with a range of analytical tools and resources. Through its partnership with Claws & Horns, traders gain access to exclusive content, including video reviews and trade signals that highlight specific entry and exit points [10][4]. A built-in market sentiment indicator provides real-time insight into other traders’ positions, helping users assess market trends [12].

For those who rely on automation, LiteFinance integrates AI-powered tools that use LSTM and CNN technologies to analyze sentiment and forecast prices [2]. The platform also features a weekly economic calendar and employs Natural Language Processing to extract sentiment from news and social media. According to reports, these AI tools can speed up decision-making by at least five times compared to manual methods [2][13].

With over 600 trading assets available – including currency pairs, oil, precious metals, stock indices, and cryptocurrencies – LiteFinance ensures traders have diverse options [2][14]. To manage risks, traders are encouraged to use stop-loss orders, limit position sizes to no more than 1% of their deposit per trade, and set daily loss caps. Backtesting strategies in demo mode with historical data is also recommended to assess their viability before live trading [2].

Account Types and Trading Conditions

ECN and Classic Account Options

LiteFinance offers two main account types tailored to different trading preferences: the ECN Account and the Classic Account. The ECN Account is ideal for traders seeking tight spreads and direct market access. It provides raw spreads starting at 0.0 pips, with commissions set at $5 per lot for FX majors and gold, $6 per lot for FX minors, and $0.50 per lot for oil [6][9]. On the other hand, the Classic Account features floating spreads starting at 1.8 pips and charges no commission [6][15].

Both account types require a minimum deposit of $50 and offer leverage up to 1:1000 [9][15]. The ECN account stands out with a 2.5% annual interest rate on surplus funds, the ability to handle up to 500 simultaneous orders (compared to 300 for the Classic account), and access to the cTrader platform [6][10][9][15].

"ECN (Electronic Communications Network) is a unique e-technology for Forex trades with no broker intervention… it is a good option for opening a professional Forex trading account." – LiteFinance [6]

Important: LiteFinance Global LLC does not provide services to residents of the United States [9][10].

Next, let’s explore how leverage and margin requirements shape trading strategies.

Leverage and Margin Requirements

LiteFinance offers flexible leverage options ranging from 1:1 to 1:1000 for both account types [1][6]. The platform enforces a Margin Call level of 100%, which serves as a warning when equity matches the used margin. Additionally, the Stop Out level is set at 20%, automatically closing losing positions to limit further losses [6][9].

For ECN accounts, negative balance protection is included, ensuring traders cannot lose more than their initial deposit [9]. With LiteFinance executing over 588,520 trades daily at lightning-fast speeds of 0.01 seconds, it’s crucial for traders to maintain a buffer above the margin call level, especially during volatile market conditions [1].

Funding Methods and Processing Times

LiteFinance supports a variety of funding methods to make deposits and withdrawals as seamless as possible. These include credit and debit cards (Visa/Mastercard), bank wire transfers (SWIFT), and electronic payment systems like WebMoney, Perfect Money, Neteller, Skrill, Advcash, and Sticpay [4][10][16]. For those preferring quicker transactions, cryptocurrency deposits via Bitcoin and Ethereum are also available [4][10].

Withdrawals are processed efficiently, with the platform offering an automatic withdrawal system for amounts up to $5,000 per day, typically completed within 24 hours [1]. Smaller automatic withdrawal limits apply to e-wallets like Skrill and Neteller, capped at $100 [4]. Bank wire transfers, however, may take up to five working days [4]. To ease deposit costs, LiteFinance offers a "Zero Fee" promotion, though withdrawal fees vary: Mastercard charges 3%, Perfect Money 0.5%, and Neteller 2% up to $30 [4][16].

In compliance with Anti-Money Laundering (AML) regulations, all withdrawals must be directed back to the original payment method [4]. For the fastest transaction times, cryptocurrency remains the preferred choice, avoiding the delays associated with international bank transfers [4].

VPS Setup for NinjaTrader and LiteFinance Integration

Why US Traders Need VPS for Automated Trading

If you’re using LiteFinance’s advanced trading platforms alongside automated strategies on MT4/MT5 or NinjaTrader, a reliable VPS is a must-have. Why? Because home computers just aren’t built to handle the constant uptime and stable connectivity required for automated trading. Power outages, internet issues, or even routine system restarts can disrupt your Expert Advisors (EAs) right in the middle of execution. This can leave your positions vulnerable during critical market movements. A VPS eliminates these risks by offering uninterrupted uptime and dedicated resources through Microsoft Hyper-V‘s 64-bit virtualization. This setup ensures your trading strategies run smoothly, even if local outages occur.

TraderVPS Plans for LiteFinance and NinjaTrader Users

TraderVPS provides four tailored plans to match varying trading needs. Here’s a breakdown:

- VPS Lite ($69/month): Equipped with 4 AMD EPYC cores, 8GB DDR4 RAM, and 70GB NVMe storage. Perfect for running a single MT4/MT5 terminal with a few EAs and one NinjaTrader chart.

- VPS Pro ($99/month): Designed for traders managing 3–5 charts. It includes 6 AMD EPYC cores, 16GB DDR4 RAM, 150GB NVMe storage, and support for up to two monitors. This ensures smooth performance across multiple terminals.

- VPS Ultra ($199/month): Built for high-frequency trading or heavy backtesting. This plan offers 24 AMD EPYC cores, 64GB DDR4 RAM, and 500GB NVMe storage, capable of handling 5–7 charts across four monitors.

- Dedicated Server ($299/month): For institutional-level algorithmic trading or demanding optimization tasks. It features 12+ AMD Ryzen cores, 128GB RAM, and supports setups with 7+ charts across up to six monitors.

All plans come with 1Gbps+ network speeds, unmetered bandwidth, and Windows Server 2022. Combined with LiteFinance’s fast execution capabilities, TraderVPS ensures your trading operations stay efficient and uninterrupted [2][3].

Once you’ve chosen a plan that fits your trading style, it’s time to optimize your VPS setup for peak performance.

VPS Configuration and Maintenance Tips

Start by connecting to your VPS via Remote Desktop using the provided IP address and login credentials. Install your MT4/MT5 terminal, ensuring the file paths and registry settings are correctly configured.

Next, upload your Expert Advisors, indicators, and profiles. You can do this securely via cloud storage or by manually configuring them directly on the VPS. To maintain optimal performance, keep the number of open charts and background applications to a minimum.

Finally, synchronize any changes made on your local terminal with your VPS. This ensures your strategies remain consistent and aligned across both environments.

2026 Summary and Future Outlook

Main Points for Futures Traders

As 2026 approaches, LiteFinance has rolled out major platform updates that are reshaping automated trading workflows. To avoid potential technical lockouts, MetaQuotes now mandates the use of MT4 Build 1440 or MT5 Build 4755 for seamless operation [11]. Additionally, the introduction of cTrader Automate as a standalone application brings a game-changing feature: cloud synchronization. This allows cBots to operate around the clock without needing your local computer to stay on [7].

For futures traders in the U.S., the integration of high-performance VPS solutions is more important than ever. Servers based in Chicago, offering ultra-low latency (under 0.52ms), ensure precise order execution – particularly during critical moments like high-impact news releases [17][18]. With daily futures trading volume exceeding $16.44 billion on these low-latency setups, the infrastructure supports a robust automated trading environment [17].

While these updates promise smoother execution, they also bring new challenges to navigate.

What to Expect and Risk Factors

Beyond platform and VPS advancements, traders must remain vigilant about market and infrastructure risks. The next frontier in automated trading lies in integrating autonomous AI learning and sentiment analysis. LiteFinance analyst Gleb Kabanov highlights its transformative potential:

"The use of AI in trading and investing allows you to automate processes, reduce mistakes, and respond faster to market changes" [2].

Traders are increasingly leveraging advanced algorithms like LSTM and CNN for analyzing volatility and identifying patterns [2].

However, for U.S.-based traders, much of this innovation depends on VPS integrations [6][19]. Risks such as power outages, internet disruptions, and model overfitting remain significant concerns. To mitigate these issues, traders are advised to implement safeguards like daily loss caps and limiting position sizes to no more than 5% of total capital [2]. Automated systems also require ongoing monitoring and periodic retraining to adapt to shifting market conditions [2][20].

FAQs

What are the advantages of using AI tools on LiteFinance’s trading platform?

LiteFinance stands out for its advanced trading services, offering low spreads, fast ECN and STP execution, and a comprehensive suite of analytical tools tailored to traders across all experience levels. However, there’s no clear indication that the platform incorporates AI-driven tools at this time.

Features commonly linked to AI in trading – like automated signal generation, predictive analytics, or intelligent order routing – are not confirmed as part of LiteFinance’s offerings. To get the most accurate and current information about any potential AI capabilities, it’s best to consult LiteFinance’s latest documentation or reach out to their support team directly.

What are the key differences between LiteFinance’s ECN and Classic accounts?

LiteFinance offers two distinct account types tailored to different trading needs:

The ECN account is perfect for traders who want direct access to the market. It features floating spreads starting as low as $0.00, paired with a per-lot commission. This account uses straight-through processing (STP), ensuring fast order execution directly with liquidity providers. It’s a great fit for scalping strategies and automated trading systems that rely on speed and precision.

On the other hand, the Classic account provides floating spreads starting at $1.80 with no additional commission. This setup is ideal for traders who prefer a straightforward pricing model without worrying about extra fees for each trade.

Each account serves a unique trading style, so the choice ultimately depends on your approach and what matters most to you.

Why is using a VPS essential for automated trading with LiteFinance?

A Virtual Private Server (VPS) plays a crucial role in automated trading by ensuring your strategies run seamlessly without interruptions. Unlike depending on your home internet or power supply, a VPS offers a stable, always-on environment with dedicated resources. This allows your LiteFinance automated systems to operate around the clock without any downtime.

Using a VPS also means faster trade execution, lower latency, and a secure setup – key factors for achieving efficiency and precision in automated trading. It’s the go-to solution for traders who demand consistent performance and reliability.