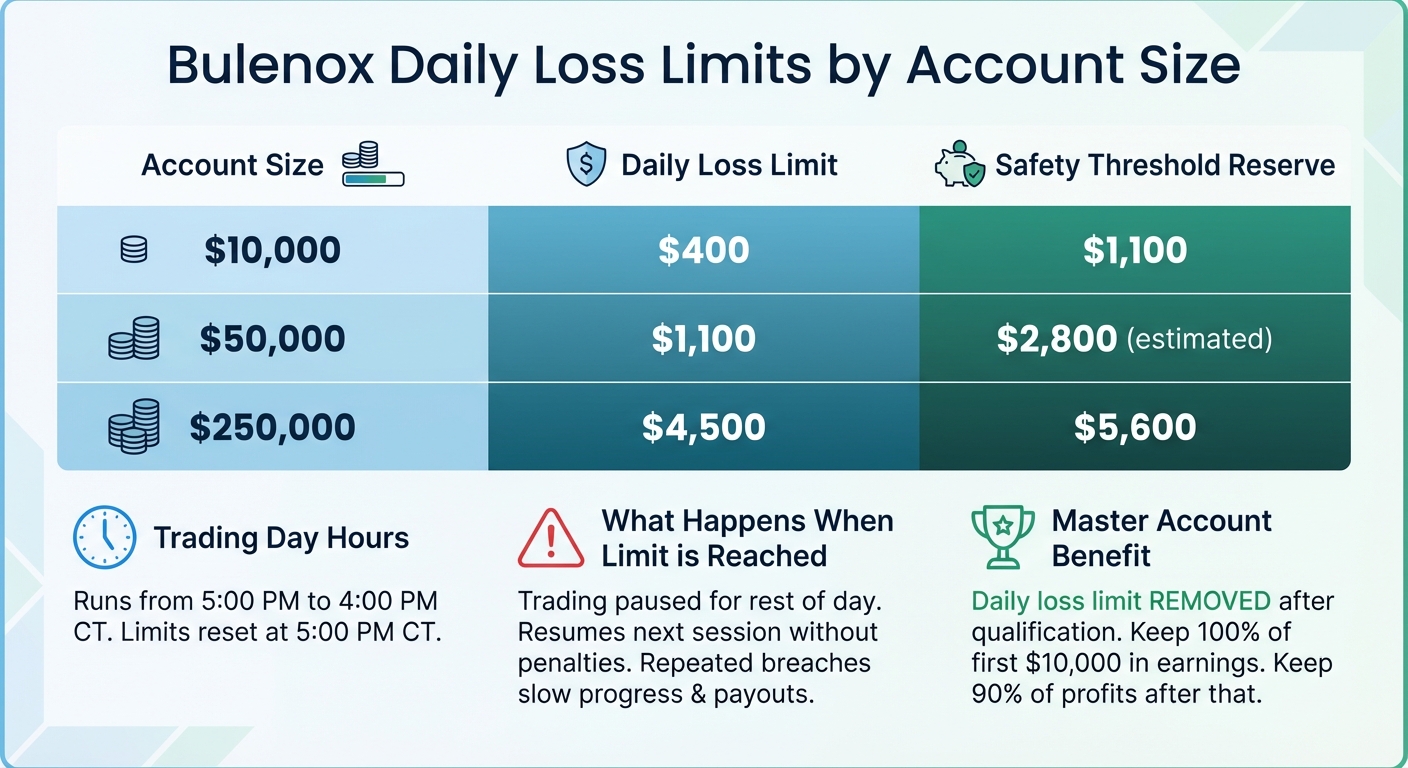

Bulenox enforces daily loss limits on Option 2 accounts to protect traders and the firm from excessive losses within a single trading session. If you hit the limit, trading is paused for the rest of the day but resumes the next session without penalties. These limits, based on account size, help manage risk, prevent emotional trading, and encourage discipline. For example, a $10,000 account has a $400 daily loss limit, while a $250,000 account has a $4,500 limit. The trading day runs from 5:00 p.m. to 4:00 p.m. CT, with limits resetting at 5:00 p.m. CT.

Key points:

- Daily loss limits by account size: $400 to $4,500.

- Trading suspension: Activated if the limit is reached.

- Risk management tools: Alerts, stop-loss orders, and position sizing help avoid breaches.

- Progress impact: Repeated suspensions can slow payouts and progress.

Understanding and adhering to these rules ensures safer trading and long-term stability.

Bulenox Daily Loss Limits by Account Size

Problems Traders Face When Exceeding Daily Loss Limits

Account Suspension and Its Ripple Effects

When you hit the daily loss limit, your account is immediately suspended for the rest of the trading session. This doesn’t mean your account is terminated right away, but every loss chips away at your balance, bringing you closer to the maximum drawdown limit. If suspensions happen repeatedly, they can gradually erode your buffer, eventually leading to a breach of the hard limit – and that means account termination. Beyond the numbers, this enforced pause can also take a toll on your mindset, creating challenges beyond just the financial setback.

The Psychological Toll on Trading

While the suspension is designed to prevent impulsive "revenge trading" after significant losses, it can also bring stress that lingers into future trading sessions. Knowing you’ve hit the limit may lead to over-leveraging or straying from proven strategies in an attempt to recover quickly. This shift in approach can hurt your confidence and disrupt the consistency needed for long-term success.

Delays in Progress and Payouts

Frequent suspensions don’t just affect your trading rhythm – they can also slow your path to profitability. For instance, withdrawals from Master Accounts require a minimum of 10 trading days, so every suspension pushes that timeline further out. On top of that, the Consistency Rule – which requires no single day’s profit to exceed 40% of your total profit balance at withdrawal – can complicate things. A big rebound after a suspension might disqualify you from payouts until your profits are more evenly spread out. To add to the challenge, repeated losses can drag your account balance below the Safety Threshold Reserve (ranging from $1,100 to $5,600 depending on your account size). When this happens, payouts are frozen until you rebuild your balance, setting back your progress even more.

How TraderVPS Helps Traders Stay Within Daily Loss Limits

Fast Execution for Better Risk Control

Bulenox imposes strict daily loss limits ranging from $400 to $4,500, depending on the account size. In such a high-stakes environment, every millisecond matters. TraderVPS’s servers, located in Chicago, deliver sub-millisecond execution speeds with 99.999% uptime. This ensures that stop-loss orders are executed at the intended price, reducing slippage that could push you past your daily limit. Even if your home internet or power goes down, the VPS keeps your NinjaTrader platform running, preventing unwanted positions from accumulating losses.

With a network boasting 1Gbps+ connectivity, the system processes market data instantly. This is especially crucial when you’re managing a $50,000 account with an $1,100 daily loss limit. By combining this rapid execution infrastructure with real-time performance monitoring, TraderVPS helps you maintain precise control over your losses.

Real-Time P&L Tracking and Alerts

TraderVPS makes managing Bulenox’s daily loss limits easier with real-time P&L tracking through a multi-monitor RDP setup. This ensures you’re always viewing the same data Bulenox uses to enforce its limits. Since Bulenox calculates these limits within the RTrader platform, you can run both RTrader and NinjaTrader simultaneously on the VPS. Thanks to high-speed memory, P&L updates and risk alerts happen instantly, ensuring there’s no delay as you approach your limit.

The VPS operates 24/7 in a secure data center, allowing automated P&L alerts and trading bots to monitor your account continuously – even when you’re away from your desk. You can configure NinjaTrader to send alerts or halt trading automatically when your account balance nears the daily loss threshold. This constant monitoring adds a critical layer of protection, giving you peace of mind in volatile markets.

Strategy Testing and Refinement

Before putting real money on the line, TraderVPS’s NVMe M.2 SSD storage allows you to backtest strategies against historical data quickly. This is particularly helpful for analyzing futures instruments like ES, NQ, and CL to determine which strategies align with Bulenox’s daily loss limits for your account size. The high-speed storage also prevents platform freezes during high-volatility events, ensuring you can monitor P&L without disruption.

For added security, you can deploy automated risk bots that liquidate positions if your account approaches its daily loss limit. These bots are tailored to your strategy’s complexity and work without lag, even during market turbulence. By providing a reliable, always-on environment, TraderVPS minimizes the risks of local internet or power outages, keeping your trades under control and within the boundaries set by Bulenox.

How To Avoid MAX DAILY LOSS On Prop Accounts

Practical Methods for Avoiding Daily Loss Limit Breaches

Staying within your daily loss limit requires a mix of discipline and practical tools. Here are some actionable strategies to help you stay on track:

Configure Daily P&L Alerts in NinjaTrader

Set up alerts to notify you when your losses approach 80–90% of your daily limit. For example, if your account has a $50,000 balance with an $1,100 daily loss limit, configure alerts between $880 and $990. This buffer accounts for slippage and commissions. Use either "Equity" or "Total P&L" as the trigger, since unrealized trades also count toward your limit [2][1].

It’s a good habit to cross-check NinjaTrader’s P&L with RTrader to ensure accuracy. Additionally, NinjaTrader’s "Automated Exit" and "Risk Manager" tools can automatically flatten your positions if your account equity nears the set threshold [1]. These tools act as safety nets, helping you avoid breaches.

Use Proper Position Sizing

Position sizing is crucial for managing risk. Aim to size your trades so that a single stop-loss hit represents only a small portion of your daily loss limit. For smaller accounts, like those with a $10,000 balance and a strict $400 daily limit, micro contracts are a better option. They offer finer control and reduce the risk of exceeding your limit [2][5].

Also, follow Bulenox’s Scaling Plan, which allows you to increase position sizes only after your account equity reaches the next tier [1]. This ensures your trades remain aligned with the account’s risk parameters.

Conduct Daily Performance Reviews

At the end of each trading day, use RTrader to confirm your Daily Loss Limit, including commissions and unrealized P&L [1]. Check the "Reports" section in your Bulenox Profile to verify profit targets and active trading days [3]. Make sure to close all positions by 3:50 PM CT to comply with the mandatory 3:59 PM CT closure rule [1][4].

For Master Accounts, calculate your daily P&L percentage using this formula: (Best day P&L / Total P&L) * 100. This helps ensure you stay under the 40% consistency threshold required for payouts [3]. Regular reviews like these keep your trading within safe and compliant boundaries.

Conclusion

Bulenox’s daily loss limits act as essential safeguards to protect your trading capital while encouraging disciplined trading habits. For traders using Bulenox Option 2 accounts, these structured daily loss thresholds temporarily halt trading for the rest of the session if exceeded. However, this isn’t a permanent setback – you can pick things back up in the next session.

These limits are vital for managing risk, as they help prevent significant daily losses. Just as importantly, they provide a cooling-off period, reducing the urge to engage in revenge trading during stressful moments. This approach to risk management adapts as traders grow and advance.

Once traders qualify for a Master Account and hit the required profit milestones, the daily loss limit is completely removed. At this stage, traders enjoy the benefit of keeping 100% of their first $10,000 in earnings and 90% of any profits after that [2].

FAQs

What are the consequences of repeatedly exceeding the daily loss limit on my Bulenox account?

Bulenox establishes daily loss limits tailored to the size of your trading account. These limits are designed to help you manage risk and promote responsible trading habits. Exceeding these limits repeatedly can lead to significant consequences, such as account suspension or even termination.

To prevent such outcomes, it’s essential to keep a close eye on your trades and operate within the specified thresholds. Adhering to these guidelines not only safeguards your account but also ensures you remain eligible to trade within the Bulenox platform.

How does TraderVPS help me manage Bulenox’s daily loss limits?

TraderVPS delivers a lightning-fast, low-latency virtual private server (VPS) designed to keep your trading connection stable and dependable. This setup allows you to execute trades swiftly and precisely, helping you avoid surpassing Bulenox’s daily loss limits – like the $400 cap on a $10,000 account.

With its consistent performance and minimal interruptions, TraderVPS ensures you can monitor trades in real time, adhere to Bulenox’s risk management guidelines, and safeguard your account from unwarranted termination.

What are the best strategies to stay within Bulenox’s daily loss limits?

To stay within Bulenox’s daily loss limits, it’s crucial to practice disciplined risk management. Start by using tight stop-loss orders to cap potential losses on individual trades. Pair this with modest position sizes that match your personal risk tolerance. Keep a close eye on your cumulative losses throughout the day, and if you’re nearing the limit, stop trading immediately. Also, make sure to trade only during Bulenox’s approved hours, and steer clear of overtrading or taking on high-volatility setups that could quickly push you over the daily cap.

Following these steps can help you manage risk effectively, safeguard your account, and stay compliant with Bulenox’s trading guidelines.