Forex trading runs 24/5, but not all hours are equally active or profitable. Understanding the best trading times is crucial for better results. Here’s what you need to know:

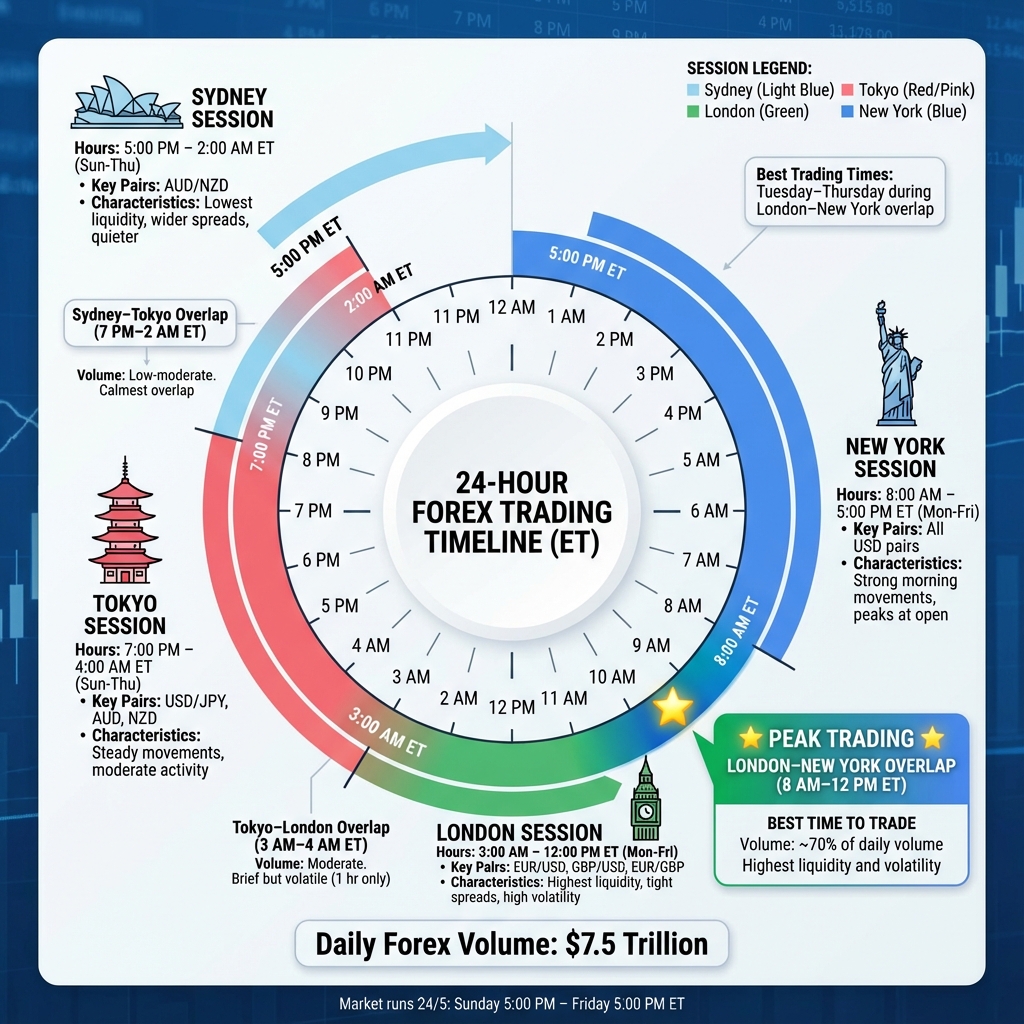

- Forex operates continuously from Sunday 5:00 PM to Friday 5:00 PM ET. Activity shifts across four major sessions: Sydney, Tokyo, London, and New York.

- Key overlaps drive peak activity: The London–New York overlap (8:00 AM–12:00 PM ET) accounts for ~70% of daily volume, offering high liquidity and volatility.

- Session characteristics vary:

- Sydney (5:00 PM–2:00 AM ET) is quieter, ideal for AUD/NZD pairs.

- Tokyo (7:00 PM–4:00 AM ET) sees steady action, especially USD/JPY.

- London (3:00 AM–12:00 PM ET) is highly active, with tight spreads and EUR/GBP dominance.

- New York (8:00 AM–5:00 PM ET) focuses on USD pairs, with strong morning movements.

Best times to trade:

- London–New York overlap for major pairs like EUR/USD and GBP/USD.

- Tokyo session for JPY and Asia-Pacific pairs.

- Mid-week (Tuesday–Thursday) often sees the largest price movements.

Timing your trades around these sessions and overlaps can improve liquidity, reduce costs, and align with market trends. Always monitor economic calendars for major news releases, as these can create sharp price shifts.

Forex Trading Sessions and Overlaps: 24-Hour Market Hours Guide

Forex trading hours and when you should trade forex

The 4 Major Forex Trading Sessions (ET)

The forex market operates across four key trading sessions, each with unique characteristics that influence liquidity and activity. Understanding these sessions can help shape your trading approach. Here’s a breakdown of their trading hours and behaviors.

Sydney Session

Trading Hours: 5:00 PM – 2:00 AM ET (Sunday through Thursday)

The Sydney session kicks off the trading week on Sunday evening. As the smallest of the major sessions, it experiences lower liquidity, which can lead to wider spreads and slower price fluctuations compared to the sessions that follow.

During this time, currency pairs involving the Australian dollar (AUD) and New Zealand dollar (NZD) tend to see more action. In contrast, major pairs like EUR/USD often experience minimal movement due to reduced market participation.

Tokyo Session

Trading Hours: 7:00 PM – 4:00 AM ET (Sunday through Thursday)

Known as the Asian session, the Tokyo session generates significant trading volume. Japan’s economic influence makes the USD/JPY pair particularly active during these hours. Additionally, pairs involving the AUD, NZD, and Chinese yuan often show increased activity.

This session typically features steadier price movements compared to the more volatile European and American sessions. As liquidity picks up during Tokyo trading hours, spreads on major pairs tend to narrow, offering a more stable environment for certain trading strategies.

London Session

Trading Hours: 3:00 AM – 12:00 PM ET (Monday through Friday)

London serves as a global hub for forex trading, handling a massive share of daily transactions. This session is marked by deep liquidity and tight spreads across popular pairs like EUR/USD, GBP/USD, and EUR/GBP. Early hours often bring heightened volatility as European traders respond to overnight developments.

For U.S.-based traders, adjusting to the London session’s timing can open up opportunities to capitalize on rapid market movements during this highly active period.

New York Session

Trading Hours: 8:00 AM – 5:00 PM ET (Monday through Friday)

The New York session wraps up the day’s trading activity. It’s a peak period for USD pairs, driven by U.S. economic data releases and Federal Reserve updates. The opening hour often sees sharp price movements as traders digest overnight news.

Liquidity is strongest in the morning but tends to taper off in the afternoon as European markets close. By Friday afternoon, activity slows further, with spreads widening as institutional traders prepare for the weekend.

Session Overlaps: When Trading Conditions Peak

Overlapping trading sessions are where the action heats up in the forex market. These periods bring higher liquidity, tighter spreads, and stronger price movements – perfect conditions for U.S. traders looking to spot and ride trends. Let’s break down the unique characteristics of the three main overlaps: Sydney–Tokyo, Tokyo–London, and London–New York.

Sydney–Tokyo Overlap

Active Hours: 7:00 PM – 2:00 AM ET (Sunday through Thursday)

During this overlap, trading picks up compared to the Sydney session alone, but it’s still the calmest of the three. Price movements tend to stay steady and range-bound [7][8]. If you trade Asia-Pacific pairs like AUD/JPY or NZD/USD, this window offers a smoother experience with narrower spreads and better execution opportunities.

Tokyo–London Overlap

Active Hours: 3:00 AM – 4:00 AM ET (Monday through Friday)

This overlap is brief – just one hour – but it packs a punch. It’s the handoff from Asian to European markets, and unexpected news can spark sudden volatility [7]. Pairs like EUR/JPY and GBP/JPY often see sharp movements, so traders need to stay sharp and ready to act quickly.

London–New York Overlap

Active Hours: 8:00 AM – 12:00 PM ET (Monday through Friday)

This is where the forex market hits its stride, with roughly 70% of trading volume happening during this overlap. Major pairs like EUR/USD, GBP/USD, and USD/JPY dominate, offering high liquidity and tight spreads [5]. U.S. economic data releases at 8:30 AM ET often add extra fuel, creating opportunities to ride significant price trends [7].

Matching Trading Times to Your Strategy and Pairs

The best times to trade depend heavily on both your chosen currency pairs and your trading approach. Aligning your trading schedule with the busiest market hours for your selected pairs can mean the difference between catching robust price movements and dealing with sluggish, choppy markets. Below, we break down the ideal trading sessions for various currency groups. Tailor your trading times to fit your targeted pairs and preferred style.

Trading Major USD Pairs Intraday

For major USD pairs like EUR/USD and GBP/USD, the London–New York overlap (8:00 AM – 12:00 PM ET) is where the action happens. This period features high liquidity and volatility, creating an environment ripe for quick, decisive moves [5]. Key economic reports from the U.S. and Eurozone often hit during this window, sparking sharp price shifts. Additionally, announcements from the Federal Reserve or European Central Bank can strongly influence trends, making this overlap a prime time for intraday trading.

Trading GBP and EUR Cross Pairs

Cross pairs such as GBP/JPY, EUR/GBP, and EUR/JPY thrive during the London session and its overlap with New York. These hours bring together European and American market participants, amplifying trading activity [1]. The heightened volatility during this time provides opportunities for bold intraday strategies, though it also demands disciplined risk management to navigate the frequent price swings effectively.

Trading JPY and Asia-Pacific Pairs

Pairs like USD/JPY, AUD/JPY, and NZD/USD perform well during the Tokyo session and the Sydney–Tokyo overlap (7:00 PM – 2:00 AM ET). These hours tend to feature moderate volatility and more stable, range-bound price movements, making them particularly suitable for swing trading strategies. The steadier pace during this session allows traders to focus on capturing smaller, consistent gains within defined ranges.

Weekly Patterns, News Releases, and Risk Control

How Each Day of the Week Differs

The forex market has a rhythm that unfolds predictably throughout the week, offering traders opportunities to plan their strategies. The trading week officially begins on Sunday evening at 5:00 PM ET with the Sydney session. This early phase often sees gaps caused by weekend developments[4][6][10]. Monday trading tends to start cautiously as institutions evaluate the market’s new dynamics.

Tuesday through Thursday generally see the most significant price movements across currency pairs[6]. These mid-week days are marked by heavy institutional activity and a full economic calendar, making them prime time for active trading strategies. On the other hand, Friday afternoons experience a noticeable slowdown as traders unwind positions ahead of the weekend[4][6][10]. This means the most favorable trading opportunities often arise mid-week, while Mondays and Fridays may require more selective tactics. These patterns also set the stage for how the market reacts to key economic news.

Economic News Release Timing

In the U.S., major economic data is typically released at 8:30 AM ET, during the critical London–New York overlap. For U.S.-based traders, Federal Reserve announcements are particularly influential, often causing swift and dramatic currency movements[2].

During the London–New York overlap, these data releases can spark intense market reactions. Currency prices can shift within moments, especially when the actual numbers differ from expectations[4][3]. To prepare, traders should be ready at least 15 minutes before the 8:30 AM ET release time[9]. Similarly, key European data released during the London session can significantly impact EUR and GBP pairs. Keeping a close eye on economic calendars is crucial for timing trades effectively.

Adjusting Risk Based on Session Characteristics

News releases and session-specific behaviors make it essential for traders to fine-tune their risk strategies. The London–New York overlap, known for its high volatility and tight spreads due to strong liquidity, often justifies slightly larger position sizes. However, this period also demands wider stop-losses to account for sudden price swings driven by major announcements.

In contrast, the Asian session, with its lower volatility, calls for a more conservative approach. Tighter stop-losses and smaller positions are typically more appropriate, as moves of 75–100 pips occur only about three times a month during this session[11]. Since most currency pairs move between 50 and 100 pips daily[6], aligning risk parameters with the typical volatility of each session is essential for effective risk management.

Conclusion

Timing in forex trading is a game-changer for improving results. While the forex market runs 24 hours a day, five days a week, not every hour offers the same opportunities. Aligning your trades with the most active sessions and overlaps can lead to better liquidity, tighter spreads, and more pronounced price movements.

For U.S. traders, the London–New York overlap (8:00 AM–12:00 PM ET) stands out as the busiest and most liquid trading window. This period is ideal for traders looking to capitalize on heightened market activity and increased trade opportunities.

Your trading strategy should also reflect the nature of the currency pairs you focus on. For example, day traders seeking volatility may find the London–New York overlap particularly rewarding. On the other hand, swing traders might prefer quieter periods with steadier price movements, which align better with their approach to trading [6]. Adapting your strategy to the rhythm of the sessions can significantly improve your trading outcomes.

Weekly trends and economic news releases further refine timing strategies. Historically, Tuesday through Thursday see the largest price fluctuations, while Fridays tend to slow down as traders wrap up their positions before the weekend [6]. Key economic data released during peak trading hours can create rapid market shifts, making risk management essential [4].

With a daily trading volume averaging $7.5 trillion [6][12], it’s clear that liquidity and volatility vary across sessions. Concentrating your efforts on periods with favorable market conditions can help you trade more efficiently and, potentially, more profitably. By applying these insights, you can focus on trading during optimal windows, ensuring your approach is smarter, not just busier.

FAQs

When are the best times for beginners to trade forex?

For those just starting out in forex trading, timing is everything. The best times to trade are when the market is buzzing with activity. Two key windows to watch are the U.S./London overlap (8:00 a.m. to 12:00 p.m. EST) and the Tokyo/Sydney overlap (2:00 a.m. to 4:00 a.m. EST). These periods typically see higher liquidity and more price movement, offering tighter spreads and more chances to trade.

Jumping in during these busy sessions can give beginners a better grasp of how the market flows and allow them to refine their strategies under optimal conditions.

How do economic news releases impact forex trading during overlapping market hours?

During overlapping market hours, like the London-New York session overlap, economic news releases can have a major impact on forex trading. These overlaps often bring heightened volatility and liquidity, as traders respond to key data such as employment reports, GDP updates, or central bank announcements.

The surge in activity during these times can lead to sharper price swings, presenting more trading opportunities. That said, these rapid market movements can also increase risks. Staying informed and timing your trades around these events allows you to harness the market’s momentum while keeping potential challenges in check.

Why is the overlap between the London and New York sessions the busiest time for forex trading?

The overlap between the London and New York sessions, running from 8:00 a.m. to 12:00 p.m. EST, is the most active period for forex trading. Why? It merges the trading activity of two of the world’s largest financial hubs, creating a bustling market environment.

During these hours, liquidity hits its peak, with a high number of buyers and sellers actively participating. This often results in tighter spreads and more competitive pricing – something every trader appreciates.

It’s also a time of heightened volatility, as major economic news and data from both Europe and the United States are frequently released. For traders, this combination of liquidity and volatility offers prime opportunities to take advantage of significant price swings and execute trades with greater precision.