Funded trading accounts let you trade using a firm’s money instead of your own after passing an evaluation. These accounts reduce personal financial risk, as losses are covered by the firm, and you keep 70%–95% of profits. The process involves paying an evaluation fee (typically $100–$1,500) and meeting strict profit and risk rules. Most traders fail these evaluations due to lack of discipline or overtrading, with success rates often below 10%.

Key points:

- Profit Sharing: Retain 70%–95% of profits; firms cover losses.

- Evaluation Fees: Range from $100 to $1,500, depending on account size.

- Evaluation Phases: One-phase or two-phase models with profit targets (8%–10% in Phase 1, ~5% in Phase 2).

- Account Types: One-phase, two-phase, and instant funding options.

- Eligibility: Requires consistent trading, adherence to rules, and meeting profit targets.

Funded accounts are ideal for skilled traders seeking access to larger capital without risking personal savings. Success depends on discipline, risk management, and consistency.

How To Pass A Funded Account In 2025

How Funded Accounts Work

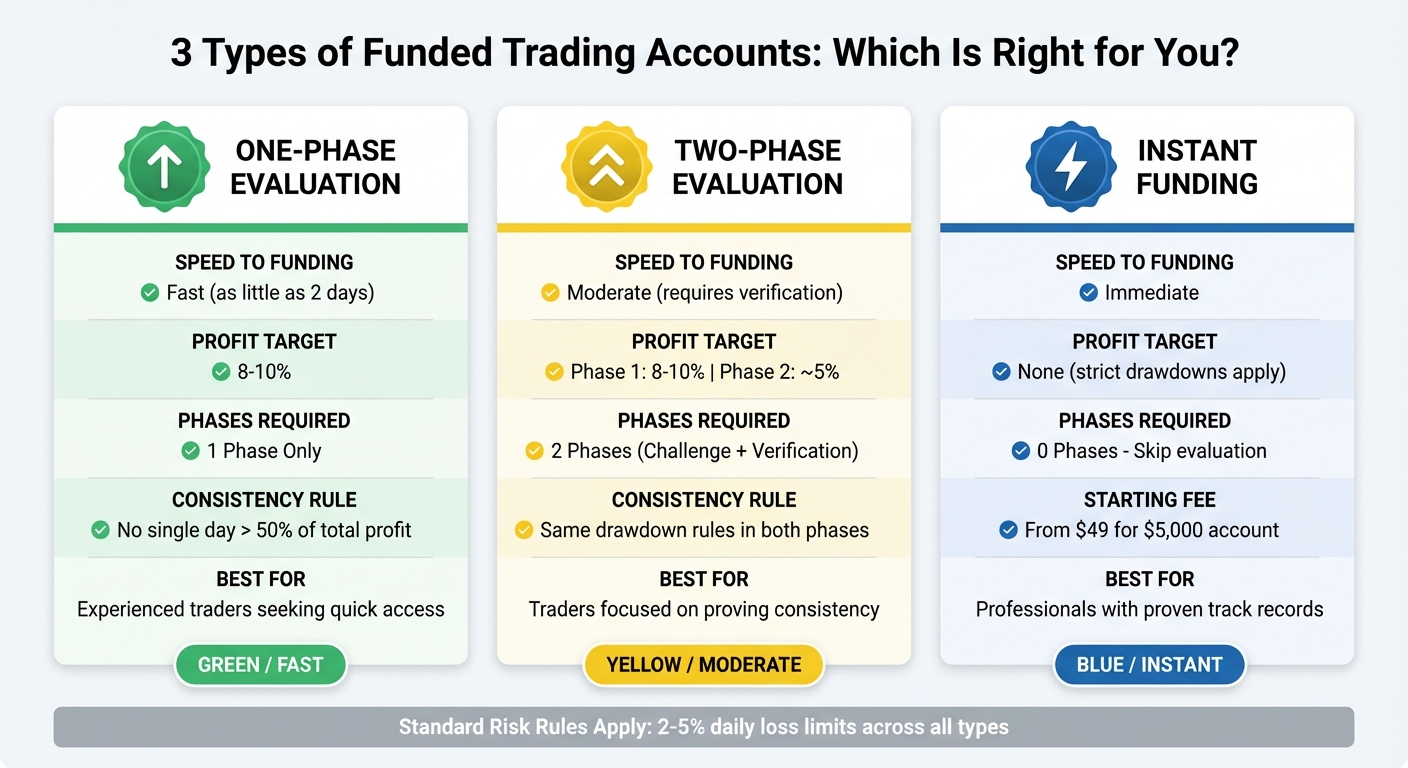

Funded Trading Account Types Comparison: One-Phase vs Two-Phase vs Instant Funding

Proprietary trading firms provide traders with access to their capital once they pass an evaluation process. After paying a fee and successfully completing the required challenges, you gain the opportunity to trade using the firm’s funds instead of your own. While you trade as usual, the firm’s risk management systems ensure strict limits are enforced at all times.

These firms usually set drawdown limits, which can either trail your profits or remain fixed. If your account balance drops below the specified threshold, your access to the funds is revoked[12]. This structured approach not only controls risk but also establishes how profits are shared once you’re funded.

Profit-Sharing Structure

When you become a funded trader, you’ll share your profits with the firm. Most programs offer a profit split ranging from 70% to 90%, with some even going up to 95%. However, there are rules to ensure consistent performance. For instance, no single trading day can contribute more than 40% to 50% of your overall profits[12]. This discourages reliance on one-off lucky trades and promotes disciplined, sustainable trading practices. Additionally, some firms require traders to achieve a minimum number of "winning days" – usually five days with at least $100 in profit – before they can request a withdrawal[12].

Evaluation Process

The evaluation phase is where traders prove their skills – or fall short. Between January 2024 and July 2025, only 20.35% of evaluation accounts with one provider managed to meet the criteria to move forward[11]. Here’s an overview of how the process typically works:

First, you select an account size, such as $50,000 or $100,000, and pay an evaluation fee. For example, one provider charges about $77 for a $50,000 "Core" evaluation account[12]. You’ll then trade in a simulated environment with a specific profit target – usually 8% to 10% of the starting balance – while adhering to strict risk rules. These rules often include daily loss limits of 2% to 5% of your account balance[2].

Some firms add a second "Verification" phase. This step has a lower profit target, around 5%, but maintains the same risk rules to confirm that your initial success wasn’t just luck[2]. Once you clear these stages, you’ll complete identity verification (KYC) and sign a funding agreement. Industry data shows that over 90% of traders fail these evaluations, often due to overtrading, lack of discipline, or misunderstanding the rules[4]. For instance, one study found that only 1.01% of participants in simulated funded accounts advanced to live funded accounts[11].

Types of Funded Accounts

Funded accounts are tailored to fit different trading styles and experience levels:

- One-Phase Evaluations: These are the quickest route to funding, with some traders getting funded in as little as two days[10]. You’ll face a single profit target, typically 8% to 10%, along with standard drawdown rules. Many firms also include a consistency requirement, ensuring no single day accounts for more than 50% of the overall profit target[12].

- Two-Phase Evaluations: This model includes an additional "Verification" phase after the initial challenge. The first phase requires an 8% to 10% profit target, while the second phase lowers the target to around 5%, keeping the risk rules the same. While this approach takes longer, it ensures your results are repeatable, not based on chance.

- Instant Funding: These accounts skip the evaluation process entirely. You pay a higher upfront fee – starting at about $49 for a $5,000 account[5] – to gain immediate access to capital. However, these accounts come with very strict risk parameters to safeguard the firm’s funds. They are best suited for experienced traders with proven track records who need quick access to capital.

| Account Type | Speed to Funding | Profit Target | Best For |

|---|---|---|---|

| One-Phase | Fast (as little as 2 days) | 8–10% | Experienced traders seeking quick access |

| Two-Phase | Moderate (requires verification) | Phase 1: 8–10%; Phase 2: ~5% | Traders focused on proving consistency |

| Instant Funding | Immediate | None (strict drawdowns apply) | Professionals with proven track records |

Choosing the right type of funded account depends on your experience level and trading strategy. Each option has its own advantages and challenges, so aligning your choice with your goals is key.

Benefits of Funded Accounts

Funded accounts come with a structured evaluation process and a profit-sharing model that not only manage risk but also offer a range of advantages to traders. By trading with a funded account, you avoid putting your own money on the line. Instead, your only expense is the evaluation fee, which typically ranges from $49 to a few hundred dollars[3]. Let’s break down how these benefits – from minimizing financial risk to gaining access to larger capital and advanced tools – can make a real difference for traders.

"The biggest advantage is of course the access to outside capital, which also reduces personal financial risk."

- G. Dautovic, Author, Fortunly[13]

Lower Personal Financial Risk

One of the standout perks of funded accounts is the protection of your personal finances. Once you’re trading with a funded account, any losses come out of the firm’s capital – not your savings. This means your net worth stays intact, even if you hit a rough patch or violate account rules. The only financial commitment you’ve made is the initial evaluation fee. This structure is particularly appealing for skilled traders who lack significant savings but are confident in their ability to trade successfully.

Access to Larger Capital

Funded accounts provide access to significant trading capital – ranging from $25,000 to over $1,000,000 – amounts that most individual traders wouldn’t have at their disposal. For instance, with a $100,000 account and an average monthly return of 5% ($5,000), a trader could take home $4,000 under an 80% profit-sharing arrangement[14]. This level of capital enables traders to handle multiple contracts – up to 15 on a $150,000 account – and diversify across various futures markets, including gold, crude oil, and the S&P 500.

"Handling six-figure balances forces precise position sizing and sharpens your risk-to-reward instincts – experience impossible to gain with a tiny retail account."

- SuperFunded Team[15]

Professional Trading Tools

In addition to financial benefits, funded accounts come with access to top-tier trading tools. Proprietary trading firms provide institutional-grade platforms and real-time data feeds that are often too expensive for individual traders. Platforms like TopstepX, MetaTrader 4/5, NinjaTrader, and Quantower become part of your toolkit, along with the infrastructure needed for high-frequency trading and advanced strategies. Plus, the strict risk management rules – such as daily loss limits and maximum drawdowns – mirror those used by elite professionals. These measures encourage disciplined, calculated trading and help traders avoid the emotional pitfalls that can derail success in an unstructured retail environment.

Psychological Benefits of Trading Firm Capital

Trading with firm capital offers more than just financial perks – it reshapes your mindset and approach to trading. By removing the fear of losing personal savings, it allows you to focus on executing trades with clarity and precision. This shift can make a world of difference, especially for traders who struggle with emotional decision-making.

"Trading your own money can be nerve-wracking. Funded trading lets you gain valuable market experience while minimizing your financial risk. It’s like having a safety net."

Reduced Fear of Personal Loss

One of the biggest advantages of trading with firm capital is the reduced emotional burden. Without the fear of losing your own money, you’re less likely to fall into traps like FOMO (fear of missing out), revenge trading, or greed. Losses are seen as part of the process – more like a business expense than a personal setback [9]. This mindset encourages disciplined and consistent trading.

But here’s the hard truth: about 80% of funded accounts fail because traders lack discipline [9], and over 90% don’t pass prop firm evaluations due to emotional trading and overtrading [4]. The key difference between success and failure? Treating a funded account as a professional endeavor rather than a risky gamble.

"Most failures come from emotional lapses, not bad strategies."

- 4proptrader [2]

This mental shift lays the groundwork for a more strategic and sustainable trading approach.

Focus on Long-Term Strategy

When you’re not worried about personal financial loss, you can take a step back and focus on the bigger picture. Many funded programs now allow traders to operate without strict time constraints, understanding that patience often yields better outcomes. This environment nurtures what some call a "Funded Mentality" – a mindset that values capital preservation and steady growth over aggressive risk-taking.

A structured routine can make all the difference. For instance, trading three days a week, limiting yourself to two trades per day, and aiming for a modest 1% weekly profit can help reduce fatigue and prevent overtrading [9]. With firm capital, you can afford to be selective, risking just 0.25% to 0.5% per trade. Over time, these small, consistent gains can add up significantly – something that’s hard to achieve when you’re chasing losses from your own pocket.

"The difference between a trader who keeps their account for 6 months and one who keeps it for 5 years? Discipline and long-term strategy."

- Propfirmscodes [9]

To further refine your approach, keep a journal to track both your emotional state and trading results. Identifying patterns can help you avoid situations that lead to poor decisions. And if you hit a rough patch, implement a cool-off rule – take a three-day break to reset mentally [9]. These practices encourage the professional detachment that trading with firm capital makes possible, helping you stay focused on your long-term goals.

Eligibility and Getting Started

Joining a funded trading program isn’t about having a long resume or advanced credentials – it’s about showing you can trade with discipline and stick to the rules. Most firms require you to go through an evaluation phase, often called "the challenge", where you prove your trading skills under strict guidelines before gaining access to live capital [16][17].

Eligibility Requirements

Funded trading programs are designed to assess your discipline and consistency through clearly defined performance metrics. Entry is based on your trading performance, not formal qualifications. For example, profit targets typically fall between 8% and 10% of the starting balance, meaning you’d need to generate $4,000–$5,000 on a $50,000 account [2][18].

Strict risk rules are a core part of these programs. You’ll need to stay within daily loss limits, which usually range from 2% to 5%, and adhere to overall drawdown restrictions [2]. Many firms also require consistency, meaning your profits can’t rely on a single, lucky trade. For instance, some programs enforce a "Max Position Profit Ratio" rule, where no single trade can make up more than 30% of your total profit target [2][17].

To further ensure steady performance, you’ll need to meet minimum trading activity requirements. These typically include trading for at least 5 to 10 days or making 10 to 20 trades. Additional restrictions might include avoiding overnight positions, steering clear of high-impact news events like NFP or CPI announcements, and keeping trades open for a minimum duration, often around 30 seconds [2][17].

"A funded trading evaluation process is a mandatory trading test set by a reputable prop firm where traders must prove their skills under strict, specific rules." – Trade The Pool [17]

The pass rate for these programs is low – only about 5% to 15% of traders succeed overall, and fewer than 10% pass on their first try [17]. Most failures stem from breaking risk rules rather than poor trading strategies.

With these requirements in mind, the application process is straightforward and follows a series of clear steps.

Application Steps

Once you meet the eligibility criteria, here’s how to get started with a funded trading account. First, choose a program that aligns with your trading style and budget. Evaluation fees typically range from $100 to $1,000, depending on the account size. For example, gaining access to a $150,000 buying power account might cost around $375 [2][8]. Some firms also require a monthly subscription fee until you achieve funded status.

After paying the fee, you’ll enter the evaluation phase. This simulated trading environment mirrors live market conditions, and you’ll need to meet specific profit and risk targets. In two-step programs, the process usually involves hitting a 10% profit target in Phase 1, followed by a 6% target in Phase 2. One-step programs simplify this with a single 10% profit target [18].

Once you pass the evaluation, you’ll sign a funded trader agreement to access live capital. Profit splits typically range from 70% to 90%, and some firms even allow traders to keep 100% of their first $5,000 in profits [2][17][8].

The key to success is focusing on avoiding rule violations rather than rushing to hit profit targets. Many traders fail by over-leveraging early in the evaluation. Treat the evaluation as if you’re managing a real account from the start – firms prioritize consistent risk management and professional behavior over quick wins [2]. Also, make sure you’re aware of when the firm’s trading day resets (e.g., 5:00 PM CT) to avoid accidental breaches of daily loss limits [2][8].

Conclusion

Funded trading accounts offer traders the chance to expand their strategies without risking their own savings. By successfully completing an evaluation, you can unlock access to significantly larger capital with relatively low upfront costs – usually just an evaluation fee ranging from $100 to $1,000 [4].

The key to thriving in this model lies in discipline and consistency. Successful traders approach evaluations as if they were live accounts from the start, following strict risk management rules and resisting the urge to chase profit targets recklessly. As Seacrest Markets emphasizes:

"Risk management is the backbone of a successful funded trading career. Successful traders focus less on chasing big wins and more on protecting capital" [6].

Once discipline is in place, the next step is leveraging scaling opportunities. Many firms offer plans that can double your capital allocation every few months if you consistently hit a 10% profit target. Some traders even go on to manage up to $1 million in capital [6]. To protect your earnings, consider withdrawing profits regularly instead of letting them accumulate, and always stick to the program’s rules [3].

Before diving into a funded account program, take the time to determine if this approach fits your trading style and objectives. A good starting point is 30 days of demo trading with a focus on achieving consistent weekly profits [7]. Pay close attention to the program’s withdrawal policies, reset fees, and specific guidelines. Details like when the trading day resets or how trailing drawdowns are calculated can significantly impact your experience.

Funded accounts aren’t a quick route to wealth. However, for traders who are disciplined, diligent, and committed to improving their skills, they can provide a real opportunity to access professional-level capital while minimizing personal financial risk.

FAQs

What challenges do traders face when trying to pass a funded account evaluation?

Passing a funded account evaluation isn’t easy – it’s designed to test traders against strict requirements and high standards. One of the biggest challenges? Hitting the profit target while staying within limits on drawdowns and daily losses. Just one major loss can knock you out of the running. That’s why solid risk management is non-negotiable. Strategies like setting stop-loss orders and keeping position sizes manageable can make all the difference.

Another key hurdle is maintaining consistent and disciplined performance throughout the evaluation. Prop firms prioritize steady, reliable returns over quick, high-risk wins. This means traders need to focus on building a dependable track record rather than chasing big, flashy gains. Add the pressure of being monitored, and it’s easy to let emotions take over – making psychological discipline just as important as technical skills.

Finally, traders have to stick to the firm’s specific rules – and these can be surprisingly detailed. Restrictions might include trading only during certain hours, using approved instruments, or adhering to a maximum number of trading days. Breaking even one rule, whether intentional or not, can lead to disqualification. So, a clear understanding of the guidelines is absolutely essential.

How does profit-sharing work in funded trading accounts?

Profit-sharing in funded trading accounts determines how net profits are divided between the trader and the firm providing the capital. Generally, traders take home a large share of their earnings – often 70% to 90% – while the firm keeps the remainder as compensation for providing the funding. The exact percentage split can differ depending on the specific program and may even include performance-based tiers.

Before any profits are distributed, traders must meet certain conditions. These typically include hitting profit targets, staying within daily loss limits, and following strict risk management rules. Once these requirements are satisfied, the agreed profit-sharing arrangement kicks in. One key point: the firm shoulders any losses, not the trader. This setup encourages disciplined, low-risk trading to safeguard the interests of both the trader and the firm.

What’s the difference between one-phase, two-phase, and instant funding accounts?

One-phase accounts are straightforward. You pay a fee, trade in a simulated account, and aim to hit the profit target while adhering to the firm’s loss and drawdown rules. If you meet these conditions, you’re promoted to a live funded account.

Two-phase accounts break the process into two steps. In the first phase, you work toward a moderate profit target. If successful, you move to the second phase, which might have stricter rules or require trading over a longer period. Completing both phases grants you access to proprietary capital.

Instant funding accounts skip the evaluation altogether. You pay a higher upfront fee and gain immediate access to a funded account. However, these accounts often come with tighter risk restrictions and a smaller share of the profits.

To sum it up: one-phase accounts involve a single test, two-phase accounts require two stages, and instant funding accounts bypass testing but come with higher costs and stricter conditions.