DAS Trader Pro is a high-performance trading platform designed for active day traders. Monthly costs range from $100 to $200, depending on the subscription tier, broker, and additional features like market data packages. Here’s what you need to know:

- Subscription Plans: Four tiers – Basic ($100), Standard ($120), Elite ($175), and Premium Elite ($200). Higher tiers include features like Level 2 data, advanced charting, and multi-account management.

- Broker Integration: Fees vary by broker (e.g., Interactive Brokers starts at $100/month). Some brokers offer waivers or rebates for high trading volumes.

- Market Data Costs: Add-ons like Nasdaq TotalView ($20/month) or NYSE Open Book ($65/month) can increase costs.

- Other Fees: Replay features ($15/month) and per-share commissions vary by broker.

While costs can add up, volume-based discounts and commission offsets can reduce expenses for frequent traders. For casual users, the platform might feel expensive. Evaluate your trading needs to decide if it’s worth the investment.

DAS Trader Review (Platform Demo & Connecting to Schwab and IBKR)

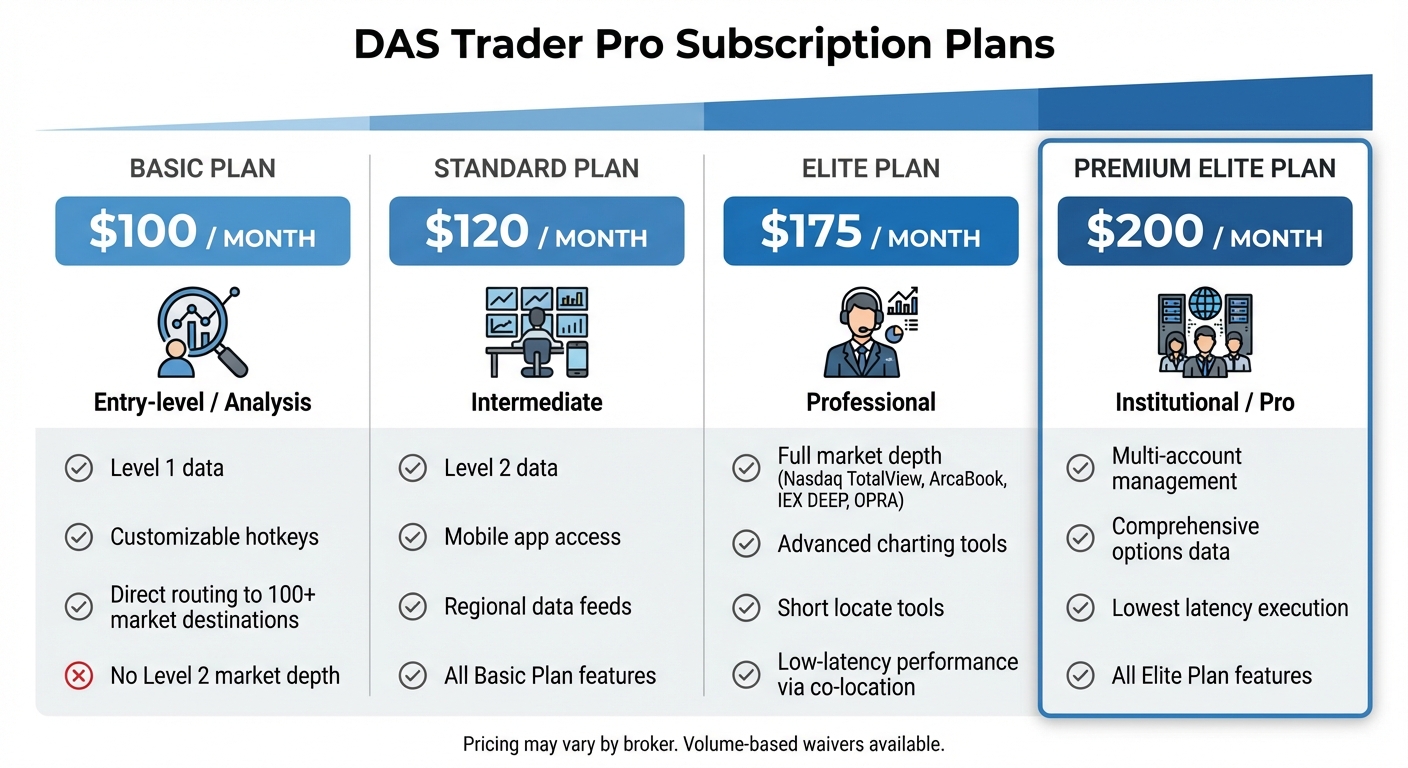

DAS Trader Pro Subscription Plans

DAS Trader Pro Pricing Plans Comparison Chart

DAS Trader Pro provides four subscription options, priced between $100 and $200 per month. Each plan caters to different trading needs, offering varying levels of market data, tools, and execution capabilities. It’s worth noting that pricing may differ depending on whether you subscribe directly or through a broker. In some cases, brokers may waive fees for high-volume traders. Here’s a detailed look at what each plan offers.

Basic Plan

Priced at $100 per month, the Basic Plan covers the essentials for direct-access trading. It includes Level 1 quotes for U.S. equity exchanges, customizable hotkeys, and direct routing to over 100 market destinations[5]. This plan is a solid choice for beginners who are primarily focused on market analysis. However, it does not offer Level 2 market depth, which could be a drawback for scalpers or momentum traders needing more granular data.

Standard Plan

The Standard Plan, at $120 per month, builds on the Basic Plan by adding Level 2 data, mobile app access, and regional data feeds[5]. This makes it a suitable option for intermediate traders who need deeper market insights without committing to a professional-grade package.

Elite and Premium Elite Plans

For advanced users, the Elite Plan ($175 per month) and the Premium Elite Plan ($200 per month) deliver a comprehensive suite of features. Both plans include full market depth (Nasdaq TotalView, ArcaBook, IEX DEEP, OPRA), advanced charting tools, short locate tools, and low-latency performance through co-location[1].

The Premium Elite Plan goes a step further by offering multi-account management, making it ideal for traders managing multiple portfolios or institutional accounts. As Nathan Michaud, founder of InvestorsLive, noted:

"DAS Trader is by far the most robust trading platform out there. I’ve used this tool every day trading since 2003. I’ve compared it to many others out there and it always stands out as the fastest!"[1]

| Plan Tier | Monthly Cost | Target Trader | Key Features |

|---|---|---|---|

| Basic | $100 | Entry-level / Analysis | Level 1 data, customizable hotkeys, direct routing |

| Standard | $120 | Intermediate | Level 2 data, mobile app access, regional data feeds |

| Elite | $175 | Professional | Full market depth (TotalView), advanced charting |

| Premium Elite | $200 | Institutional / Pro | Multi-account management, comprehensive options data, lowest latency |

How Broker Integration Affects Pricing

DAS Trader Pro is accessible exclusively through contracted retail brokers, with monthly fees ranging from $90 to $135. One significant factor to consider is whether your broker provides fee waivers or rebates based on your trading volume [5]. Below, we break down integration details for some of the major brokers to highlight these differences.

Interactive Brokers

Interactive Brokers charges $100 per month for the standard DAS Trader Pro package, which includes Level 1 quotes. For traders needing Level 1 options quotes and mobile app access, there’s an additional $50 monthly charge [5]. It’s important to note that only IBKR Pro accounts are supported; IBKR Lite accounts are not compatible [7]. Unlike some brokers, Interactive Brokers does not waive platform fees for high-volume traders [3]. However, it does provide access to 135 market centers across 33 countries through DAS [3]. As Sam Levine, CFA, CMT from StockBrokers.com, explains:

"Interactive Brokers offers the most complete DAS Trader Pro experience… providing traders access to global markets (135 market centers in 33 countries)" [3].

Charles Schwab

Charles Schwab integrated DAS Trader Pro after acquiring TD Ameritrade, with beta testing starting in July 2020 and the platform becoming fully operational later that year [2]. Schwab’s platform fees typically fall within the $100 to $135 range, consistent with other DAS brokers [3]. Transitioning to Schwab requires obtaining new DAS login credentials, as existing credentials cannot be transferred. These new credentials are sent via email, which may involve a short waiting period [2].

| Broker | Monthly Platform Fee | Fee Waiver Available | Special Requirements |

|---|---|---|---|

| Interactive Brokers | $100 (basic) + $50 (options/mobile) | Generally not waived | Must have IBKR Pro account |

| Charles Schwab | $100–$135 range | Not specified | New DAS login required |

| Cobra Trading | $125 | Waived if trading >250,000 shares/month | Volume-based rebate |

| SpeedTrader | $99 | Waived after $499 in monthly commissions | Commission-based rebate |

Extra Fees and Market Data Costs

In addition to your monthly subscription, you might encounter extra fees for market data and other features, which can add $5–$100 to your monthly costs. These charges often depend on whether you’re accessing Level 1 or Level 2 data feeds[3].

Market Data Packages

Market data fees are an important part of your overall trading expenses. The cost varies based on the exchanges and data levels you need. For example, Nasdaq Total View costs about $20 per month, while NYSE Open Book runs around $65[5]. Comprehensive data packages typically range from $12 to $100 monthly[5]. Your classification as a Non-Professional or Professional trader also plays a big role – Professional users often pay three to five times more than Non-Professional traders[8].

Some brokers include Level 1 quotes in their subscriptions but charge extra for Level 2 and regional data. Additional options like IEX Deep and Forex data are available for roughly $5 per month each, while Option Level 2 data costs $50 per month for Non-Professional users and $85 for Professionals[8]. Make sure to review bundled data fees carefully to avoid surprises.

Replay Add-On

The Replay feature, priced at $15 per month, allows you to replay historical market data for backtesting strategies[4]. One trader highlighted its usefulness for practicing during market openings[1]. However, full 24/7 replay access is usually part of standalone simulator packages, while live account users are often limited to non-market hours[2].

Per-Share Commissions

If you’re using a DAS-linked broker, you’ll also need to consider per-share commissions, which can significantly impact costs for high-volume traders. For example:

- Interactive Brokers charges $0.0035 per share, with a $0.35 minimum per trade.

- Lightspeed offers rates between $0.001 and $0.0035 per share, with a $0.25 minimum.

- SpeedTrader charges $0.0009 to $0.0025 per share but has a higher minimum of $2.49 per trade[3].

These per-share fees can quickly add up for scalp traders who execute a high number of trades, making it essential to choose a commission structure that aligns with your trading style.

What Affects Your Total Cost

The monthly cost of DAS Trader Pro can vary depending on your usage, and certain factors may even bring your effective fee down to zero.

Volume-Based Discounts

If you’re a high-volume trader, you might not have to pay platform fees at all. Many brokers waive these fees once you hit specific trading thresholds. For example:

- Cobra Trading waives its $125 fee for traders who reach 250,000 shares in a month.

- SpeedTrader eliminates its $99 fee when commissions total $499.

- Capital Markets Elite Group offers a $90 rebate when commissions hit $650.

For active day traders who consistently meet these benchmarks, the platform can essentially become free.

"DAS Trader brokers compete heavily on price." – Sam Levine, CFA, CMT [3]

These volume-based waivers significantly impact your net trading costs, especially when combined with other fee adjustments and commission offsets.

Annual Plans

DAS Trader Pro does not offer annual payment options. Instead, monthly subscriptions are the standard across all brokers. Cost savings are generally achieved through commission offsets and volume-based waivers rather than prepayment discounts.

In addition to the subscription structure, broker credits can further reduce your overall expenses.

Broker Credits

Some brokers allow you to apply your trading commissions directly against the platform fee, effectively lowering your out-of-pocket costs. For instance, Lightspeed offsets the $130 fee entirely and even offers new users a 3-month waiver [3].

For frequent traders, these commission offsets can make the platform cost negligible. One professional trader shared that their total monthly trading expenses were approximately $6,649, which included the DAS subscription, $3,500 in commissions, and $2,500 in short locate fees [9]. In cases like this, the platform fee becomes a very small part of the overall trading costs, with broker credits significantly reducing the financial burden.

Is DAS Trader Pro Worth the Cost?

For high-frequency traders and scalpers, DAS Trader Pro offers some compelling advantages. Its ultra-low latency execution, powered by Nasdaq-colocated servers, provides a critical edge for executing trades quickly and efficiently [1]. Nathan Michaud, the Founder of InvestorsLive, has frequently highlighted the platform’s speed and dependability throughout his trading career [1].

One standout feature is its advanced hotkey scripting, which allows traders to automate complex tasks like calculating position sizes based on account equity. However, if you’re a trader who operates less frequently or deals with smaller positions, the platform’s cost might feel harder to justify, as the benefits of faster execution may not outweigh the expense.

Value for Active Day Traders

DAS Trader Pro is built to handle substantial trading volumes, making it a solid choice for professionals. For active day traders executing hundreds of trades daily, the monthly subscription cost becomes a relatively minor part of their overall expenses. For instance, one professional trader shared their monthly trading costs: $6,649, which included the DAS subscription, $3,500 in commissions, and $2,500 in short locate fees [9]. In this scenario, the DAS subscription fee is just a small piece of the puzzle, especially when broker credits or volume-based waivers are factored in.

For those preparing to trade live, the platform’s simulator adds even more value.

Simulator Costs and Benefits

If you’re not ready to dive into live trading, the DAS Trader Pro simulator offers a risk-free way to learn the platform and refine your strategies. This simulator provides real-time Level 1 and Level 2 market data, creating a practice environment that feels very close to actual trading conditions. One of its standout features is Replay Mode, which lets traders focus on specific market scenarios outside regular hours. As trader Achim K explains:

"I only trade at the open, and I can practice this in replay-mode from morning till evening" [1].

New users can explore the simulator with a 14-day trial, and DAS hosts free "Intro to DAS" webinars every Wednesday to help new traders get up to speed. For those serious about mastering DAS Trader Pro’s intricate hotkey system and order types, the simulator subscription – typically between $100 and $200 per month, depending on the chosen data package – can be a smart investment before transitioning to live trading [3].

Whether you’re actively trading or practicing strategies, it’s essential to weigh the platform’s cost against your trading frequency and goals.

Conclusion

DAS Trader Pro’s pricing structure goes beyond the base fee of $100–$150. You’ll need to factor in additional costs like market data packages (Level 1 and Level 2) and any broker-specific fees that may apply [3]. As DAS Trader makes clear: "All sales are final. DAS does NOT offer refunds on any purchases of data subscriptions or Add-On services" [4]. This makes it crucial to thoroughly evaluate your trading needs before committing.

For professional traders, it’s important to consider the full scope of expenses. If you’re classified as a Professional under SEC/CFTC rules, you could face significantly higher market data fees [4]. High-frequency traders and scalpers may also need to budget for specialized infrastructure, such as a dedicated VPS for ultra-fast, sub-millisecond execution [6].

That said, some of these costs can be reduced through broker commission credits. For instance, SpeedTrader waives its $99 monthly fee once you generate $499 in commissions, and Lightspeed offers new clients a three-month fee waiver along with ongoing commission offsets [3].

Take advantage of the 14-day free trial to test the platform’s speed and features [2]. Be sure to estimate your monthly trading volume, confirm your professional status for data fees, and check that your broker integrates smoothly with the platform.

DAS Trader Pro’s modular pricing lets you pay only for what you need. By understanding all the cost components upfront, you can avoid unexpected surprises.

FAQs

What advantages come with upgrading to a higher-tier DAS Trader Pro plan?

Upgrading to a higher-tier DAS Trader Pro plan unlocks advanced tools and detailed market data feeds, giving you an edge in trading. Premium features like NASDAQ TotalView, Options Level 2, and other comprehensive market books provide a deeper look into order flow and price movement. These insights can help you execute trades more efficiently and reduce the chances of slippage.

Higher-tier plans also improve your trading setup with mobile access, multi-monitor support, and extras like market replay, trade alerts, and access to fundamental data. When paired with advanced order types, smart order routing, and real-time account management, these features cater to active traders who prioritize speed, flexibility, and enhanced control over their strategies.

How can broker fee waivers and rebates help reduce costs with DAS Trader Pro?

Broker fee waivers and rebates can be great ways for DAS Trader Pro users to cut down on trading costs. Fee waivers happen when brokers cover certain charges, like SEC or FINRA fees. This often serves as a reward for traders who hit specific trading volume targets. The result? Lower or even zero fees on qualifying trades, which can make a big difference over time.

Rebates work a little differently. They’re usually earned by adding liquidity to the market – for instance, by placing limit orders that stay on the order book until they’re executed. When that happens, the exchange might issue a small credit. Brokers then pass this credit on to the trader, helping offset other fees. For traders who deal in high volumes or trade frequently, these rebates can lead to noticeable savings.

DAS Trader Pro also throws in some perks for active traders. For example, if you trade 250,000 shares or more in a single month, you might qualify for a free platform subscription, cutting your costs even further. To stay on top of these benefits, it’s a good idea to check the platform’s “fees & rebates” section regularly. This way, you can keep track of your savings and get a clearer picture of your actual trading expenses.

Is the DAS Trader Pro simulator worth it for new traders?

The DAS Trader Pro simulator provides a great opportunity for beginners to practice trading without risking real money. Its pricing details are accessible, but whether it’s worth the investment depends on your personal trading goals and how much you prioritize practical experience. If you’re committed to sharpening your skills, this platform can be a helpful resource. However, it’s essential to carefully consider the cost and how it fits into your budget and learning needs before making a decision.