Counterparty risk is the risk that one party in a financial transaction fails to meet their obligations, potentially causing losses to the other party. In futures trading, this risk is managed through central clearinghouses (CCPs), which act as intermediaries to reduce direct risks but also concentrate credit and liquidity risks within their system.

Key Points:

- Types of Counterparty Risk:

- Credit Risk: Occurs when a party defaults on financial obligations.

- Pre-Settlement Risk: Happens if a counterparty defaults before a trade is finalized.

- Settlement Risk: Arises when a party fails to complete the final step of a trade (e.g., payment or asset delivery).

- How Futures Traders Face Risk:

- Brokers and clearing members interact with CCPs to ensure trades are secure. Failures at any level can disrupt trading and cause losses.

- Market volatility increases risks, as seen in events like the 1987 market crash and the 2020 Treasury cash-futures crisis.

- Managing Counterparty Risk:

- Central clearing (CCPs) replaces direct exposure with a centralized system.

- Performance bonds, variation margins, and collateral haircuts help mitigate risks.

- Low-latency infrastructure supports quick trade execution and settlement, reducing exposure to delays.

- Historical Failures:

- Examples like the 1974 sugar crisis and 1987 Hong Kong Futures Exchange crisis illustrate the dangers of inadequate margin coverage and poor risk management.

Understanding counterparty risk and using tools like reliable infrastructure and real-time monitoring are crucial for managing futures trading effectively.

What Are Best Practices For Managing Counterparty Risk? – Learn About Economics

Types of Counterparty Risk

Three Types of Counterparty Risk in Futures Trading

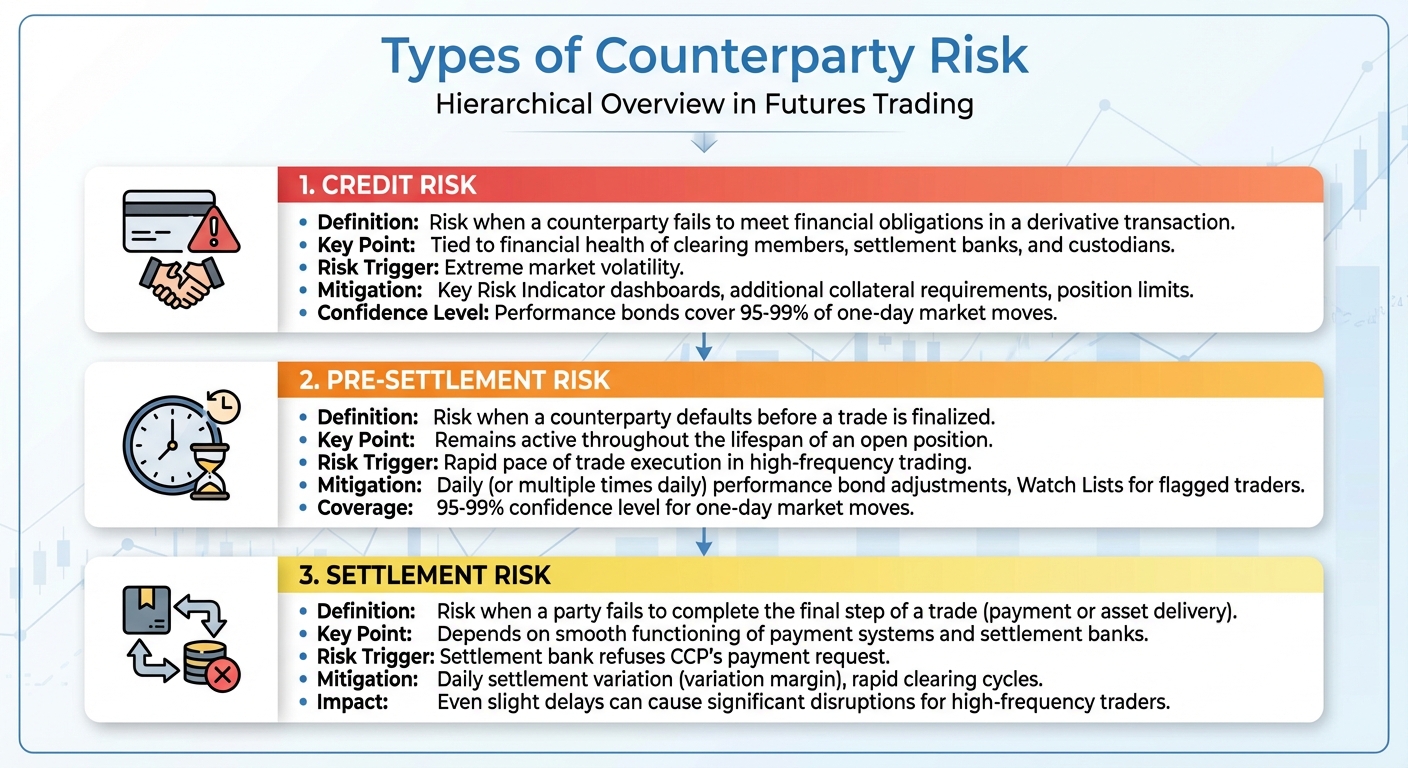

Counterparty risk breaks down into several categories, each affecting different stages of a transaction. Understanding these risks is essential for identifying potential weak points in trading operations. Let’s take a closer look at the main types of counterparty risk and how they play out in futures trading.

Credit Risk

Credit risk arises when a counterparty fails to meet its financial obligations in a derivative transaction[5]. In the context of futures trading, this risk is tied to the financial health of clearing members, settlement banks, and custodians[2]. For instance, if a broker (a clearing member) cannot meet margin calls or fulfill performance bond requirements, it can disrupt the Central Counterparty’s (CCP) balance, forcing the use of collateral and default funds to stabilize the market[4].

The OCC defines it as:

"Counterparty credit risk is the risk arising from the possibility that the counterparty may default on amounts owed on a derivative transaction"[5].

This risk tends to spike during periods of extreme market volatility. To manage it, CME Clearing employs a Key Risk Indicator dashboard that monitors credit default swap prices, stock prices, and external credit ratings. When exposures exceed thresholds, CME Clearing may demand additional collateral, set position limits, or restrict trading to risk-reducing activities[2].

Pre-Settlement Risk

Pre-settlement risk occurs when a counterparty defaults before a trade is finalized[4]. This risk remains active throughout the lifespan of an open position. For high-frequency traders, the rapid pace of trade execution and settlement can amplify this risk. Performance bonds are designed to cover a one-day market move with a 95–99% confidence level, but extreme market events can occasionally exceed these limits[6].

To address this, clearing houses adjust performance bonds daily – or even multiple times a day – to ensure adequate market coverage[3]. Traders flagged on “Watch Lists” may face stricter scrutiny, including more frequent reviews and higher collateral requirements[2].

Settlement Risk

Settlement risk refers to the chance that a counterparty fails to complete the final step of a trade, such as delivering assets or payments as agreed[6]. This risk depends heavily on the smooth functioning of payment systems and settlement banks. In futures markets, settlement typically happens at least once daily through a process called settlement variation (also known as variation margin), where funds are transferred from losing parties to winning ones[6][3].

If a settlement bank refuses a CCP’s payment request, the trade defaults, potentially triggering widespread operational issues[6]. As McPartland highlights:

"Clearing and settlement systems work perfectly when all relevant settlement payments are made promptly. If clearing members are not given full or immediate access to funds due from a CCP, then… market participants might assume that the CCP has failed"[6].

For high-frequency traders, even slight delays in settlement can cause significant disruptions, as their operations rely on rapid clearing cycles that align with national banking hours[6]. Recognizing these vulnerabilities is essential for traders looking to minimize their exposure to settlement risks.

Counterparty Risk in Futures Trading

How Traders Face Risk in Futures Markets

Futures trading comes with counterparty risks that traders encounter at various stages. Brokers, acting as clearing members, interact with the central counterparty (CCP) on behalf of traders by collecting margin and transferring it to the clearinghouse. If a clearing member fails to meet its obligations, the CCP may step in, liquidating positions and using performance bond collateral to cover the resulting losses [6]. Since futures contracts are marked to market at least once a day, traders must quickly pay variation margin in cash to cover any losses. Delays in these payments can lead to defaults [6][3].

These risks become even more pronounced during periods of market volatility. Performance bond requirements are designed to cover a single day’s expected market movement with a 95% to 99% confidence level. However, extreme market events can surpass these safeguards [6]. For instance, during the October 1987 market crash, late settlement payments in derivatives markets nearly caused a financial gridlock [6]. Additionally, liquidity issues at settlement banks and operational delays can slow down the settlement process, increasing the window of exposure [6][2].

The CCP itself presents a unique risk paradox. While central clearing reduces individual bilateral risks, it centralizes credit and liquidity risks. A failure at the CCP level could result in widespread market disruptions [4][7]. To address this, CME Clearing actively monitors risks using a Key Risk Indicator dashboard. If exposures exceed acceptable thresholds, the clearinghouse may require additional collateral, impose position limits, or restrict trading activity to manage the situation [2].

How Low-Latency Infrastructure Reduces Risk

Given these vulnerabilities, low-latency infrastructure plays a critical role in reducing risk by enabling fast trade confirmations and settlements. Speed is particularly important for high-frequency traders who execute numerous transactions daily. A low-latency setup minimizes the time between trade execution and confirmation, ensuring that trades are quickly matched and guaranteed by the CCP. This rapid process helps maintain anonymity and security while reducing the risk of unmatched trades remaining unguaranteed [6].

Automated systems further enhance risk management by enabling real-time monitoring of settlement variations and performance bond levels. This allows traders to respond immediately to unusual exposures [2]. Services like TraderVPS support these efforts by offering reliable, high-speed connections to exchanges and clearinghouses. Such infrastructure minimizes operational risks, reduces errors in trade execution, and shortens the pre-settlement period, during which a counterparty could potentially default [8][9].

In fast-moving markets, every millisecond matters. A stable, low-latency connection ensures that margin calls are received and variation margin payments are processed without delay. This capability is essential, especially since clearinghouses might adjust performance bond requirements multiple times in a single day [3]. By maintaining consistent execution speeds and reducing communication delays, traders can better meet cash requirements, avoid technical defaults, and maintain their relationships with clearing members.

Examples of Counterparty Risk

Major Counterparty Failures in Financial History

The 1974 sugar crisis involving France’s Caisse de Liquidation des Affaires en Marchandises (CLAM) is a striking example of how concentrated trading positions can lead to the downfall of a clearinghouse. Between 1971 and 1974, sugar prices and trading volumes skyrocketed, only to crash in November 1974. CLAM, lacking sufficient default funds, was unable to absorb the shock. The largest participant, Nataf, controlled a staggering 56% of all open positions, representing 600 retail traders. When a French court deemed the market closure unlawful in June 1975, CLAM was forced into administration [10]. This case underscores the importance of maintaining adequate margin requirements and efficient settlement processes in futures trading.

Another significant failure occurred in March 1984 with Malaysia’s Kuala Lumpur Commodities Clearing House (KLCCH). A dramatic 275% surge in palm oil prices exposed a trader’s massive short position, which was based on an expectation of falling prices. This miscalculation triggered simultaneous defaults by KLCCH and its clearing members. As the trader failed to meet obligations, confidence in the market evaporated, causing trading volumes to plummet by over 95% [10]. This event highlights the necessity of strict collateral management and position limits to prevent similar collapses.

One of the most severe examples of counterparty failure occurred during the October 1987 Hong Kong Futures Exchange (HKFE) crisis. Trader Robert Ng held a long position in Hang Seng Index futures that accounted for over half of the open interest. Following Black Monday, the Hang Seng Index plunged 33%, with futures dropping 44% upon reopening. The resulting chaos required a HK$2 billion bailout to stabilize the market. Nearly 30% of the owed margin went unpaid, surpassing the Guarantee Corporation’s financial resources, and 45 participants defaulted as clients failed to meet margin calls [10]. This event illustrates the critical need for sufficient margin coverage and rapid settlement mechanisms in futures markets.

These historical examples demonstrate the dangers of concentrated positions, inadequate default funds, and lax oversight. They also serve as a reminder that clearing operations remain a vulnerable point in financial markets, even in today’s advanced systems.

Counterparty Failures in Futures Trading

The "dash for cash" crisis of March 2020 revealed the fragility of the Treasury cash-futures basis trade. Hedge funds and leveraged investors held approximately $317 billion in Treasuries, often using leverage as high as 20x. When market stress intensified, clearinghouses raised margin requirements, forcing investors to unwind their positions quickly. Estimates suggest that these investors sold between $35 billion and $473 billion in Treasuries during this period. The Market Structure Subcommittee observed:

"the basis trade contributes to market function in normal times but could amplify market stress that originates from other sources, as some evidence suggests it did in March 2020" [11].

Modern clearinghouses typically adhere to "cover 1" or "cover 2" requirements, ensuring their default funds can handle the failure of one or two of the largest participants. For futures traders, it’s essential to evaluate whether their exchange has strong mutualized resources and operates under independent regulatory supervision. These safeguards can mean the difference between a managed default and a widespread market collapse [10].

How to Reduce Counterparty Risk

Methods to Lower Counterparty Risk

In volatile markets, managing counterparty risk is essential for stable trading operations. One effective way to mitigate this risk is by using central counterparty (CCP) clearing. In this system, the clearinghouse steps in as an intermediary between buyers and sellers through a process called novation. This transforms direct bilateral exposure into a centrally managed framework, providing a safeguard against default[4].

Another method is multilateral netting, which consolidates all gains and losses into a single net exposure. This reduces the need for excessive collateral and lowers overall credit risk[4]. To further manage risk, traders should post initial margin to cover 99% of potential one-day market moves and settle variation margin daily to prevent debt accumulation[3][6]. For non-cash collateral, such as Treasuries or equities, clearinghouses apply haircuts (valuation discounts) to account for market fluctuations[3].

Risk monitoring is equally important. Use Key Risk Indicator (KRI) dashboards to track counterparties, set internal thresholds for settlement variations and performance bond levels, and maintain a watch list to act swiftly if a counterparty’s credit profile weakens[2]. Additionally, employing low-latency infrastructure can reduce risk by enabling faster execution and response times.

How TraderVPS Supports Risk Management

Infrastructure speed plays a critical role in managing counterparty risk, especially in futures trading. TraderVPS’s ultra-low latency technology minimizes delays in margining – the gap between a collateral call and asset posting[12]. This speed advantage is crucial during volatile periods, allowing traders to act quickly and prevent positions from escalating out of control.

TraderVPS also provides 24/7 uptime, ensuring continuous monitoring of counterparty exposure and real-time health assessments. Its DDoS protection and automatic backups keep risk management systems operational even during network disruptions or system failures[2][6]. In the event of a counterparty default, clearinghouses need to cancel contracts and liquidate positions at current market prices immediately[12]. With strategically located servers optimized for futures trading, TraderVPS enables traders to meet margin calls or adjust positions in milliseconds – giving them a vital edge in fast-paced markets.

Conclusion

Counterparty risk – the possibility that the other party in a transaction defaults – remains one of the biggest challenges in futures trading [1]. By understanding the various forms of counterparty risk, such as credit risk and settlement risk, traders can better identify where their positions might be vulnerable. Central counterparties play a key role in managing this risk by replacing direct exposures between trading parties with a centralized system [4].

To stay ahead, traders must stay alert and act quickly, especially when dealing with margin calls and sudden market swings. This awareness forms the foundation for appreciating how rapid execution and strong technological infrastructure can further reduce risk.

Systems with ultra-low latency, like TraderVPS, are designed to minimize delays between margin calls and asset posting, allowing traders to respond in milliseconds during volatile market conditions. Features like 24/7 uptime, DDoS protection, and automatic backups ensure that these systems remain functional when they’re needed the most. These tools are critical because, as history has shown, delays in action can significantly increase systemic risks.

The 2008 financial crisis highlighted how counterparty failures can ripple through markets. AIG’s inability to post collateral on time led to government intervention [13]. Learning from these events, it’s clear that combining real-time monitoring with fast, dependable infrastructure is essential for avoiding similar situations. In the high-speed world of futures trading, even a difference of milliseconds can determine whether a trader successfully manages risk – or becomes exposed to it.

FAQs

What are the best ways to reduce counterparty risk in futures trading?

To reduce counterparty risk in futures trading, traders can take a few smart steps. One of the most reliable methods is working with a clearinghouse or central counterparty. These entities help manage trades by netting and collateralizing them, which lowers the chances of a default. Another way to mitigate risk is by spreading exposure across multiple counterparties, so you’re not overly dependent on just one.

Additional strategies include setting up netting agreements to offset obligations, keeping position sizes and leverage under control, and using stop-loss orders to cap potential losses. It’s also crucial to monitor daily margins closely and maintain enough collateral to cover any unexpected market shifts. By combining these techniques, traders can manage counterparty risk more effectively and navigate the complexities of the financial markets with greater confidence.

What role do central clearinghouses play in reducing counterparty risk?

Central clearinghouses play a crucial role in managing counterparty risk by stepping in as the middleman for all trades – a process called novation. Essentially, they take on the role of the buyer for every seller and the seller for every buyer, ensuring that each party meets their commitments.

They also mitigate risk through multilateral netting, which simplifies multiple trades into a single net obligation. To further protect against defaults, clearinghouses require participants to provide collateral (also known as margin). In extreme cases, they may even share losses among their members. Together, these measures help strengthen the stability and reliability of financial markets.

What are some historical examples of counterparty failures and their impact?

Historical events provide clear examples of how counterparty failures can disrupt markets and harm investors. Take the 2011 bankruptcy of MF Global, for instance. On October 31, 2011, the firm collapsed after massive margin calls on risky European debt positions left it unable to meet its obligations. The fallout was severe, with approximately $1.6 billion in customer funds unaccounted for. This incident highlighted the dangers traders face when clearing firms fail to adhere to segregation rules.

Another striking case occurred in the aftermath of the September 11, 2001 attacks. A spike in settlement failures in the U.S. Treasury market led to an emergency same-day auction of 10-year notes on October 4, 2001. The move was necessary to stabilize the market and underscored the importance of closely monitoring counterparty exposure to mitigate potential losses.

Even central counterparties (CCPs), which are specifically designed to reduce counterparty risk, have occasionally failed under extreme circumstances. These rare but impactful CCP collapses have exposed the dangers of inadequate risk management, prompting reforms to bolster their resilience and protect financial systems. These examples make it clear that strong safeguards are essential in trading environments to prevent systemic failures.