Vital Markets In-Depth: Trading Terms and Conditions for 2026

Vital Markets has rolled out key updates for 2026, impacting traders using platforms like NinjaTrader. Here’s what you need to know:

- Account Options: Choose from Micro, ECN/STP, and VIP accounts with leverage up to 1:500. Minimum deposits range from $10 to $25,000, with commissions starting at $5 per lot.

- New Fees: A $10 monthly inactivity fee applies after 90 days of no trading or wallet activity. Margin requirements can change without notice.

- Trading Rules: Strategies like HFT and hedging are allowed, but exploiting glitches or arbitrage trading is banned. News trading is restricted during a 4-minute window around major events.

- Platform Updates: Changes to TradeLocker and the User Portal , as well as other platforms for rapid high-frequency trades, may disrupt connectivity temporarily.

- TraderVPS Benefits: For automated traders, TraderVPS offers low-latency connections (<0.52ms to CME), 99.999% uptime, and plans starting at $69/month.

Staying compliant with these updates is essential to avoid penalties or disruptions. For seamless trading, consider pairing NinjaTrader with a VPS setup to minimize risks like outages or delays.

Account Types and Requirements

Vital Markets Account Types Comparison 2026

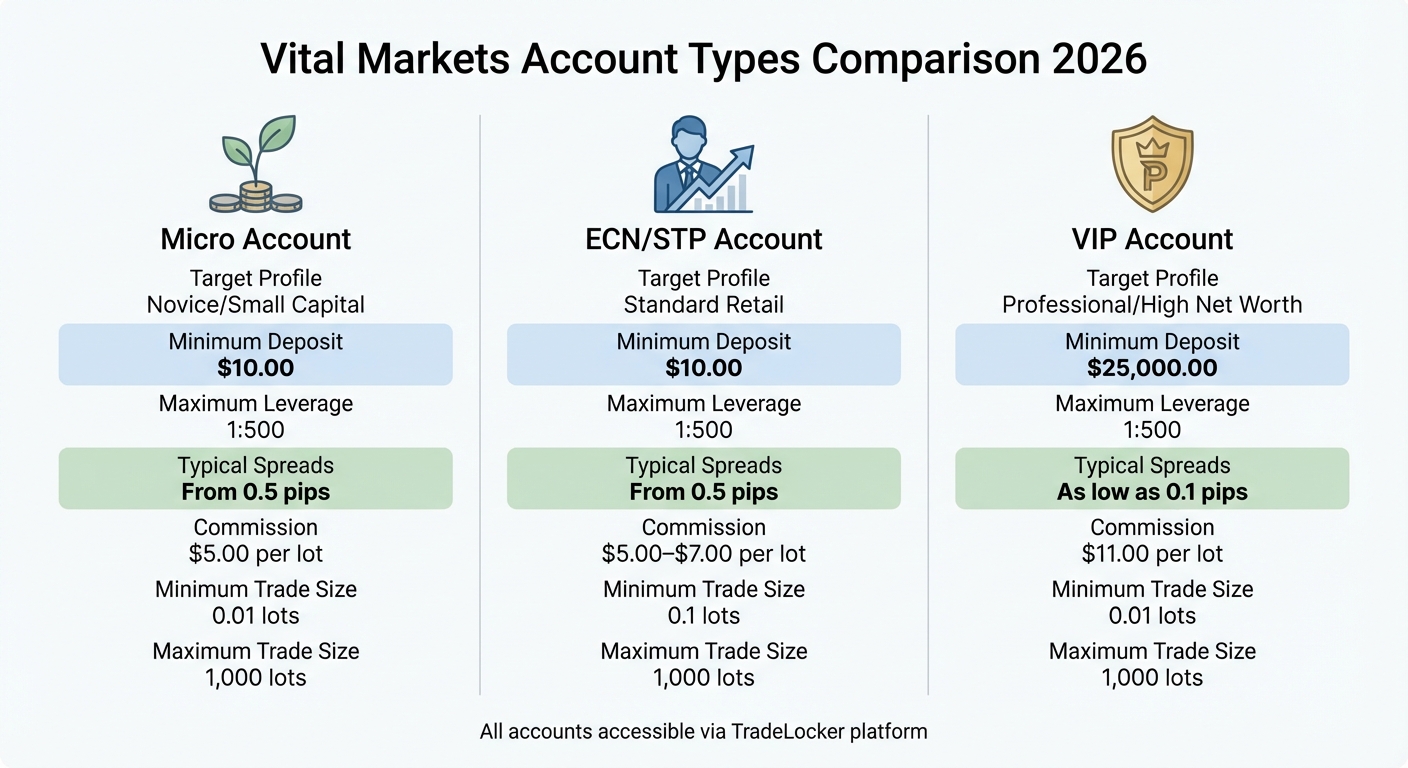

Vital Markets provides three main live account options - Micro, ECN/STP, and VIP - along with a specialized Get Funded program [3][4]. All accounts offer up to 1:500 leverage and are accessible via the TradeLocker platform [2][3]. Below is an overview of each account type, highlighting their unique features and requirements.

The Micro Account is ideal for beginners or traders experimenting with new strategies. It has a low entry barrier, requiring just a $10.00 minimum deposit. This account supports small trading positions starting at 0.01 lots, with spreads beginning at 0.5 pips. A $5.00 commission per lot applies [3].

For retail traders seeking direct market access, the ECN/STP Account is a strong choice. Like the Micro Account, it requires a $10.00 minimum deposit but has a higher minimum trade size of 0.1 lots. Commissions vary between $5.00 and $7.00 per lot, depending on spread conditions [3].

The VIP Account is tailored for professional traders and individuals with significant capital. With a $25,000.00 minimum deposit, this account offers some of the tightest spreads available, starting as low as 0.1 pips. The commission is $11.00 per lot, reflecting premium trading conditions and execution [3].

To open an account, users must complete an email verification process and enable two-factor authentication (2FA). During the KYC (Know Your Customer) process, Vital Markets collects personal details such as full name, date of birth, and residential address [1].

| Feature | Micro Account | ECN/STP Account | VIP Account |

|---|---|---|---|

| Target Profile | Novice/Small Capital | Standard Retail | Professional/High Net Worth |

| Min. Deposit | $10.00 | $10.00 | $25,000.00 |

| Max. Leverage | 1:500 | 1:500 | 1:500 |

| Typical Spreads | From 0.5 pips | From 0.5 pips | As low as 0.1 pips |

| Commission | $5.00 per lot | $5.00–$7.00 per lot | $11.00 per lot |

| Min. Trade Size | 0.01 lots | 0.1 lots | 0.01 lots |

| Max. Trade Size | 1,000 lots | 1,000 lots | 1,000 lots |

Fees, Spreads, and Margin Policies

Spreads and Commissions

Vital Markets uses a direct spread model, offering spreads that start from 0.5 pips for most account types. For VIP accounts, spreads can go as low as 0.1 pips on major currency pairs like EUR/USD [3]. When it comes to commissions, the rates depend on your account type. Micro accounts are charged $5.00 per lot, ECN/STP accounts range between $5.00 and $7.00 per lot, and VIP accounts have a commission of $11.00 per lot [2][3]. If you hold a position past 5:00 PM EST, you'll incur rollover fees based on interest rate differences [1].

For accounts that remain inactive for 90 consecutive days, there's a $10.00 monthly inactivity fee. A warning email is sent after 83 days, giving account holders 7 calendar days to make a transaction and avoid the fee [1]. Knowing these fees is crucial, especially since they tie into the broker's margin policies, which play a big role in managing trading risks.

Margin and Equity Requirements

Vital Markets offers leverage of up to 1:500 across all retail accounts, which is much higher than what you'd typically find with regulated futures exchanges [2]. While this level of leverage can boost potential profits, it also increases risk significantly. The broker advises traders to maintain a Margin Level (the ratio of Equity to Necessary Margin) of no less than 1,000% to avoid forced liquidations during periods of market volatility [5].

Margins can be adjusted by the broker without prior notice, and positions may be liquidated immediately if the collateral falls short [1]. To stay on top of this, traders should regularly check their margin and equity through the platform's Portfolio section. It's important to note that during volatile market conditions, margin calls may be delayed, which could lead to negative usable margin balances - balances that traders are still responsible for covering [1][7].

Trading Rules and Restrictions

Allowed and Restricted Strategies

Vital Markets supports a variety of trading strategies, including High-Frequency Trading (HFT), Hedging, and even Martingale systems [8]. This approach makes it an attractive option for automated traders using platforms like NinjaTrader to execute quantitative strategies. However, there are clear boundaries. Arbitrage trading, particularly strategies that exploit price feed delays, is strictly off-limits [1]. If your system attempts to profit from such delays, Vital Markets may delete those transactions from your trading history [4].

News trading is generally allowed, but there’s a critical restriction: it’s prohibited during a 4-minute window - 2 minutes before and 2 minutes after high-impact news events [8]. This rule applies to both manual and automated trading. Automated strategies should include news filters to avoid triggering trades during these blackout periods. Swing trading accounts, on the other hand, can hold positions through news events, but opening or closing trades during that 4-minute window is still not allowed [8].

Another important restriction is the prohibition of using opposite positions across connected accounts to manipulate market outcomes [4]. For example, hedging across multiple accounts in a way that artificially reduces risk is not permitted. These rules are designed to maintain fair trading practices and lead into the operational guidelines outlined below.

Operational Rules

To ensure account security and compliance, Vital Markets enforces additional operational rules. Traders are advised to limit account access to no more than two devices to adhere to the platform’s internal security and IP policies [8]. For those using automated systems, this means sticking to two dedicated devices or VPS providers for futures trading.

When it comes to holding positions, there are specific requirements. Close positions held over the weekend or during rollover periods lasting more than 2 hours before market close [4]. Any positions left open at 5:00 PM EST will roll over to the next settlement date, with the applicable interest differential applied [1].

For funded accounts, payouts are processed once every 7 days, provided the profit exceeds $100.00 [8][4]. It’s also crucial to note that Vital Markets does not provide services to residents of the USA, UK, Japan, or Russia [1]. Make sure you’re in an eligible region before attempting to open an account.

Using TraderVPS for NinjaTrader Futures Trading

TraderVPS Performance Benefits

As trading conditions tighten at Vital Markets, ensuring a stable and reliable connection becomes more important than ever. That’s where TraderVPS steps in. Running NinjaTrader on a VPS eliminates common home PC issues like power outages, internet disruptions, or even those dreaded forced Windows updates that can derail automated strategies. TraderVPS servers, based in Chicago, deliver lightning-fast execution speeds of less than 0.52ms to the CME using direct fiber-optic cross-connects [9][10].

The hardware behind this performance includes AMD EPYC processors, DDR4/5 RAM, and NVMe M.2 SSDs - designed to handle the intense tick data that comes with volatile markets [9][10]. This robust setup ensures your platform remains stable, even during high-impact events like Non-Farm Payroll announcements, something standard home PCs often struggle with [6]. And with a 99.999% uptime guarantee, your automated strategies can keep running smoothly, even when your local computer is off [9].

"Our Chicago datacenter delivers <0.52ms latency to the CME exchange, facilitating quicker futures trade execution and substantially reducing slippage." - TraderVPS [9]

TraderVPS also offers enterprise-grade DDoS protection and advanced firewall configurations, keeping your trading strategies and capital secure [9]. These features make it a reliable choice for traders looking for uninterrupted and secure performance.

TraderVPS Plan Recommendations

TraderVPS offers a variety of plans tailored to different trading needs, making it easier to find one that fits your setup.

- VPS Lite Plan ($69/month): Ideal for basic setups with 1–2 charts, this plan includes 4 AMD EPYC cores and 8GB of RAM [9].

- VPS Pro Plan ($99/month): A popular choice for moderate setups with 3–5 charts, offering 6 cores, 16GB RAM, and support for up to 2 monitors [9].

- VPS Ultra Plan ($199/month): Designed for traders managing intensive quantitative strategies or 5–7 charts, this plan provides 24 cores, 64GB RAM, and support for up to 4 monitors [9].

- Dedicated Server Plan ($299/month): Perfect for professional-grade setups with 7 or more charts, it features 12+ AMD Ryzen cores, 128GB RAM, 2TB+ NVMe storage, and 10Gbps+ network capacity [9].

All plans come pre-installed with Windows Server 2022 and include unmetered bandwidth, ensuring you have everything you need to run NinjaTrader effectively [9]. Plus, with Remote Desktop Protocol (RDP), you can manage your setup 24/7 from anywhere [10].

Conclusion

Vital Markets' 2026 account options range from $10.00 Micro accounts to $25,000.00 VIP accounts. These accounts come with features like leverage up to 1:500 and spreads starting as low as 0.1 pips. However, traders should be aware of a $10.00 inactivity fee applied after 90 days and the strict policies against exploiting technical glitches. These updated terms reflect the shifting dynamics of the trading landscape, emphasizing the importance of a dependable trading setup.

For NinjaTrader users, relying on home PCs introduces risks like outages that can disrupt trading. TraderVPS addresses this with sub-millisecond CME latency, 99.999% uptime, and powerful hardware capable of handling high-frequency tick data without fail.

Whether you're refining strategies or managing funded accounts, operational stability is non-negotiable. With Chicago-based servers, enterprise-grade DDoS protection, and plans starting at $69.00/month (scaling up to dedicated server options), TraderVPS offers the robust infrastructure necessary to align with Vital Markets' demanding standards.

The bottom line: Knowing the trading terms is just the beginning. Combining them with a reliable execution environment that eliminates local hardware vulnerabilities is the key to confident and effective futures trading in 2026. Together, these elements form the backbone of a successful trading strategy in today’s evolving markets.

FAQs

What are the main differences between the Micro, ECN/STP, and VIP accounts offered by Vital Markets?

Vital Markets provides a range of account options, including Micro, ECN/STP, and VIP accounts. However, the exact distinctions between these accounts - such as minimum deposit amounts, spreads, leverage, or fee structures - aren’t clearly detailed in the available information.

General features mentioned include a $0 minimum deposit and a 0.01 lot minimum trade size, though it’s unclear if these apply to all account types or just specific ones.

To get a clear understanding of how these accounts differ - whether it’s in terms of spreads, commissions, or execution methods - it’s a good idea to check out the "Account Types" section on the Vital Markets website or reach out to their customer support team for accurate details.

What is the $10 monthly inactivity fee, and when does it apply?

If you're wondering about the $10 monthly inactivity fee, the specifics - like how it works or when it kicks in - aren't clearly spelled out in the provided sources. For accurate details, it's best to check Vital Markets' official terms and conditions or reach out to their support team directly.

What makes TraderVPS a great choice for futures trading on NinjaTrader?

TraderVPS is purpose-built for NinjaTrader 8 futures trading, offering a lightning-fast, low-latency environment with servers strategically located near CME data centers. With latency as low as 0.52 milliseconds, it allows for quicker order execution, minimizing slippage - especially vital for high-frequency and algorithmic trading strategies. The platform also promises 100% uptime, ensuring your automated strategies run without interruptions, backed by 24/7 system monitoring and a money-back guarantee for added peace of mind.

Every plan comes packed with key features, including a dedicated IP address, unmetered bandwidth, automatic backups, and built-in cybersecurity measures to keep your connection secure and stable. Select plans even offer multi-monitor support, letting traders analyze multiple charts at once. Plus, a knowledgeable support team is available around the clock to assist with any issues. By blending speed, dependability, and tailored optimization for NinjaTrader, TraderVPS delivers a powerful solution for serious futures traders.