Swing trading with funded prop accounts offers opportunities for holding positions over multiple days, but it comes with strict rules that traders must follow to avoid account termination. Key considerations include:

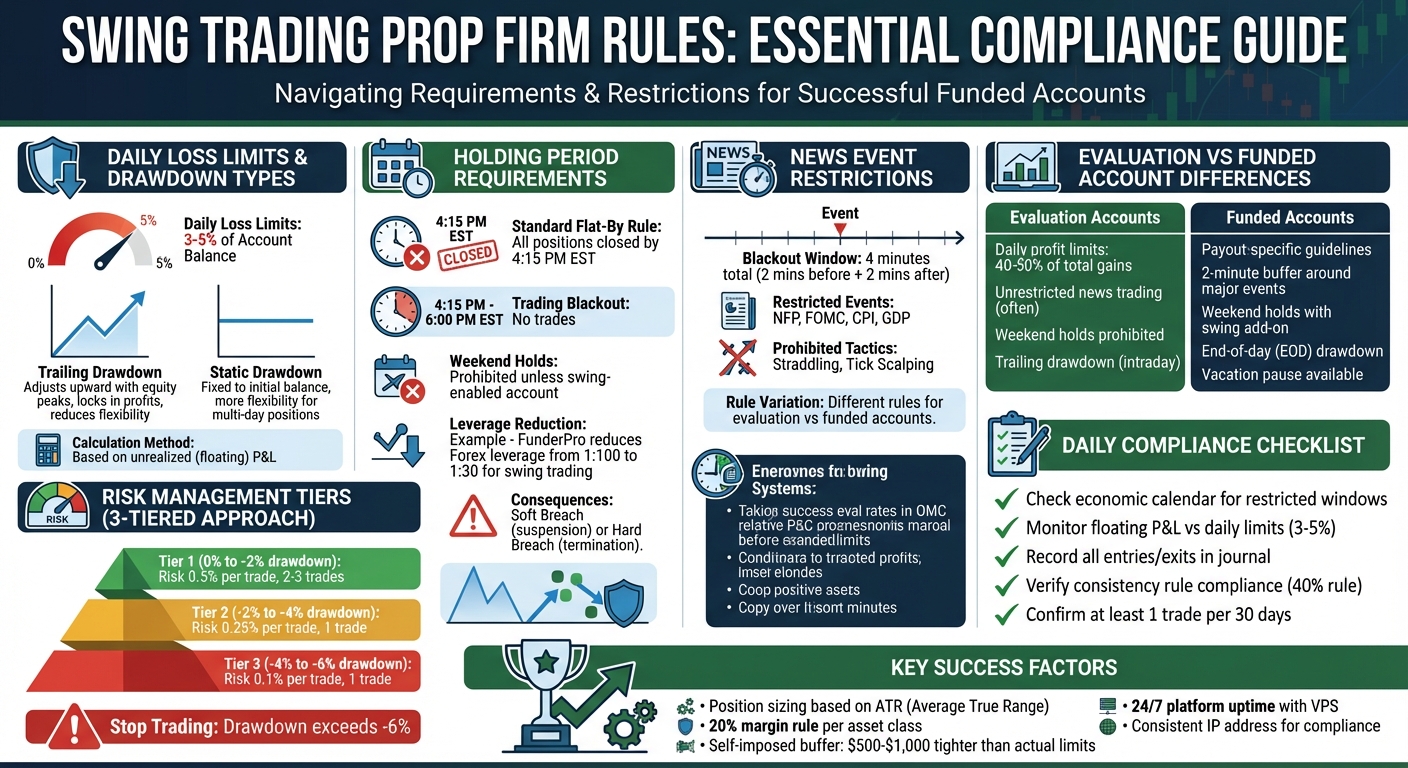

- Daily Loss Limits: Typically set at 3-5% of your account balance, exceeding this can result in immediate account closure.

- Trailing Drawdown: Adjusts as your account grows, locking in profits but reducing flexibility for multi-day trades.

- Holding Period Rules: Many firms require positions to be closed by 4:15 PM EST or prohibit weekend holds unless you have a swing-enabled account.

- News Restrictions: High-impact events like NFP or CPI often come with blackout periods, prohibiting trades during these times.

- Account Type Variations: Rules differ between evaluation and funded accounts, with stricter guidelines often applied once funded.

To succeed, traders must align their strategies with firm-specific rules, use risk management tools like TraderVPS, and maintain discipline. Compliance isn’t optional – it’s the foundation for sustainable trading in this environment.

Prop Firm Swing Trading Rules and Requirements Comparison Chart

Core Rules and Restrictions for Swing Traders

Daily Loss Limits and Trailing Drawdown

Most futures prop firms set strict limits on how much your account can lose in a single day, typically falling between 3% and 5% of your starting balance or equity [3][1]. For swing traders, this daily loss limit (DLL) can be a major hurdle. Multi-day positions often experience intraday fluctuations that might trigger a breach, even when the overall trade setup remains solid.

Understanding how drawdown works is critical. Trailing drawdown adjusts upward as your account grows, locking in profits but also reducing the margin for error. For example, if your equity peaks at $110,000 and then dips to $105,000 due to a normal market pullback, you could hit the trailing drawdown limit and lose your account – even without closing a losing trade [4][10]. In contrast, static drawdown remains fixed to your initial balance, providing swing traders with more flexibility during temporary equity dips. This makes it a favored choice for those holding multi-day positions [9][10].

It’s also important to note that most firms calculate drawdown using unrealized (floating) profits and losses. For instance, an open trade showing a $2,000 gain can increase your trailing drawdown level. However, if the market reverses before you close the trade, you could breach the limit without even realizing the profit [1][10]. To manage this risk, always base your calculations on the lowest equity point during a trade, not just on closed profits.

Next, let’s look at how session-end rules impact swing trading strategies.

Holding Period and Flat-By Requirements

Many firms require all positions to be closed by 4:15 PM EST, with no trades allowed until the market reopens at 6:00 PM EST. Weekend holds are usually prohibited unless you have a swing-enabled account [3][8][11]. These rules can significantly affect your ability to hold multi-day positions.

Failing to meet a flat-by requirement can have serious consequences. Some firms will automatically liquidate your positions, which could count as either a "soft breach" (temporarily suspending your account) or a "hard breach" (account termination), depending on the firm’s policies [4][11]. Additionally, holding overnight or through weekends often comes with reduced leverage. For example, FunderPro lowers Forex Majors leverage from 1:100 to 1:30 when their Swing Add-on is activated [8].

Certain firms also require traders to declare overnight positions in advance through specific communication channels or risk desks [5]. Skipping this step – even if overnight trading is allowed – can lead to compliance issues.

These session rules are just one piece of the puzzle. Managing risk during economic events is another critical aspect.

News Event Trading Restrictions

High-impact news events come with their own set of restrictions. Most firms enforce a 4-minute blackout window – you cannot open or hold positions starting two minutes before and ending two minutes after major announcements like Non-Farm Payrolls (NFP), Federal Open Market Committee (FOMC) decisions, Consumer Price Index (CPI), or Gross Domestic Product (GDP) reports [8].

Even firms that allow news trading often ban specific tactics like "straddling" or "tick scalping" [8]. The rules can also differ depending on whether you’re in the evaluation phase or trading a funded account. For instance, FunderPro permits unrestricted news trading during challenges but enforces blackout windows once you’re funded – unless you’ve activated their Swing Add-on [8][3].

If your strategy involves holding positions through major news releases, a swing-specific account is usually necessary. Otherwise, you’ll need to close affected trades at least two minutes before the announcement to stay within compliance [8].

How to Align Your Swing Trading with Prop Firm Rules

Step 1: Understand Evaluation vs. Funded Account Rules

The rules you follow during the evaluation phase often differ quite a bit from those in a funded account. For example, evaluation accounts typically limit daily profits to 40–50% of total gains to prevent traders from advancing on lucky streaks [12][3]. Once funded, these restrictions may either disappear (as seen with MyFundedFutures Core/Scale plans) or shift to payout-specific guidelines [12][1].

Another key difference lies in trading around news events and holding positions over the weekend. Evaluation accounts might allow unrestricted news trading but often prohibit weekend holds. On the other hand, funded accounts may enforce a 2-minute buffer around major events and allow weekend holds if you purchase a swing add-on [3].

Drawdown rules also vary. Evaluation accounts commonly use a trailing drawdown, which adjusts intraday based on unrealized equity. In contrast, funded accounts often switch to an end-of-day (EOD) drawdown, which only updates at the market close [11]. Before activating your funded account, check whether drawdown resets are based on "Realized Gains" or "Intraday Equity." EOD calculations are generally more forgiving for multi-day positions [11].

Funded accounts usually offer additional perks, such as vacation pauses. If you need time off, you can email your firm’s support team to prevent your account from being deactivated due to inactivity. This option is typically unavailable during the evaluation phase [12]. Once you’ve reviewed these differences, adjust your trading strategy to align with the rules.

Step 2: Adjust Your Trading Timeframe to Match Firm Rules

Your trading timeframe should align with your firm’s session-end rules and drawdown model. For instance, if you hold positions for 3–5 days, a firm with a strict 4:15 PM EST flat-by rule might not suit your strategy unless you upgrade to a swing-enabled plan. Even if weekend holds are allowed, it’s often wise to close positions by 3:00 PM EST on Friday to avoid the risk of weekend price gaps that could wipe out your account [2].

Keep your position sizes conservative to cushion against market volatility. If your firm enforces a 20% margin rule – limiting exposure to no more than 20% of your account margin on a single asset class – factor this into your calculations before placing trades [3].

"The most successful funded traders don’t view prop firm rules as limitations, but as a framework that aligns with professional risk management principles." – FundedFast [13]

Adopting a "funded mentality" is essential. This mindset prioritizes minimal risk (0.25–0.5% per trade) and consistency [2]. By focusing on setups that perform well outside restricted periods – like avoiding trades during major economic releases or low-liquidity sessions – you’ll naturally refine your approach [13].

Step 3: Create a Rule Reference Checklist

Once your trading approach is in sync with your firm’s rules, formalize it by building a reference checklist. Write down the specific rules you need to follow and keep this list visible during every trading session. Include details like your Daily Loss Limit (DLL), Maximum Loss Limit (MLL), and the type of drawdown (trailing or end-of-day) [11][13]. Note restricted high-impact events – such as FOMC, NFP, and CPI – and any buffer zones around these releases [1][3].

Document maximum position sizes and correlation limits. For example, if you trade EUR/USD and GBP/USD simultaneously, note how your firm calculates total exposure across correlated pairs [13]. Also, clarify your firm’s weekend holding policy – whether it’s prohibited, allowed, or requires a swing add-on [3].

Set personal circuit breakers at 50–60% of your official daily loss limit to give yourself an extra safety margin [13]. Before placing any trade, double-check your equity, review the economic calendar, and confirm your position sizes [13].

Lastly, track whether your firm enforces a consistency rule during the funded phase. If they do, note the maximum percentage of total profit allowed in a single day [3][12]. Also, confirm if vacation pauses are available and understand the process for requesting them [12]. This checklist will help you stay compliant and prepared, even in fast-moving markets.

Risk Management for Swing Trading in Funded Accounts

Position Sizing and Drawdown Control

When holding multi-day positions, using wider stop-losses can increase the likelihood of hitting daily loss limits or violating trailing drawdown rules. The smart approach is to size your positions based on volatility, not just your confidence in the trade. One useful tool is the Average True Range (ATR), which helps you adjust position sizes according to market conditions. For example, during periods of high volatility, reducing the number of contracts can help keep potential losses within your drawdown buffer [14].

Let’s say you’re trading a $50,000 account with a $2,000 drawdown limit. If your account hits an equity peak of $52,000, the trailing drawdown locks in at your starting balance of $50,000 [15]. This means that until you build a sufficient buffer, any intraday profit spike tightens the threshold for a violation.

"Trailing drawdown (dynamic): Moves up with new equity highs; punishes giving back gains. It does not move down after losses." – FunderPro [14]

To stay within these limits, consider a 3-tiered risk approach based on your current drawdown percentage:

- Risk 0.5% per trade (2–3 trades) when your drawdown is between 0% and -2%.

- Reduce to 0.25% per trade (1 trade) when in the -2% to -4% range.

- Drop risk further to 0.1% per trade (1 trade) when drawdown reaches -4% to -6%.

- If your drawdown exceeds -6%, stop trading entirely [2].

It’s also wise to assume your trailing limit is $500–$1,000 tighter than it actually is. This self-imposed buffer accounts for overnight volatility and helps prevent unexpected gaps from wiping out your account [14]. Don’t forget to factor in the 20% margin rule for each asset class when calculating your position sizes [3].

These strategies are a strong foundation for risk control, but automated tools like TraderVPS can take your oversight to the next level.

Using TraderVPS for Risk Monitoring

While manual risk management is essential, automation provides an additional layer of security. Ensuring 24/7 uptime is critical – any local failures or outages could lead to missed stop-loss executions, exposing your account to unnecessary drawdowns. That’s where TraderVPS steps in, keeping your NinjaTrader platform and risk management Expert Advisors (EAs) running smoothly, even if your home setup goes offline. Many proprietary trading firms, such as FundingPips and The5ers, allow EAs specifically for trade and risk management [7], ensuring your stop-losses are active at all times.

A dedicated, stable IP address also prevents compliance issues. Firms like Maven and FundedNext monitor IP activity to detect unauthorized account sharing [7]. By using TraderVPS, you maintain a constant, secure connection to your firm’s trade servers, avoiding potential violations.

Additionally, TraderVPS can run automated scripts to flatten positions during high-impact market events. Its low-latency infrastructure ensures fast order execution, which is critical for staying within the tight daily drawdown limits of 3% to 5% that many firms enforce [4]. Reliable connectivity not only safeguards your trades but also keeps you compliant with firm guidelines.

The Truth About Swing Accounts in Prop Firms & How To Win!

Best Practices for Swing Trading Compliance

When it comes to swing trading with a proprietary (prop) firm, staying compliant with their rules is just as important as managing your risk. Below are some practical steps to ensure your trading approach aligns with these guidelines.

Setting Up NinjaTrader for Compliance

To keep your trading within the boundaries of prop firm rules, configure NinjaTrader’s ATM (Advanced Trade Management) strategies to automatically apply a stop-loss to every trade. This is especially critical for firms like The5ers, which mandate a stop-loss be set within 3 minutes of opening a position [7]. Additionally, create session templates that match your firm’s trading hours. These templates will help you avoid violations like holding trades over the weekend, a common restriction for firms such as FunderPro, which requires positions to be closed before Friday’s market close [3].

Set up automated alerts to avoid trading during restricted periods. Many firms prohibit trading within two minutes of major economic announcements, such as Non-Farm Payroll (NFP) or Consumer Price Index (CPI) reports [7][3]. You can configure NinjaTrader to highlight these restricted windows on your charts, reducing the risk of accidental violations. To protect your settings and data, schedule daily VPS (Virtual Private Server) backups. This precaution ensures you’re covered in case of platform updates or unexpected server issues.

Daily and Weekly Compliance Routines

Start each trading day by reviewing the economic calendar and marking key technical levels. This helps you steer clear of restricted news windows [1]. Throughout the trading session, keep an eye on both closed and floating losses to ensure you stay within daily drawdown limits, which are typically capped at 3% to 5% [6][1]. At the end of the day, stop trading and record all your entries and exits in a journal. Make a habit of noting your emotional state as well – this can help you build discipline over time [1].

On weekends, take time for a weekly rule audit. Check for any updates from your prop firm regarding market hours, leverage adjustments, or news restrictions, often shared via Discord or email [7][16]. Evaluate your performance to confirm you’re adhering to consistency rules. For instance, many firms enforce a "40% rule", which limits a single day’s profit to no more than 40% of your total profit [1]. Also, ensure you’ve made at least one trade in the past 30 days to avoid account deactivation [7][6].

| Routine Frequency | Task | Purpose |

|---|---|---|

| Daily | Check Economic Calendar | Avoid restricted news windows [7] |

| Daily | Monitor Floating PnL | Stay within daily drawdown limits [6] |

| Weekly | Review Trading Journal | Spot patterns that could lead to rule violations [1] |

| Weekly | Check Consistency Rules | Ensure daily profits align with firm guidelines [7][1] |

| Monthly | Make an Inactivity Trade | Prevent account closure due to inactivity [7] |

By following these routines, you can efficiently adapt to any rule changes and maintain compliance.

Responding to Rule Changes

Prop firms often communicate rule updates through their dashboards, dedicated "RuleBook" pages, or email notifications [4]. When rules change, update your NinjaTrader alerts to reflect the new thresholds. For added safety, consider setting alerts 1% below the stated limits [1][17].

If your firm alters its weekend holding policy, check if they offer a "Swing add-on" that allows you to maintain your strategy without violating the typical "flat-by-Friday" rule [3]. For changes in consistency rules – such as reducing the single-day profit cap from 50% to 30% – you might need to spread your trades across more days to balance out the impact of a particularly strong trading session [3][12][17]. Always document these changes. If you believe a rule update has led to an unfair penalty, stop trading immediately, gather evidence (like screenshots), and contact support within the appeal window [2][4].

"The RuleBook may be updated periodically. All revisions are published on the RuleBook page with version numbers and change logs." – Alfa Prop Traders [4]

Conclusion

Swing trading in funded prop accounts demands careful market analysis and unwavering discipline. It’s this discipline that distinguishes traders who maintain accounts for months from those who sustain them for years[2].

To succeed, align your trading approach with a firm that supports your strategy. Check if overnight or weekend positions require a "Swing add-on", clarify whether drawdowns are calculated based on balance or equity, and be aware of any consistency rules that might limit single-day profits to 40–45%[3]. Using a solid, automated setup can help ensure adherence to these rules.

Tools like TraderVPS can be invaluable in this process. They provide 24/7 platform uptime, real-time monitoring of trailing drawdowns, and automated scripts to close positions during restricted news events – all while keeping you compliant, even when you’re away from your desk[3]. For traders working with firms that allow weekend holds, TraderVPS ensures stop-losses and take-profits remain active as markets reopen, helping you manage potential price gaps effectively.

Build compliance into your daily routine. This means reviewing the economic calendar, tracking your profit and loss, and regularly auditing your adherence to firm rules. As FundedNext wisely puts it:

"Discipline isn’t the opposite of freedom, it’s what keeps you free in the long run."[1]

Treat these rules not as constraints but as safeguards for sustained success.

FAQs

What’s the difference between a trailing drawdown and a static drawdown in a funded trading account?

A trailing drawdown works like a moving safety net for your trading account. As your profits grow and your account hits new highs, this limit adjusts upward to reflect those gains. However, it never moves downward, even if your account value drops. Essentially, it locks in at the peak, protecting a portion of your profits.

On the other hand, a static drawdown is a fixed limit set at the start of your trading journey. Unlike the trailing drawdown, it stays the same no matter how much your account grows or shrinks. While this makes it simpler to calculate, it lacks the flexibility of adapting to your account’s performance.

How should I handle my trades during major economic news events?

Major economic events – like the U.S. Non-Farm Payrolls (NFP), Consumer Price Index (CPI), or Federal Open Market Committee (FOMC) announcements – often lead to sharp market swings. Because of the risks involved, many proprietary trading firms enforce strict rules, requiring traders to close all positions and cancel pending orders just before and after these events.

Here’s how you can stay compliant and manage your trades effectively:

- Monitor the economic calendar: Keep track of high-impact events that overlap with your trading schedule.

- Adjust your positions early: Close or reduce your trades before the firm’s required buffer period. For example, if the rule specifies a 2-minute buffer for an 8:30 a.m. release, ensure you’re flat by 8:28 a.m.

- Steer clear of restricted strategies: Avoid tactics like trading directly around the news or using straddles/strangles to capitalize on price swings.

- Leverage special accounts if permitted: Some firms offer Swing Accounts or similar features for holding positions during news events. If you use these, stay within the defined risk limits.

By preparing in advance, respecting blackout periods, and keeping risk under control, you can handle these volatile moments confidently while staying in line with your firm’s guidelines.

What happens if I don’t follow the holding period rules in a funded prop account?

Failing to follow a prop firm’s holding period rules can lead to some tough consequences. You might lose your eligibility for payouts, face account suspension, or even have your funded account permanently terminated.

To steer clear of these penalties, it’s important to fully understand and stick to the holding period requirements set by your prop firm. These rules are usually designed to manage risk and ensure traders operate within the firm’s guidelines.