RoboForex offers high-leverage trading up to 1:2000, making it appealing for experienced traders who prioritize bold strategies. However, its offshore regulation under the Belize FSC raises concerns about investor protection compared to stricter Tier-1 regulators like the FCA or ASIC. To balance these risks, RoboForex provides safety measures like negative balance protection, segregated funds, and $2.5M in Civil Liability insurance.

The broker also supports automated trading with free VPS hosting for active traders, but user reviews highlight occasional platform stability issues during volatile markets. Partnering with TraderVPS can improve reliability for those needing ultra-low latency and uninterrupted execution.

Key points:

- Leverage: Up to 1:2000 (Pro/ProCent accounts).

- Regulation: Belize FSC, with additional insurance and dispute resolution through The Financial Commission.

- Safety Features: Negative balance protection, segregated funds, 2FA, and trade verification.

- Platform Stability: Free VPS for 3+ monthly lots; execution speeds as fast as 0.1 seconds.

- Challenges: Offshore regulation and user-reported stability issues.

For traders comfortable with offshore risks and seeking cost-efficient, high-leverage options, RoboForex can be a viable choice, especially when paired with a robust VPS solution.

RoboForex Review: Everything You Need to Know!

1. RoboForex

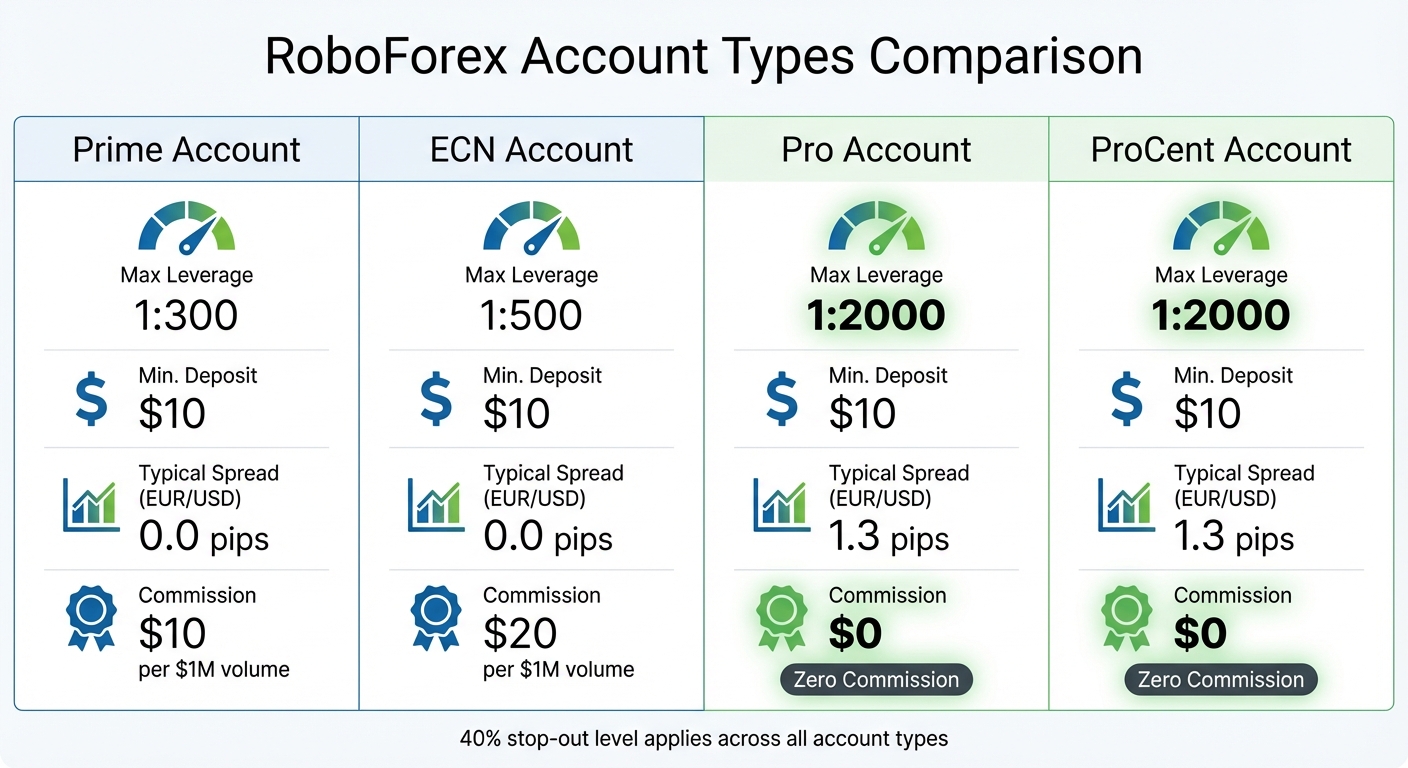

RoboForex Account Types: Leverage, Spreads & Commissions Comparison

Regulatory Compliance

RoboForex operates under the oversight of the Financial Services Commission (FSC) of Belize, holding license number 000138/32. While FSC is considered a "Red-Tier" offshore regulator, offering less investor protection compared to Tier-1 regulators like the UK’s FCA or Australia’s ASIC, RoboForex takes additional measures to reassure its clients. The broker holds a Category "A" membership with The Financial Commission, an independent body that resolves disputes and provides a compensation fund covering up to €20,000 per case. Additionally, RoboForex has €2,500,000 in Civil Liability insurance to safeguard against risks such as fraud, errors, and negligence. These measures aim to provide extra layers of security for traders, particularly those engaging in high-leverage trading.

Safety Features

RoboForex incorporates key safety measures to protect its clients. Negative balance protection ensures that accounts are reset to zero if losses exceed deposits, shielding traders from incurring debts. Client funds are stored in segregated bank accounts, separate from the broker’s operational funds, which helps protect clients’ money in case of insolvency.

To enhance account security, RoboForex offers two-step authentication (2FA) via SMS and backup codes for its Members Area. For added transparency, the broker submits 5,000 anonymized client trades monthly to "Verify My Trade" (VMT) for independent analysis. This process has earned RoboForex an execution quality certificate from The Financial Commission, further bolstering its credibility.

Platform Stability

RoboForex supports popular platforms like MetaTrader 4 and MetaTrader 5, along with its proprietary R StocksTrader platform, which offers market execution across all account types. The broker’s infrastructure is designed to handle over 12,000 trading instruments spanning seven asset classes, with order execution speeds typically ranging from 1 to 3 seconds.

"In my view, the TradingView charting package that’s integrated into RoboForex’s custom platform represents the industry’s pinnacle in terms of adaptability and functionality."

High-Leverage Performance

RoboForex’s account options are specifically designed to accommodate high-leverage trading. The broker provides leverage up to 1:2000 on Pro and ProCent accounts, 1:500 on ECN accounts, and 1:300 on Prime accounts. A 40% stop-out level is applied across all account types, helping to minimize the risk of total account depletion during volatile market conditions.

| Account Type | Max Leverage | Min. Deposit | Typical Spread (EUR/USD) | Commission |

|---|---|---|---|---|

| Prime | 1:300 | $10 | 0.0 pips | $10 per $1M volume |

| ECN | 1:500 | $10 | 0.0 pips | $20 per $1M volume |

| Pro / ProCent | 1:2000 | $10 | 1.3 pips | $0 |

RoboForex has received a 4.5/5 rating from both DayTrading.com and DailyForex, and it was named the "Best CFD Broker for Automated Trading" by FXEmpire in 2025. However, reviews on Trustpilot average 2.6/5 from 631 users, with common complaints citing platform stability and delays in withdrawals.

2. TraderVPS

Platform Stability

TraderVPS works hand in hand with RoboForex’s infrastructure to boost reliability and reduce trading risks. By operating independently of your local internet or hardware, TraderVPS ensures 24/7 uptime, keeping automated strategies and Expert Advisors (EAs) running without interruption[5]. This is especially crucial in high-leverage trading, where even a brief delay can expose you to unnecessary risks.

Orders are executed on high-performance servers strategically located near major trading hubs, cutting down latency – a game-changer for high-frequency and intraday strategies. With multiple global server locations, traders can connect to the server that best matches their RoboForex account, ensuring faster and more efficient execution. This setup adds an extra layer of reliability to your trading experience.

Safety Features

For high-leverage traders, uninterrupted access to risk management tools like stop-loss orders and automated exits is non-negotiable. TraderVPS ensures these critical functions work seamlessly, even if your personal computer goes offline. This consistent performance complements RoboForex’s negative balance protection, which resets your account to zero if losses exceed deposits during volatile market conditions.

TraderVPS also strengthens the security and integrity of your trading operations. With features like DDoS protection, NVMe storage, and automatic backups, it safeguards your trading data and EA settings. These protections help minimize the risk of data loss or disruptions during sudden market swings, giving traders peace of mind.

Pros and Cons

| Aspect | RoboForex | TraderVPS |

|---|---|---|

| Regulatory Compliance | Regulated by the FSC of Belize (License No. 000138/32); Category "A" member of The Financial Commission with up to €20,000 compensation per case; holds €2,500,000 in Civil Liability insurance [2][5] | Not a regulated broker; operates as an infrastructure support service |

| Safety Features | Negative balance protection resets accounts to zero; two-step authentication via SMS; Verify My Trade (VMT) execution quality certificate [2][5] | DDoS protection, NVMe storage, and automatic backups safeguard trading data and EA settings |

| Platform Reliability | Free VPS for traders with a monthly trading volume of 3+ lots; execution speeds from 0.1 seconds; supports MT4, MT5, and R StocksTrader [1][2][4] | 24/7 uptime guarantee with AMD EPYC processors; global server locations near major trading hubs; unmetered 1Gbps+ network |

| Trading Performance | Leverage up to 1:2000 for accounts with less than $10,000 equity; spreads from 0.0 pips on ECN/Prime accounts; commissions from $1.00 per lot [1][3][5] | Ultra-low latency connections optimize order execution; supports intensive backtesting; scalable plans starting at 4 CPU cores |

| Limitations | Some user reviews report platform stability issues during periods of high volatility (average rating of 2.6/5 from 631 reviews); offshore regulation may raise trust concerns [3] | Monthly costs range from $69 to $299; requires a separate broker account; lacks direct trading functionality |

The table highlights the key advantages and challenges of both RoboForex and TraderVPS. While RoboForex provides a free VPS for traders who meet the minimum trading volume, the resources are shared among users, which might not guarantee consistent performance during peak trading hours. On the other hand, TraderVPS offers dedicated hardware with robust features like AMD EPYC processors and up to 128GB of RAM on higher-tier plans, ensuring stable performance but at a cost – ranging from $69 to $299 per month.

For traders, the choice boils down to priorities: RoboForex’s free VPS is ideal for those meeting trading volume requirements and seeking a cost-effective option, albeit with shared resources. Meanwhile, TraderVPS caters to those who value reliability and high performance, especially for strategies that demand ultra-low latency and uninterrupted uptime. The decision ultimately depends on whether you prioritize cost savings or the assurance of dedicated, high-performance infrastructure.

Conclusion

RoboForex appeals to seasoned traders who are prepared to handle the high risks associated with leveraging up to 1:2000 in pursuit of potentially significant rewards. To help mitigate these risks, the broker employs measures like segregated funds, negative balance protection, and $2,500,000 in Civil Liability insurance. Additionally, RoboForex’s membership in the Financial Commission provides access to a compensation fund of up to $20,000 per claim, and trade execution quality is backed by the Verify My Trade certificate [2][5][6].

However, user feedback highlights issues with platform stability during periods of high market volatility, which can increase risks for high-leverage strategies [3]. For strategies where split-second timing is critical, these reliability concerns can lead to costly setbacks.

Addressing these challenges, TraderVPS offers a solution by removing local hardware risks and ensuring uninterrupted execution for automated trading systems with its high-performance infrastructure. While RoboForex provides free VPS hosting for traders with a monthly volume of 3+ lots, a dedicated VPS can deliver more consistent performance by avoiding the potential limitations of shared resources.

For traders utilizing RoboForex’s ECN or Prime accounts – featuring spreads starting at 0.0 pips and commissions as low as $1.00 per lot – combining the broker’s offerings with a reliable VPS setup can enhance execution speed and reduce the impact of platform stability issues [1][3]. This combination is particularly well-suited for aggressive trading strategies that demand precision and reliability.

Ultimately, RoboForex is most suitable for experienced traders who are comfortable with offshore regulation, have a solid understanding of leverage management, and adhere to disciplined risk controls like the 2% rule. When paired with a dedicated VPS, this setup provides the speed and reliability needed for high-stakes trading, keeping in mind that extreme leverage magnifies both potential profits and losses [7].

FAQs

What are the key risks of trading with high leverage on RoboForex?

Trading with high leverage on RoboForex comes with a significant level of risk. While it lets you control larger positions with a smaller upfront investment, even small market movements can result in considerable losses. These losses can rapidly drain your account, trigger margin calls, or even force the liquidation of your positions.

RoboForex offers leverage options ranging from 1:2,000 to an eye-popping 1:12,000, which magnifies both your potential profits and losses. To safeguard your capital, it’s crucial to use risk management tools like stop-loss orders and avoid overextending your account. Approach high-leverage trading with caution and make sure you fully understand the risks before diving in.

What does RoboForex’s offshore regulation mean for trader protection?

RoboForex is regulated by Belize’s Financial Services Commission, an offshore authority known for having less rigorous oversight compared to regulators like the FCA or ASIC. This setup may not offer the same level of formal investor protections, but RoboForex takes steps to mitigate concerns. For instance, the broker is a member of the Financial Commission, which provides traders with access to a dispute-resolution process and a compensation fund. This fund can cover up to $20,000 per case, offering some financial protection in specific scenarios.

While offshore regulation might make some traders hesitant, these additional safeguards aim to provide a layer of confidence for those opting to trade with RoboForex, especially in high-leverage environments.

How does RoboForex ensure platform stability during market volatility?

RoboForex ensures platform stability during volatile market conditions by offering a range of trading platforms, including MetaTrader 4, MetaTrader 5, R WebTrader, R MobileTrader, and R StocksTrader. This variety allows traders to easily switch platforms if one experiences congestion or downtime, maintaining uninterrupted access to the markets. On top of that, the broker provides a free VPS service, which helps minimize latency and keeps connections stable during periods of rapid market movement.

For risk management, RoboForex includes built-in tools like Stop-Loss and Stop-Limit orders. These features automatically adjust or close positions when prices shift sharply, helping traders mitigate potential losses. While extreme market conditions can sometimes impact execution, these tools are specifically designed to reduce the effects of sudden volatility.

The broker operates under the regulation of the Belize Financial Services Commission (FSC) and the international Financial Commission, both of which enforce strict standards for platform reliability and service quality. This regulatory oversight reflects RoboForex’s commitment to offering a secure and dependable trading environment, even in the face of market turbulence.