Historical options APIs are essential for traders and developers looking to access archived and live options data for backtesting, strategy development, or real-time trading. This article evaluates seven APIs based on data granularity, historical depth, ease of integration, and pricing. Here’s a quick summary of each:

- TagX Stock Market API: Offers RESTful integration but lacks transparency in features and pricing.

- Alpha Vantage: Provides 20+ years of data, free and premium plans, and strong integration options.

- Alpaca: Focuses on U.S. options with free and paid plans, but historical data starts from 2024.

- EODHD: Affordable for end-of-day data with two years of history and bulk download options.

- ORATS: Deep historical coverage (since 2007) with advanced analytics, but pricing leans toward institutional users.

- QuoteMedia: Offers both real-time and historical options data with advanced analytics, though pricing details require inquiry.

- i-Volatility: Delivers 30 years of historical data with pre-computed Greeks and implied volatility, ideal for institutional use.

Each API caters to different needs, from basic backtesting to high-frequency trading. Pricing and features vary, so choosing the right provider depends on your specific requirements.

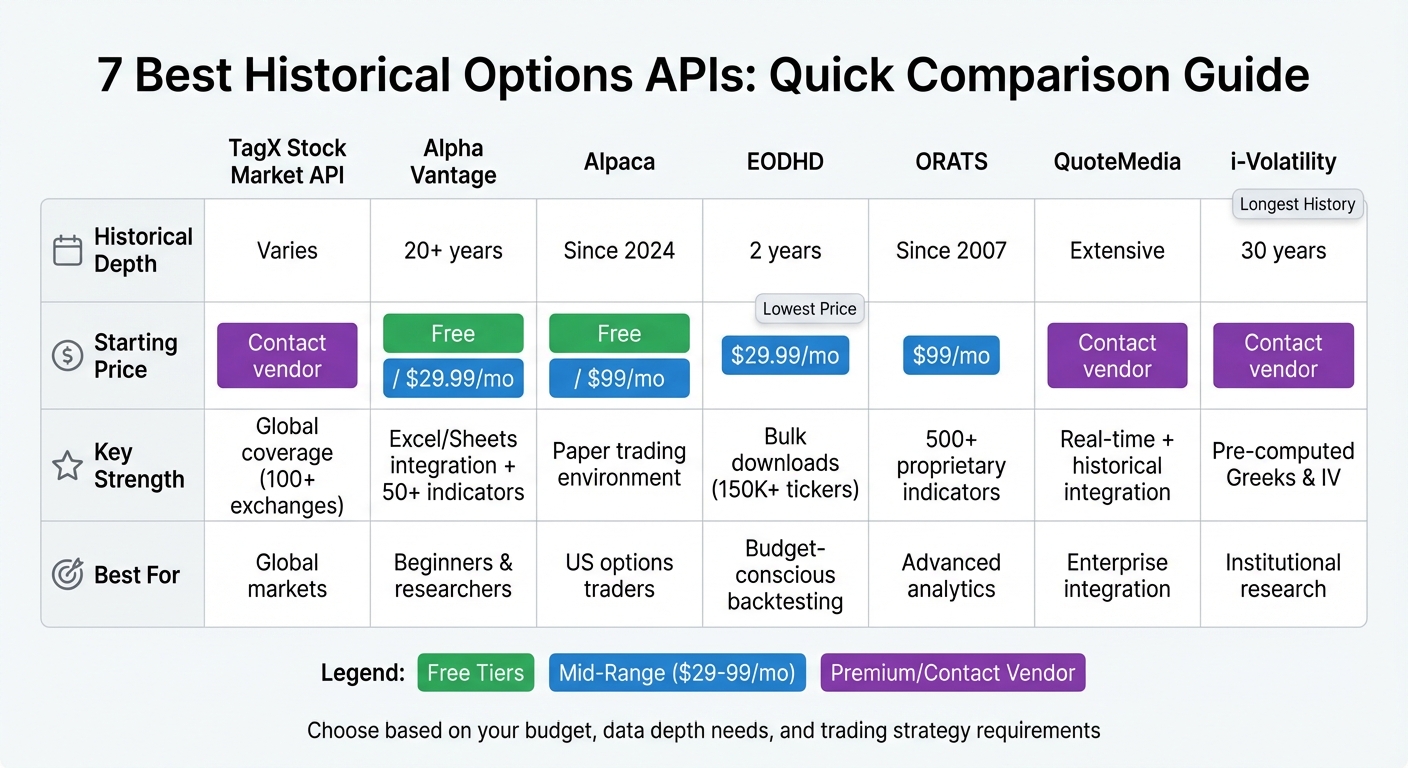

Quick Comparison:

| API Provider | Historical Depth | Key Features | Starting Price |

|---|---|---|---|

| TagX | Varies | RESTful API, unclear features | Contact vendor |

| Alpha Vantage | 20+ years | Free tier, Excel/Sheets integrations | Free; $29.99/mo |

| Alpaca | Since 2024 | U.S. options, free and paid plans | Free; $99/mo |

| EODHD | 2 years | Bulk downloads, affordable | $29.99/mo |

| ORATS | Since 2007 | Advanced indicators, institutional focus | $99/mo |

| QuoteMedia | Extensive | Real-time/historical data, analytics | Contact vendor |

| i-Volatility | 30 years | Pre-computed Greeks, implied volatility | Contact vendor |

Selecting the right API depends on your budget, integration needs, and trading strategy.

Historical Options APIs Comparison: Features, Pricing, and Data Depth

1. TagX Stock Market API

Data Coverage

The public documentation for the TagX Stock Market API leaves much to the imagination when it comes to historical options data. It doesn’t clearly indicate whether the API provides archived data, live data, or both. Additionally, there’s no mention of the specific exchanges or contract types it supports. If these details are critical for your strategy, reaching out to TagX directly for clarification is a must. This lack of transparency could make it harder to determine if the API meets your data needs.

Pricing Tiers

TagX doesn’t openly share its pricing structure. Instead, you’ll need to contact their sales team for a custom quote tailored to your data volume and usage. While this personalized approach might work well for institutional clients, smaller teams or individual users will need to inquire directly to explore their options.

Integration Ease

The API operates on a standard RESTful HTTP interface, which is widely supported. However, the documentation doesn’t provide much detail about client libraries, which could mean extra effort is required for testing and implementation. For anyone aiming to streamline backtesting or deploy live strategies efficiently, this lack of detail might be a stumbling block.

Options-Specific Features

When it comes to options trading, certain features can make or break an API’s usefulness. Unfortunately, the public documentation doesn’t specify whether TagX offers critical options-related data like pre-calculated Greeks, raw tick data, timestamp precision, data granularity, or implied volatility metrics. To get a complete picture of what’s available, you’ll need to contact TagX directly for more information.

2. Alpha Vantage Options API

Data Coverage

Alpha Vantage stands out as an officially licensed NASDAQ market data provider, offering extensive US options data [6][7]. With over 20 years of historical data for core equity time series, the platform is well-suited for developing options strategies. Data can be accessed in both JSON and CSV formats, with resolutions ranging from daily and weekly to intraday intervals like 1, 5, 15, 30, and 60 minutes [6]. Covering more than 100,000 symbols – including global equities, ETFs, and mutual funds – it provides a rich dataset for comprehensive strategy development [6][7]. All of this is supported by straightforward and flexible pricing options.

Pricing Tiers

Alpha Vantage offers a free tier, allowing users to claim an API key and explore the full API portfolio with compact data outputs [6]. For users needing detailed historical data and advanced features, premium plans start at $29.99 per month [9]. Businesses requiring commercial use can contact the sales team to arrange specific licensing agreements [6].

Request Limits

The free tier comes with a daily limit of 25 requests, enforced through IP-based rate limiting and API key tracking [11][12]. For users requiring more frequent data retrieval or large-scale analysis, upgrading to a premium plan is necessary. Premium memberships not only remove daily limits but also unlock real-time US options data and 15-minute delayed feeds [11].

Integration Ease

The API is designed to integrate seamlessly with widely used programming languages. The open-source community has contributed over 1,000 libraries across 20+ languages, including Python, JavaScript, PHP, and C# [6]. It also supports spreadsheet integrations for Excel and Google Sheets. Additionally, the API allows for queries of both raw (as-traded) and split/dividend-adjusted data, ensuring accuracy in backtesting [6].

Options-Specific Features

Alpha Vantage provides options chain data with real-time and historical metrics [10]. Users can choose between "compact" (latest 100 data points) and "full" (trailing 30 days or longer historical periods) output sizes to optimize data transfer [6]. Beyond options data, the platform includes tools like RSI and MACD technical indicators, enhancing strategy development capabilities [9][10]. Premium users benefit from the ability to retrieve 30 days of intraday data in a single request with the full output size parameter [6], making it an efficient solution for testing and refining strategies.

3. Alpaca Historical Options API

Data Coverage

Alpaca offers historical options data, including bars, trades, and quotes [13][17]. Users can choose between two data sources: the Indicative feed, a free derivative of OPRA data with a 15-minute delay, and the OPRA feed, which provides the consolidated Best Bid and Offer feed for paid subscribers [14].

Historical data availability begins in February 2024 [14]. While the platform provides full US options market coverage, the data’s recency makes it more suitable for short-term strategies rather than extensive long-term backtesting.

Pricing Tiers

Alpaca’s pricing is structured to match its data offerings. The Free plan costs nothing monthly and provides access to the Indicative feed with delayed data [15]. For traders needing real-time data and advanced functionality, the Algo Trader Plus plan is priced at $99 per month, granting access to the official OPRA consolidated feed and unlimited API calls [15]. The free plan works well for basic research, but its delay and limitations make it less practical for precision backtesting [14].

Request Limits

The Free plan allows for 200 API calls per minute [15]. Upgrading to the Algo Trader Plus plan removes this restriction, offering unlimited API calls [15]. For WebSocket connections, free users can stream data for up to 30 symbols, whereas paid subscribers enjoy unlimited streaming [15]. These limits influence how efficiently users can gather data across multiple contracts or assets.

Integration Ease

Alpaca supports developers with official SDKs for Python, Go, NodeJS, and C# [18]. The API follows a RESTful design, with authentication managed via API Key and Secret Key passed in HTTP headers (APCA-API-KEY-ID and APCA-API-SECRET-KEY) [18]. Python users can utilize the alpaca-py SDK and its OptionHistoricalDataClient for straightforward data access [13][16]. Additionally, WebSocket protocols enable real-time data streaming, making it ideal for event-driven applications [15][18].

Options-Specific Features

The Option Chain endpoint consolidates contract data, including pre-calculated Greeks (Delta, Gamma, Theta, Vega, Rho) and Implied Volatility (IV), into a single JSON response [13]. This feature simplifies strategy development by reducing the need for multiple API calls. For developers building custom systems, these pre-calculated values save both computational resources and development time.

4. EODHD APIs

Data Coverage

EODHD offers end-of-day historical options data for over 6,000 prominent US stock symbols, with a two-year history of options contracts available. This makes it a practical choice for medium-term backtesting strategies [19][20]. The platform processes approximately 1.5 million bid, ask, and trade events daily, ensuring comprehensive and up-to-date information [20].

Each trade includes over 40 data fields, covering Greeks like Delta, Gamma, Theta, Vega, and Rho, along with implied volatility, open interest, and volume [19][20]. With such detailed data, users can perform in-depth quantitative analysis without needing to combine multiple sources. While the focus is on end-of-day snapshots rather than intraday tick data, this approach is particularly beneficial for swing traders and researchers examining longer-term trends. The extensive data coverage supports advanced strategy development and market analysis.

Pricing Tiers

EODHD positions itself as a cost-effective alternative to institutional providers. The Options Data API is priced at $29.99 per month during its beta phase, with a standard rate of $39.99 per month [19][20]. For users seeking broader access, the All-In-One Package costs €99.99 per month and includes end-of-day, fundamental, real-time, and intraday data [21]. Additionally, students can take advantage of a 50% discount on all subscription plans for academic purposes [21][8].

The platform boasts a 4.7 out of 5 rating on Trustpilot from 129 reviews, with users frequently highlighting its value for money [19].

"Prices were very favorable compared to competitors. API was decent. Overall good." – James Kerns [19]

Subscriptions are flexible, operating on a month-to-month basis without requiring long-term commitments [21][22].

Request Limits

EODHD’s paid plans allow for 100,000 API calls per day, with a rate limit of 1,000 requests per minute [21][22]. For those testing the service, the Free Starter plan offers 20 daily calls [21][8]. These limits are designed to meet the needs of most retail traders and researchers without pushing users into higher-cost enterprise plans.

Integration Ease

EODHD simplifies integration by offering data in JSON format, with CSV options also available for flexibility [23][8][20]. Official libraries are provided for popular programming languages, including Python, C#, R, PHP, Java, MATLAB, and C++ [23][24][8]. For non-developers, data can be accessed through Excel, Google Sheets, or a WordPress plugin [23][24][25].

A standout feature is the ChatGPT assistant, which can generate working code snippets in various programming languages based on the API documentation [23]. Developers can easily test the integration using a "demo" API key for symbols like AAPL.US without needing to register [23][19]. Authentication is straightforward, requiring a private API key passed as a request parameter [23][22]. Additionally, users benefit from 24/7 live chat support with real assistants for any technical or account-related questions [8][25].

5. ORATS Options API

Data Coverage

ORATS offers a wealth of options data, starting with end-of-day records dating back to 2007, making it a solid choice for thorough backtesting [5]. The platform covers the entire universe of US equity options – spanning over 5,000 symbols, including stocks, ETFs, and indexes. Additionally, it provides 1-minute intraday historical data from August 2020 onward [5].

One standout feature is ORATS’ focus on data accuracy. By capturing a complete market snapshot 14 minutes before the close of trading, it avoids the pitfalls of wide bid-ask spreads that often occur at the final bell [5]. The data is further enriched with over 500 proprietary indicators, such as smoothed market values, volatility forecasts, and insights into earnings effects. Furthermore, it includes weighted average tickers for more than 30 major indexes and ETFs [5].

Pricing Tiers

ORATS caters to institutional-level needs with premium pricing plans. Monthly subscriptions are structured as follows: a Delayed Data API for $99, a Live Data API for $199, and a Live Intraday API for $399 [30]. For users needing historical data for extensive backtesting, one-time purchases are available. End-of-day data since 2007 is priced at $599, while 1-minute intraday data from August 2020 costs $1,500 [30]. As of October 2025, the platform has earned a 4.0 out of 5 rating from Bullish Bears [30].

"ORATS is fantastic platform! I have used several including ivolatility/Options omega, but nothing comes close to ORATS." – Ramesh [26]

Request Limits

The API’s Strikes History endpoint allows up to 10 tickers per request [27]. It also calculates live options data in real time, with a market delay of less than 10 seconds [29]. To further streamline operations, users can specify the exact fields they need in their API requests, optimizing data transfer.

Integration Ease

ORATS’ RESTful API is designed for simplicity and efficiency, returning data in JSON format and utilizing standard HTTP codes. This setup allows users to move seamlessly from research to trade execution [28].

"I’m very pleased so far since I can go straight from research in ORATS to placing trades without needing to go into IBKR." – Ryan K. [26]

This integration-friendly approach enables users to transition effortlessly into advanced quantitative analysis.

Options-Specific Features

ORATS employs its proprietary SMV system to deliver precise Greeks, which are crucial for accurate backtesting [31]. The platform also addresses earnings-related volatility spikes with its Ex-Earnings metrics, offering normalized volatility analysis that spans various timeframes [31]. To simplify volatility surfaces, the API condenses them into three main factors: at-the-money volatility, strike slope (skew), and derivative (curvature) [31]. Another unique feature is the "Rip Value" indicator, which pinpoints overvalued low-priced options and acts as a systematic exit trigger in backtesting strategies [31]. Additionally, ORATS calculates residuals from put-call parity to determine implied dividends and borrow rates, uncovering hidden costs or potential opportunities [31].

"ORATS proprietary data including implied summarizations and historical volatility readings, have been shown in backtesting to be important predictors of profitable trading strategies." – ORATS [31]

6. QuoteMedia Options Data API

Data Coverage

QuoteMedia delivers a wide range of historical options data on demand. This includes daily, weekly, monthly, and various minute intervals – even down to tick-level records. Users can access full option chains featuring expiration stats and advanced analytics like IV Rank, unusual open interest patterns, and trade profit/loss probabilities. Whether you need regional exchange data or composite feeds, QuoteMedia has it covered. Beyond basic pricing, the platform offers both adjusted data (accounting for splits and dividends) and unadjusted "as-traded" records, making it a versatile tool for backtesting needs [32].

Pricing Tiers

Pricing for QuoteMedia’s services is tailored to individual data needs and commercial agreements. To get specific details, potential users are encouraged to reach out directly to their sales team [32].

"QuoteMedia offered a single point of contact for a diverse array of content, ranging from price quotes, reference and fundamental data. Comtex was able to quickly sample and trial different APIs, usually provisioned same day." – Kan Devnani, President and CEO, Comtex [32]

Integration Ease

The API is built as a cloud-based REST service, delivering data through HTTPS in formats like JSON, XML, and CSV. This design ensures quick and seamless integration. Its distributed cloud architecture provides redundancy, guaranteeing high uptime. On top of that, QuoteMedia supports over 100 APIs across various financial categories, while also gathering news and market insights from more than 300 sources [32].

Options-Specific Features

For options-focused users, QuoteMedia offers a robust toolkit. This includes a full set of Greeks – Delta, Gamma, Theta, Vega, and Rho – along with Implied Volatility calculations. The platform’s trade analytics features include IV Rank, IV Percentile, unusual open interest and volume data, and open interest/volume ratios, which can spotlight potential volatility breakouts or mispriced premiums. Strategy developers will appreciate tools like Trade P/L Probability Data, price trajectory analysis, and trade risk assessments. Users can also filter option chains by strike price, expiration date, or moneyness. Additionally, the integrated Security Master provides identifiers such as OpenFIGI, ISIN, CUSIP, and CIK for precise symbol mapping [32].

Next, we’ll take a closer look at the i-Volatility API.

Comparing Options Data and APIs | Driven by Data Ep 47

7. i-Volatility API

After exploring QuoteMedia, i-Volatility steps in as a powerful tool for options analysis, offering extensive historical data and integrated features.

Data Coverage

i-Volatility provides institutional-level real-time and historical options data with an impressive 30-year history. Its coverage includes U.S. equity options, major indices like SPX and VIX, ETFs such as SPY and QQQ, as well as futures contracts. The platform also delivers pre-computed variables like implied volatility and Greeks. Additionally, it offers tailored volatility metrics, including historical volatility for 10, 20, and 30-day periods, and a proprietary "IV Index Mean", which averages the IV Index Call and IV Index Put values. Users can access this data through API, Snowflake integration, or FTP [2].

"IVolatility is a reliable source for options data, providing timely delivery of all essential pre-computed variables necessary for derivatives research." – Grigory Vilkov PhD, Professor of Finance, Frankfurt School of Finance and Management [2]

Pricing Tiers

While specific pricing details aren’t publicly available, i-Volatility offers academic pricing for universities and researchers, along with affordable options for smaller firms. One client highlighted the service’s balance of quality and cost:

"Getting options market data in the United States is a very difficult proposition and IVolatility has been able to deliver a great product at a price that is not cost-prohibitive for smaller firms like ours." – Bay Hill Capital Management [2]

Integration Ease

The platform simplifies integration with a VS Code Cloud Workspace, eliminating the need for local installation and enabling users to immediately execute code with the IVol API. It also features an AI-powered reconciliation tool that cross-checks data accuracy against external sources, ensuring reliability before large-scale backtesting. Looking ahead, the upcoming "IVolAI" tool will allow users to describe strategies in plain language, which will then be converted into Python code for backtesting and optimization [2]. These tools are designed to streamline workflows while complementing the API’s advanced options-focused capabilities.

Options-Specific Features

i-Volatility tackles the complexities of options trading by handling stock dividends, interest rates, and contract adjustments automatically, delivering the data needed for pricing models. Its IV Index uses vega-weighted averages of implied volatility for calls, puts, or a combined mean, offering a refined estimate of future volatility. The platform also includes 30-day historical correlation data with the S&P 500 Index, balancing responsiveness and stability in analysis. For risk management, the system supports flexible evaluations, whether for individual positions or entire portfolios [2].

"Their good coverage on futures, equities, and indices in addition to long histories make the data especially useful for academic work." – Dr. sc. ETH Mark James Thompson, Senior Researcher, Zurich University of Applied Sciences [2]

Pros and Cons of Each API

TagX boasts global reach, covering over 100 exchanges and offering corporate-adjusted data suited for long-term backtesting [33]. However, pricing details are not readily available and require direct inquiry. Alpha Vantage shines with its dedicated Excel and Google Sheets add-ons and over 50 technical indicators, but its free tier is capped at 5 API calls per minute [9]. Alpaca stands out for its risk-free paper trading environment, while EODHD enables large-scale backtesting with bulk downloads spanning 150,000+ tickers [34].

ORATS offers more than 15 years of historical data (dating back to 2007) and includes 500+ proprietary volatility indicators, such as smoothed implied volatility surfaces and earnings-adjusted volatility [5]. However, its primary focus is on US equities. QuoteMedia provides robust real-time and historical integration, while i-Volatility delivers institutional-grade data like pre-computed Greeks and implied volatility, backed by a 30-year historical archive [2].

Here’s a side-by-side look at the key features of these providers:

| API Provider | Historical Depth | Key Strength | Key Weakness | Starting Price |

|---|---|---|---|---|

| TagX | Varies by exchange | Global coverage (100+ exchanges) [33] | Pricing not publicly listed | Contact vendor |

| Alpha Vantage | 20–30 years | Excel/Sheets compatibility, 50+ indicators [35] | Limited to 5 calls/min (free tier) [9] | Free; $29.99/month premium [9] |

| Alpaca | Varies | Paper trading environment | Limited historical depth | Free tier available [9] |

| EODHD | Extensive | Bulk downloads (150,000+ tickers) [34] | 20 requests/day on free tier [9] | $17.99/month [9] |

| ORATS | Since 2007 | 500+ proprietary indicators [5] | US equities focus [5] | Subscription required |

| QuoteMedia | Comprehensive | Real-time and historical integration | Pricing requires inquiry | Contact vendor |

| i-Volatility | 30 years | Pre-computed variables [2] | Commercial pricing not transparent [2] | Academic pricing available |

When deciding which API to use, consider how well their features align with your needs. For instance, ORATS is ideal if your trading strategy relies on historical volatility patterns, as it provides proprietary intraday measurements that enhance daily volatility data [3]. On the other hand, EODHD is a great fit for large-scale backtesting, especially when working with extensive stock universes, thanks to its bulk data access that avoids rate-limit issues [34]. If you’re focused on real-time execution, look for APIs offering WebSocket streaming for the low-latency performance required in algorithmic trading.

"IVolatility is a reliable source for options data, providing timely delivery of all essential pre-computed variables necessary for derivatives research." – Grigory Vilkov PhD, Professor of Finance, Frankfurt School of Finance and Management [2]

Using TraderVPS for API-Based Trading

When it comes to API-driven trading, having a reliable execution environment is non-negotiable. Running trading strategies on your local machine might seem convenient, but it comes with risks – power outages, internet disruptions, or system crashes can derail your backtesting or halt live trading bots at the worst possible moments. A dedicated VPS solves these issues by offering 24/7 uptime, completely independent of your local setup. This ensures uninterrupted operations, which is critical for executing API-based strategies smoothly [36][38].

Processing historical options data demands serious computing power, and TraderVPS delivers. With enterprise-grade AMD EPYC and Ryzen processors and NVMe M.2 SSD storage, TraderVPS is built to handle the heavy lifting of backtesting large datasets [36][37]. Whether you’re working with extensive options chains or performing complex volatility calculations, the NVMe drives ensure data access remains lightning-fast [36][1].

Location also plays a huge role in trading performance. TraderVPS operates datacenters in Chicago, enabling sub-millisecond execution speeds (<0.52ms) to the CME Group via direct fiber-optic cross-connects [36][37]. This setup minimizes latency and slippage, which is crucial for API strategies that rely on precise timing for entering and exiting trades. The infrastructure also supports 1Gbps+ network speeds with 10Gbps burst capabilities, ensuring high-fidelity market data feeds are processed without delays [36].

TraderVPS offers tailored plans to meet the needs of different API workloads:

- VPS Lite ($69/month): Includes 4 AMD EPYC cores and 70GB NVMe storage, ideal for basic API monitoring.

- VPS Pro ($99/month): Features 6 cores and 150GB storage, suited for running active trading bots.

- VPS Ultra ($199/month): Provides 24 cores and 64GB DDR4 RAM, perfect for high-frequency strategies handling multi-asset API feeds.

- Dedicated Server ($299/month): Equipped with 12+ AMD Ryzen cores and 2TB+ NVMe storage, designed for intensive backtesting and large-scale historical data analysis.

All plans come with DDoS protection, automated backups, and compatibility with major data feeds like Rithmic, CQG, and IQFeed [36][37][38]. This combination of robust hardware, strategic location, and flexible plans makes TraderVPS a reliable choice for API-based trading.

Conclusion

When choosing an API provider, it’s essential to align your decision with your specific trading strategy. As discussed earlier, some APIs excel in delivering raw tick data ideal for high-frequency strategies, while others focus on pre-calculated indicators tailored for long-term analysis. For example, APIs designed for microstructure trading offer features like nanosecond timestamps and full order book depth. On the other hand, platforms catering to multi-leg strategies often include advanced backtesting tools with custom entry and exit filters [1][3].

Cost and data requirements are equally important factors. Pricing models range from pay-as-you-go to fixed annual subscriptions, so it’s crucial to select an option that fits both your budget and the volume of data you need [1][4][6][39].

The way data is delivered – whether raw or pre-calculated – can significantly affect both the complexity of model development and ease of integration. For instance, Databento emphasizes that their "API design prioritizes transparency by avoiding vendor-calculated or derived data, such as IV and greeks" [1], which appeals to traders who prefer building their own models. However, for those more focused on execution, pre-calculated Greeks and implied volatility can save valuable development time [2][3]. The key is to ensure your chosen API supports a robust, low-latency trading infrastructure.

For live trading, combining a well-matched API with an optimized execution setup is critical. This ensures reliable, low-latency performance, whether you’re backtesting decades of options data or executing trades in real-time with millisecond precision.

FAQs

What should I look for when choosing a historical options API?

When choosing a historical options API, start by focusing on data coverage and accuracy. The ideal API should provide a broad range of data covering U.S. equity options, including key exchanges like OPRA and CME. Make sure it includes critical fields like Greeks, implied volatility, and dividend forecasts. Also, check the depth of the historical data to ensure it meets your backtesting requirements.

Another key factor is data granularity and accessibility. If you’re working on high-frequency strategies, you’ll likely need tick-level or sub-minute data. For long-term analysis, daily or less frequent intervals might be enough. Verify that the API supports your workflow with suitable access methods, such as RESTful endpoints or client libraries compatible with your preferred programming language.

Lastly, pay attention to pricing, licensing, and support. Ensure the pricing fits your budget and that the licensing terms align with your intended use, whether it’s personal or commercial. Reliable documentation and responsive support are crucial for a hassle-free integration into your trading platform or custom systems.

What are the common pricing models for historical options APIs?

Pricing models for historical options APIs typically depend on the type of data you need and how you plan to use it. Two common approaches are flat-rate subscriptions and pay-as-you-go pricing. Flat-rate subscriptions are charged either monthly or annually and grant access to specific data tiers, such as end-of-day (EOD), intraday, or tick-level data. On the other hand, pay-as-you-go pricing ties costs to usage, like the number of API calls you make or the amount of data you consume (e.g., per GB). For businesses with more complex or large-scale requirements, custom enterprise plans are also an option.

When deciding on a pricing model, think about factors such as how detailed the data needs to be, how often it updates, and whether it integrates seamlessly with your trading tools. These considerations will help you pick the plan that aligns best with your goals or strategies.

What should I look for in an API to backtest options strategies effectively?

When selecting an options data API for backtesting, it’s crucial to focus on features that deliver precise data and integrate seamlessly with your models.

Start by ensuring the API provides rich historical data, including end-of-day, intraday, and tick-level details. This data should span a broad range of U.S. equity, index, and futures options while offering key fields like bid, ask, volume, greeks (delta, gamma, theta, vega), and implied volatility. These elements are the backbone of most options strategies, giving you the granularity needed for accurate analysis.

APIs that incorporate corporate action data – such as dividend schedules, earnings dates, and volatility estimates – are highly valuable for capturing the full picture of risk and reward. Additionally, APIs with tools designed for backtesting can streamline your workflow. Look for features like pre-built scans or the ability to run custom tests with adjustable parameters, such as strike prices, expiration dates, and specific timeframes.

Lastly, prioritize APIs that are developer-friendly. Clear documentation, dependable performance, and flexible pricing models are key. Integration becomes much easier when the API offers RESTful endpoints, client libraries for popular programming languages, and low-latency data delivery. These features ensure a smoother, more efficient development process.