Daily loss caps are critical rules in proprietary trading that limit how much you can lose in a single day. They help prevent large losses, encourage disciplined trading, and protect both the trader and the firm. Here’s what you need to know:

- What is a Daily Loss Cap?

It’s the maximum amount you’re allowed to lose in one trading day, typically set at 3–5% of your account balance or equity. Breaching this cap can lead to account suspension or termination. - How It’s Calculated:

Firms may use fixed dollar amounts or percentages, factoring in closed trades, unrealized losses, and fees. For example, on a $50,000 account with a $1,200 cap, a small market move with open positions can breach the limit. - Soft vs. Hard Breaches:

A soft breach stops you from trading for the day but keeps your account active. A hard breach, often tied to a maximum drawdown, results in account termination and requires a reset fee. - Risk Management Tips:

- Limit risk to 1–2% per trade.

- Stop trading after using 70–80% of your daily cap.

- Use bracket orders and position-sizing tools to stay within limits.

- Monitor real-time equity, including unrealized losses.

- Technology Solutions:

Tools like TraderVPS ensure real-time tracking, low latency, and uninterrupted risk management during outages, helping traders avoid unintentional breaches.

Daily loss caps are not just rules – they’re safeguards that promote better trading habits. By understanding and respecting these limits, traders can improve their performance and preserve their accounts.

Calculate Your Daily Loss Limit Like a Pro! | Prop Trading Guide by FundedNext

How MFU Daily Loss Caps Work

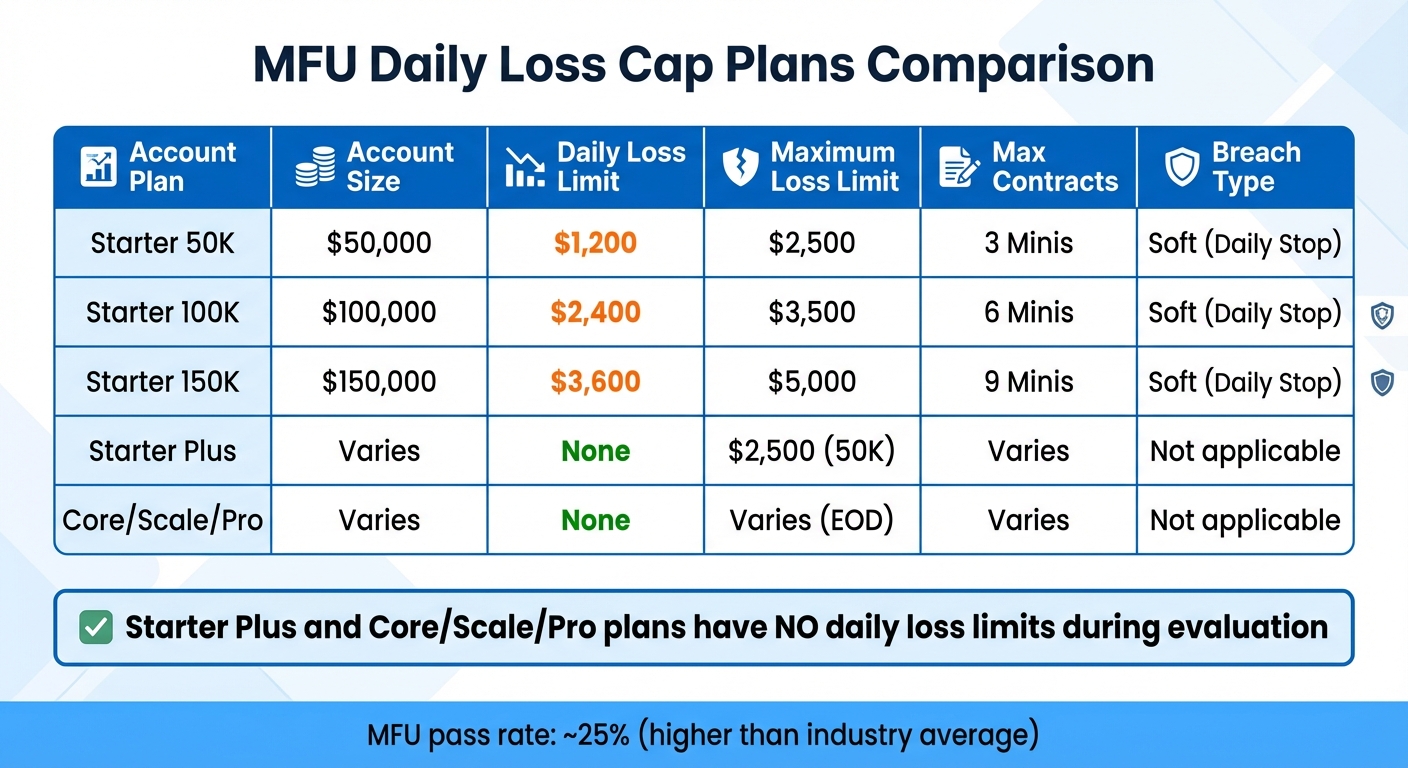

MFU Daily Loss Cap Plans Comparison Chart

How Daily Loss Caps Are Calculated

MFU employs static daily loss limits, meaning these limits don’t fluctuate based on your account performance or whether you’re on a winning streak [2]. These limits are monitored from market open to close (6:00 PM to 4:10 PM EST), and the system activates once the limits are breached [2].

The calculation factors in several components: closed trade results, unrealized losses on open positions, along with commissions and fees [3]. This means you can hit your limit even without closing a trade – if the unrealized loss on your open positions surpasses your available daily allowance, the system will immediately pause your account [3].

For example, in a $50,000 Starter account trading three E-Mini contracts, a 3-point market move – risking roughly $400 per point – could nearly deplete the $1,200 daily loss limit [2]. Every dollar at risk, including fees, counts toward this calculation.

"Daily Loss Limits function as critical safety mechanisms… creating protective guardrails that prevent catastrophic losses while enforcing disciplined trading approaches." – MyFundedFutures [2]

MFU’s internal data reveals that traders who keep their losses below 50% of their Daily Loss Limit achieve funded status 2.3 times faster than those who frequently approach the maximum threshold [2].

Next, let’s break down the difference between soft and hard limits to better understand their enforcement.

Soft vs. Hard Daily Loss Caps

When you reach the daily loss limit, it results in a soft breach. This stops you from opening new positions for the rest of the trading day, but your account remains intact [2][4].

"The Daily Loss Limit is said to be a soft-breach and stops you for the trading day to prevent traders from Tilt." – MyFundedFutures Help Center [4]

On the other hand, a hard breach occurs if you violate the Maximum Loss Limit (also known as maximum drawdown). This leads to immediate account termination, and you’ll need to pay a reset fee to continue: $97 for a 50K account, $150 for a 100K account, or $220 for a 150K account [4].

The key difference is that a soft breach offers a temporary pause, giving you a chance to regroup. Your daily limit resets at the start of each new trading session (typically at 12:00 AM server time or market open) [3]. This mechanism acts as a safeguard rather than a permanent penalty, helping traders manage risk and adjust their strategies within defined boundaries.

Daily Loss Cap Policies Across MFU Plans

MFU’s plans feature varying daily loss structures. For instance, the Starter Plus plan doesn’t impose a daily loss limit [2][4]. Similarly, the Core, Scale, and Pro plans generally waive daily loss limits during the evaluation phase [5].

| Account Plan | Account Size | Daily Loss Limit | Maximum Loss Limit | Max Contracts | Breach Type |

|---|---|---|---|---|---|

| Starter 50K | $50,000 | $1,200 | $2,500 | 3 Minis | Soft (Daily Stop) |

| Starter 100K | $100,000 | $2,400 | $3,500 | 6 Minis | Soft (Daily Stop) |

| Starter 150K | $150,000 | $3,600 | $5,000 | 9 Minis | Soft (Daily Stop) |

| Starter Plus | Varies | None | $2,500 (50K) | Varies | Not applicable |

| Core/Scale/Pro | Varies | None | Varies (EOD) | Varies | Not applicable |

While some plans don’t enforce daily loss limits, the Maximum Loss Limit still applies across all accounts. MFU boasts a pass rate of around 25%, which is higher than the industry average – partly due to the absence of daily loss limits during evaluations [5]. However, only 1.01% of participants in a Simulated Funded Account advance to a Live Funded Account [6], showing that passing the evaluation is just the beginning of the journey.

How Daily Loss Caps Affect Trading Performance

Managing Risk Without Limiting Profits

Daily loss caps are like safety nets for your trading account – they protect you from devastating losses while still allowing room for profits to grow [1]. The purpose of these limits isn’t to stifle your gains; instead, they’re designed to prevent emotional decisions that can drain your capital.

Professional traders often stick to risking just 1% to 2% of their account per trade [1]. For instance, if you’re working with a $50,000 account and have a 5% daily loss cap ($2,500), risking 1% per trade ($500) gives you multiple chances to trade without hitting your limit.

"The daily loss limit isn’t just a rule – it’s a psychological and strategic checkpoint." – 4proptrader [1]

Many traders follow the "70–80% Rule", which means stopping trading once they’ve used 70% to 80% of their daily loss allowance [1]. This buffer accounts for factors like slippage and execution fees in fast-moving markets, reducing the chance of unintentionally breaching the cap.

In volatile markets, reducing your position sizes is a smart move. Even a temporary price dip can cause a breach, as unrealized losses are tracked in real time by MFU systems [1]. Scaling down can help you avoid triggering limits prematurely, even if your trade eventually moves toward profit.

These strategies highlight the importance of balancing risk management with the challenges traders often face under daily loss caps.

Common Problems Traders Face With Daily Loss Caps

Even with solid risk management, traders still face psychological hurdles that can undermine their performance.

A major challenge is dealing with emotions like FOMO (fear of missing out). If you hit your daily loss cap early in the trading session, it’s hard to watch the market make significant moves without you [1]. This frustration can lead to poor decisions the next day, as you try to chase missed opportunities.

Another common issue is ignoring floating losses. Focusing only on closed trades while overlooking unrealized losses can lead to unexpected breaches of your daily cap.

Transitioning from evaluation to managing a funded account requires a shift in mindset. Statistics show that over 90% of traders fail due to poor risk management [8], and about 80% of funded accounts falter because traders struggle to maintain discipline with live capital [7]. The aggressive approach that might work during an evaluation phase often becomes a liability when the focus shifts to preserving capital.

To combat these challenges, implementing a structured risk management plan can cut realized losses by up to 50% [8]. Additionally, around 65% of traders use position-sizing calculators to keep emotions in check and maintain consistency [8]. These tools help enforce discipline, reducing the urge to overtrade or take oversized positions.

How to Stay Within Daily Loss Caps

Risk Management Techniques

If you want to stick to your daily loss cap and still perform well as a trader, adopting practical risk management strategies is key. Start by managing your position sizes carefully. A popular approach is the "1% rule", which means you shouldn’t risk more than 1% of your account equity on any single trade. This way, even if you experience a losing streak, your losses won’t spiral out of control and exceed your daily limit.

Another useful tactic is setting a personal loss limit that’s 20%–30% lower than the cap set by your firm. For example, if the firm allows a $3,000 daily loss, consider stopping your trading day when your losses reach $2,200 to $2,400. This buffer can help you account for slippage and trading fees, preventing any accidental breaches of the limit.

Bracket orders are another tool worth using. These automated settings link your stop-loss and take-profit levels as soon as you enter a trade. By doing this, you ensure your risk-reward ratio stays intact, even if the market moves quickly.

Adjusting Your Trading Strategy

Adjusting your trading strategy isn’t about giving up your edge; it’s about working within the boundaries of your loss cap. On days when market volatility is high, reduce your position sizes significantly. In highly volatile futures markets, sharp price swings can quickly lead to losses that hit your cap.

Adopting a "quit while ahead" rule can also protect your gains. If you reach your daily profit target, stop trading for the day. This prevents you from losing those hard-earned profits later. Similarly, if you’ve used up 70%–80% of your daily loss allowance, it’s wise to step away. Walking away not only helps you avoid breaching your loss cap but also gives you time to reset emotionally, which is crucial for making better decisions in future trades. Additionally, keeping a trading journal to analyze your losses can reveal patterns, such as revenge trading, that you’ll want to avoid.

Technology can further assist in monitoring and controlling your losses in real time, making it easier to stay on track.

Using Technology to Monitor Losses

When it comes to daily loss caps, real-time monitoring is a must. Many proprietary trading firms base their loss limits on floating equity, which includes unrealized losses, not just closed trades. This makes it essential to track your trades and equity in real time.

High-performance VPS (Virtual Private Server) solutions can help by offering latency as low as 0.52ms to major exchanges like CME. This ultra-low latency reduces slippage, which could otherwise push you over your loss limit. VPS technology also enables automated risk-monitoring tools and "kill switches" to run continuously, even if your local computer is turned off.

Here’s a comparison of manual monitoring versus automated VPS solutions:

| Feature | Manual Monitoring | Automated VPS Solutions |

|---|---|---|

| Execution Speed | Relies on local internet | <0.52ms to CME Group |

| Uptime | Affected by power/ISP outages | 99.999% uptime guaranteed |

| Risk Control | Requires constant attention | Automated 24/7 circuit breakers |

| Slippage Risk | Higher during market volatility | Minimized with low latency |

Automated circuit breakers, for example, can instantly close your positions if a preset loss threshold is reached. This kind of technology has become indispensable for serious traders, as reflected in the projected growth of the global trading risk management software market, which is expected to reach $3,465 million by the end of 2025 [8]. These tools offer the reliability and precision needed to enforce your risk parameters consistently.

Using TraderVPS for MFU Prop Trading

Benefits of TraderVPS for MFU Prop Traders

For MFU prop traders working within strict daily loss caps, having a reliable VPS can make all the difference. TraderVPS offers 0.52ms latency to the CME Group, thanks to its direct fiber-optic cross-connects from Chicago [9]. This ultra-low latency is crucial, as even a small delay during volatile market swings could lead to slippage that breaches your daily limit – despite a solid trade setup.

TraderVPS also guarantees 99.999% uptime, ensuring that automated stop-losses and circuit breakers remain operational even if your home internet fails or your computer crashes [9]. This level of reliability is critical for MFU traders, where a single unmonitored position during a power outage could result in exceeding your loss cap and ending your evaluation. With over $16.44 billion in futures volume traded daily on these high-performance servers as of December 2025, it’s clear that professional traders value dependable infrastructure [9]. TraderVPS provides tailored solutions that cater to various trading needs, ensuring every trader has the tools they require.

TraderVPS Plans for Different Trading Needs

TraderVPS offers four distinct plans to suit a variety of trading styles and account sizes:

- VPS Lite ($69/month): Includes 4 AMD EPYC cores and 8GB RAM, making it a great choice for traders using NinjaTrader or handling smaller accounts.

- VPS Pro ($99/month): Designed for those managing multiple MFU accounts or requiring dual-monitor support, with 6 cores and 16GB RAM.

- VPS Ultra ($199/month): Tailored for traders managing larger accounts or running complex algorithms, offering even more processing power.

- Dedicated Server ($299/month): Features 12+ AMD Ryzen cores, 128GB RAM, and support for up to 6 monitors. This plan is ideal for traders who need to monitor multiple prop firm dashboards and track real-time equity across numerous positions.

All plans come with NVMe storage, DDoS protection, and Windows Server 2022 optimized specifically for trading environments, ensuring stability and peak performance.

Improving Trading Performance With VPS Technology

A robust VPS setup does more than just keep your platform stable – it ensures split-second stop-loss execution during fast-moving news events, thanks to high-performance hardware like NVMe M.2 SSDs and powerful CPUs [9]. This rapid response is vital when you’re nearing your daily loss threshold and need positions closed immediately.

The multi-monitor RDP support allows you to view your MFU firm’s dashboard alongside trading charts, keeping you fully aware of your unrealized losses at all times [9]. Many prop firms calculate daily loss caps based on floating equity, which includes open positions, so having this real-time visibility is key to avoiding unpleasant surprises. Additionally, you can run automated trade copiers and risk management bots continuously, helping to maintain a personal buffer below the firm’s official loss limit – typically 20-30% lower. This extra margin provides a safety net against slippage or unexpected market gaps [1][9].

Conclusion

Daily loss caps act as essential safety measures in prop trading, protecting both the firm’s capital and your trading career from devastating losses. These caps – often set at 3–5% of your starting equity – encourage traders to step back when emotions take over, helping to avoid revenge trading, a behavior linked to over 90% of trader failures [8]. Knowing how your firm calculates these limits is crucial for long-term success.

Seasoned MFU traders often go a step further by setting personal buffers, typically 20–30% below the firm’s limits, to account for slippage and market gaps [1]. They stick to strict per-trade risk rules, utilize automated stop-losses, and monitor equity in real time. Interestingly, around 65% of professional traders now use position-sizing calculators to maintain this level of discipline [8].

Technology plays a key role in ensuring these risk management strategies work seamlessly. For instance, a reliable VPS (Virtual Private Server) can keep automated controls running during internet outages or power failures, preventing unmonitored positions from breaching your loss cap. TraderVPS enhances these safeguards with ultra-low latency, high uptime, and multi-monitor support, ensuring you have continuous visibility of your trading dashboard. This kind of real-time control is especially critical when firms factor unrealized losses into their daily limits.

FAQs

What are the consequences of repeatedly exceeding the daily loss cap?

If you consistently go over the daily loss cap, most proprietary trading firms won’t hesitate to take action. This could mean losing your funded account or being removed from their program. These caps aren’t just rules – they’re there to protect both the firm and you from taking on too much risk.

To steer clear of this, keep a close eye on your trades and tweak your strategy to stay within those limits. Sticking to these caps not only keeps your account safe but also shows you have the discipline prop firms are looking for in a trader.

What are the best strategies for managing risk and staying within daily loss caps?

Managing risk effectively and staying within daily loss caps means treating the cap as a firm boundary and shaping your trading strategy around it. A good starting point is to size your positions so that no single trade puts more than 1%–2% of your account balance at risk. For instance, if you’re working with a $100,000 account, keep potential losses per trade between $1,000 and $2,000. Using pre-set stop-loss orders is a smart way to manage risk, and you might want to adjust stops to break even once a trade moves in your favor.

Keep a close eye on your daily profit and loss in real time to stay aware of your proximity to the cap. If you’re getting close, it’s crucial to stop trading right away to avoid making emotional moves or trying to recover losses. To add another layer of protection, steer clear of over-trading in volatile markets, limit the number of open positions, and regularly review your trades to spot areas for improvement. By treating the daily loss cap as an unbreakable rule, you can protect your funded account while sticking to a disciplined path toward profitability.

How does using a VPS help traders manage daily loss caps?

Using a Virtual Private Server (VPS) gives traders a dependable, always-on environment to keep their trading platforms running smoothly. This setup minimizes risks tied to daily loss caps by avoiding common issues like power outages, internet interruptions, or hardware failures that can happen with a home-based system. With continuous uptime, a VPS ensures that your risk-management rules are applied without fail, reducing the likelihood of unexpected losses caused by technical glitches.

Another key advantage of a VPS is ultra-low latency, which allows for faster order execution. This speed is crucial when your loss cap is hit, as it ensures that orders to close or adjust positions are carried out immediately, helping you stay within your limits. Plus, with remote access, you can check your account and set automated alerts no matter where you are, giving you complete control over your trading activities even when you’re away from your desk. These features together make a VPS a powerful tool for enforcing daily loss caps and safeguarding your trading capital.