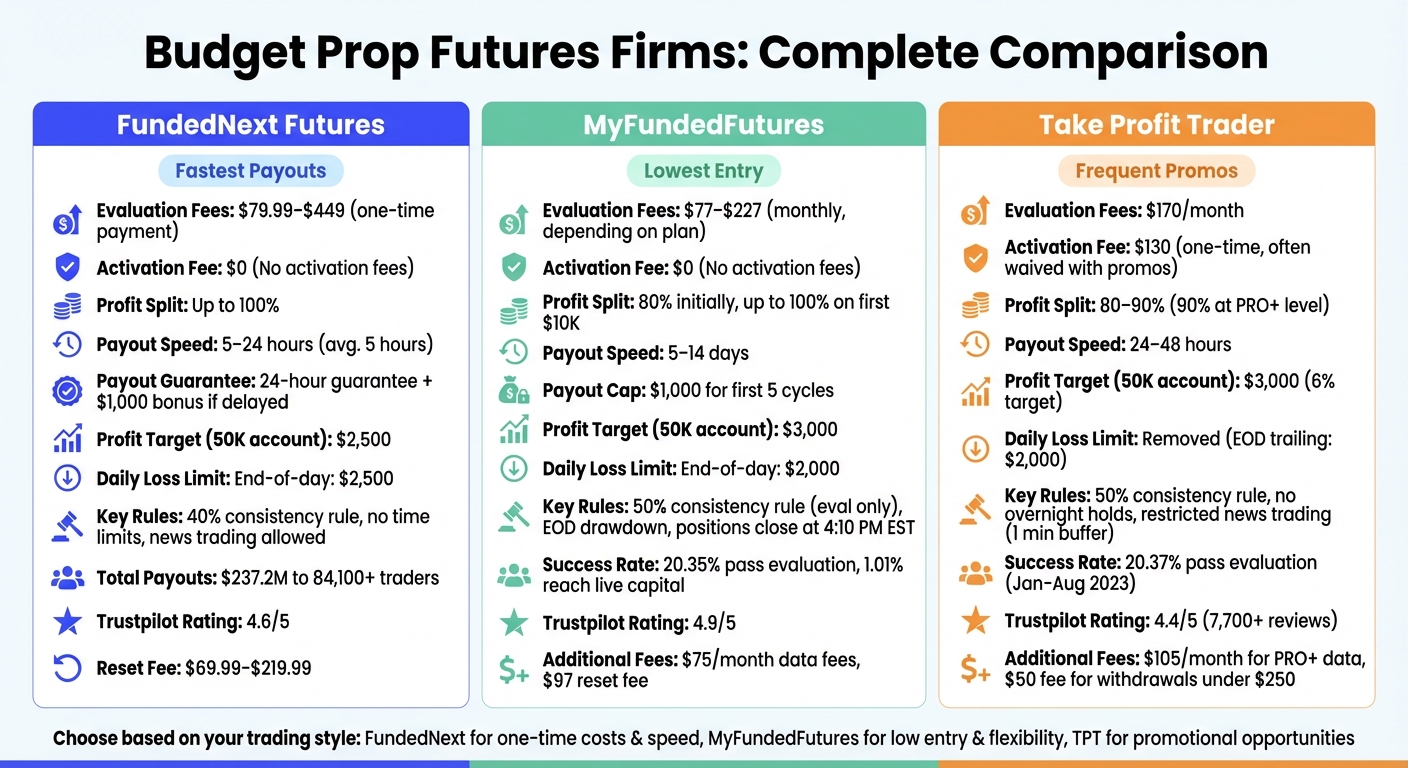

Looking to trade futures without putting up your own capital? Budget proprietary futures firms offer funding options for traders after passing evaluations. Here’s what you need to know:

- FundedNext Futures: One-time fees ($79.99–$449), no activation fees, and payouts processed in as little as 5 hours. Offers flexible rules like no time limits on profit targets and allows news trading. However, a 40% consistency rule applies during evaluations.

- MyFundedFutures: Low-cost entry ($77 for a $50,000 account), no activation fees, and end-of-day drawdowns. Profit splits start at 80%, but payouts are capped at $1,000 for the first five cycles. Only 1.01% of accounts reach live trading capital.

- Take Profit Trader (TPT): Monthly evaluation fees ($170 for $50,000 accounts), a $130 activation fee, and a 6% profit target. Offers frequent promotions to waive fees. Payouts are processed within 24–48 hours, but overnight holds and news trading near key events are restricted.

Quick Comparison

| Firm | Fees | Activation | Profit Split | Rules | Payout Speed |

|---|---|---|---|---|---|

| FundedNext Futures | $79.99–$449 (one-time) | No activation fees | Up to 100% | No time limits, news trading | 5–24 hours |

| MyFundedFutures | $77+ (monthly) | No activation fees | 80% initially | EOD drawdown, $1,000 cap | 5–14 days |

| Take Profit Trader | $170 (monthly) + $130 setup | $130 activation fee | 80–90% | No overnight holds, news rules | 24–48 hours |

Each firm has distinct fee structures, payout terms, and trading rules. Choose based on your trading style, budget, and goals.

Budget Prop Futures Firms Comparison: Fees, Activation & Payout Terms

1. FundedNext Futures

Fees

FundedNext Futures operates on a straightforward one-time payment model, eliminating the hassle of recurring charges. Depending on the account size and challenge type, fees range from $79.99 to $449 – no monthly subscriptions, activation costs, or platform fees. To date, the firm has paid out over $237.2 million to more than 84,100 traders and boasts a 4.6/5 rating on Trustpilot [4][6].

There are two challenge options available. The Legacy Challenge costs $79.99 for a $25,000 account, $159.99 for a $50,000 account, and $249.99 for a $100,000 account. The Rapid Challenge is priced at $99.99, $149.99, and $249.99, respectively [6]. If you breach a rule, you can reset your account for fees ranging from $69.99 to $219.99, depending on the account size [4]. To lower upfront costs, traders can use discount codes like "DGT" or "PROP10" [3]. Once the challenge is completed and payment is made, account activation happens immediately.

Activation Process

After successfully passing the evaluation, FundedNext activates your funded account right away, with no activation fees [4][6]. The Rapid Challenge can be completed in as little as one day [2]. The firm guarantees payout processing within 24 hours – and if they miss this deadline, they’ll pay an additional $1,000. On average, payouts are processed in just 5 hours [4][6]. Additionally, you’ll receive a 15% bonus on the profits earned during the evaluation phase once you reach funded status [5][2]. For withdrawals, traders can request payouts every three days under the Rapid model or every five days under the Legacy model [6].

Profit Targets

Profit targets are clearly defined based on account size:

- $1,250 for a $25,000 account

- $2,500 for a $50,000 account

- $6,000 for a $100,000 account

There’s no time limit to hit these targets, giving you the freedom to wait for the right trading opportunities [4][5]. Instead of intraday loss limits, FundedNext uses end-of-day loss limits, which are set at $1,000 for $25,000 accounts, $2,500 for $50,000 accounts, and $3,000 for $100,000 accounts. This approach provides more flexibility during volatile market conditions [4].

Trading Rules

FundedNext has established trading rules to encourage disciplined strategies. A 40% consistency rule ensures that no single day contributes more than 40% of total profits during either the evaluation or funded phases [6]. This prevents traders from relying on one high-volatility trade to meet their goals. Position limits are also enforced: for example, a $50,000 account allows 3 mini contracts (or 30 micro contracts) during the challenge, increasing to 5 mini contracts (or 50 micro contracts) once funded [4].

The firm supports news trading without restrictions, making it ideal for traders using volatility-based strategies [4][2]. However, practices like latency arbitrage, grid schemes, and tick manipulation are strictly prohibited [6]. Challenge accounts will become inactive if there’s no trading activity for 7 days, while funded accounts allow up to 30 days of inactivity [6].

2. MyFundedFutures

Fees

MyFundedFutures stands out by charging no activation fees for any of its account types – Core, Scale, Pro, or Starter. For a standard $50,000 account, evaluation costs are as follows: $77 for the Core plan, $127 for the Scale plan, and $227 for the Pro plan. The platform has earned a 4.9/5 rating on Trustpilot and supports a community of over 70,000 active traders. Monthly data fees are approximately $75, and if you need to reset a failed evaluation, a flat fee of $97 applies. During the simulated funded phase, traders retain 80% of their profits, with a payout cap of up to $100,000. These transparent fees make it easy to understand the costs involved.

Activation Process

Getting started with MyFundedFutures is simple. After choosing your plan and account size, you’ll need to pass a one-step evaluation by hitting the profit target while adhering to drawdown and consistency rules. Most plans require at least two trading days to complete the evaluation, but specific Pro add-ons allow for one-day completion. Once you meet the target, your account moves to the verification stage, and you should receive a notification within two business days. After signing the Simulated Trader Agreement, your account becomes funded. If you don’t receive a notification within the expected timeframe, you can quickly resolve the issue by opening a support ticket on their website.

Profit Targets

Profit targets are clearly defined. For a $50,000 account, the target is $3,000 across most plans. The platform applies an End-of-Day (EOD) trailing drawdown of $2,000, which is generally more forgiving than intraday limits. Additionally, there is no daily loss limit on the Core, Scale, or Pro plans, offering traders more flexibility during active sessions. A 50% consistency rule is enforced during the evaluation phase, meaning no single day’s profit can exceed half of the total profit target. This rule is lifted once you enter the funded phase. Payout frequency depends on the plan – Core and Scale accounts allow withdrawals every five winning days, while Pro accounts offer withdrawals every 14 days.

Trading Rules

MyFundedFutures has straightforward trading rules. All open positions must be closed by 4:10 PM EST to avoid automatic liquidation. To keep your funded account active, you need to place at least one trade every seven days or email support to request a break. News trading is unrestricted on Core accounts, but Pro (and Rapid) plans prohibit trading two minutes before or after Tier 1 news events, such as FOMC announcements or CPI reports. Additionally, hedging – trading the same asset in opposite directions simultaneously – is not allowed. These rules help maintain a structured and fair trading environment.

3. Take Profit Trader

Fees

Take Profit Trader (TPT) offers a $50,000 account with a monthly evaluation fee of $170. Instead of recurring subscription charges, there’s a one-time activation fee of $130. For PRO+ accounts, traders pay $105 monthly for CME data and Tradovate access. If an evaluation fails, reset fees range from $100 to $150. Withdrawals under $250 incur a $50 fee, while larger withdrawals are free. Promo codes like "NOFEE40" can waive the activation fee entirely. TPT has earned a Trustpilot rating of 4.4 out of 5 stars from over 7,700 reviews [9][11][12].

Activation Process

After paying the fees and hitting a 6% profit target during the Test phase, traders pay the $130 activation fee to unlock a funded PRO account. Account setup typically takes 1 to 2 business days, and traders can choose between Rithmic or Tradovate data feeds. Completing the evaluation requires at least 5 trading days, even if the profit target is reached earlier. Once funded, traders who generate $5,000 in profits may be invited to upgrade to a PRO+ account, increasing their profit split from 80% to 90%. Between January and August 2023, the firm reported a 20.37% success rate for traders passing the evaluation [9][12].

Profit Targets

Every account requires a 6% profit target, which translates to $3,000 for a $50,000 account. TPT uses an End-of-Day (EOD) trailing drawdown of $2,000, giving traders more room to recover from intraday losses without immediate disqualification. In January 2025, TPT removed its daily loss limit, allowing for more flexibility. A 50% consistency rule applies during evaluations, ensuring no single day’s profits exceed half of the total. Once funded, traders must build their account balance to the account size plus the maximum drawdown (e.g., $52,000 for a $50,000 account) before making withdrawals. Payouts are processed within 24 to 48 hours [8][10][12].

Trading Rules

Traders must close all positions before the market closes, as overnight holds are not allowed. PRO and PRO+ account holders are restricted from trading one minute before or after Tier 1 news events, such as FOMC announcements or Non-Farm Payrolls. To keep an account active, traders need to place at least one trade per week, held for a minimum of one minute. The platform supports over 15 trading platforms via Rithmic or CQG data feeds, including NinjaTrader, TradingView, and Tradovate. Additionally, traders can manage up to 5 PRO accounts simultaneously [9][12].

Ultimate Futures Prop Firm Tier List 2025 (From A 7 Figure Trader)

Pros and Cons

Here’s a breakdown of the strengths and drawbacks of each firm.

FundedNext Futures shines with its one-time fee structure and the freedom to trade during news events without restrictions. The company has paid out over $237.2 million to more than 84,100 traders [4]. However, it imposes a 40% consistency rule during evaluations, which can be challenging for some traders. Additionally, withdrawing 100% of profits can result in a breach, as the Maximum Loss Limit is recalculated based on the updated balance [2][4].

MyFundedFutures offers an attractive entry point with its Core plan priced at $77 for a $50,000 account. It also uses an end-of-day (EOD) drawdown, which provides more flexibility for active traders [7]. Between January 2024 and July 2025, 20.35% of evaluation accounts successfully met their objectives [7]. However, only 1.01% of simulated funded accounts advanced to live capital, and Core accounts limit payouts to $1,000 until five payout cycles are completed [7].

To make it easier to compare, here’s a summary table highlighting the key points:

| Firm | Pros | Cons |

|---|---|---|

| FundedNext Futures | One-time payment; 24-hour payout guarantee with $1,000 bonus if delayed; unrestricted news trading [2][4] | 40% consistency rule; breach risk on full withdrawals; higher upfront cost at $149.99 [2][4] |

| MyFundedFutures | Low entry cost at $77; EOD drawdown; no daily loss limit during sim-funded phase [7] | Only 1.01% reach live capital; $1,000 payout cap for first five cycles; $75/month data fees [1][7] |

| Take Profit Trader | Frequent promotional pricing, sometimes waiving activation fees [13] | N/A |

Conclusion

Budget prop futures firms cater to various trading styles, each offering unique advantages. FundedNext stands out with its one-time fee structure, while MyFundedFutures appeals to traders seeking rapid funding, thanks to its streamlined evaluation process and an attractive 100% profit split on the first $10,000 earned. These differences make it easier for traders to find a firm that aligns with their specific goals and strategies.

In addition to selecting the right firm, improving trading performance often hinges on using reliable VPS (Virtual Private Server) infrastructure. A VPS enhances connectivity and execution speed, boasting 99.999% uptime. Hosting on Chicago-based servers further reduces latency to CME Group markets, ensuring trades – like stop-loss orders – are executed without delay. For automated strategies, a VPS is invaluable, keeping trading setups active even when your local computer is offline. Features like DDoS protection and regular backups add an extra layer of security, helping safeguard funded accounts from unexpected technical issues.

FAQs

What are the main differences between FundedNext Futures and MyFundedFutures?

FundedNext and MyFundedFutures stand apart in key areas like fees, funding limits, payout speeds, and trading features.

FundedNext operates on a one-time challenge fee model, with costs ranging from $129 to $449. There are no activation or recurring monthly fees. In contrast, MyFundedFutures uses a monthly subscription system, with fees spanning roughly $80 to $665 depending on the chosen plan. For funding, FundedNext provides account sizes of $25,000, $50,000, or $100,000, while MyFundedFutures offers funding options that go as high as $600,000.

Both platforms offer flexible trading rules, but their standout features differ. FundedNext focuses on fast payouts, averaging just 5 hours, and allows news trading without imposing time limits on challenges. MyFundedFutures, however, emphasizes a single-step evaluation process and a range of tiered plans tailored to various traders. Both support widely-used platforms like Tradovate and NinjaTrader, with FundedNext also integrating with TradingView.

In summary, FundedNext appeals to traders prioritizing low initial costs and rapid payouts, while MyFundedFutures is better suited for those seeking higher funding options and subscription flexibility.

How do evaluation processes differ across budget-friendly prop futures firms?

Evaluation processes at budget-friendly proprietary futures firms can differ quite a bit in terms of structure, timeframes, and rules. Some firms implement multi-step evaluations with stricter guidelines, while others offer single-step processes that are quicker and more flexible. For instance, multi-phase evaluations often come with tighter daily loss limits and consistency requirements, whereas single-step evaluations might set higher profit goals but impose fewer restrictions overall.

The time given to complete these evaluations also varies. Some firms enforce strict deadlines, while others allow traders to move at their own pace, free from time constraints. Picking the right firm comes down to aligning with your trading style, timeline, and risk tolerance. It’s crucial to weigh these factors carefully to find the one that suits you best.

What trading strategies work best with different prop firms’ fees and rules?

Choosing a trading strategy that fits well with a prop firm’s fee structure and risk rules can make a big difference in your success. If you’re into swing trading or trend-following strategies, look for firms with low, one-time activation fees. These strategies often aim for steady, moderate gains, making it easier to stay within drawdown limits.

On the flip side, if scalping or high-frequency trading is your style, firms that offer refundable challenge fees or daily payouts might be a better match. These setups allow you to recover costs faster by locking in consistent daily profits.

For those who thrive on news-driven or volatility-based strategies, it’s crucial to choose firms that permit trading during high-impact events and don’t impose daily loss limits. This flexibility lets you take advantage of market spikes without worrying about automatic stop-outs. Matching your trading approach to the firm’s structure and rules can help you manage costs more effectively and boost your profit potential.