Looking to understand the difference between Level 2 and Level 3 market data? Here’s a quick breakdown:

- Level 2 Data: Provides detailed market depth with 5–10 bid/ask price levels, aggregated order sizes, and market maker IDs. It’s ideal for day traders and swing traders who need a clear view of price movements and liquidity.

- Level 3 Data: Goes deeper by showing individual orders with unique IDs, trader identities, and up to 20 price levels. It’s designed for institutional traders and market makers needing granular insights and direct order management.

Quick Comparison Table:

| Feature | Level 2 Data | Level 3 Data |

|---|---|---|

| Market Depth | 5–10 price levels | Up to 20 price levels |

| Order Details | Aggregated orders | Individual orders with unique IDs |

| Trader Info | Market maker IDs | Trader identities and order intentions |

| Access | Retail and institutional traders | Institutions and market makers only |

| Cost | Moderate subscription fees | High costs, often requiring registration |

Which Should You Choose?

For most retail traders, Level 2 data offers enough detail to make informed trading decisions. If you’re an institutional trader or rely on high-frequency strategies, Level 3 data provides the advanced insights and tools you need – though it comes with higher costs and hardware requirements.

Level 2 Market Data Features and Applications

What Level 2 Data Includes

Level 2 data provides a detailed look at up to 60 levels of the order book, updating every 0.3 seconds to reflect real-time market activity [6][7].

This data includes multiple bid and ask prices, order sizes, market maker IDs, and the latest transaction details [4]. Unlike Level 1 data, which only shows the best bid and ask prices, Level 2 offers a complete view of the bid-ask spectrum.

"Level 2 data gives you full access to the order book underneath a share’s buy and sell prices… This gives a far more detailed view of market sentiment, trends and how popular a market really is." – Katya Stead, Financial Writer [8]

One of its key advantages is revealing market depth, which shows the supply and demand beyond the National Best Bid and Offer (NBBO) price. This includes the number of shares available at each price level [5].

Typically, Level 2 data displays the best 20 bids and asks for a given symbol. However, if there are fewer than 20 orders, it will reflect only the available levels. The information comes from both market makers and electronic communication networks (ECNs) [11][5].

These features make Level 2 data a critical tool for understanding market sentiment and trends, laying the groundwork for comparing it to more advanced Level 3 data later on.

How Traders Use Level 2 Data

Traders rely on Level 2 data to refine their strategies, identifying optimal entry and exit points while gaining insights into liquidity and market dynamics [5].

By analyzing large orders, traders can spot areas of support and resistance. For example, significant buy orders can act as temporary price floors, while large sell orders may serve as price ceilings [2].

Market sentiment becomes clearer through order depth analysis. A high concentration of buy orders below the current price often signals strong support, whereas numerous sell orders above the price indicate potential resistance [9][7].

Level 2 data also helps traders assess market momentum and liquidity by monitoring how quickly orders are filled or replaced. When combined with Time & Sales data, it provides a clearer picture of executed orders and market maker behavior [4][2].

For traders handling larger positions, the ability to evaluate bid-ask spreads and available volume at each price level is invaluable. This insight minimizes the risk of market impact during trades [4].

However, traders should always cross-check Level 2 signals with technical analysis to guard against spoofing – when false orders are placed to manipulate market activity [2][4].

An example from December 2024, shared by Lightspeed Financial Services Group, illustrates how Level 2 data uncovers market depth. When a stock’s current bid is $50.00 and the ask is $51.00, Level 2 shows additional bids at $49.90, $49.80, and $49.70. This kind of visibility helps traders better understand the underlying market sentiment [Source: Lightspeed, 2024].

Level 3 Market Data Features and Applications

What Level 3 Data Includes

Level 3 market data provides a comprehensive, real-time view of the order book, tracking every update, modification, and cancellation [13]. Unlike Level 2 data, which aggregates orders at each price level, Level 3 goes deeper, showing individual orders with unique IDs. This allows traders to see details like order age and specific changes [13][14]. Such granular visibility offers insights into market activity that are simply unavailable with Level 2.

For instance, where Level 2 might display five orders totaling 18 shares at $102.30, Level 3 breaks this down into individual orders – like 1, 3, 7, 4, and 3 shares – along with the exact age of each order [14]. Additionally, Level 3 data typically covers up to 20 or more price levels, compared to the 5–10 levels standard in Level 2, providing a much broader view of market depth [12]. This includes detailed bid/ask information, order sizes across all price levels, and recent trade data [12].

One of the standout features of Level 3 data is its ability to identify trader names and order intentions [3]. This level of transparency allows market participants to see which traders are placing significant orders, enabling them to adapt their strategies accordingly.

"Level 3 Data is crucial for professional traders and institutions that require an in-depth understanding of market dynamics. It provides a transparent view of all orders in the market. This enables users to make informed and strategic trading decisions." – CoinAPI.io [12]

Moreover, Level 3 data supports direct order management. Institutions and market makers can enter, modify, and execute orders directly within the trading system [12]. This functionality, combined with its granular insights, makes Level 3 data indispensable for professional trading strategies.

How Professional Traders Use Level 3 Data

Professional traders rely on Level 3 data for advanced order flow analysis and strategies that demand full market transparency. High-frequency trading (HFT) operations use Level 3 data to pinpoint the best bid/ask spreads for executing rapid trades [15]. Similarly, institutional investors managing large block trades benefit from this data by identifying optimal execution prices, which helps them minimize market impact when handling substantial positions [15].

Level 3 data also plays a critical role in backtesting. It allows traders to simulate precise fills for passive orders, improving both strategy development and risk management [13]. Market makers utilize this detailed visibility to fine-tune their quotes and enhance their risk management practices [12].

Imagine an institutional trader monitoring a volatile stock using Level 3 data. They can view the entire order book, including open orders, trader identities, and the intentions behind outstanding orders. If a large institution places a significant sell order at a specific level, other participants can immediately recognize this and adjust their bids or sell orders accordingly [3].

Traders also use Level 3 data to confirm support and resistance levels with greater precision. By observing where orders are concentrated at certain price points, they gain direct evidence of institutional activity, which enhances their technical analysis [16]. Despite its detailed nature, Level 3 data feeds are often optimized for lower latency, giving traders a speed advantage in fast-moving markets [13].

This high level of market transparency empowers professional traders to anticipate major moves, strategically time their trades, and optimize execution while minimizing their impact on the market.

Level 2 vs Level 3 Data Comparison

Side-by-Side Comparison Chart

Comparing Level 2 and Level 3 market data can help you understand their key differences and decide which one aligns better with your trading needs. Here’s a breakdown of the main distinctions:

| Feature | Level 2 Data | Level 3 Data |

|---|---|---|

| Market Depth | Displays 5–10 best bid/ask price levels [1] | Offers up to 20 best bid/ask price levels [1] |

| Order Detail | Aggregates orders at each price level | Shows individual orders with unique order IDs [13] |

| Trader Information | Shows market maker IDs and quantities [10] | Identifies traders and their order intentions [3] |

| Order Management | View-only access to market data | Allows order entry, modification, and execution [1] |

| Data Updates | Real-time price and volume updates | Includes all order updates, cancellations, and changes [13] |

| Access Level | Open to retail and institutional traders | Limited to market makers and registered institutions [10] |

| Processing Requirements | Moderate computing power | High-performance systems needed for real-time processing |

| Primary Users | Day traders, swing traders, and position traders [10] | Market makers, institutional traders, and high-frequency trading firms [3] |

| Cost Structure | Moderate subscription fees | Premium pricing, often requiring exchange registration |

What stands out most is the level of granularity. Level 2 data gives you an aggregated view of market activity – like "18 shares at $102.30" – while Level 3 data breaks that down into each individual order, offering unparalleled detail.

How to Choose the Right Data Level

Your trading strategy and budget will largely determine whether Level 2 or Level 3 data is the better fit. Each has its unique strengths, and understanding them will help you make an informed choice.

Level 2 data is a cost-effective option, offering aggregated market depth that highlights essential support and resistance levels without overwhelming you with too much detail. It’s a great choice for day traders, swing traders, and those who prioritize simplicity in their analysis.

On the other hand, Level 3 data is designed for traders who need highly detailed insights. It’s particularly valuable for algorithmic trading and institutional strategies, where knowing individual order details and trader intentions can enhance decision-making and execution timing [3]. However, this level of detail comes with higher costs and technical demands – ultra-low latency hardware and high-speed internet are essential for processing the real-time updates efficiently.

If you’re upgrading from basic Level 1 feeds, starting with Level 2 data is a logical step. It allows you to evaluate how the additional depth impacts your trading decisions without immediately committing to the higher costs and hardware requirements of Level 3 data. Once you’re comfortable and see the need for even more granular insights, transitioning to Level 3 data can further refine your strategy and execution.

How to Use Level 2 Market Data? – Market 1,2,3 Level Data!

sbb-itb-24dd98f

Hardware Requirements for Market Data Processing

When it comes to market data processing, your computer’s performance plays a crucial role. The hardware requirements can vary significantly between handling Level 2 and Level 3 data, as each comes with its own set of demands.

Hardware Specs for Level 2 Data

Processing Level 2 data doesn’t require the same heavy-duty hardware as Level 3, but it still demands a solid setup. Since Level 2 data is pre-aggregated by exchanges, your computer doesn’t need to perform the complex calculations that raw Level 3 data entails.

At a minimum, you’ll need a quad-core 2.8 GHz 64-bit processor [17]. This provides enough power to handle real-time updates of bid/ask spreads and market depth. If you’re trading across multiple platforms, a faster processor will make everything run more smoothly.

For memory, 8 GB of RAM is the baseline, though 16 GB is recommended if you’re juggling multiple data streams [17]. Level 2 feeds aren’t as memory-intensive as Level 3, as you’re working with aggregated data rather than individual order details.

Storage speed is another important factor. An SSD (solid-state drive) significantly enhances system responsiveness compared to traditional hard drives. It reduces platform load times and improves data logging performance [17].

Your graphics card should be capable of supporting the number and resolution of monitors you plan to use. Many traders rely on dual or triple monitor setups, so a mid-range graphics card with multiple display outputs should suffice [17].

For the operating system, Windows is the go-to choice for most traders due to its compatibility with a wide range of trading software [17].

Hardware Specs for Level 3 Data

Level 3 data processing is a whole different ballgame. This type of data includes granular details, such as individual order activity, which means your computer needs to build and maintain a local order book. This dramatically increases the workload [13].

For starters, you’ll need multi-core processors with clock speeds exceeding 3.0 GHz to handle the intense demands of high-frequency trading, where systems can make up to 1,000 decisions per second [18].

Memory requirements are also higher. Additional RAM is necessary to manage real-time order book updates and track orders effectively.

Network latency becomes a critical factor with Level 3 data. For example, some trading platforms achieve latencies as low as 200 microseconds, which underscores the importance of a high-speed internet connection and optimized network configurations [19].

High-speed SSDs are essential for quick data access. While some implementations of Level 3 feeds are optimized for efficiency [13], the speed of your storage still plays a key role in overall system performance.

For professional traders, colocation services can further reduce latency by placing your system physically closer to exchange servers. This investment highlights the importance of timing down to milliseconds or even microseconds in Level 3 trading strategies [18].

These advanced hardware setups ensure that Level 3 data can be processed with the speed and precision required for professional-grade trading.

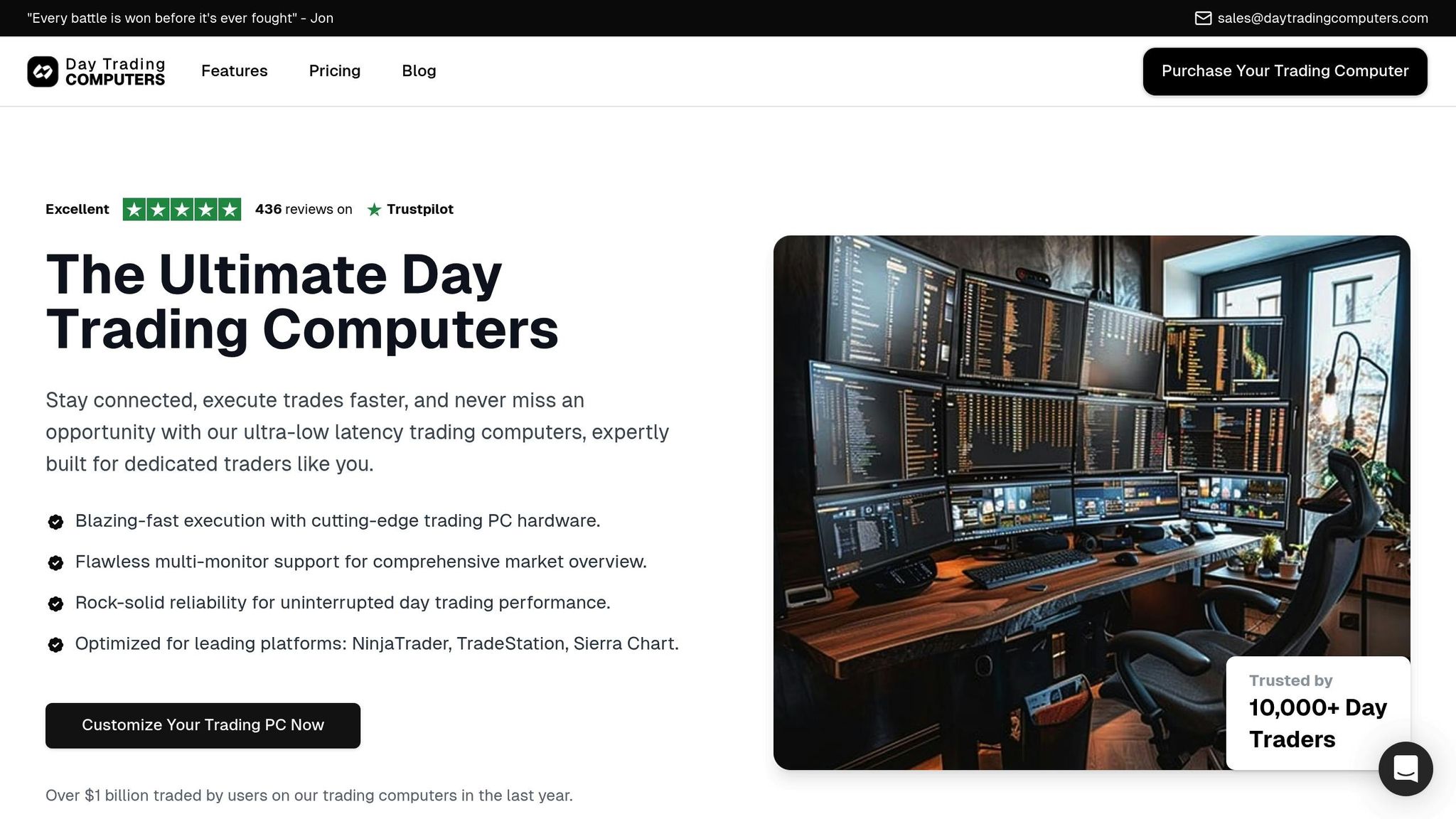

DayTradingComputers: Purpose-Built Trading Systems

Given the complexity of hardware requirements, purpose-built trading systems can simplify the process by offering pre-configured setups tailored to market data processing. DayTradingComputers specializes in designing PCs optimized for trading, ensuring they meet the unique demands of this field. These systems are engineered to keep up with trading software and improve execution efficiency [17].

Their offerings include:

- Lite System ($3,569): Features an NVIDIA GeForce RTX 3070 Ti SUPER graphics card, 32 GB DDR5 RAM, an AMD Ryzen 5600X processor, and a 1 TB NVMe SSD. This setup is ideal for Level 2 processing and dual-monitor setups.

- Pro System ($4,569): Upgrades to an NVIDIA GeForce RTX 4070 Ti SUPER, 64 GB DDR5 RAM, an AMD Ryzen 7900X processor, and a 2 TB NVMe SSD. This configuration is built for demanding Level 2 applications and entry-level Level 3 processing.

- Ultra System ($5,569): Offers an NVIDIA GeForce RTX 4090 SUPER, 128 GB DDR5 RAM, an AMD Ryzen 9800X3D processor, and a 4 TB NVMe SSD. Designed for intensive Level 3 data processing and advanced algorithmic trading strategies.

These systems come pre-optimized for trading applications, reducing the guesswork involved in hardware selection and setup. They also deliver lower latency, higher throughput, and more reliable trading operations [20].

"The increasing accessibility of proprietary trading technology driven by the above-mentioned technologies is lowering barriers to entry, increasing competition among firms across the financial ecosystem and ultimately acting as an engine for innovation. In 2025, an increasing number of firms will reassess their technology estates to ready themselves for the adoption of new technologies – from the proliferation of AI to 24/7 trading or increasingly streamlined multi-asset platforms."

– Matt Barrett, CEO and co-founder, Adaptive [20]

As the trading landscape evolves, having purpose-built hardware ensures your system can handle today’s challenges and adapt to future demands. In a world where milliseconds matter, these setups position you to stay competitive in the ever-accelerating "data arms race" [20].

Conclusion: Choosing Your Market Data Strategy

Picking the right market data level involves balancing your trading style, strategy needs, and hardware capabilities. For most retail traders, Level 2 data offers a solid solution. It provides market depth visibility, helping traders identify support and resistance levels, monitor liquidity, and spot trends as they develop. This makes it a practical choice for aligning your trading strategy with the appropriate tools and technology.

On the other hand, Level 3 data is tailored for institutional traders and market makers. It delivers a deeper market view, including detailed order book information, trader identities, and outstanding order intentions. These features are essential for advanced algorithmic and high-frequency trading strategies [3]. However, the trade-off comes in the form of higher costs and greater hardware demands. For example, systems like DayTradingComputers’ Lite System are optimized for Level 2 data, while their Ultra System is designed to handle the intensive demands of Level 3. Brokers often charge extra for access to these data levels, so costs should be a key consideration when deciding which level suits your strategy [3].

For the majority of traders, Level 2 data strikes the right balance, offering valuable insights without the steep expenses and complexity of Level 3. But if your strategy hinges on split-second execution or direct market access, Level 3 becomes a necessity, despite its higher entry barriers.

Ultimately, successful trading isn’t just about market knowledge – it’s also about having the right systems in place. Make sure your market data choice aligns with hardware capable of meeting its processing demands.

"Successful trading requires more than just market knowledge – it demands consistent habits and reliable support systems to help you reach your financial goals."

FAQs

What’s the difference between Level 2 and Level 3 market data, and how does each impact trading decisions?

The Difference Between Level 2 and Level 3 Market Data

The main distinction between Level 2 and Level 3 market data lies in how much information they provide about market activity.

Level 2 data gives you a snapshot of the best bid and ask prices, along with several additional price levels – usually the top 5 to 10 bids and offers. It helps traders see market depth by showing aggregated volumes at these price points, making it easier to gauge supply and demand across different levels.

On the other hand, Level 3 data offers a full view of the order book. It shows every individual order at all price levels and includes details about order changes, cancellations, and executions. This level of detail is particularly useful for institutional traders and market makers who rely on precise insights into market activity and order flow to refine their trading strategies.

For most retail traders, Level 2 data provides enough detail to analyze market depth and implement their strategies. However, Level 3 data is generally tailored to those with more advanced trading requirements.

Why do institutional traders often choose Level 3 market data over Level 2, even with its higher costs and technical demands?

Institutional traders often choose Level 3 market data because it offers a detailed breakdown of the order book. This includes specifics like the size of individual orders, their placements, and any changes made to them. With this level of detail, traders can gain a clearer understanding of market depth and craft more precise execution strategies.

For those engaged in high-frequency or algorithmic trading, where every millisecond counts, Level 3 data provides critical insights that can make a real difference. While it does require advanced hardware and comes with higher costs, the ability to analyze market behavior more thoroughly and refine trading decisions often makes it a worthwhile investment for institutional traders.

What hardware upgrades do traders need to handle Level 2 and Level 3 market data effectively?

Level 2 vs. Level 3 Market Data: Hardware Demands

The complexity and volume of market data you deal with – Level 2 or Level 3 – directly influence the hardware you’ll need for smooth processing.

Level 2 data gives you a snapshot of bid and ask prices across multiple levels in the order book. Handling this requires a system with moderate processing power and memory to manage the depth of the data efficiently.

Level 3 data, however, takes things up a notch. It captures every single order, massively increasing the data volume. To keep up, you’ll need more advanced hardware: faster processors, higher RAM, and reliable storage systems designed to handle the increased load without lag.

Another key factor to consider is your internet connection. Low latency and sufficient bandwidth are critical for ensuring that the data reaches you quickly and without interruptions. Align your hardware and network setup with your trading strategy to meet the demands of real-time data processing seamlessly.